Member Services Desk

Weekly Market Update

This MSD Weekly Market Update reflects information for the week ending June 28, 2024.

Economist Views

Click to expand the below image.

Please note that the Weekly Update will return on Friday, July 12. Happy Independence Day!

Markets will confront a busy economic data calendar in the upcoming holiday-shortened week. The marquee report on the June employment situation probably will show that the pace of net hiring slowed marginally, while wage gains matched those posted in May. Purchasing manager canvasses likely will reveal that conditions in the manufacturing and service-producing segments of the economy were little changed from those witnessed in the prior month. Tracking estimates for Q2 real GDP growth remain centered at 2% annualized, though the range of available forecasts is wide. The probability of an initial 25 bps cut in the federal funds rate target range stands at about 60%, up from 45% at the end of May. Fed Chair Jerome Powell and New York Fed President John Williams will make public appearances. The minutes from the June 11-12 FOMC meeting may provide useful information on participants’ current thoughts on economic conditions and monetary policy.

Construction Spending: To be released on July 1, the nominal value of new construction put-in-place is expected to have risen by .3% in May, erasing the decline recorded over the prior two months.

ISM Manufacturing Activity Survey: Available canvasses suggest that activity contracted marginally in June, with the index registering at 49.2% following the 48.7% reading posted in the prior month.

JOLTS Job Openings: A reported increase in online help-wanted postings suggests that nationwide job openings rose by 275K to 8.33mn in May, reversing one-third of the falloff witnessed over the March-April span. At an estimated 1.69mn, the excess of vacant positions nationwide would represent almost 1.25 jobs per unemployed person.

Jobless Claims: Initial claims for unemployment insurance benefits probably remained in a 230K-245K range during the filing period ended June 29. Keep a close eye on continuing claims, which rose to a 2½-year high of 1.84mn during the week ended June 15, for signs that recently furloughed employees are indeed having a more challenging time finding work.

Factory Orders: Fueled by a projected rebound in nondurables bookings, factory orders probably climbed by .6% in May, after a downwardly revised .5% increase in April.

ISM Services Activity Survey: The expansion in activity likely continued in June, although the breadth of reported gains probably retreated to 53% from the 53.8% reading posted in May.

Employment Situation Report: Labor market conditions probably remained firm at the end of Q2. Buoyed by a favorable swing in weather, nonfarm payrolls likely expanded by 240K, almost matching the surprisingly strong 272K gain witnessed in May. The results of the Bureau of Labor Statistics’ household survey is expected to show that the unemployment rate held steady at 4%. With the June survey period ending precisely on the 15th of the month, average hourly earnings probably continued apace, rising by .4% for a second straight month. If realized, that increase would place the closely followed nominal compensation measure 4% above the level recorded a year ago.

Federal Reserve Appearances:

- July 2 Fed Chair Powell, ECB President Legarde, and Bank of England Governor Bailey to speak in Sintra, Portugal.

- July 3 NY Fed President Williams to speak on a panel about the drivers of equilibrium interest rates in Sintra, Portugal.

- July 3 Minutes from June 11-12 Federal Open Market Committee to be released.

- July 5 NY Fed President Williams to give keynote remarks at an event organized by the Reserve Bank of India in Mumbai.

