Member Services Desk

Weekly Market Update

This MSD Weekly Market Update reflects information for the week ending November 4, 2022.

Economist Views

Click to expand the below image.

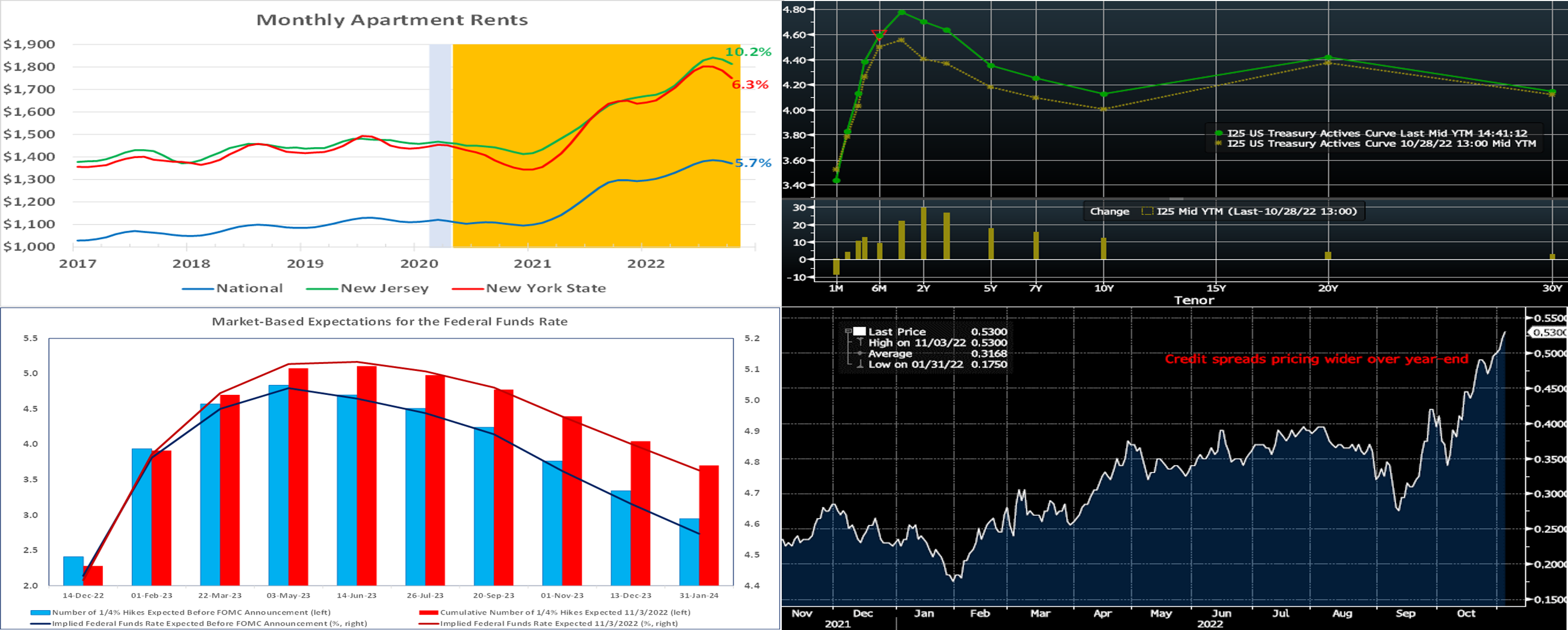

With the Federal Open Market Committee’s (FOMC) latest rate hike in the rear-view mirror, the countdown to the December 13-14 meeting begins. Between now and then, monetary policymakers will have another employment update and a pair of reports on consumer price inflation to consider. The Bureau of Labor Statistics’ (BLS) update on the Consumer Price Index (CPI) for last month will undoubtedly be the marquee event this week. Higher energy prices are expected to boost the headline figure in October, but there may be some positive developments on the core inflation front. A key question is how long it will take for recent reductions in apartment rental rates to filter through to the BLS’ monthly reports. Shelter costs account for roughly one-third of the headline CPI and almost 42% of the core ex-food-and-energy measure. Any relief on that front would be welcomed by both the FOMC and market participants. On the lecture circuit, Federal Reserve officials are slated to make over half a dozen public appearances to discuss a variety of timely topics.

Consumer Installment Credit: Buoyed by an anticipated pickup in automotive loans, consumer installment growth likely quickened in September, following a $32.2bn takedown in August.

NFIB Small Business Optimism Index: Sentiment among the nation’s independent businesses probably improved in October, lifting the NFIB’s confidence barometer to an eight-month high of 93.5.

