Member Services Desk

Weekly Market Update

This MSD Weekly Market Update reflects information for the week ending July 25, 2025.

Economist Views

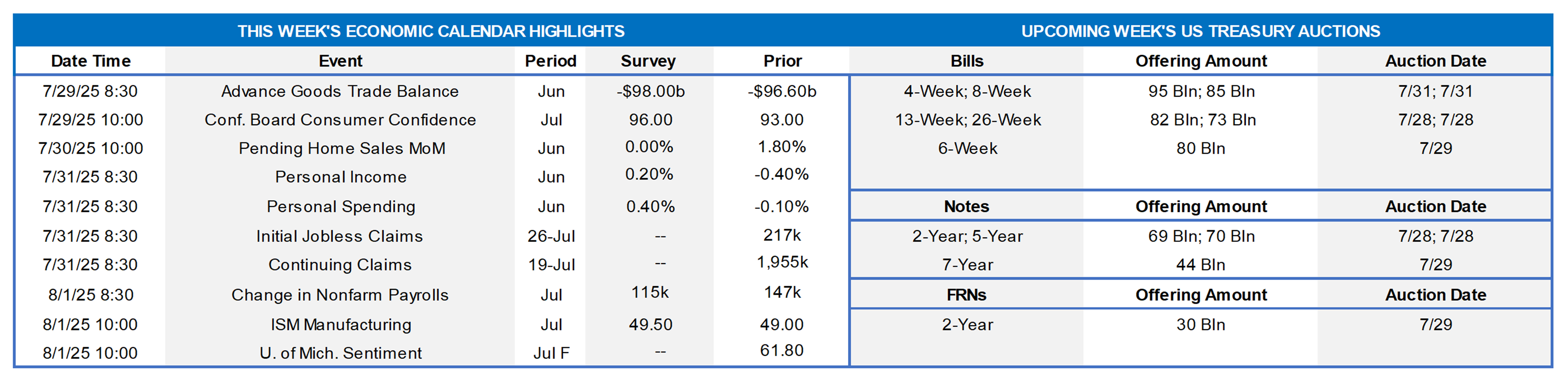

Click to expand the below image.

Following a week of second-tier data, the upcoming week will serve a blizzard of reports as well as the Federal Market Open Committee (FOMC) meeting. The FOMC outcome is slated for Wednesday afternoon. Given that recent economic data has portrayed general resilience and overall financial condition metrics are not tight, the Fed is expected to remain in “wait-and-see” mode, thereby leaving the fed funds range at 4.25 to 4.50%. Recent inflation readings, while looking relatively benign on the surface, have shown accelerating upward price pressures in certain areas. See below for more color. So, most Fed members appear likely to desire more time to assess economic conditions and the delayed impacts of tariffs. On the employment side of the Fed’s dual mandate, conditions have reflected some weakening in the continuing jobless claims data. Still, the overall picture has been one of relatively stable, albeit certainly not robust, conditions. The upcoming week’s jobs report will shed light on this space. If the Fed saw clear weakness in jobs and/or economic growth/activity, then the backdrop would change for rate cuts. Watch for any dissents in the FOMC outcome; see inside for further color. Lastly, adding a potential curveball at the end of the week is the August 1st tariff deadline.

Advance Good Trade Balance: Economists expect the trade balance to decline to $98bn from last month’s $96.6bn.

Conference Board Consumer Confidence: Surveys expect the gauge to rise to 96 from last month’s reading of 93, as heightened fears of a tariff-induced economic downdraft have receded from previous worrisome levels.

Pending Home Sales: Sales are expected to be flat month-over-month. Affordability issues, mainly in the form of prevailing high prices and mortgage rates higher than in recent years, have been shown to impede recent housing data such as existing and new home sales.

Personal Income and Spending: Both measures are expected to reflect a rebound after last month’s negative readings, thereby signaling consumer resilience for certain demographic cohorts.

Initial and Continuing Jobless Claims: Jobless claims data continues to be closely watched by economists as a potential early indicator of a weakening economy. Continuing Claims, while coming in essentially flat this past week to the week prior, have been on a notable uptrend since spring and will be closely assessed for clues to employment market conditions.

Employment Situation Report & Change in Nonfarm Payrolls: Last month’s report revealed a better-than-expected addition of 147K jobs and a resilient labor market, but the July consensus projection is calling for a lower 115K positions added. Given that last month’s gain included an idiosyncratic 63K jump in state and local employment, the report will be dissected for clues to ongoing and/or widespread trends. Economic uncertainties continue to cloud the employment situation nationwide. Hours worked, earnings, and the unemployment rate will also be reported.