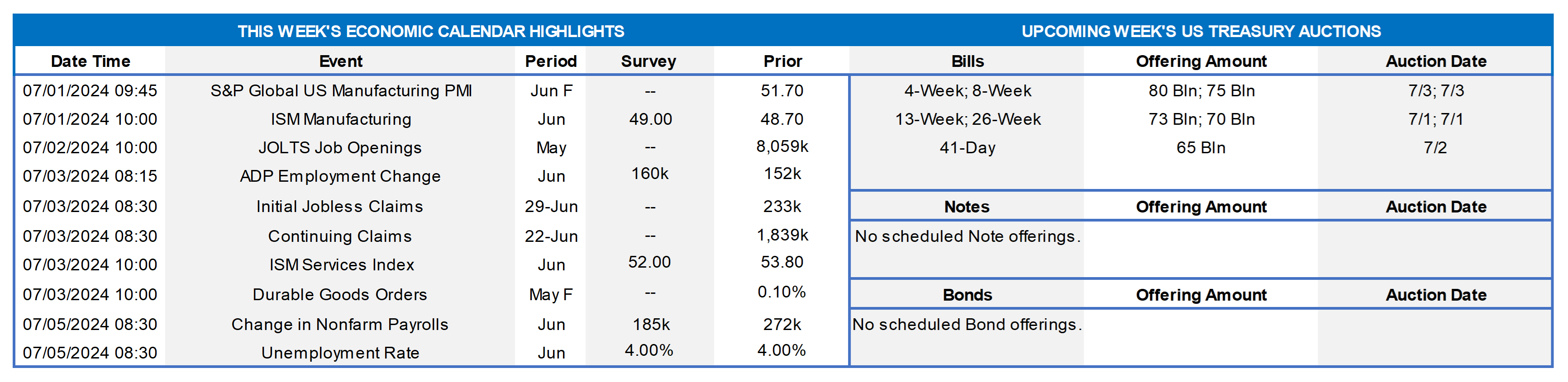

CHART 1 UPPER LEFT AND CHART 2 UPPER RIGHT

Source: Bureau of Labor Statistics (BLS); National Bureau of Economic Research; FHLB-NY. Notes: Blue-shaded areas denote recessions; orange-shaded area highlights current economic expansion. Waiting on the July 5th release of the BLS’ update on the employment situation for June, market participants may look to the prior-month job openings tally for clues to the strength of demand for workers. Since hitting a peak of almost 12.2mn positions in March 2022, openings have retreated to 8.06mn as of April. Despite the pullback, available positions eclipsed the number of unemployed persons by 1.57mn in April. Put another way, there were 1.24 jobs per unemployed person – still well above the historical average of .7 witnessed since December 2000. Labor demand has been somewhat softer across most of the FHLB-NY coverage area, per the right-side chart. At 660K, the number of job openings across New York and New Jersey in April was one-third shy of the 992K all-time high set in November 2021, representing 1.04 available positions per unemployed person. Given the Fed’s dual mandate to balance and achieve maximum employment and stable prices, certainly this data space will be of import.

