Member Services Desk

Weekly Market Update

This MSD Weekly Market Update reflects information for the week of October 13, 2020.

Economist Views

Click to expand the below image.

Financial-market sentiment probably will wax and wane along with prospects for the Democrats and Republicans agreeing on yet another fiscal support package. House Speaker Nancy Pelosi has stated that there will be no stand-alone measure to support the domestic airline industry without a bigger overall aid package. Senate Majority Leader Mitch McConnell has said that a Coronavirus stimulus package is unlikely in the next three weeks. On the data front, retail sales figures for September, along with revised tallies for July and August, will allow economists to solidify their projections for Q3 consumer spending. There will be five appearances by Federal Reserve officials in the coming week, albeit none of which is likely to prompt a significant market response.

NFIB Small Business Optimism Index: Already reported improvements in a variety of labor-market soundings suggest that the NFIB’s Small Business Optimism Index climbed to its highest level since the Coronavirus pandemic struck with a vengeance in March.

Consumer Price Index: Increases in consumer goods and services costs likely slowed in September, thereby leaving year-to-year hikes in both overall and core inflation gauges below the Fed’s desired 2% target.

Jobless Claims: Online inquiries on how to file for unemployment insurance benefits suggest that initial claims probably dipped below the 800K mark during the period ended October 10, after an 840K tally in the prior week. New filings remain well above the 233K average prevailing before the pandemic crisis began in late March.

Retail Sales: Powered by a solid jump in motor vehicle purchases, the pace of retail sales probably quickened in September, after a 0.6% gain in August. Control sales – the portion of the Census Bureau’s report excluding automotive, building materials, and gasoline purchases that is used to estimate nominal consumer goods spending – are expected to edge 0.1% higher, placing the Q3 outlays a whopping 36.8% above their COVID-depressed spring-quarter average.

Industrial Production: Industrial production is expected to have risen for a fifth straight month in September. The consensus projection of a 0.6% increase, if realized, would still leave output at the nation’s factories, mines, and utilities roughly 6.5% below the level achieved before the pandemic.

Michigan Consumer Sentiment Index: The University of Michigan’s canvass likely will reveal that consumer confidence improved for a third straight month in October but remained well below the level prevailing before the COVID crisis began. Indeed, the 80.5 reading anticipated by the Street pales in comparison to the 101.0 posted in February.

Federal Reserve Appearances:

Oct. 14: Federal Reserve Vice Chair Clarida to speak at annual IIF meeting.

Oct. 14: Fed Vice Chair for Supervision Quarles and Dallas Fed President Kaplan to discuss supervision, regulation, and policy in the U.S. and the world.

Oct. 14: Dallas Fed President Kaplan to hold a virtual town hall: A Discussion of Economic Developments and Implications for Monetary Policy.

Oct. 15: Fed Vice Chair for Supervision Quarles to speak at annual IIF meeting.

Oct. 15: Minneapolis Fed President Kashkari to speak on U.S. economic outlook.

Click to expand the below images.

