Member Services Desk

Weekly Market Update

Economist Views

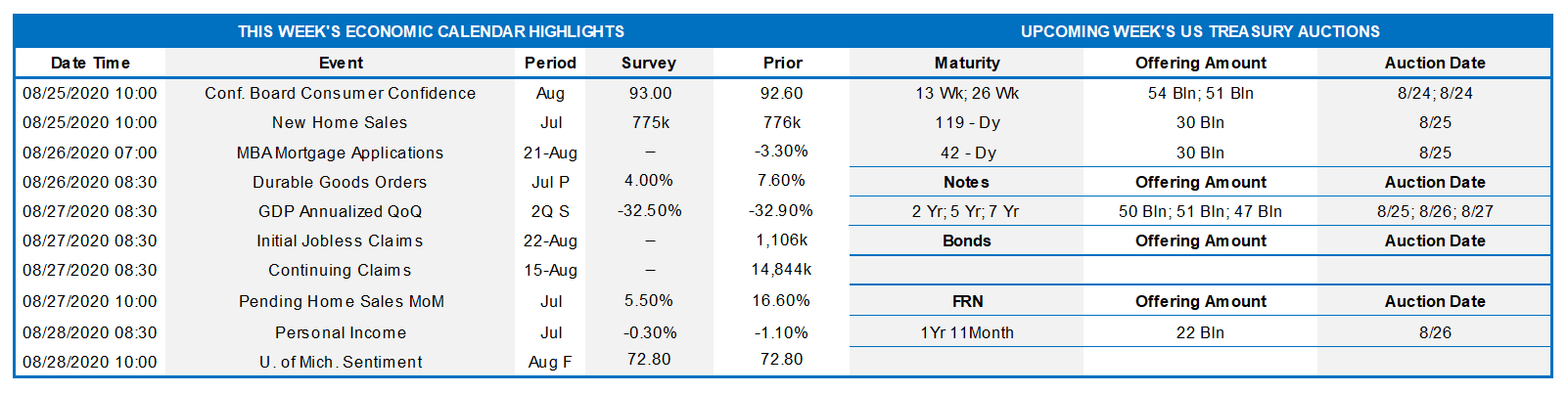

Click to expand the below image.

Having digested the Minutes of the FOMC’s July 28-29 meeting and no gathering scheduled until mid-September, market participants will likely focus on efforts in Washington to cobble together yet another pandemic economic relief package. Discussions have stalled, and there is no sign that a breakthrough is imminent. The four main principals – Treasury Secretary Steven Mnuchin, White House Chief of Staff Mark Meadows, House Speaker Nancy Pelosi and Senate Minority Leader Chuck Schumer – have not spoken since August 7. With lawmakers now on summer recess, prospects have risen that another round of fiscal relief may not be forthcoming at least until Congress returns in September. On the data front, economic releases are expected to improve across the board from their prior-period readings.

Conference Board Consumer Confidence: The Conference Board’s sentiment gauge likely rose modestly to 94.0 in August from 92.6 in the previous month but still well below the 127.3 average posted in Q1, before the Coronavirus-induced shuttering of the economy.

New Home Sales: Reported increases in single-family building permits and housing units in July suggest that the Street’s call for no change in contract signings is probably much too pessimistic. Indeed, last month’s hikes in those two housing barometers is consistent with home sales being at a seasonally adjusted annual rate near 900K, 16% above the 776K recorded in June, and the strongest showing since December 2006.

Durable Goods Orders: Echoing the recoveries in other economic indicators, hard goods bookings probably climbed by 4.0% last month, boosting the cumulative increase since April to 28.7%. Pay particular attention to nondefense capital goods shipments excluding commercial jetliner deliveries, for clues to the contribution of business equipment spending to Q3 real GDP growth.

Real GDP (Q2 Revised): Upward adjustments to key inputs to the Bureau of Economic Analysis’ quarterly GDP estimates suggest that the advance Q2 figure of -32.9% annualized could be marked slightly higher in this week’s report.

Weekly Jobless Claims: A reduction in online inquiries about applying for unemployment insurance benefits hints at a sharp pullback in initial claim filings to roughly 895K during the week ended August 22, after the surprising 1.1mn tallied in the preceding week.

Pending Home Sales: Figures compiled by local realtors point to yet another double-digit increase in contract signings, following a 16.6% rise in June and a 44.3% leap in May.

Chicago Purchasing Managers Index: Manufacturing activity in the Windy City likely expanded further in August, with the headline measure improving upon July’s 51.9 reading.

Federal Reserve Appearances:

Aug. 25: San Francisco Fed President Mary Daly to discuss inequity and COVID-19 on a virtual panel hosted by the Rotary Club of Oakland, CA. Text and Q&A to be determined.

