Financial Intelligence

Symmetrical Prepayment Advance Feature

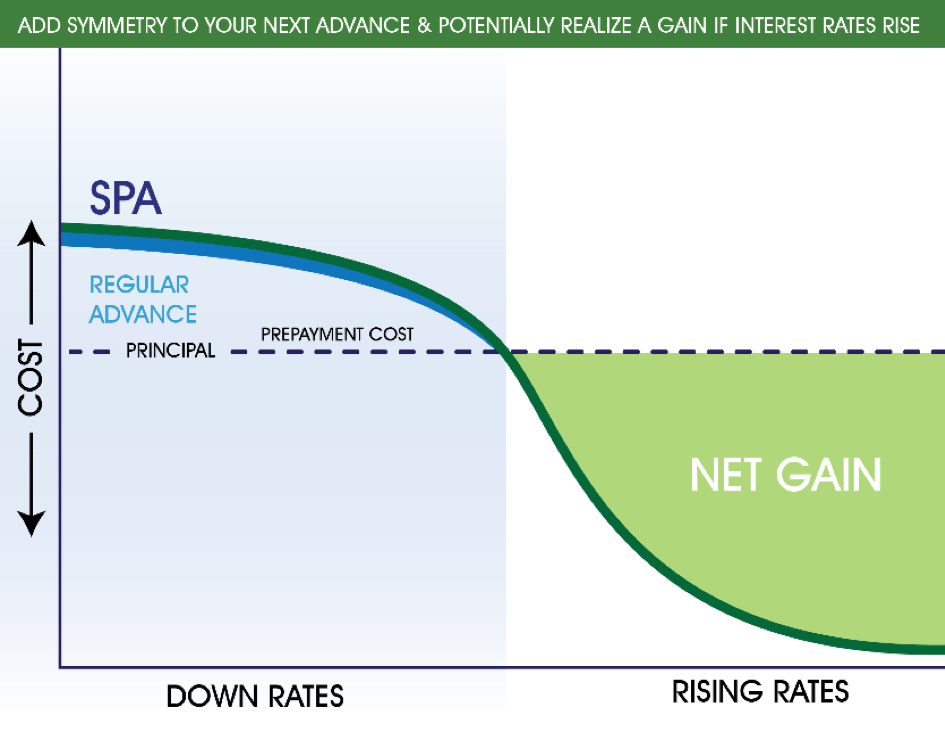

Federal Home Loan Bank of New York (FHLBNY) members have the ability, at the time of the trade, to add symmetry to certain advances with maturities of one year or greater. The SPA feature allows members to receive compensation for favorable changes in the Fair Value of an advance should a member wish to terminate (prepay) the advance prior to its maturity.

The Symmetry feature is available only at the time of booking an advance transaction at an additional two basis points increase over an advance without symmetry.

Why Use a SPA Feature?

The changing market conditions of today require flexibility in managing the balance sheet. The SPA feature was developed to provide an advance alternative for members looking for funding tools which offer greater flexibility in a rising rate environment. Members can add the SPA feature to eligible fixed-rate non-amortizing advances to meet their liquidity needs and will retain the ability to prepay the advance early like all other advances. However, unlike all other advance products, favorable changes in the Fair Value of the advance may be harvested at the time of prepayment if the advance contains the symmetrical prepayment feature.

In all cases, the member is still required to pay a minimum prepayment fee to ensure the FHLBNY’s financial indifference to the prepayment of the advance. However, a portion of the prepayment fee may be eligible for the FHLBNY’s Advance Rebate Program.

Available SPA Advance Structures

| Symmetrical Prepayment Advance Feature | ||

|

Terms |

One year up to 30 Years (term dictated by individual product parameters) |

|

|

Minimum Transaction Size |

$3 Million |

|

|

Minimum Partial Prepayment Size |

$3 Million |

|

|

Advance Types with Symmetrical |

Regular fixed-rate, non-amortizing bullet advances (not available for Community Lending Program advances) |

|

Note: Prepayment above $1 billion per member per month will require review and approval from the FHLBNY.

How Does the SPA Feature Work

When terminating advances early, members are always subject to prepayment penalties when the coupons on those borrowings are “out of the money”. However by adding a SPA feature to an advance, if interest rates rise beyond a threshold causing the market value of the advance to become positive, a net gain may be realized, allowing a member to repay the advance at an amount below the outstanding par value.

Benefits to Members

- Provides more flexibility when managing the Balance Sheet (e.g. gains can serve as an offset to unrealized losses in securities portfolios)

- Can potentially harvest gains during balance sheet restructuring

- Unrealized gains on the liability side of the balance sheet may serve to enhance value during merger and acquisition scenarios

Contact Us

If you would like more information on adding symmetry to your next qualified Fixed-Rate Advance, contact a Relationship Manager at (212) 441-6700 or Member Services Desk at (212) 441-6600.

Disclaimer: Notwithstanding any language to the contrary, nothing contained in these disclosures is intended to constitute an offer, inducement, promise, or contract of any kind. Any product descriptions and pricing may be subject to change without notice.

The content provided in these disclosures is presented as a courtesy to be used only for informational purposes and is not represented to be error free. The FHLBNY makes no representations or warranties of any kind with respect to the content contained herein, such representations and warranties being expressly disclaimed. The FHLBNY is not a financial or investment advisor.

Moreover, the FHLBNY does not represent or warrant that the content of these disclosures is accurate, complete or current for any specific or particular purpose or application. It is not intended to provide nor should anyone consider that it provides legal, accounting, tax or other advice. Such advice should only be rendered in reference to the particular facts and circumstances appropriate to each situation. The FHLBNY encourages you to contact appropriate professional(s) and consultant(s) to assess your specific needs and circumstances and to render such advice accordingly. In addition, the FHLBNY is not endorsing or recommending the use of the means or methods contained in or through these disclosures for any special or particular purpose.

It is solely your responsibility to evaluate the risks or merits of any funding or investment strategy. In no event will FHLBNY or any of its officers, directors or employees be liable for any damages — whether direct, indirect, special, general, consequential, for alleged lost profits, or otherwise – that might result from any use of or reliance on these materials.