Member Services Desk

Weekly Market Update

This MSD Weekly Market Update reflects information for the week of December 6, 2021.

Economist Views

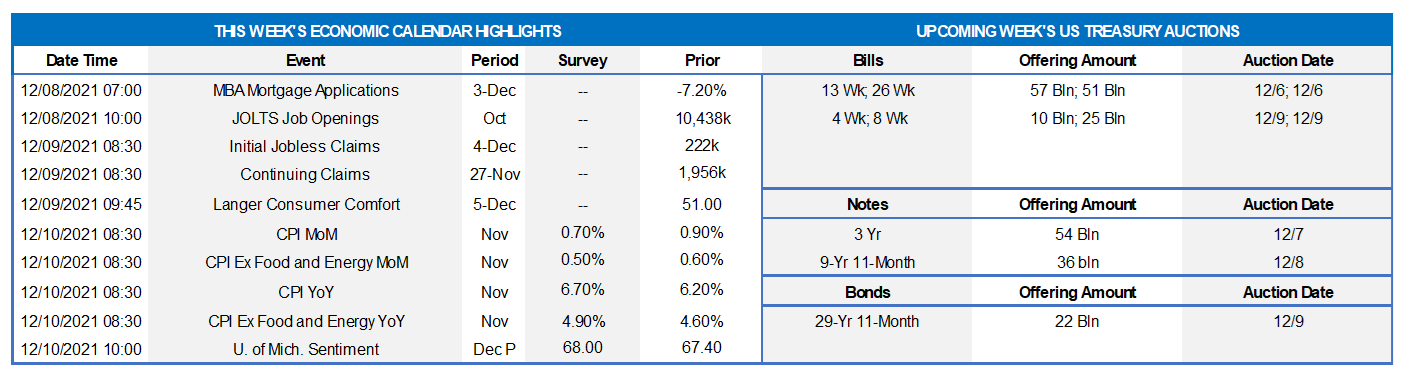

Click to expand the below image.

Market participants will face a comparatively thin economic data calendar this week. With the next Federal Open Market Committee (FOMC) meeting scheduled for December 14-15, the update on consumer prices in November will undoubtedly be the marquee release. Job openings likely dipped slightly at the beginning of Q4, but the gap between available positions and the unemployed probably widened to a record high. Jobless claims are expected to have moved lower, hinting at a reacceleration in payroll employment growth in the final month of the year. Federal Reserve officials will be taking a break from the lecture circuit to observe the traditional blackout period ahead of the upcoming FOMC meeting.

International Trade Deficit: The already reported narrowing of the merchandise gap in October suggests that the total shortfall on international trade in goods and services closed to $66.8bn from $80.9bn in September. Such a result would be consistent with a positive net contribution to real GDP growth from the external sector in Q4.

JOLTS Job Openings: A reported dip in online help-wanted postings suggests that total job openings declined by 50K to 1.039mn in October. That projection, if realized, would widen the gap between available positions and the jobless two months earlier to an all-time high of 2.97mn.

Jobless Claims: Initial and continuing claims under regular state unemployment insurance programs likely moved lower over their latest respective reporting periods. The termination of pandemic-related jobless benefits suggests that the total number of persons receiving assistance will also decline further during the week ended November 20 from the 2.3mn, or 1.4% of the civilian labor force, recorded in the prior week.

Consumer Price Index: Widespread increases in retail goods and services costs are expected to have propelled the Consumer Price Index (CPI) .7% higher in November, after a .9% rise in the prior month. Excluding anticipated hikes in volatile food and energy costs, the so-called core CPI likely climbed .5% higher, almost matching October’s .6% gain. The median Street projection, if realized, would place the year-to-year growth in the headline consumer inflation measure at a 39½-year high of 6.8%. The implied 4.9% advance in the core CPI would be the steamiest since the 12-month period ended June 1991.

Michigan Sentiment Index: Powered by rosier appraisals of current economic conditions, the University of Michigan’s consumer confidence gauge likely climbed to 68.5 in early December from 67.4 in the previous month.

Federal Reserve: Federal Reserve officials will be observing the traditional blackout period preceding the December 14-15 FOMC meeting.

FHLB Special Event Webinar: “Your Trusted Partner Through All Operating Environments: A Fireside Chat with José R. González, President and CEO”, on Thursday December 9, 11 a.m. to Noon. You are cordially invited to join José R. González, President, and CEO, in a fireside chat with Adam Goldstein, Senior Vice President & Chief Business Officer, as they discuss the current operating environment, your cooperative’s performance throughout 2021, and the challenges and opportunities in the year ahead. Click here to register.