Aug. 27-28: Kansas City Fed to hold annual Economic Policy Symposium online, with theme of “Navigating the Decade Ahead: Implications for Monetary Policy.” It will be live-streamed to the public.

Click to expand the below images.

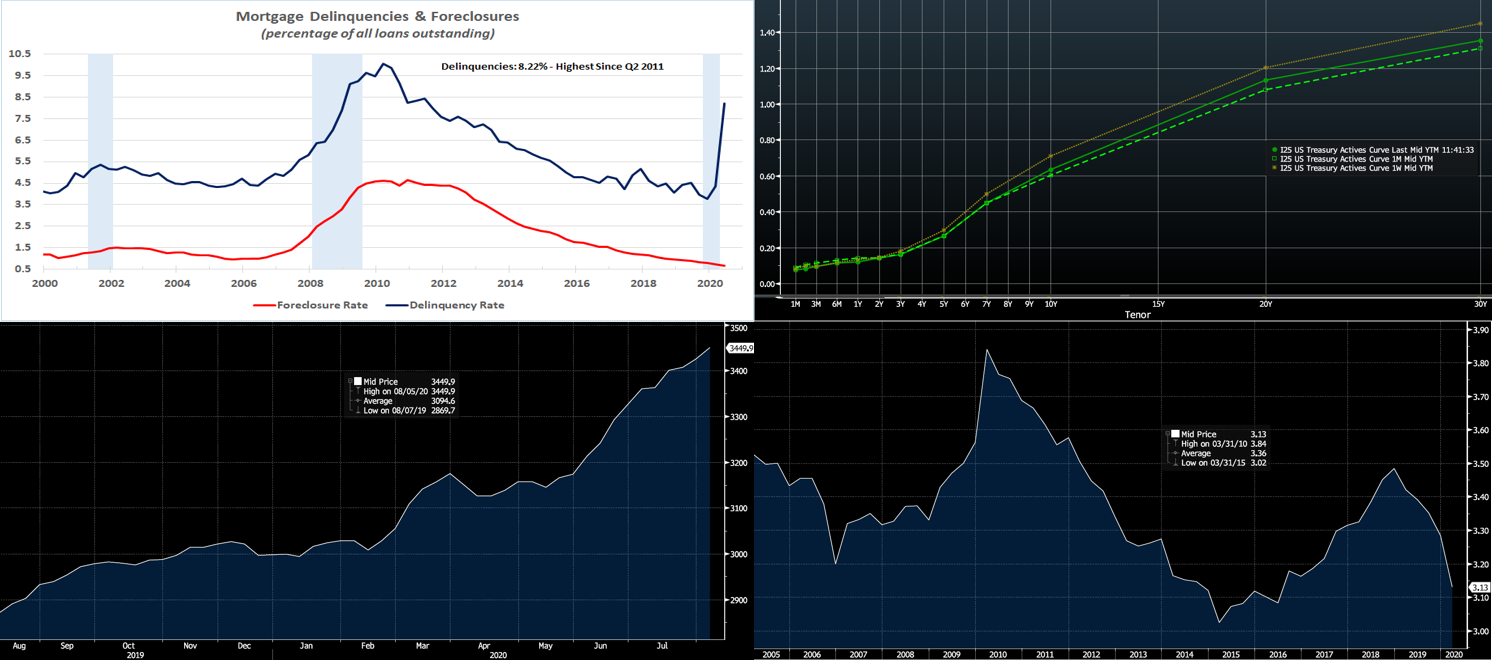

CHART 1 – UPPER LEFT

Source: MBA; FHLBNY. In data released this past week, mortgage delinquencies posted their largest quarterly rise on record in Q-2. The 8.2% rate was the highest in nine years. The MBA estimated that 4.2mn homeowners were on forbearance plans as of June 28, and servicers were asked to report loans in forbearance as delinquent for the survey. Forbearance has become prevalent, as the CARES Act allowed it on certain types of loan payments and some lenders voluntarily offered it. These changes in policy could have been particularly important for certain government-backed mortgages; indeed, the delinquency rate for FHA mortgages surged to an all-time high in Q-2. The delinquency rate for VA mortgages also surged in Q-2, close to its record high, while the rate for conventional mortgages rose but remained further away from earlier peak levels. The CARES Act also put temporary restrictions on new foreclosures; consequently, the MBA data reflected a record-low share of mortgages entering foreclosure in Q-2. Future developments related to delinquencies and foreclosures should depend in part on economic developments and related policy measures.