ISM Manufacturing: The July projection calls for a continued contraction in the manufacturing sector and a 49.5 reading. Information on prices will be included in the report, and it is important to assess.

University of Michigan Sentiment: The preliminary July report showed an increase to 61.8 from June’s final reading of 60.7. The preliminary reading for July represented the highest level in 5 months, as sentiment has rebounded from previous worrisome levels of a few months ago.

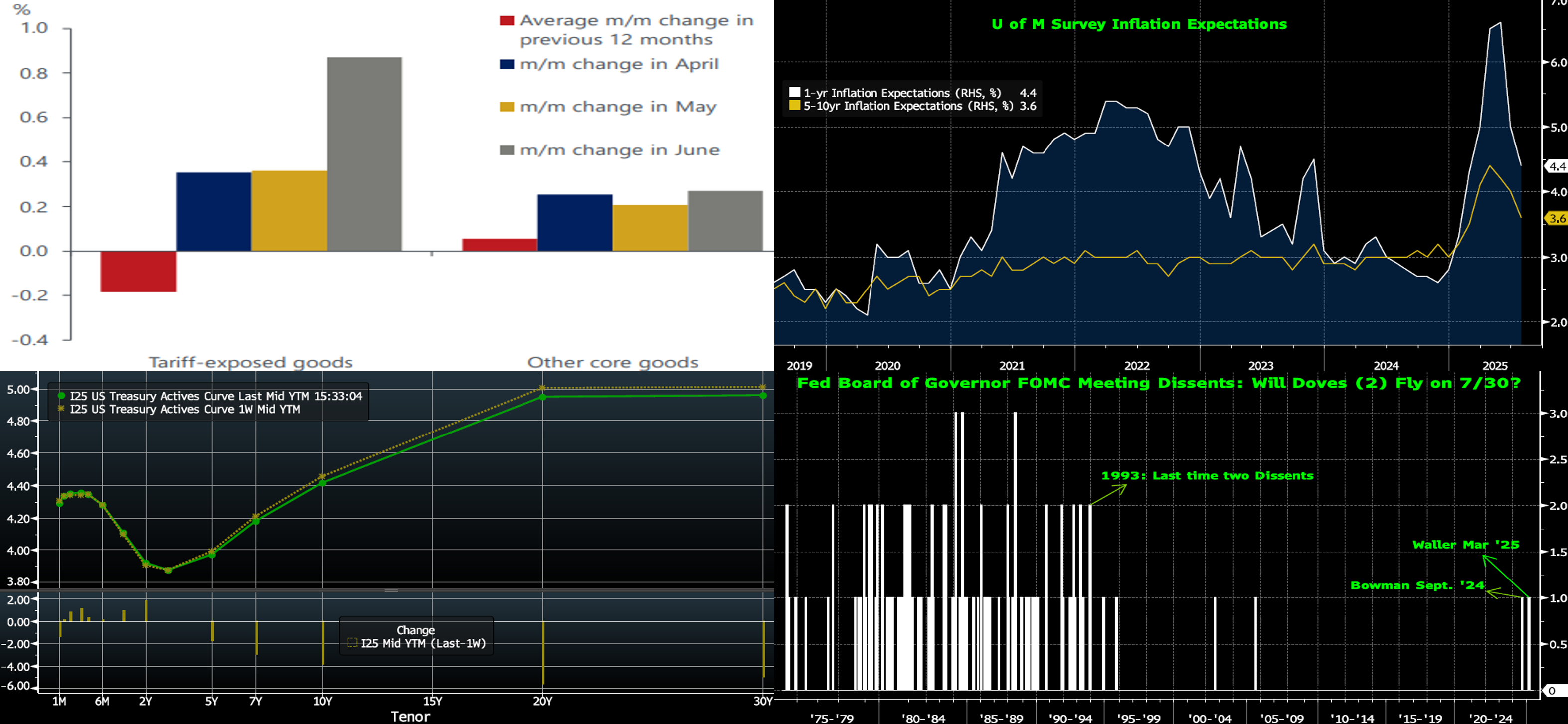

CHART 1 UPPER LEFT

Sources: Oxford Economics; Haver Analytics; Bloomberg. The Fed is expected to remain on hold at this upcoming week’s meeting, owing to many members wanting to wait for more data on inflation trends. Here we can see a reason for some members’ caution, given that the Fed maintains a 2% (annual) inflation goal. In recent months, goods that are exposed to tariffs are displaying an upward price trend, whereas other core goods remain under control. Moreover, it still may be “early days” for the trend in tariff-exposed goods, as existing inventories are eventually drawn down and businesses potentially decide that they must pass along more of the tariff-induced costs into their pricing.

