Collateral Guide

Collateral Guide

We are delighted that you have decided to take advantage of the Federal Home Loan Bank of New York’s (FHLBNY) Collateral guide. As you know, members must have sufficient qualifying collateral pledged in order to obtain borrowing potential to secure credit extensions.

This guide will assist you through the process of maximizing your borrowing potential by providing an overview of the identification, submission, reporting and valuation of eligible collateral. You can navigate through each tab above. At any time, we encourage you to contact your Relationship Manager who will be happy to provide assistance.

As always, we value your membership and look forward to our ongoing partnership.

Key Contacts

Relationship Managers

(212) 441-6700

Member Services Desk

(212) 441-6600

[email protected]

Safekeeping Department

(800) 546-5101, Option 3-1

Collateral Analysis Department

(201) 356-1069

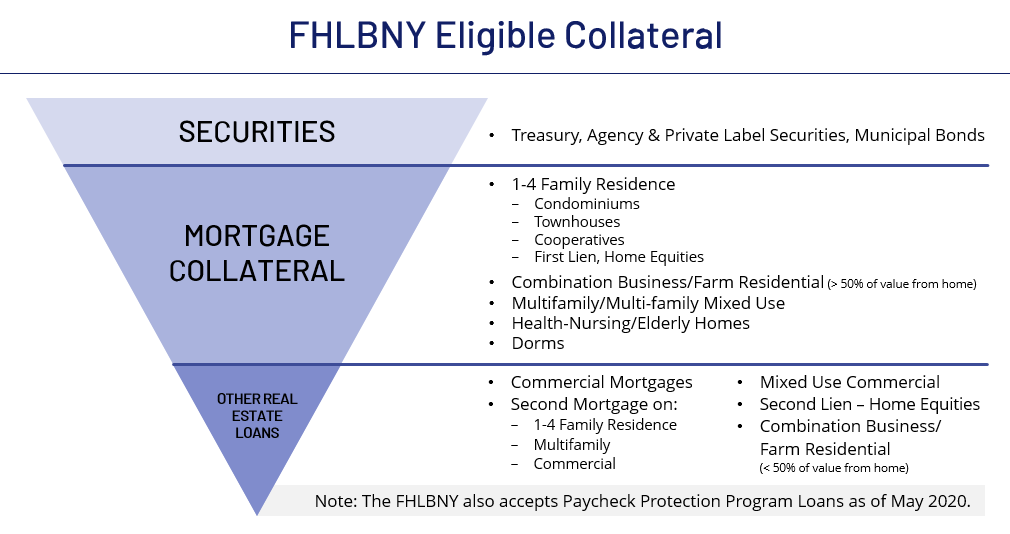

Identifying Eligible Collateral

The FHLBNY accepts eligible mortgage loans on 1-4-family residential properties, home equity lines of credit (HELOC), multi-family, and commercial real estate. Agency and U.S. Treasury securities, certain private-label mortgage-backed securities, and certain municipal bonds, as well as cash are also accepted as collateral. Additionally, as of May 2020, the FHLBNY also accepts Paycheck Protection Program (PPP) Loans.

For complete details regarding eligible forms of collateral and their specific haircuts and qualification guidelines, please refer to the Member Products Guide. To obtain a copy, please log onto 1Link®, our secure internet banking system.

Key Contacts

Relationship Managers

(212) 441-6700

Member Services Desk

(212) 441-6600

[email protected]

Safekeeping Department

(800) 546-5101, Option 3-1

Collateral Analysis Department

(201) 356-1069

Submitting Collateral

Securities Collateral

Pledging eligible securities collateral is accomplished by requesting a safekeeping account and delivering your securities. Securities are marked-to-market on a daily basis and a haircut is applied to arrive at your borrowing potential for those pledged assets.

Submit Securities Collateral

Submit Municipal Bonds

Submit Paycheck Protection Program Loans

Mortgage Loan Collateral

Pledging whole-loan mortgage collateral is more complex as it involves submitting a data feed. Members are assigned collateral categories and some entail additional mortgage documentation requirements. Based on the attributes of your loans, they are marked-to-market (residential loans on a monthly basis & income producing loans on a quarterly basis) and a haircut is applied to arrive at your borrowing potential.

Submit Mortgage Loan Collateral

Collateral Standing Instructions Process

Key Contacts

Relationship Managers

(212) 441-6700

Member Services Desk

(212) 441-6600

[email protected]

Safekeeping Department

(800) 546-5101, Option 3-1

Collateral Analysis Department

(201) 356-1069

Determine Borrowing Capacity

About Lendable Value

Maximum Lendable Values are established to ensure that the FHLBNY always has sufficient eligible collateral securing credit extensions. Maximum Lendable Values are typically designated by the type of collateral pledged. The collateral is periodically evaluated and adjusted to reflect current market conditions. In establishing the various Maximum Lendable Values, the FHLBNY considers the potential market, credit and liquidity risks associated with each type of pledged collateral. In addition, the Maximum Lendable Value allows for reasonable costs associated with the liquidation of collateral as well as any remaining unknown factors.

However, the Maximum Lendable Values may also be impacted by the overall financial condition of the members, or third-party entities (i.e., pledgors, servicers, custodians) involved in the relationship between the member and the FHLBNY.

Members with a weakened financial condition may be assigned a lower Maximum Lendable Value and may be required to provide additional collateral to cover accrued interest, and estimated early termination fees on outstanding advances.

For a summary of Maximum Lendable Value requirements and how it applies, please refer to the Member Products Guide.

Current Borrowing Potential

Members can view their Collateral Position Report on 1Link® which enumerates a member’s borrowing potential.

Once you log into 1Link®, click on the “Information Reporting” tab, then under “Reports” drop-down list click on “Special Reports,” then select “Collat Customer Summary Report.” Through 1Link®, you can also arrange to have your report automatically delivered to you via email. If you are not signed up on 1Link®, please contact your Relationship Manager.

Determining your Total Borrowing Capacity