CHART 2 – UPPER RIGHT

Source: Bloomberg. In a partial reversal of the prior week, the UST yield curve “bull flattened” this past week. A respite from massive UST issuance helped the move, although corporate issuance remains strong for a usually slow August period. The Fed Minutes were essentially a non-event, and there was no fresh news of yield curve control or caps from the release. As has been the case in recent months, the Fed’s rate guidance and programs have served to pin the shorter (5-year and in) portion of the curve in a tight range, and so it has been the longer end of the curve leading any moves.

CHART 3 – LOWER LEFT

Source: Bloomberg. US Commercial Bank holdings of US and Agency securities have surged to a record high near $3.5trn. With deposits near all-time highs and tighter conditions on bank borrowers, flows into securities holdings have, in turn, risen markedly in recent months.

CHART 4 – LOWER RIGHT

Source: Bloomberg. A consequence of banks’ increased securities holdings can be downward pressure on net interest margins, as evidenced here in Bloomberg’s index of “NIM All Insured Institutions”. Downward pressure on bank NIM has persisted since the last data point seen here, with some institutions in the sub-3% zone. For members with potential term funding interest and aiming to combat NIM pressure, please take note of our Community Lending Programs, particularly the Disaster Relief Funding (DRF) program offering discounted rates with flexibility on maturities.

FHLBNY Advance Rates Observations

Front-End Rates

Short-end advance rates finished 2 to 4 bps lower week-over-week, thereby more than reversing the prior week’s uptick. Heavy T-bill issuance was a feature, as usual, but net supply has been slowing and thereby allowing for easier market absorption. Government-only and Prime MMF AUM experienced ~$10bn of outflows on the week, but conditions in the short-end were nonetheless liquid and readily accessible.

Heavy T-Bill issuance will remain a theme; UST issuance overall is now net positive supply in that more is being issued than what the Fed is buying in its programs, and so this scenario could prove a small challenge. However, with short UST rates at rock-bottom levels, and the Fed likely on hold for a long period, rates may trade in a sideways pattern. Net T-bill issuance is forecast by Street dealers to notably slow in the months ahead, and Treasury has announced plans to shift issuance out the curve, but a new fiscal relief package may complicate/alter this forecast.

Term Rates

Medium and longer-term advance rates were 2 to 8 bps lower, week-over-week, in a “bull-flattener” shift. While the 1 to 5-year sector was 2 to 4 bps lower in yield, the 6 to 10-year sector was 4 to 8 bps lower. See the previous section for more context on the move.

The upcoming week contains more UST term issuance, with regular 2/5/7-year auctions. Given the current backdrop of Fed guidance and programs, plus sturdy domestic and foreign demand, the supply should be absorbed with minimal impact. Attention will remain on further relief legislation and certainly also on COVID-19 and the question of whether or not it is being managed effectively enough to avoid any pauses in reopening.

The Symmetrical Prepayment Advance Feature

With rates at or near multi-year lows, it is a compelling juncture to use the SPA feature on term advances. This feature allows member to capture, at prepayment, changes in the Fair Value of the advance which are favorable to the member. Contact us to discuss.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the

MSD Team.

Special Member Alert

The FHLBNY recently announced a newly expanded and flexible Disaster Relief Funding (DRF) advance program which offers discounted rate advances with maturities 1-mo and greater. Additionally, we have announced that PPP loans will be accepted as eligible collateral. Please contact us with any questions.

Disclaimer: Notwithstanding any language to the contrary, nothing contained in these disclosures is intended to constitute an offer, inducement, promise, or contract of any kind. Any product descriptions and pricing may be subject to change without notice.

The content provided in these disclosures is presented as a courtesy to be used only for informational purposes and is not represented to be error free. The FHLBNY makes no representations or warranties of any kind with respect to the content contained herein, such representations and warranties being expressly disclaimed. The FHLBNY is not a financial or investment advisor.

Moreover, the FHLBNY does not represent or warrant that the content of these disclosures is accurate, complete or current for any specific or particular purpose or application. It is not intended to provide nor should anyone consider that it provides legal, accounting, tax or other advice. Such advice should only be rendered in reference to the particular facts and circumstances appropriate to each situation. The FHLBNY encourages you to contact appropriate professional(s) and consultant(s) to assess your specific needs and circumstances and to render such advice accordingly. In addition, the FHLBNY is not endorsing or recommending the use of the means or methods contained in or through these disclosures for any special or particular purpose.

It is solely your responsibility to evaluate the risks or merits of any funding or investment strategy. In no event will FHLBNY or any of its officers, directors or employees be liable for any damages — whether direct, indirect, special, general, consequential, for alleged lost profits, or otherwise – that might result from any use of or reliance on these materials.