Member Services Desk

Weekly Market Update

This MSD Weekly Market Update reflects information for the week of October 10, 2022.

Economist Views

Click to expand the below image.

Returning from the extended long weekend, market participants will focus on consumer price inflation in September. While lower energy prices are expected to limit the rise in headline inflation, and core goods and services costs likely slowed last month, year-to-year growth rates remained well above the 2% target desired by the Federal Reserve. Initial and continuing jobless claims are projected to remain near recent levels. Stepped-up motor vehicle purchases probably buoyed end-of-summer retail sales. A quartet of Fed officials will provide their latest thoughts to the public. The minutes of the September 20-21 Federal Open Market Committee meeting may provide some clues to prospective monetary policy tightening.

NFIB Small Business Optimism Index: Small business sentiment probably improved once again in September, lifting the NFIB’s gauge to a seven-month high of 95.

Producer Prices: Capped by reported declines in wholesale energy costs, the Producer Price Index (PPI) likely edged .2% higher in September, erasing the surprising .1% dip recorded in August. That result, if realized, would place the PPI 7.4% above its year-ago level.

Consumer Prices: Reported reductions in gasoline pump prices probably limited the rise of the Consumer Price Index (CPI) to .2% last month, after the .1% uptick witnessed in August. Excluding projected movements in volatile food and energy costs, the core CPI is expected to have climbed by .4% during the reference period, following a larger-than-expected .4% rise in the prior month. Those projections, if realized, would place the overall and core CPIs 8.1% and 6.5% above their respective year-ago levels.

Jobless Claims: New claims for unemployment insurance benefits likely remained in a historically low 190-220K range during the week ended October 8. Continuing claims probably clocked in below the 1.4mn mark once again during the week ended October 1, supporting the view that recently furloughed employees are having little trouble finding new work.

Retail & Food Services Sales: Powered by an anticipated increase in auto-dealership revenues, retail and food services sales probably edged .2% higher in September, after a similarly modest .3% gain in the preceding month. Market participants will be paying particular attention to so-called control sales excluding auto, building materials and gasoline purchases in this week’s report. Barring any prior-month revisions, a .1% uptick would place core purchases over the July-September span 5.9% annualized above their April-June average, after a 6.9% annualized spring-quarter advance.

University of Michigan Sentiment Index: Rosier appraisals of current and prospective economic conditions likely propelled the consumer confidence barometer to a six-month high of 60 in early October from 58.6 in September.

Federal Reserve Appearances:

- Oct. 10 Chicago Fed President Evans to speak at the annual National Association for Business Economics conference.

- Oct. 10 Fed Vice Chair Brainard to speak at the annual National Association for Business Economics conference.

- Oct. 11 Cleveland Fed President Mester to speak to The Economic Club of New York.

- Oct. 12 Minneapolis Fed President Kashkari to take part in an economic development summit in Rhinelander, Wisconsin.

- Oct. 12 Federal Reserve Board to release minutes from the Sept. 20-21 Federal Open Market Committee meeting.

