Member Services Desk

Weekly Market Update

Economist Views

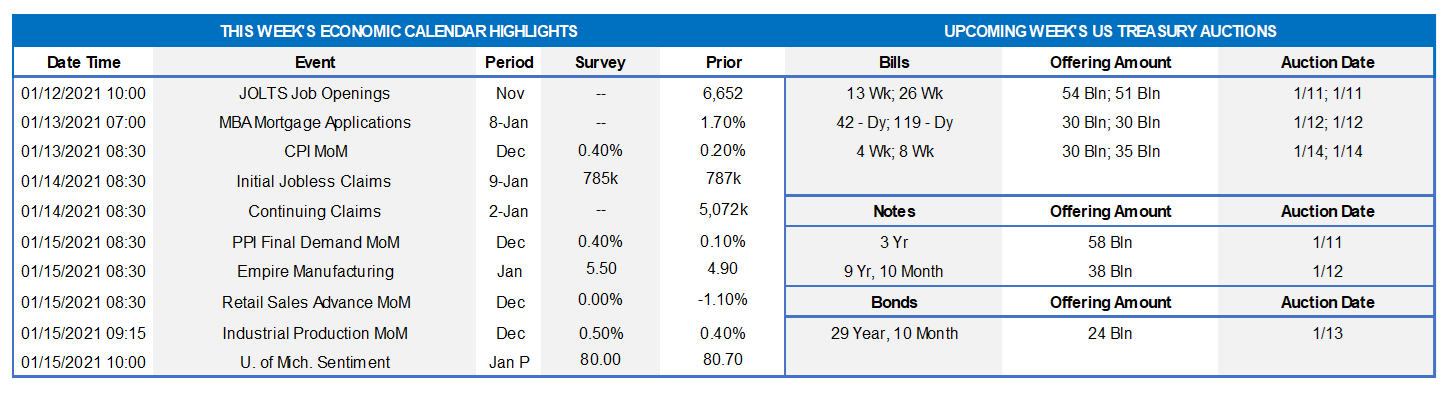

Click to expand the below image.

Market participants generally looked beyond last week’s politically-motivated disturbance in Washington, D.C. to prospects for increased fiscal stimulus under a Democrat-controlled Congress. This week will offer traders and investors a smorgasbord of updates on economic activity in the final month of 2020, as well as a crowded slate of Federal Reserve officials discussing a variety of topics. On the former front, the Census Bureau’s update on retail sales in December could materially impact economists’ projections for Q4 real GDP growth. On the latter, Fed Chair Clarida’s talk on the central bank’s updated monetary policy framework could prove the most illuminating.

NFIB Small Business Optimism Index:

Already reported pullbacks in a variety of employment-related metrics hint that the NFIB’s small business sentiment gauge likely dipped from the 101.4 reading posted in November.

JOLTS Job Openings:

Online help-wanted postings dipped by 1¼% in November, suggesting that the Bureau of Labor Statistics’ count of available positions probably fell to 6.57 million from 6.65 million in October.

Consumer Price Index:

Fueled by anticipated hikes in retail energy costs, the CPI likely rose by 0.4% in December, after a 0.2% uptick in the previous month. The core subindex excluding volatile food and energy components probably edged just 0.1% higher during the reference period, following November’s apparel and airline-fare led 0.2% gain. The above projections, if realized, would leave the overall and core CPI’s 1.3% and 1.7% above their respective year-ag levels.

Initial Jobless Claims:

New filings for regular state unemployment insurance benefits likely remained in the 775K-800K range over the period ended January 9. While continuing state claims may move below the 5-million mark during the week ended January 2, the number of persons receiving benefits under all programs, including those related to the pandemic, probably remained near a staggering 19 million.

Retail & Food Services Sales:

Retail and food services sales probably were little changed in December, after the surprisingly large 1.1% decline posted in November. Pay attention to control sales excluding auto, building materials and gasoline purchases in the upcoming report for clues to the strength in Q4 consumer spending. The 0.2% uptick anticipated by the Street would be consistent with a 3.6% annualized increase in this key spending metric in Q4, after a 44.6% summer-quarter surge.

