Credit Products

Give Your Institution the Strategic Flexibility to Maintain a Competitive Edge

The FHLBNY offers credit products designed to help facilitate your balance sheet strategies. Members can customize advances with a wide variety of maturities and structures, allowing you to choose funding that meets your objectives. FHLBNY advances can be customized by size, term, settlement date, amortization schedule, symmetry and more. If this is your first time borrowing with the FHLBNY, we created a Borrower’s Quick Reference Guide to assist members who want to initiate their first borrowing.

As a true cooperative, all of our members are treated equally, regardless of asset size; your institution will receive the same terms, whether you are borrowing $1 million or $100 million. Click on an advance for more information or view a printable version of all the descriptions.

For more information or view a printable version of all the descriptions.

Adjustable-Rate Credit (ARC) Advance (ST, MT & LT)

Amortizing Advance (MT & LT)

Callable ARC Advance (ST, MT & LT)

Callable Fixed-Rate Advance (MT & LT)

Fixed-Rate Advance (ST, MT & LT)

Fixed-Rate Advance with a SOFR Cap* (MT & LT)

Overnight Advance

Principal-Deferred Advance (MT & LT)

Putable Advance* (MT & LT)

Repo Advance (ST, MT & LT)

Reduced cost of funding under FHLBNY Community Lending Programs (CLP) is available for all advances with a minimum term of one year, except Putable Advances; CLP Advances are not eligible for the SPA feature or the Advance Rebate Program; our Putables (when available), Callable, Swaps, and Letters of Credit programs require additional agreements; all credit product terms are subject to credit conditions.

To maintain access to FHLBNY’s products, programs, and services, members are required to complete and submit their Member Attestation Form by the requested deadline annually. In addition, throughout the year, members must promptly disclose to the FHLBNY any material adverse change events that may impact their financial condition by both emailing [email protected] and contacting their designated Relationship Manager at (212) 441-6700.

Rate Information

Contact our Credit Services Representatives at (212) 441-6600 for a live quote or sign up to receive the daily rate indications (members only)

Advance Rebate Program

Provides members with a cash rebate on a portion of the fees paid relating to the early extinguishment of eligible advances when new eligible advances are obtained within 30 calendar days1. To receive the cash rebate, the prepaid advance(s) must have a remaining term of six months or longer, and new advance(s) must have a term of six months or longer.

Advantages:

- Members receive cash rebate

- Provides additional flexibility with balance sheet management

- Strengthens and adds value to your Co-op

For more information on the Advance Rebate Program, please read this funding strategy article or download the overview.

1Advances booked under Community Lending Programs and advances with remaining maturities of less than six months are not eligible advances.

Letters of Credit

Supports liquidity, asset/liability management, and housing and economic development activities.

Advantages:

- Obtain a guarantee of payment by a highly-rated* financial institution (the FHLBNY) to third parties in the event of a default of performance by a member

- Collateralize state and local government deposits at low cost

- Receive credit enhancements for a variety of transactions

- Choose from maturities between 2 weeks to 3 years

- Facilitate transactions that promote eligible housing and community development activities at a discounted price.

Click here to learn more about our Letters of Credit.

*The FHLBNY is currently rated “Aa1” and “AA+” by Moody’s and Standard & Poor’s, respectively. These ratings are equivalent to those assigned to the U.S. Government.

Interest Rate Derivatives

Reduces income fluctuations caused by interest rate volatility

Advantages:

- Achieve asset/liability management goals

- Hedge interest rate exposure or increase the certainty of future funding costs

- Potentially lower the cost of funding

Note: Available for institutions with total assets less than $10 billion

Putable Advance Modification Program

Offers the ability to potentially lower interest expense, reduce optionality in a member’s balance sheet and to better manage interest-rate and liquidity risks.

|

Modifications: |

Learn more on Financial Intelligence.

Symmetrical Prepayment Advance (SPA) feature

For added flexibility, symmetry can be added for an additional 2 basis points to either Fixed-Rate or Repo Advances with maturities of one year or greater and a minimum advance size of $3 million. If the advance becomes “in the money” during its term, you could extinguish and realize a gain.

Advantages:

- Gain additional flexibility with balance sheet management and/or restructuring (e.g., gains can serve as an offset to unrealized losses in securities portfolios)

- Enhance value during merger and acquisition scenarios (potential gains on the liability side of the balance sheet)

Click here to learn more about our Symmetrical Prepayment Advance (SPA) feature.

