Member Services Desk

Weekly Market Update

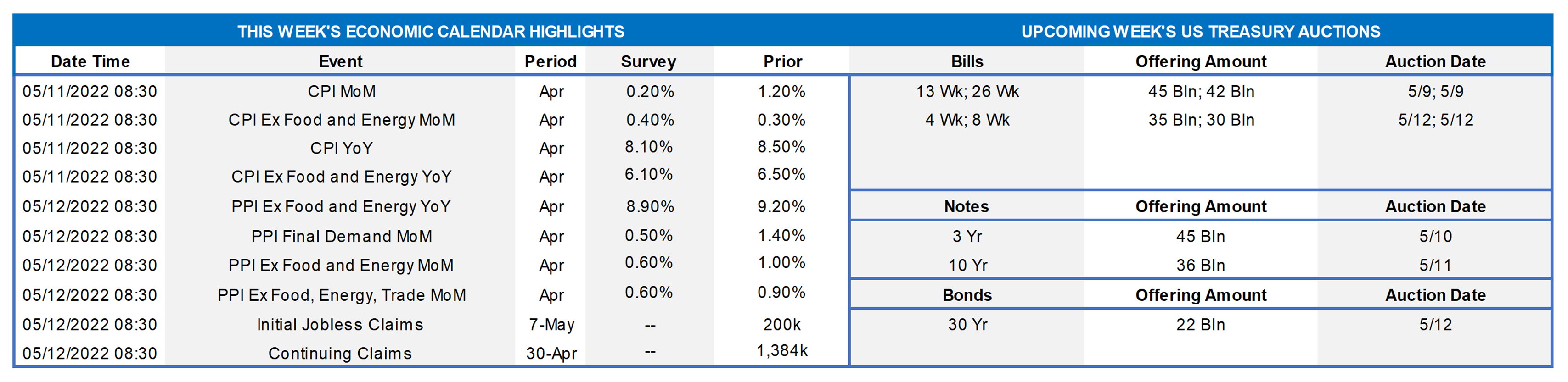

This MSD Weekly Market Update reflects information for the week of May 9, 2022.

Economist Views

Click to expand the below image.