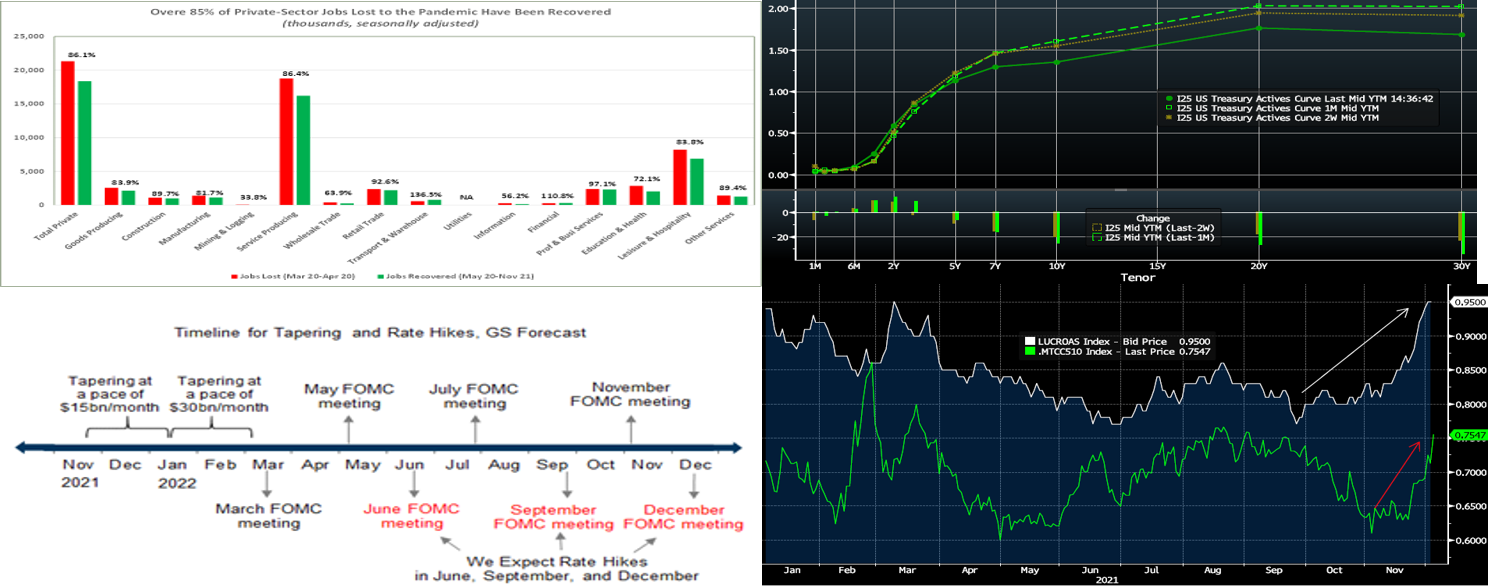

Click to expand the below image.

CHART 1 UPPER LEFT

Source: Bureau of Labor Statistics; FHLBNY. The labor market continues to display steady progress in recouping the jobs lost to the pandemic. To date, 18.45mn, or 82.5%, of the 22.36mn nonfarm jobs shed over the March-April 2020 span have been recovered. With the exceptions of utilities, mines & forests, and information providers, all major industrial segments have regained almost two-thirds or more of the positions destroyed by the pandemic. Headcounts in two areas – transportation & warehousing and financial activities – have moved above their respective prior business-cycle peaks. This past Friday’s jobs report, despite a headline nonfarm payroll “miss”, was definitively solid overall. Given this report, and various Fed members this past week expressing support for a faster taper, it appears that the FOMC is poised to accelerate the pace of tapering at the December 15 meeting. For further information and/or charts on the jobs report, please contact us.

CHART 2 UPPER RIGHT

Source: Bloomberg. Note: Top pane is yield (%), bottom pane is change (bps). Since our pre-holiday edition two weeks ago, UST yields have traded in volatile fashion but with an overall flattening trend. Renewed pandemic concerns, driven partly by the new Omicron variant, have contributed to the move lower in longer-end yields. Shorter-end yields out to 3-year are higher over the period, as the market has firmly priced Fed rate hikes into the curve. With the January 2023 Fed Funds future trading at .69%, the curve currently prices for slightly under 2.5 Fed hikes by the end of 2022. The expectation for the Fed to potentially taper faster and hike sooner, and thereby squelch inflation, has helped the notable decline in 5-year-and-out yields. Breakeven inflation rates on TIPS reflect this theme, as they are notably lower from mid-November. The market’s recent higher intraday volatility may present opportunities to borrow advances at more advantageous rates. Please engage with the desk to monitor rate levels. Meanwhile, on the asset side, higher implied volatility in market-pricing can offer an opportunity (higher implied volatility increases a security’s yield, all else equal) to consider callable and MBS purchases. As the market eagerly awaits the December 14-15 FOMC, the highlight this coming week should be the CPI data as well as pandemic developments.