CHART 2 UPPER RIGHT

Sources: Bloomberg. The Fed did witness some good news on the inflation front in the form of the latest University of Michigan Consumer Sentiment preliminary (final to be released August 1st) report. As seen here, the survey revealed a notable decline in both the 1-year and 5-to-10-year inflation expectations components. The results are likely tracing developments on the tariff front and the, thus far, relatively mild impacts on official headline inflation readings. But, as mentioned above, there may be brewing and delayed impacts still to come. And note that the expectations readings seen here are still well above the Fed’s stated 2% target. Hence, Fed members may view this data as inconclusive and a reason to remain cautious on rate policy.

CHART 3 LOWER LEFT

Sources: Bloomberg. Top pane is yield (LHS, %); bottom pane is change (LHS, bps). As of late Thursday, the UST term curve was modestly changed from the week prior. The 2-year rose ~2 bps, while the 5- and 10-year dipped by ~2 and 4 bps, respectively. Essentially, the week’s action continued the low-volatility and range-trade nature of July. As cited previously herein, the week’s data was seemingly supportive of a Fed “wait-and-see” mode at the upcoming week’s FOMC meeting. As of late Thursday afternoon, the market priced end-2025 fed funds at 3.915%, or the same as a week ago. The market’s end-2026 forward is ~3.8%, or 1.5 bps higher than last week.

CHART 4 LOWER RIGHT

Sources: Bloomberg. While the upcoming week’s FOMC meeting is expected to result in no policy changes, it will be interesting to watch for any dissents from committee members who may be in favor of a rate cut. The FOMC consists of twelve voting officials, seven of whom are on the Board of Governors of the Fed, the president of the FRB-NY, and then four of the remaining eleven district reserve banks who serve 1-year terms on a rotating basis. As can be seen here, dissents have been few and far between in the last three decades. The two most recent dissents were Governors Waller and Bowman. Waller had dissented on the change to a slower pace of runoff to the Fed’s securities holdings, while Bowman had dissented on the 50-bps rate cut and favored only a 25-bps cut. Somewhat coincidentally and ironically, both have recently expressed openness to earlier rate cuts, and Waller has been cited in news report as a potential in-house candidate to replace Powell as the next Fed Chair. Fed-watchers, therefore, consider the pair as potentially “in play” to formally dissent on a “no-change” outcome. Not since 1993 have two Governors dissented at the same FOMC meeting, and so this outcome would be notable and potentially “pull forward” the market’s pricing of projected rate cuts.

FHLBNY Advance Rates Observations

Front-End Rates

- As of Thursday afternoon, short-end rates were modestly mixed vs. a week ago, with the shorter tenors a bp higher and 2-month-and-out a few bps lower on average. While robust Money Market Fund (MMF) AUM levels and negative net T-bill supply in the past few months had underpinned demand for short-end paper and benefited our funding spreads, the backdrop has shifted now that the debt ceiling was raised via the budget bill signed on July 4th. Net T-bill supply has now turned positive, as Treasury rebuilds its General Account. This change should serve to reduce liquidity in the financial system. MMFs, however, are expected to absorb sizable portions of the T-bill supply, as they switch some of their substantial AUM from repo to T-bills and thereby contain any further severe impacts for bills and/or our paper.

- The market will focus on the upcoming week’s FOMC outcome

Term Rates

- The longer-term curve, as of late Thursday and generally mirroring the moves in USTs and swaps, was lower and flatter by 1 to 7 bps from the week prior. Kindly refer to the previous section for color on market dynamics and changes.

- On the UST term supply front, the upcoming week serves a slate of 2/5/7-year auctions to begin the week. Note that UST auctions usually occur at 1pm and can occasionally spur volatility around that time. Please contact the Member Services Desk for further information on market dynamics, rate levels, or products.

Reminder: FHLBNY’s 0% Development Advance (ZDA) program is open and running – This program provides members with subsidized funding in the form of interest-rate credits to assist in originating fixed-rate loans or purchasing loans/investments that meet one of the eligibility criteria under the Business Development Advance, Climate Development Advance, Infrastructure Development Advance, Tribal Development Advance, or the new Housing Development Advance. Members can apply for interest rate credits up to $250,000. Please contact Member Services Desk to learn more and check out our ZDA page.

Price Incentives for Advances Executed Before Noon: In effect as of Tuesday, September 5, 2023, the FHLBNY is pleased to now offer price incentives for advances executed before Noon each business day. These pricing incentives offer an opportunity to provide economic value to our members, while improving cash and liquidity management for the FHLBNY. For further details, kindly refer to the Bulletin.

Looking for more information on the above topics? We’d love to speak with you!

Archives

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the MSD Team.