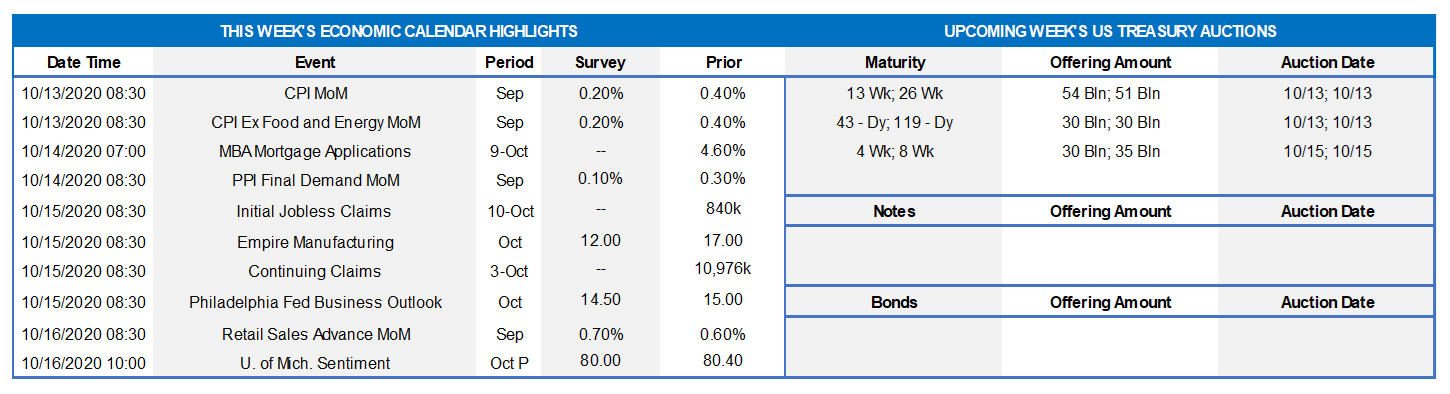

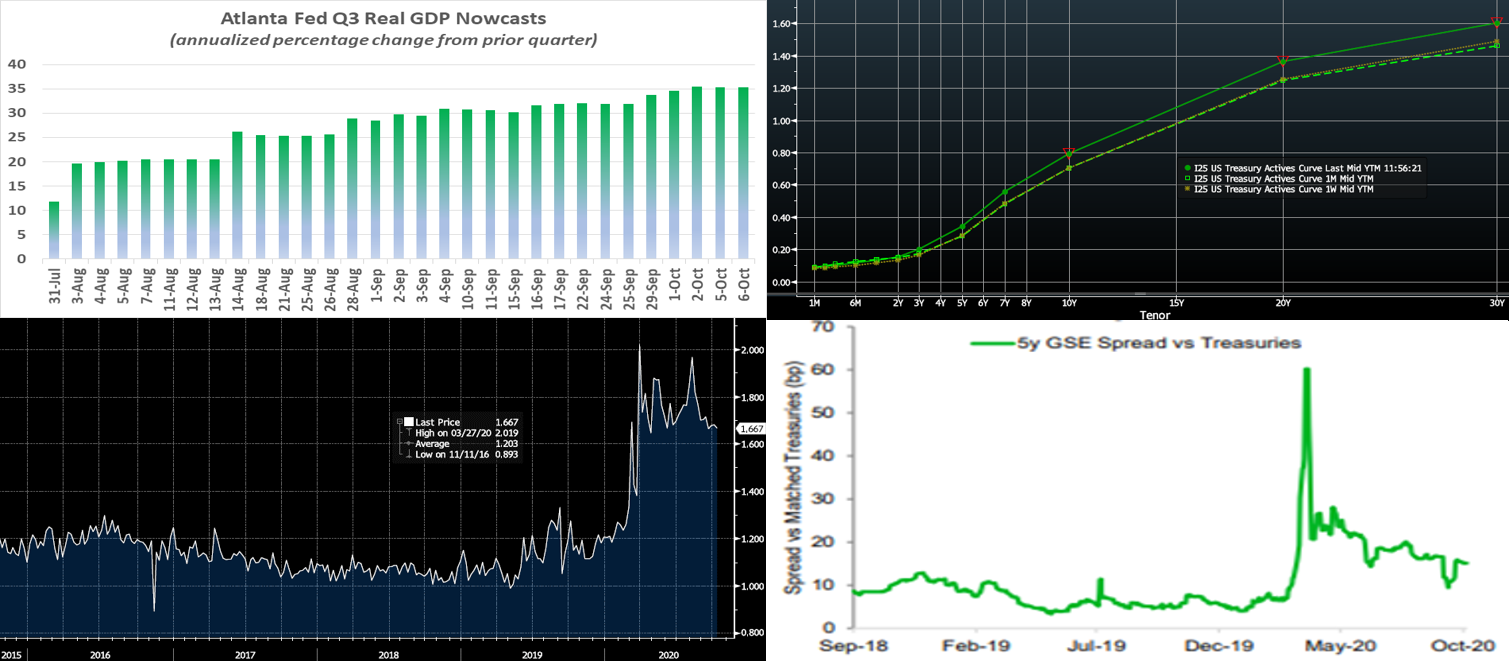

CHART 1 – UPPER LEFT

Source: FHBLNY. Expectations for the magnitude of the rebound in Q3 real GDP growth have moved markedly higher over the past two months. The Federal Reserve Bank of Atlanta, which came “closest to the pin” on the originally reported 32.9% annualized plunge in spring-quarter activity, has essentially tripled their estimate from 11.9% at the end of July to 35.3% this week. That estimate, along with the consensus call for a further 5% rise over the final three months of the year, would leave inflation-adjusted activity 1.9% below that of Q4 2019, besting the Federal Reserve’s projected 3.7% decline.