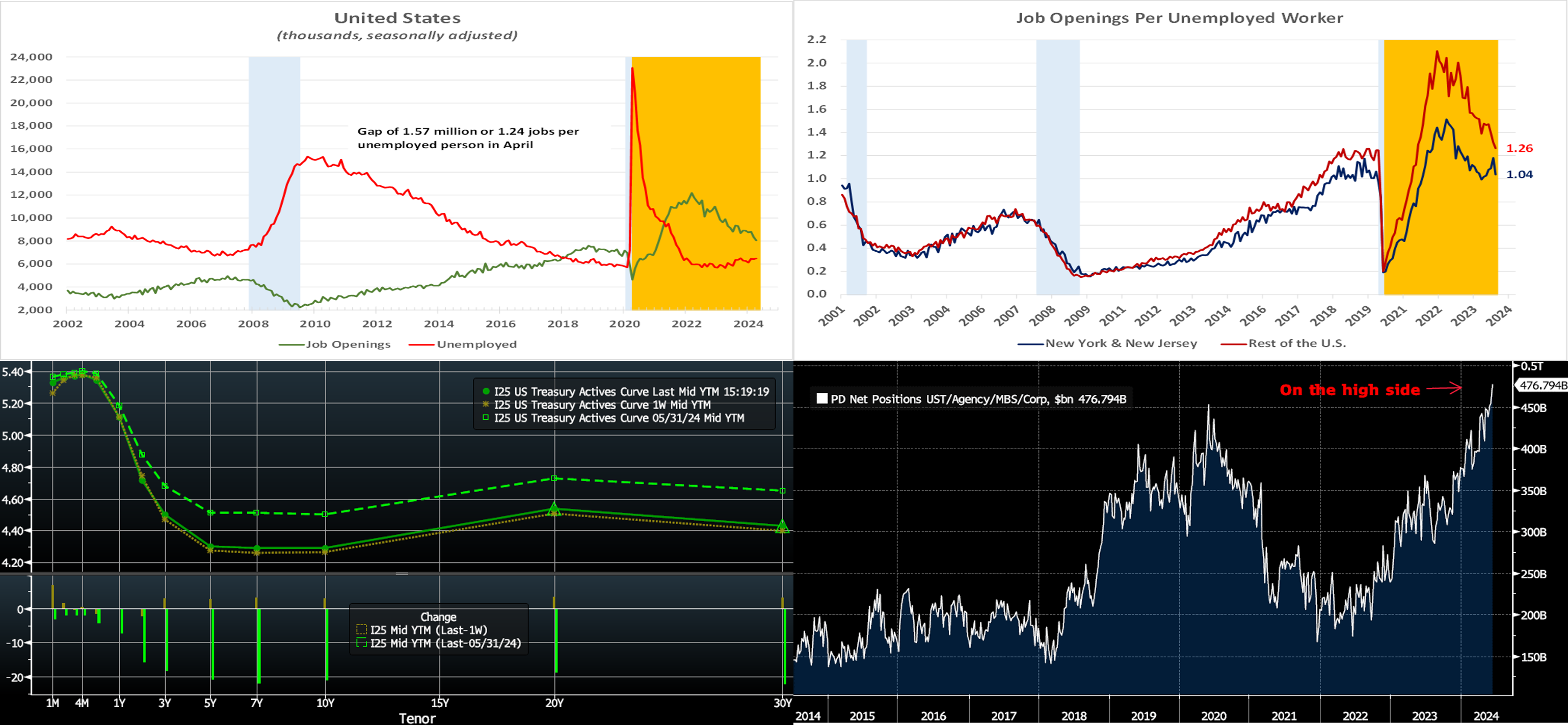

CHART 3 LOWER LEFT

Source: Bloomberg. Top pane is yield (LHS, %), bottom pane is change (LHS, bps). As of Thursday afternoon, the UST term curve was modestly higher by two to three bps week-on-week. For instance, adjusted for the roll to a new on-the-run security, the 2-year UST was two bps higher. Economic data was generally mixed and of second-tier importance. Note that rates are lower on the month and may be consolidating in a range until more impactful data is released. The 5-year SOFR swap at ~4.03%, for example, is currently ~24 bps lower than its May 31st level. In terms of market-implied pricing of the Fed, there is now ~68% chance of a 25 bps rate cut priced for the September 19th FOMC; the November meeting is at 103%, just a tad lower than last week. The year-end 2024 forward is now ~4.89%, compared to last week’s 4.87%, thereby implying a cumulative total of 44 bps of cuts, somewhat shy of two eases, by the end of this year. The upcoming week is heavy on data but also contains a holiday. See below for related color.

CHART 4 LOWER RIGHT

Source: Bloomberg; Federal Reserve Bank of NY. Shown here is the status of primary dealer net positions in UST, Agency, MBS, and Corporate securities. As a refresher, primary dealers are trading counterparties of the NY Fed in its implementation of monetary policy and are expected to make markets for the NY Fed and to bid in all UST auctions at reasonably competitive prices. As can be seen, the primary dealer holdings of securities reside at high levels; indeed, it was at the highest levels in years as of mid-June (note that the position reports are released near the NY close of business on Thursdays and with a 1-week lag). This dynamic could prove to be a potential technical risk factor for rates to move higher, all else equal, in the week ahead. This risk is more prevalent owing to a holiday-shortened week filled with data but perhaps light on both participants and a willingness to absorb risk, especially on the employment situation day of July 5th. Rates have declined over the course of June, moreover, adding to the potential for a set of stronger-than-expected data to prompt a swift retracement.

FHLBNY Advance Rates Observations

Front-End Rates

- Short-end rates were mixed week-on-week. The very-short tenors were up 2 to 4 bps, as typical month-end balance sheet dynamics exerted upward pressure on market repo rates and SOFR. Meanwhile, the 5-and 6-month tenors declined 2 and 3 bps, respectively. Money Market Fund AUM dipped last week, owing to the corporate tax date, but has remained robust. Moreover, net T-bill issuance has tapered off in the past two months, and so the supply/demand dynamic in the short-end remains solid, and FHLB paper continues to trade tight to T-bills.

- The market’s focus will be on data, particularly the post-holiday July 5th jobs report, and Fed speakers in the week ahead.

Term Rates

- The longer-term curve, generally mirroring moves in USTs and swaps, was a few bps higher across the board from a week ago. Please refer to the previous section for color on the changes.

- On the UST term supply front, the upcoming week serves a reprieve from auctions. Note that UST auctions usually occur at 1pm and can occasionally spur volatility around that time. Please contact the Member Service Desk for further information on market dynamics, rate levels, or products.

The FHLBNY is pleased to announce the 2024 0% Development Advance (ZDA) Program, now available with a new streamlined submission process. This program provides members with subsidized funding in the form of interest rate credits to assist in originating loans or purchasing loans/investments that meet the eligibility criteria under the Business Development Advance (BDA), Climate Development Advance (CDA), Infrastructure Development Advance (IDA), or Tribal Development Advance (TDA). Please contact the Member Service Desk for information and/or visit our ZDA information page.

Price Incentives for Advances Executed Before Noon: In effect as of Tuesday, September 5, 2023, the FHLBNY is pleased to now offer price incentives for advances executed before Noon each business day. These pricing incentives offer an opportunity to provide economic value to our members, while improving cash and liquidity management for the FHLBNY. For further details, kindly refer to the Bulletin.

The Symmetrical Prepayment Advance Feature

For those anticipating term funding needs, and with rates on an uptrend, it can be an appropriate juncture to consider our SPA feature. This feature allows the member to capture, at prepayment, changes in the fair value of the advance which are favorable to the member. Contact Member Services Desk to discuss.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the MSD Team.