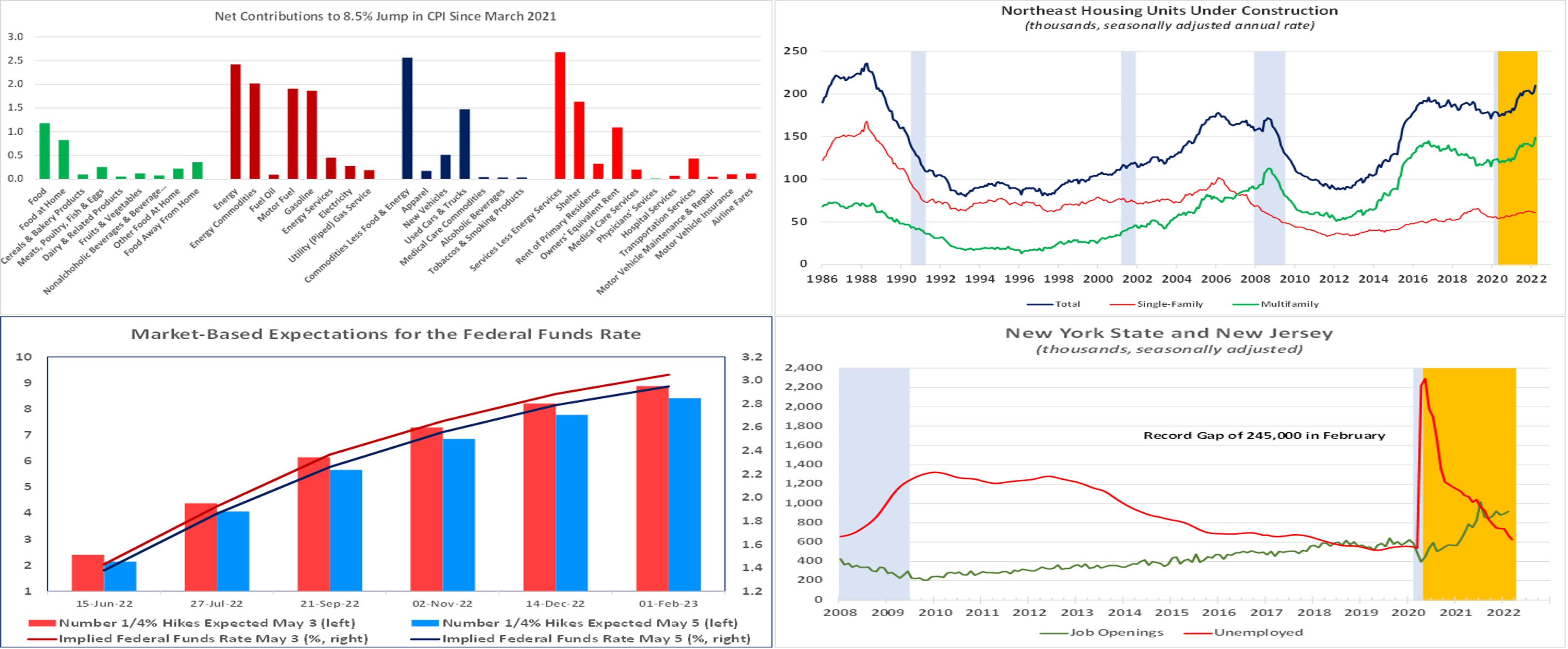

Having weathered the outcome of the Federal Open Market Committee meeting and the latest update on the employment situation last month, market participants will face a comparatively quiet week. The marquee statistical report will be the Bureau of Labor Statistics’ update on consumer prices in April. Speeches by half a dozen Federal Reserve officials will be scrutinized for their individual thoughts on the prospective direction of monetary policy.

NFIB Small Business Optimism Index: Echoing reported dips in closely followed Institute for Supply Management gauges, small business sentiment probably retreated slightly from the 93.2 reading recorded in March.

Consumer Prices: The Bureau of Labor Statistics is expected to report that seasonally adjusted declines in retail energy costs capped the rise of the CPI at 0.2% in April, after a 1.2% jump in March. However, excluding volatile food and energy components, the growth of the so-called core CPI is expected to quicken to 0.4% from 0.3% in the prior month. The anticipated increases, if realized, would place the overall and core CPIs 8.1% and 6.0% above their respective year-ago levels – both well above Federal Reserve officials 2% target.

Producer Prices: Mimicking consumer costs, producer price gains likely slowed in April. The consensus expected the PPI to climb by 0.4% during the reference period, following a 1.4% jump in March, leaving the latest observation 10.6% above its year-ago level.

Jobless Claims: With vacant positions eclipsing the number of jobless persons by a record margin, initial and continuing state unemployment insurance claims probably moved lower in their respective reporting periods.

Michigan Sentiment Index: Concerns about inflation and rising interest rates likely weighed on consumers’ spirits at the beginning of May, paring the University of Michigan’s consumer confidence barometer to 63.5 from 65.2 in April.

Federal Reserve Appearances:

- May 10 New York Fed President Williams to give a speech at a NABE/Bundesbank economic symposium in Eltville am Rhein.

- May 10 Fed Governor Waller to take part in a moderated discussion before the Economic Club of Minnesota.

- May 10 Cleveland Fed President Mester to speak on monetary policy and financial stability challenges.

- May 10 Atlanta Fed President Bostic to discuss monetary policy and the economy at his bank’s annual conference.

- May 11 Atlanta Fed President Bostic to discuss economy and monetary policy with the World Affairs Council of Jacksonville.

- May 12 San Francisco Fed President Daly to take part in a moderated discussion hosted by her bank in Anchorage, Alaska.

- May 13 Minneapolis Fed President Kashkari to takes part in a discussion on energy prices and their impact on inflation.

Click to expand the below image.

CHART 1 UPPER LEFT

Source: Bureau of Labor Statistics, FHLBNY

Awaiting the April update, it is instructive to take a closer look at the factors driving the pickup in consumer price inflation over the latest 12 months. The surge in consumer prices since March of 2021 has been broadly based across goods and services categories. Exacerbated by the Russian invasion of Ukraine, energy price hikes have been responsible for a little over one-quarter of the overall rise. Increases in new and used motor vehicle costs attributable to computer chip shortages and other supply chain issues have made an almost-equivalent contribution. Shelter costs, in particular owners’ equivalent rent, have also been a major driver. This area bears watching incoming months. Home sales are slowing down due to higher interest rates and a dearth of dwellings on the market, adding to already outsized increases in rental prices across the nation.