Consumer Prices: Powered by a gas-led rebound in retail energy costs, CPI likely climbed by .5% in October, after a .4% rise in the previous month. Smaller hikes in shelter costs, combined with further reductions in used motor vehicle prices, probably capped the advance of the CPI excluding volatile food and energy components at .4%, following a pair of larger-than-expected .6% hikes in August and September. Those projections, if realized, would place the overall and core CPI inflation gauges 7.8% and 6.4% above their respective October 2021 levels.

Jobless Claims: New claims for unemployment insurance benefits likely remained in a historically low 210-230K range during the week ended November 5. Pay particular attention to continuing claims in the upcoming report. The 121K rise in those receiving regular state benefits, over the past three reporting periods, to a 30-week high of 1.485mn, suggests that recently furloughed employees perhaps are encountering a more difficult time finding work.

University of Michigan Sentiment Index: Rosier appraisals of current economic conditions probably propelled this consumer confidence barometer to a seven-month high of 61.5 in early November from 59.9 in the preceding month.

Federal Reserve Appearances:

- Nov. 7 Boston Fed President Collins and Cleveland Fed President Mester to speak at a symposium on women in economics.

- Nov. 7 Richmond Fed President Barkin to take part in a discussion about inflation.

- Nov. 9 New York Fed President Williams to speak about global risk, uncertainty, and volatility at an event in Zurich.

- Nov. 9 Richmond Fed President Barkin to discuss the economic outlook at the Shenandoah University School of Business.

- Nov. 10 Dallas Fed President Logan to discuss energy and the economy at a joint Federal Reserve Bank conference.

- Nov. 10 Cleveland Fed President Mester to discuss the outlook at an event hosted by Princeton University.

- Nov. 10 Kansas City Fed President George to discuss energy and the economy at a joint Federal Reserve Bank conference.

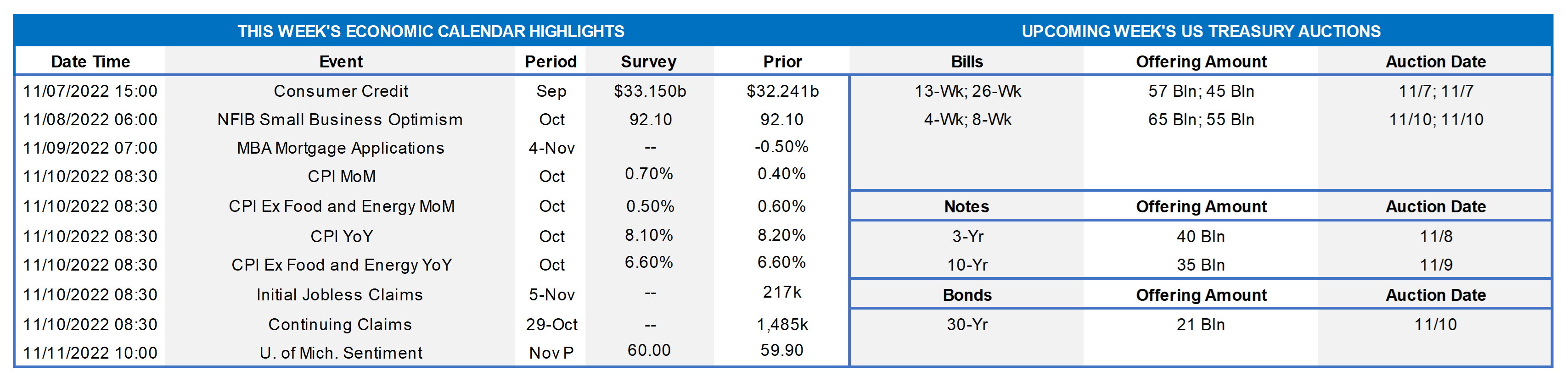

CHART 1 UPPER LEFT

Source: Apartmentlist.com; National Bureau of Economic Research; FHLB-NY. Notes: Blue-shaded area denotes recession; orange-shaded area highlights current economic expansion; percentage changes shown are over the 12 months ended October. Shelter costs, which account for almost one-third of the Consumer Price Index and have been a major contributor to the recent inflation surge, may soon provide some welcome relief in upcoming reports. Available data indicate that apartment rental rates have started to roll over both nationally and across the FHLB-NY coverage area. Over the past two months, the national average apartment rental cost has fallen by 1.1% to an estimated four-month low of $1,371, with the year-to-year growth rate receding from an all-time high of 18.1% last December to 5.7% in October. The reported reductions in apartment rental rates in New York State and New Jersey have been even larger at 2.8% and 1.5%, respectively, to $1,750 and $1,813. Since the end of 2021, the annual rental growth rate across the Empire State has decelerated from 21.8% to 6.3%, while that of the Garden State has slowed from 17.8% to 10.2%.