Transfers of Advances

Advances may be transferred between member institutions on a case by-case basis. All transaction negotiations (pricing, finding qualified counterparties*, etc.) will be the sole responsibility of the respective member involved in the advance transfer. Upon notification by the respective member that the transaction is complete, the FHLBNY will transfer the advance(s) to the acquiring member and the appropriate collateral and activity based capital stock adjustments will be made.

*To obtain transaction approval, the acquiring member will need to meet FHLBNY credit criteria and collateral requirements.

Please Note: Reduced cost of funding under FHLBNY Community Lending Programs (CLP) is available for all advances with a minimum term of one year, except Putable Advances; CLP Advances are not eligible for the SPA feature or the Advance Rebate Program; our Putables (when available), Callable, Swaps, and Letters of Credit programs require additional agreements; all credit product terms are subject to credit conditions.

Rate Information

Contact our Credit Services Representatives at (212) 441-6600 for a live quote or sign up to receive the daily rate indications (members only)

The 0% Development Advance (ZDA) Program

Thank you for your interest in this program.

At this time, all available funds for the 0% Development Advance (ZDA) Program have been fully allocated. New submissions will be placed on a waitlist and reviewed in the order received. If additional funding becomes available, we will contact waitlisted members accordingly.

For updates on future ZDA offerings, please check back regularly or contact Member Services Desk at 212-441-6600 with any questions.