Upcoming Federal Reserve Appearances:

Jan. 11: Atlanta Fed President Bostic

Jan. 12 & 13: Fed Governor Brainard

Jan. 14: Boston Fed President Rosengren

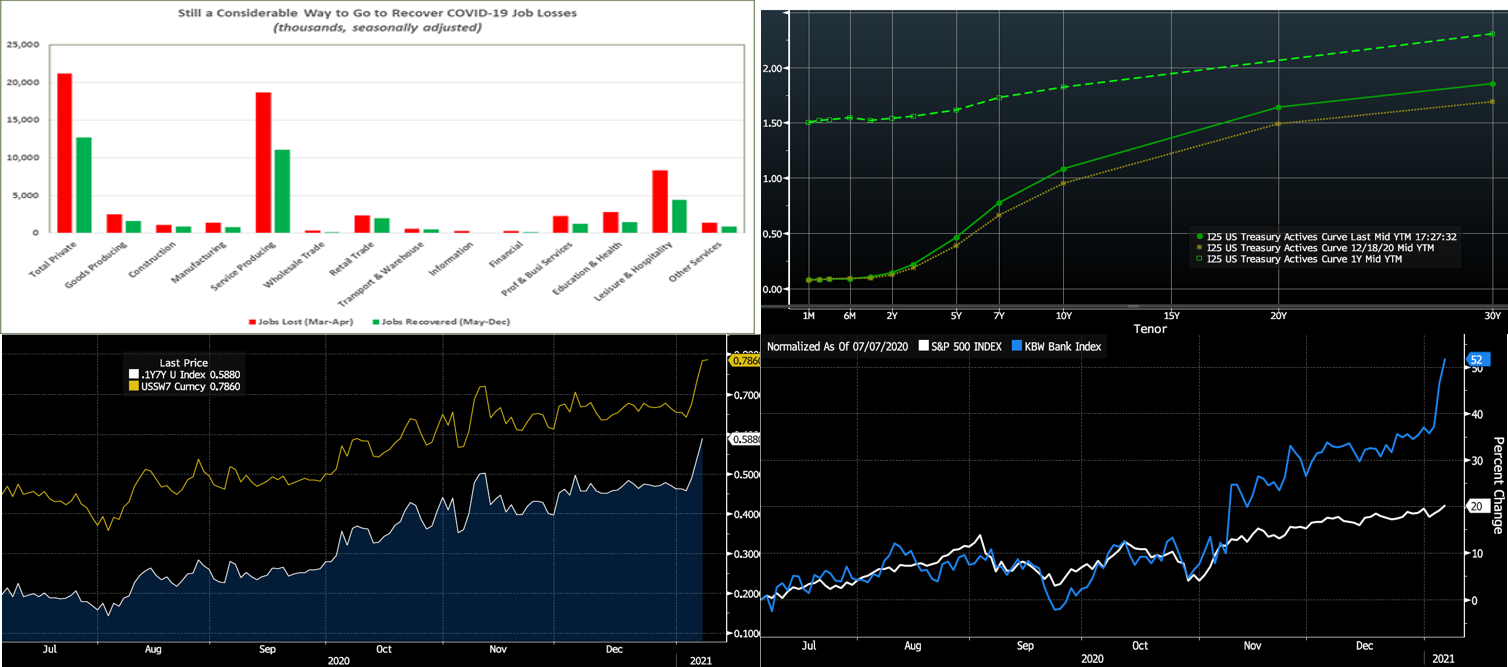

Click to expand the below images.

CHART 1 – UPPER LEFT

Source: Bureau of Labor Statistics, FHLBNY. The Bureau of Labor Statistics reported that nonfarm payrolls dropped by 140K in December, following upwardly revised jumps of 336K (was 245K) in November and 654K (was 610K) in October. Last month’s result was considerably weaker than the 50K rise anticipated by the Street and marked the first contraction in headcounts since the 20.8-million swoon recorded in April. Seasonally adjusted pink-slipping was very narrowly based during the reference period, however. Considerable ground remains to be made up to return payroll employment to the level prevailing before the healthcare crisis struck. Since April, private establishments have added 12.7 million workers, recouping 59.9% of the 21.2 million positions lost to the pandemic.