CHART 2 UPPER RIGHT

Source: Census Bureau, National Bureau of Economic Research and FHLBNY

Builders are responding to the desperate need for new housing units, but shortages of appliances, construction materials, and workers continue to delay completions of both single- and multifamily structures In the Northeast, housing units under construction climbed to 210,000 – the largest backlog since September 1988. Not surprisingly, structures containing two or more units account for a little over 70% of those awaiting completion in our region. Due to the above constraints, the length of time from start to completion for a single-family home, nationally, increased from 6.8 months in 2020 to a 12-year high of 7.2 months in 2021, while the time required to build a multifamily structure remained steady at 15.4 months, 10.7 months for single-family homes and 18.5 months for multifamily dwellings. Construction times in the Northeast were considerably longer last year.

CHART 3 LOWER LEFT

Source:: Bloomberg, FHLBNY

Consistent with the now likely outdated “dot plot” contained in the Summary of Economic Projections issued after the March meeting and current market expectations, the FOMC anticipates that ongoing increases in the federal funds rate target range will be appropriate. While market expectations of prospective rate hikes ebbed slightly in the wake of the FOMC’s policy decisions, traders and investors continue to price in with certainty a pair of 50-bps moves at the June 15 and July 27 meetings.

CHART 4 LOWER RIGHT

Source: Demand for new workers is outstripping potential supply across the Nation and within the majority of the FHLBNY coverage area. The BLS reported that the number of available job openings across the country expanded by 205,000 to a record 11.5 million in March. The gap between available positions and the unemployed swelled to an all-time high of 5.6 million, or 1.9 job openings per unemployed person, in March. The latest data for New York and New Jersey also revealed tight hiring conditions. At 917,000 in February, the number of available jobs across the Empire and Garden States stood a record 245,000 above those unemployed. There were almost 1.4 open positions per jobless person across the two states that month.

FHLBNY Advance Rates Observations

Front-End Rates

- Short-end Advance rates finished a bit higher week-over-week. The market’s ongoing aggressive pricing of forthcoming Fed rate hikes have served to push advance rates higher. As of this past Friday afternoon, the market priced for a 100% probability of 50 bps hike at the June 15th FOMC meeting. The July meeting is also pricing for a significant chance of a 50bps hike as well. This pricing and the fact that maturities are crossing further into the timeline of the Fed hiking cycle, were causal factors in the rate moves.

- Given the Fed tightening posture and upcoming FOMC meetings, rates will remain highly responsive to the market’s moves and pricing of the Fed.

Term Rates

- This past week 1/3/5 year rates were a few bps higher week-over-week. The 10 year advance was marginally higher. While our advance curve has lost points of inversion of a few weeks ago, it is still notably flat in certain areas; for instance, the 4 to 5-year is flat. This condition may provide a compelling opportunity to extend liability duration at no or minimal coupon increase.

- On the UST term supply front, this upcoming week brings 3/10/30 year auctions. Given market volatility, members should monitor conditions for potentially more optimal timing on transactions. Please call the Member Service Desk for information on market dynamics, rate levels, or products.

Product Alert: FHLBNY is pleased to announce enhancements to our Advance Rebate Program, which provides members an opportunity to receive a cash rebate when prepaying an eligible advance and rebooking a new advance within a 30-day period. Rebate-eligible advances now must have a minimum of 6-months (reduced from 1-year) remaining. Moreover, the potential cash rebate has been increased. This program can be suitable for those wishing to extend their liability duration and/or potentially improve net interest margin. Please call the Member Service Desk at (212) 441-6600 for more information.

Forward Start Advance (FSA): For members with upcoming borrowing or refunding plans, consider the FSA as a method to opportunistically “lock in” rates before advance settlement date. Please call the Member Service Desk at (212) 441-6600 for more information.

The Symmetrical Prepayment Advance Feature

With rates at or near multi-year lows, it is a compelling juncture to use the SPA feature on term advances. This feature allows member to capture, at prepayment, changes in the Fair Value of the advance which are favorable to the member. Contact us to discuss.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the MSD Team.