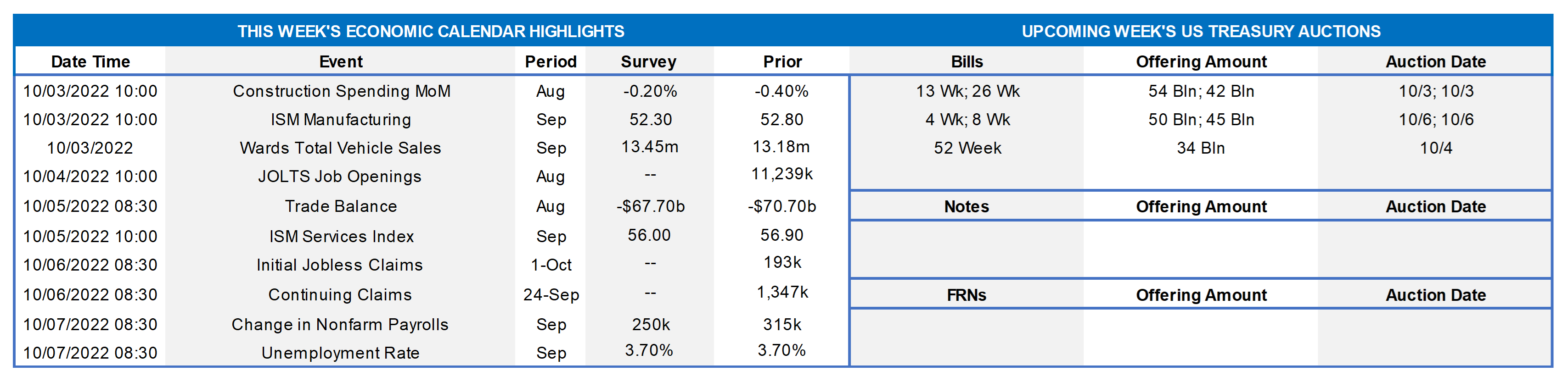

CHART 1 UPPER LEFT

Source: Bureau of Economic Analysis; Federal Reserve Board; National Bureau of Economic Research; FHLB-NY estimates. Notes: Blue-shaded areas denote recessions; Orange-shaded highlights current economic expansion; Pink-shaded area represents projections. With the September employment report in the rear-view mirror, the focus of market participants will now turn to developments on the inflation front last month. Consensus projections suggest that the personal consumption expenditure (PCE) index excluding volatile food and energy items will be 5% higher than its September 2021 level, well above the 2% target desired by Federal Reserve officials. Monetary policymakers anticipate a pullback to 4.5% over the final three months of this year and a further reduction to 3.1% over the course of 2023. Yet, despite the aggressive tightening of monetary policy, Fed governors and district bank presidents do not expect a return to target until the end of 2025.