CHART 3 LOWER LEFT

Source: Goldman Sachs Research. As noted above, an acceleration of the Fed taper appears to be a distinct possibility at this month’s FOMC. This chart portrays the timeline view of Goldman Research, as well as various other market strategists that the Fed will announce a faster pace of tapering at the December 15 meeting. Essentially, this view holds that the Fed will double the pace and thereby conclude the taper in March and position itself for the initial rate hike in June. Indeed, the market now prices (see Fed Funds futures, for reference) for this scenario. While a faster pace of tapering will result in less total buying by the Fed and thereby upwardly impact rates, the countervailing forces of ongoing Covid-19 concerns, less UST supply being issued by Treasury next year, and a perception that Fed hikes will tamper inflation all provide resistance.

CHART 4 LOWER RIGHT

Source: Bloomberg. Depicted here is a snapshot of the recent spread widening in investment securities. Mortgage spreads, reflected here as the 30-year Agency MBS Current Coupon spread over the 5-year/10-year average UST yield (RHS, green, %), have notably widened in the past few weeks. Meanwhile, corporate bond spreads have widened to the highs of the year, as seen here in the Bloomberg U.S. Aggregate Credit Average OAS index (RHS, white, %). This widening may present a more compelling opportunity to deploy funds in net interest income-boosting strategies. Specifically, the widening in corporate bond spreads may be relevant and timely to our insurance company members.

FHLBNY Advance Rates Observations

Front-End Rates

- Short-end Advance rates are mostly unchanged from two weeks ago, although 5 and 6-mo are 2 and 3 bp higher, respectively. Demand for short paper and the Fed’s RRP, which stands last at ~$1.48trn, near the record high of $1.6trn, remains strong. The Fed acknowledged this dynamic at the last FOMC, as they raised the RRP counterparty limit to $160bn from $80bn. Money Market funds AUM grew ~$22bn this past week, as strong demand persists in the sector. The overall supply/demand paradigm persists in suppressing rate levels, as the GSEs continue to invest large sums into money markets, the TGA has declined, Fed purchases instill funds to the banking system, and short-maturity paper is in low supply.

- UST issuance overall is now net positive supply in that more is being issued than what the Fed is buying in its programs. However, with short UST rates at rock-bottom levels and the Fed on hold, rates are likely to persist in a near-term sideways pattern. Importantly, weekly net T-bill issuance has been lower and often negative since 2020, and Treasury intends to shift issuance out the curve. T-bills have experienced a near-term issuance uptick on some “catch-up” issuance from September’s debt ceiling issue slowdown, but this uptick should not alter the overall money markets picture. Further legislative packages and related borrowing may lead to an eventual increase of T-bill auction sizes and positive net supply, but for now overall market supply/demand dynamics should keep short rates in check from large moves to the upside. As time ensues and maturities cross into spring/summer 2022, a timeframe that the market is pricing strong probability of rate hikes, these maturities’ rates are likely to experience some upward drift.

Term Rates

The advance curve has notably flattened from two weeks ago, with yields higher out to 3-year but lower 5-year and further. For instance, 2-year is ~11 bps higher, 5-year is ~3 lower and 10-year ~12 bps lower. Kindly refer to the previous section for relevant market color. On the UST supply front, this week carries 3/10/30-year auctions which may provide a countervailing force to the recent curve flattening. As the market eagerly awaits the December 14-15 FOMC, the highlight this coming week should be the CPI data as well as pandemic developments.

New Product Alert: FHLBNY is pleased to announce the launch of the Business Development Advance (BDA) on Thursday, November 4, 2021. The BDA is a 0% advance to help our members provide funding to qualifying small businesses to promote community & economic growth. The BDA is subsidized funding in the form of interest-rate credits. There is a total of $3 million of interest-rate credits available in 2021. Members can request to reserve their interest-rate credits up to $50,000 on a first-come/first-served basis. For further details, please view our BDA overview page and watch this past Thursday’s BDA webinar, and/or contact the Member Service Desk at 1-800-546-5101 option 1.

The Symmetrical Prepayment Advance Feature

With rates at or near multi-year lows, it is a compelling juncture to use the SPA feature on term advances. This feature allows member to capture, at prepayment, changes in the Fair Value of the advance which are favorable to the member. Contact us to discuss.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the MSD Team.