CHART 2 UPPER RIGHT

Source: Bloomberg. Note: Top pane is yield (%), bottom pane is change (bps). UST yields were higher across-the-curve, as of Thursday afternoon, from the previous Friday. The market priced into the curve a higher peak rate for the Fed’s hiking cycle, especially post the FOMC outcome, and pared back the timing/extent of a pivot from the Fed’s current course. Please see below for details. The term curve flattened, with 2 and 3-year higher by ~30 and 27 bps, respectively, while tenors further out the curve also moved higher but to a lesser extent. In addition to the relatively hawkish Fed outcome and 75 bps hike, the Bank of England also delivered a 75 bps hike the next morning, thereby adding to the theme of ongoing global central bank tightening. The highlight of the upcoming week will be the CPI release. We continue to encourage members to engage with the desk for rate updates and product information, especially since our advance rates dynamically move with market rates.

CHART 3 LOWER LEFT

Source: Bloomberg; FHLB-NY. Here is an updated view of the market’s latest (Thursday afternoon) pricing of the anticipated fed funds rate vs. that at the time just prior to this past week’s FOMC. With Fed Chair Powell declaring in his press conference that “we still have a ways to go” on rate hikes, the market increased the extent/pace of hikes and slightly pared back the timing of the cycle’s end. The market prices now for a 100% chance of a 50 bps hike at the December 14th FOMC, with a ~30% probability of a 75 bps hike. The biggest market-pricing change was in the peak funds rate, now at ~5.15% in June from ~4.95% prior to the meeting.

CHART 4 LOWER RIGHT

Source: Bloomberg. Shown here is the differential (RHS) between the December 3-month Eurodollar (Libor and bank funding/CD/CP barometer) and SOFR futures contracts. While not extreme, the differential has risen in the past month to ~53 bps and thereby indicates a potentially higher funding cost environment for banks over this year-end. Investors have opted to maintain very short duration positions, as reflected in the historically low weighted average maturity profiles of Money Market Funds (MMFs) and the high balance at the Fed’s overnight RRP facility. Moreover, current large-balance Government-only MMFs cannot invest in bank paper (CD’s/CP). Notably, overall bank CD/CP balances outstanding are near their highest levels since 2016. Importantly, Government-only funds can buy FHLB paper, thereby providing a steadier funding backdrop. Members should keep this topic on the radar and be sure to compare FHLB-NY “all-in” (including dividend) advance levels to alternative funding sources. For further information on “all-in” levels, including access to a calculator tool, please contact the Member Serivce Desk.

FHLBNY Advance Rates Observations

Front-End Rates

- Short-end rates again finished markedly higher week-over-week, spurred by the Fed’s 75 bps rate hike which led the market to also price for a higher peak fed funds rate in spring-2023; please see the prior slide for more details. Our very short tenor rates led the way, in line with the rate hike, but the 3 to 6-month sector also moved higher on account of the market’s re-pricing of the Fed.

- Given the Fed’s tightening and data-dependent posture, rates will remain highly responsive to the Fed and economic data. Post this past week’s FOMC, Fed-speak will again return to the mix, as members are out of the pre-meeting blackout period.

Term Rates

- The longer-term curve finished higher and flatter from the week prior, generally mirroring the move in UST and swaps markets. While 2-year was ~33 bps higher, 5-year finished up by ~20 bps. Kindly refer to the previous section for relevant market color. The advance curve remains inverted out to 5-year, thereby offering opportunities to extend in advance duration for minimal or lower coupon cost. The flat curve and high implied volatility environment also can serve to make putable advances more compelling.

- On the UST term supply front, this upcoming offers a duration-heavy slate of 3/10/30-year auctions. In a holiday-shortened week (Friday is Veterans Day – bond markets closed), market focus will clearly be on Thursday’s CPI data. Please call the Member Service Desk for information on market dynamics, rate levels, or products.

Product Alert: FHLBNY is pleased to announce the reintroduction, after a temporary suspension owing to Libor-cessation, of the Putable Advance, Fixed-Rate with SOFR Cap Advance, and ARC with SOFR Cap/Floor Advance. The Callable Advance continues to be offered. This expansion of the product menu will provide members with more options and flexibility for the management of funding and/or hedging needs. Please call the Member Service Desk at (212) 441-6600 for more information.

Forward Start Advance (FSA): For members with upcoming borrowing or refunding plans, consider the FSA as a method to opportunistically “lock in” rates before advance settlement date. Please call the Member Service Desk at (212) 441-6600 for more information.

The Symmetrical Prepayment Advance Feature

For those anticipating term funding needs, and with rates on an uptrend, it can be an appropriate juncture to consider our SPA feature. This feature allows the member to capture, at prepayment, changes in the fair value of the advance which are favorable to the member. Contact Member Service Desk to discuss.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the MSD Team.