CHART 2 – UPPER RIGHT

Source: Bloomberg. Since our last report, the UST curve has notably “bear steepened”, as yields have increased from 3 to 16 bps in progressive fashion out the curve. The Fed’s guidance and programs continue to restrain shorter-end yields, and so it was maturities 4-year and longer that led the move. A main development underpinning the bear steepening was the passage of another Covid-19 relief bill and the marker’s expectation of follow-up legislation, especially with the soon-to-be majority makeup of Congress under the Democrats. The fiscal measures, in tandem with hopefully improved and successful vaccine programs, could spur further economic recovery. Essentially, despite the current grim Covid-19 situation and challenged economy, the market is pricing both an expectation of higher UST issuance and improved odds of future inflation and economic growth. For perspective on current rates and the shape of the curve, added here is the yield curve back on January 7, 2020. Clearly, the pandemic and the Fed’s response served to dramatically drive rates lower and the curve steeper, and now fiscal measures have prompted higher long-end yields to start 2021.

CHART 3 – LOWER LEFT

Source: Bloomberg. To isolate a portion of the curve, portrayed here is the 1-year/7-year swaps slope, along with the 7-year swap rate, over the past six months. Since early August, the slope has increased ~40 bps, with ~12bp of that occurring in the past week. Clear here is the current directionality of the yield curve, as it is driven predominantly by the longer points, in this example the 7-year point. Higher rates and a steeper curve in the year ahead may bring at least some welcome relief to financial institutions’ net interest income and margins.

CHART 4 – LOWER RIGHT

Source: Bloomberg. Stock market investors appear to be pricing the potential positive impacts on banks of a steeper curve, higher rates, further fiscal relief legislation, and improved credit losses. As seen here, the KBW Bank Stock Index has posted a handsome gain in recent months and outpaced the S&P 500.

FHLBNY Advance Rates Observations

Front-End Rates

Short-end advance rates moved a few bps higher in recent weeks and through the year-end. T-bill issuance was its usual market feature, but net supply has slowed and thereby allowed for easier market absorption. Money market funds’ AUM increased by ~10bn this past week, and this development should temper further rate increases in the short-end. From a bigger-picture vantage point for 2021, an overall moderation in market supply of short paper is expected to help keep short-end rates relatively steady.

Heavy T-Bill issuance will remain a theme; UST issuance overall is now net positive supply in that more is being issued than what the Fed is buying in its programs. However, with short UST rates at rock-bottom levels, and the Fed likely on hold for a long period, rates may trade in a near-term sideways pattern. Importantly, net T-bill issuance has been lower since last summer and even negative in recent months, and Treasury has announced plans to shift issuance out the curve. Even with a new relief package and related borrowing, these supply/demand and Treasury issuance dynamics should keep short rates in check on the upside.

Term Rates

Medium and longer-term Advance rates moved higher to begin the year, in a notable “bear steepener” shift. While rates are 7 to 8 bps higher out to 4-year from three weeks ago, yields have moved 13 to 18bps higher thereafter. Please refer to the previous section for further color on market dynamics.

Rates still trade at historically low levels across the yield curve, and the curve is priced for the Fed to be on hold for several years. If suitable or sensible from an ALM perspective, it may be worthwhile to consider extending liabilities and locking in term rates. If not in need of funding now but anticipating future needs, a Forward Start Advance can be an appropriate solution. Please call the Member Services Desk to discuss rate levels and potential ideas.

On the UST supply front, next week brings 3/10/30-year auctions. And corporate issuance should accelerate further post-holidays. Indeed, these factors have likely contributed as well to the recent “bear steepening” of the curve. Attention will remain on Covid-19 developments, although markets have been looking and pricing beyond the current grim status of the pandemic.

Happy New Year and best wishes for the year ahead.

The Symmetrical Prepayment Advance Feature

With rates at or near multi-year lows, it is a compelling juncture to use the SPA feature on term advances. This feature allows member to capture, at prepayment, changes in the Fair Value of the advance which are favorable to the member. Contact us to discuss.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the

MSD Team.

Special Member Alert

The FHLBNY recently announced a newly expanded and flexible Disaster Relief Funding (DRF) advance program which offers discounted rate advances with maturities 1-mo and greater. Additionally, we have announced that PPP loans will be accepted as eligible collateral. Please contact us with any questions.