Financial Intelligence

September 3, 2019

Principal-Deferred Advance

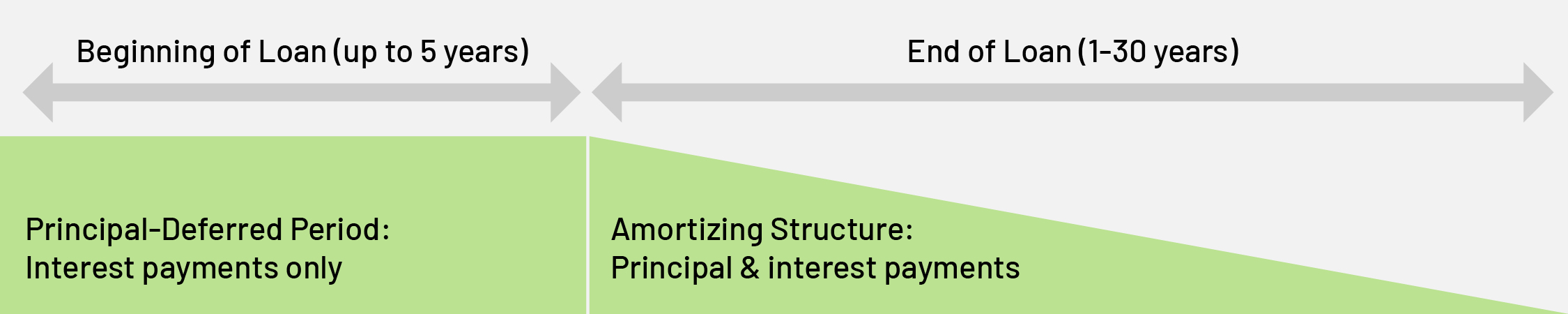

The Principal-Deferred Advance (PDA) is a hybrid advance product that combines elements of the Fixed-Rate Advance and the Amortizing Advance. With the PDA, principal payments are deferred for a predetermined period, while the interest rate is locked in for the life of the advance. It begins as a Fixed-Rate Advance, allowing members to choose a specific amount of time they would like to defer the principal payment of the advance, up to 5 years. When the lockout, or principal-deferred period ends, the advance becomes an Amortizing Advance, where the member makes principal and interest payments on the loan up to another 30 years. This structure can be used to match or pool fund a variety of loan programs, including interest-only-to-amortizing residential loans and construction-to-permanent loans.

PDA Structure:

With this advance, members can enjoy the benefits of both the Fixed-Rate and Amortizing Advances. The PDA was designed to help members manage through an uncertain interest-rate environment with the added smoothness of an integrated advance that combines an interest-only structure for the beginning of the loan and a customizable amortizing backend, all at a rate that remains unchanged for the life of the advance.

With this advance, members can enjoy the benefits of both the Fixed-Rate and Amortizing Advances. The PDA was designed to help members manage through an uncertain interest-rate environment with the added smoothness of an integrated advance that combines an interest-only structure for the beginning of the loan and a customizable amortizing backend, all at a rate that remains unchanged for the life of the advance.

PDA Features:

- Rate: fixed over the life of the advance

- Day Count Basis: 30/360

- Initial Payment Frequency: monthly on the funding date

- Term: 1-30 years after principal-deferred period

- Maximum Principal-Deferred Period: 5 years

- Maximum Settlement: 12 months out

- Prepayable: yes

PDA Benefits:

- Valuable asset/liability management tool

- Fully amortizing backend with a choice of varying balloon terms

- Mirrors characteristics of a typical construction deal with a permanent take-out

- No embedded options in the advance

Best used for:

- Members who match fund construction-to-permanent loans

- Members who want to pre-fund a branch

- Liquidity

For more information on how our Principal-Deferred Advance can help meet your institution’s funding needs, contact a Relationship Manager at (212) 441-6700.

Note: Advances may be collateralized with eligible mortgages or securities identified in the Member Products Guide.

Disclaimer: Notwithstanding any language to the contrary, nothing contained in these disclosures is intended to constitute an offer, inducement, promise, or contract of any kind. Any product descriptions and pricing may be subject to change without notice.

The content provided in these disclosures is presented as a courtesy to be used only for informational purposes and is not represented to be error free. The FHLBNY makes no representations or warranties of any kind with respect to the content contained herein, such representations and warranties being expressly disclaimed. The FHLBNY is not a financial or investment advisor.

Moreover, the FHLBNY does not represent or warrant that the content of these disclosures is accurate, complete or current for any specific or particular purpose or application. It is not intended to provide nor should anyone consider that it provides legal, accounting, tax or other advice. Such advice should only be rendered in reference to the particular facts and circumstances appropriate to each situation. The FHLBNY encourages you to contact appropriate professional(s) and consultant(s) to assess your specific needs and circumstances and to render such advice accordingly. In addition, the FHLBNY is not endorsing or recommending the use of the means or methods contained in or through these disclosures for any special or particular purpose.

It is solely your responsibility to evaluate the risks or merits of any funding or investment strategy. In no event will FHLBNY or any of its officers, directors or employees be liable for any damages — whether direct, indirect, special, general, consequential, for alleged lost profits, or otherwise – that might result from any use of or reliance on these materials.

Key Contacts

Relationship Managers:

(212) 441-6700

Member Services Desk:

(212) 441-6600 or

(800) 546-5101, option 1