CHART 2 – UPPER RIGHT

Source: Bloomberg. The UST curve remains mired in a tight range in the 5-year and shorter sector. As has been the case in recent months, the Fed’s guidance and programs have served to pin the shorter maturities, and so it has been the longer end of the curve leading any moves. This past week experienced a notable “bear steepening”, with 5-year and longer yields rising from 5 to 13 bps in progressive fashion out the curve. The past week contained heavy long-end UST issuance, and the 30-year auction demanded a yield concession to be absorbed by the market. Meanwhile, corporate issuance continued its heavy pace. But most influential in market moves has been the perceived higher chance of another fiscal relief package either near-term or at least in the next few months. Notably, Fed members have pushed for further fiscal relief.

CHART 3 – LOWER LEFT

Source: Bloomberg. Depicted here (in %) is the primary-secondary mortgage spread which is the spread between primary borrower rates and the par-priced secondary market Agency MBS coupon. The primary-secondary spread is a widely tracked and closely watched metric, because it provides insight into the margins, and thus profitability, of originators. Taking the spread and subtracting other components, such as the Agency guarantee fee and mortgage servicing fee, provides an indication of the profit margins of mortgage originators. This spread is still well north of prevailing levels of the last five years, thereby reflecting an area of opportunity for originators in the currently bustling housing and mortgage market that has been driven by historically low rates.

CHART 4 – LOWER RIGHT

Source: Bloomberg; TD Securities. The massive Fed liquidity and credit programs driven investor demand for yield higher and, in turn, credit spreads tighter. GSE (Government Sponsored Entity – such as FHLB) debt has experienced a tightening of spreads since the spring, albeit not back to pre-COVID levels. This trend has benefited Advance rates; with rates and spreads at very low levels, term funding can be more compelling if suitable from an asset/liability management perspective.

FHLBNY Advance Rates Observations

Front-End Rates

Short-end advance rates finished unchanged to 1bps higher week-over-week. Heavy T-bill issuance was a feature, as usual, but net supply has been slowing and thereby allowing for easier market absorption. Money market funds experienced ~$21bn of outflow on the week. Overall market supply of short paper has moderated in recent months, however, thereby blunting the impact of these investor outflows.

Heavy T-Bill issuance will remain a theme; UST issuance overall is now net positive supply in that more is being issued than what the Fed is buying in its programs, and so this scenario could prove a small challenge. However, with short UST rates at rock-bottom levels, and the Fed likely on hold for a long period, rates may trade in a sideways pattern. Net T-bill issuance has been lower since mid-summer, and Treasury has announced plans to shift issuance out the curve, but a new fiscal relief package may complicate/alter this forecast.

Term Rates

Medium and longer-term Advance rates were 2 to 13 bps higher on the week, in a “bear steepening” move. Rates 5-year and shorter generally remain pinned in a narrow range, and so again it was the portion of the curve past 5-year that led the week’s move. Refer to the previous section for pertinent color on the market moves.

Rates trade at historically low levels across the yield curve, and the curve is priced for the Fed to be on hold for several years. If suitable or sensible from an ALM perspective, it may be worthwhile to consider extending liabilities and locking in term rates. Note that the impending election has the potential to spur further moves in the curve and rates. Please call the Member Services Desk to discuss rate levels and potential ideas on extending existing higher-coupon advances.

Next week features a reprieve from term UST auctions. Corporate issuance should add yet again to its historic record pace. Attention will remain on the prospects of further relief legislation and certainly also on COVID-19 developments.

The Symmetrical Prepayment Advance Feature

With rates at or near multi-year lows, it is a compelling juncture to use the SPA feature on term advances. This feature allows member to capture, at prepayment, changes in the Fair Value of the advance which are favorable to the member. Contact us to discuss.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the

MSD Team.

Special Member Alert

The FHLBNY recently announced a newly expanded and flexible Disaster Relief Funding (DRF) advance program which offers discounted rate advances with maturities 1-mo and greater. Additionally, we have announced that PPP loans will be accepted as eligible collateral. Please contact us with any questions.