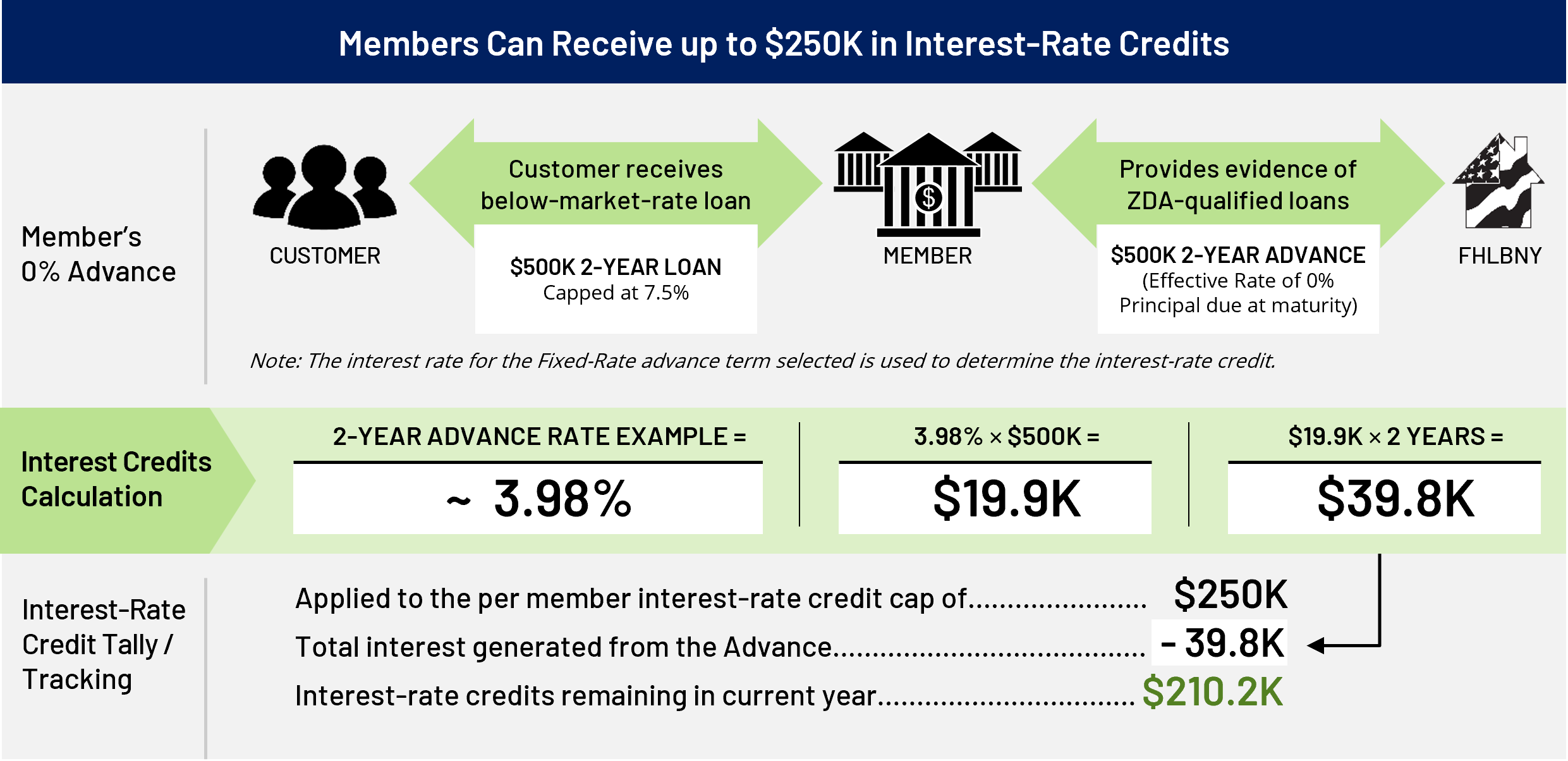

The Federal Home Loan Bank of New York (FHLBNY) 0% Development Advance (ZDA) Program provides members with subsidized funding in the form of interest-rate credits to assist in originating fixed-rate loans or purchasing loans/investments that meet one of the eligibility criteria under the Business Development Advance, Climate Development Advance, Infrastructure Development Advance, Tribal Development Advance, or the new Housing Development Advance. This program is intended to support economic development by incentivizing members to provide below-market-rate loans or invest in qualified initiatives.

Members can apply for interest rate credits up to $250,000 for any combination of the five advance types under the ZDA Program by submitting the ZDA Application Form. The overall program total available to the membership is $7.2 million in interest-rate credits ― provided on a first-come, first-served basis, as advances are issued.*

ZDA Program Benefits

The ZDA Program can afford members with greater flexibility to tailor their fixed-rate lending products to better serve their communities. Members can take advantage of the discounted liquidity through this program to:

- Support communities by providing competitive interest rates to fund initiatives that create affordable homes, help sustain your local economy and foster job opportunities

- Enhance relations with underserved communities and expand your reach

- Develop new and/or strengthen existing customer relationships

- Gain a competitive advantage when bidding and/or buying eligible loans

*Funding is provided on a first-come, first-served basis until the total allocation is reached.

| ZDA Program Attributes and Structure | |

|

Terms1 |

1 to 3 Years |

|

Advance Type |

Fixed-Rate Advances |

|

Member Cap2 |

$250K in Interest-Rate Credits |

|

Maximum Rate Charged for Qualifying Fixed-Rate Loans |

7.5% (Prime rate at the time of program launch) |

|

Loan Dates |

Qualified fixed-rate loans and qualified investment securities purchases must be issued/purchased on or after January 1, 2025, and closed or settled by December 1, 2025. |

1Subject to terms at time of product offering. The maturity date of the zero percent advance(s) shall not exceed the remaining term of the qualified loans/investments.

2Assessed annually and is subject to change. A member’s interest-rate credit cap is calculated using the interest rate of the Advance at the time of booking. Interest rate credits (subsidies) are credited back to members’ accounts monthly, over the life of the Advance.

| Loan Qualifications | |

| Business Development Advance (BDA) | |

| The BDA assists members in originating or purchasing fixed-rate loans to support the funding needs of small businesses, including farms and non-profit customers. |

|

| Climate Development Advance (CDA) | |

| The CDA assists members in originating or purchasing climate or energy efficient-oriented fixed-rate loans/investments in support of environmental initiatives (e.g., loans for solar panels, farm and agricultural loans, or the purchase of green bonds or related ESG securities). |

|

| Infrastructure Development Advance (IDA) | |

| The IDA assists members in originating or purchasing fixed-rate loans and investment securities to support local infrastructure development (e.g., construction or C&I loans, Bond Anticipation Notes or Securities that give rural communities access to clean water supply, reliable energy and vital internet access). |

|

| Tribal Development Advance (TDA) | |

| The TDA assists members in originating fixed-rate loans or purchasing assets that support housing and community and economic development on tribal lands. |

|

| NEW: Housing Development Advance (HDA) | |

| The HDA assists members in originating or purchasing fixed-rate loans that support the pre-development or acquisition phases of affordable housing projects. |

|

| Advance Request & Certification |

|

Please Note:

To maintain access to FHLBNY’s products, programs, and services, members are required to complete and submit their Member Attestation Form by the requested deadline annually. In addition, throughout the year, members must promptly disclose to the FHLBNY any material adverse change events that may impact their financial condition by both emailing [email protected] and contacting their designated Relationship Manager at (212) 441-6700.

Advances are transacted in the same manner as traditional Advances, in adherence with all credit, collateral, and capital stock requirements, and are subject to lending parameters under the Credit Risk Management Framework.