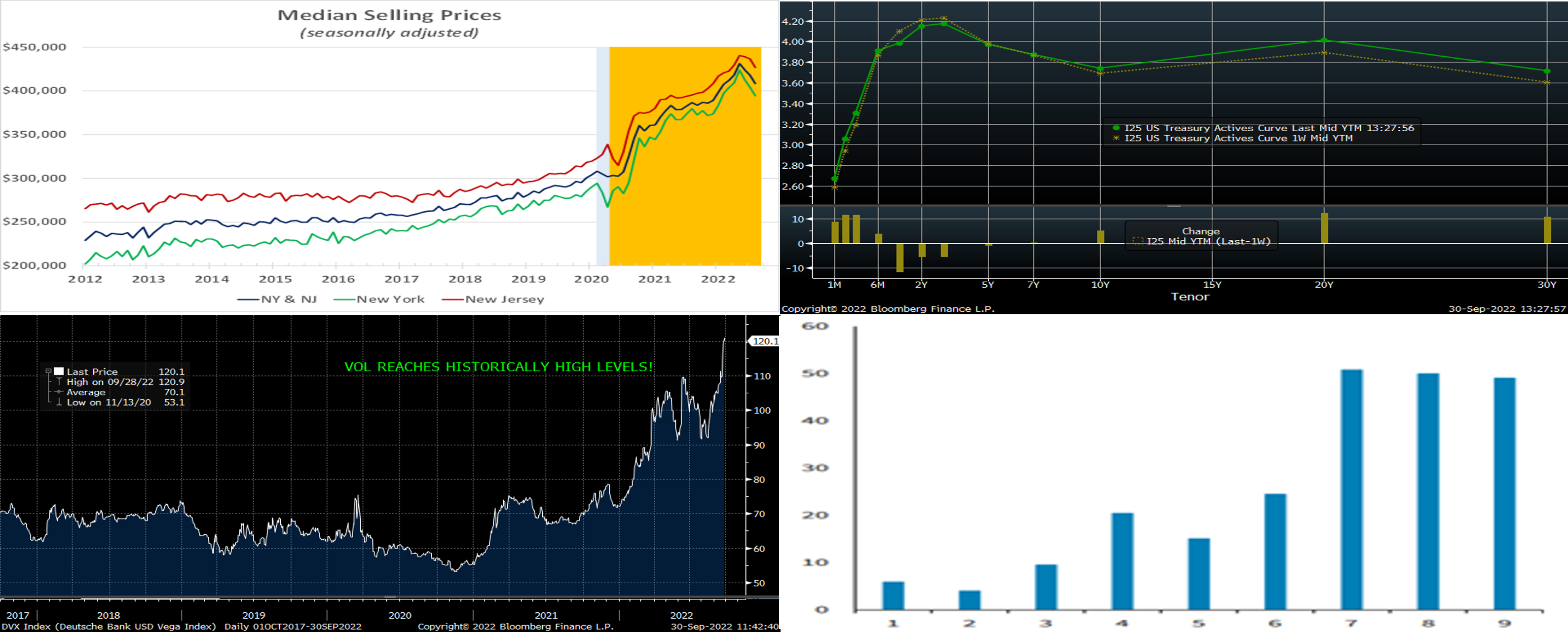

CHART 2 UPPER RIGHT

Source: Bloomberg. Note: Top pane is yield (%), bottom pane is change (bps). The UST curve, as of Friday morning post-employment report, pushed higher yet again from the week prior. The report was solid enough to unlikely sway the Fed from a 75 bps hike on November 2. Short tenors 1-year-and-in moved notably higher, as the market re-assessed the course of Fed hikes. The curve is markedly higher than that of a month ago. Attention will now be solidly trained to the upcoming week’s inflation reports. As of this past Friday morning and up from last week , the market priced for a 100% chance of a 50 bps hike for the next FOMC, with ~95% chance of a 75 bps hike. For 2022 cumulatively from now and higher as well than a week ago, the market prices ~127 bps of hikes. The market also pared back odds/extent of a Fed pivot (pause or ease in rates) in 2023, as forward rates are now closer to the Fed’s latest dot plot. Multiple Fed member comments in the past week pushing back against the idea of a pause or ease in 2023 surely supported this market re-pricing.

CHART 3 LOWER LEFT

Source: Bloomberg. Somewhat “lost in the sauce” in assessing Fed policy, at least relative to Fed Funds rate forecasts, is the current and ongoing runoff of the Fed’s securities portfolio. Shown here are the Fed’s holdings of USTs, MBS, and the sum thereof (RHS, each in $trn). The Fed drastically increased its balance sheet in response to the pandemic but began this summer to reduce its holdings and thereby remove accommodation and liquidity from the banking system. The move also reduces a steady source of demand for securities, thereby altering the market’s supply/demand dynamics. For the first three months of runoff from June to August, caps allowed for runoff of up to $30bn in UST and up to $17.5bn in MBS and agency debt each month. Starting last month, the caps increase to levels of $60bn and $35bn, respectively. In other words, the Fed had been reducing its securities holdings by up to a total of $47.5bn each month from June through August, and now the maximum monthly reduction is $95bn. The Fed will reinvest any maturing amounts above the monthly caps. As time ensues, the downward trend here will appear more pronounced when re-charted.

CHART 4 LOWER RIGHT

Source: Expanding on a theme noted in last week’s edition, portrayed here is the trend in recent months of Money Market Fund (MMF) AUM (RHS, $trn) vs. the Fed Funds Effective rate (LHS, %). In addition to liquidity being removed from the system as a result of the above-described Fed balance sheet runoff, bank deposits are likely experiencing further downward pressure from depositors fleeing to higher-yielding MMFs. After the Fed raised rates from the near-0% level, MMFs were able to recapture their management fees (typically ~.125%) and then, subsequently, basically offer yields that kept pace with each Fed hike. Given further anticipated Fed hikes, this trend is likely to continue in the near-term.

FHLBNY Advance Rates Observations

Front-End Rates

- Short-end rates finished higher week-over-week, with 1 to 4-month leading the way with a 13 to 15 bps rise. The market raised the odds of more aggressive forthcoming Fed hikes, amid persistent hawkish comments from Fed members and a decent jobs report. As of this past Friday morning and higher from the week prior, the market priced for a 100% chance of a 75 bps hike at the November 2 FOMC, with another ~100% chance of a 50 bps hike for December 14 FOMC. For 2022 cumulatively from now, the market prices for ~127 bps of hikes.

- Given the Fed’s tightening and data-dependent posture, rates will remain highly responsive to economic data and Fed-speak. This week’s inflation reports could be market-moving events.

Term Rates

- The longer-term curve finished higher from the week prior by ~15 bps on average, generally mirroring the move in UST and swaps markets. Kindly refer to the previous section for relevant market color. The advance curve remains extremely flat overall and inverted at various points, thereby offering opportunities to extend in advance duration for minimal or lower coupon cost.

- On the UST term supply front, this upcoming week offers 3/10/30-year auctions. In a holiday-shortened week, market focus will remain on Fed-speak and especially on this week’s inflation data (PPI/CPI). Please call the Member Service Desk for information on market dynamics, rate levels, or products.

Product Alert: FHLBNY is pleased to announce the reintroduction, after a temporary suspension owing to Libor-cessation, of the Putable Advance, Fixed-Rate with SOFR Cap Advance, and ARC with SOFR Cap/Floor Advance. The Callable Advance continues to be offered. This expansion of the product menu will provide members with more options and flexibility for the management of funding and/or hedging needs. Please call the Member Service Desk at (212) 441-6600 for more information.

Forward Start Advance (FSA): For members with upcoming borrowing or refunding plans, consider the FSA as a method to opportunistically “lock in” rates before advance settlement date. Please call the Member Service Desk at (212) 441-6600 for more information.

The Symmetrical Prepayment Advance Feature

With rates at or near multi-year lows, it is a compelling juncture to use the SPA feature on term advances. This feature allows member to capture, at prepayment, changes in the Fair Value of the advance which are favorable to the member. Contact us to discuss.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the MSD Team.