Member Services Desk

Weekly Market Update

Economist Views

Click to expand the below image.

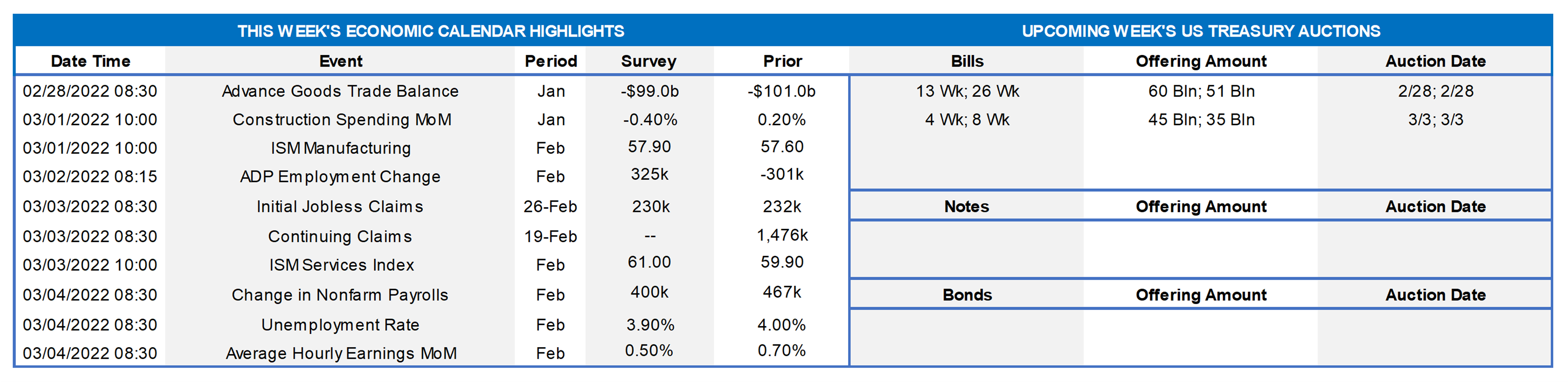

Merchandise Trade Balance: The merchandise trade deficit is expected to narrow to $98.5bn in January from the record-setting $100.5bn shortfall recorded at the end of 2021.

Construction Spending: Pared by an anticipated decline in residential spending, the nominal value of new construction put-in-place likely dipped by .5% last month, breaking a string of consecutive monthly gains going back to last March.

ISM Manufacturing Activity Index: The nationwide manufacturing expansion probably marked its 21st month in February, with the pace of activity likely quickening from January’s reported clip. District Federal Reserve Bank canvasses suggest that the Purchasing Managers Index climbed to 58.5% from 57.6% in the preceding month.

ADP National Employment Report: The Street expects ADP Employer Services to report that an estimated 320K private-sector jobs were created in February, after the 301K plunge at the beginning of the New Year. Given the massive overshoot from the 444K net positions added in the BLS’ January establishment survey, a sizable upward prior-month revision appears likely in this week’s report.

ISM Service-Producing Activity Index: Service-producing activity probably expanded at a considerably faster pace as the effects of the Omicron variant outbreak wane, with the Institute for Supply Management’s barometer jumping from 59.9% in January to 65.6% in February, within three percentage points of the all-time high of 68.4% recorded last November.

Employment Situation Report: The pace of net hiring probably slowed slightly in February, with nonfarm employers adding a projected 400K workers, after a larger-than-expected 467K jump in January. The civilian unemployment rate likely dipped to a pandemic low of 3.8% from 4.0% in the preceding month. With the BLS’ establishment survey ending on the earliest possible date – February 12th – last month’s rise in average hourly earnings may place below the consensus .5% expectation.

Federal Reserve Appearances:

- Feb. 28 Atlanta Fed President Bostic to take part in a discussion about the economy hosted by Harvard University.

- Mar. 1 Atlanta Fed President Bostic to participate in a discussion about business uncertainty during an Atlanta Fed briefing.

- Mar. 2 Chicago Fed President Evans to discuss the economy and policy with the Lake Forest-Lake Bluff Rotary Club.

- Mar. 2 St. Louis Fed President Bullard to discuss the outlook for the economy and monetary policy.

- Mar. 2 Fed Chair Jerome Powell to deliver semi-annual testimony before the House Financial Services Committee.

- Mar. 2 Federal Reserve to Release Beige Book commentary on economic conditions.

- Mar. 2 NY Fed EVP Logan to discuss Fed asset purchases at NYU’s Stern Center for the Global Economy and Business.

- Mar. 3 Fed Chair Jerome Powell to deliver semi-annual testimony before the Senate Banking Committee.

- Mar. 3 New York Fed President Williams to discuss the economy at event hosted by the Council for Economic Education.

Click to expand the below image.

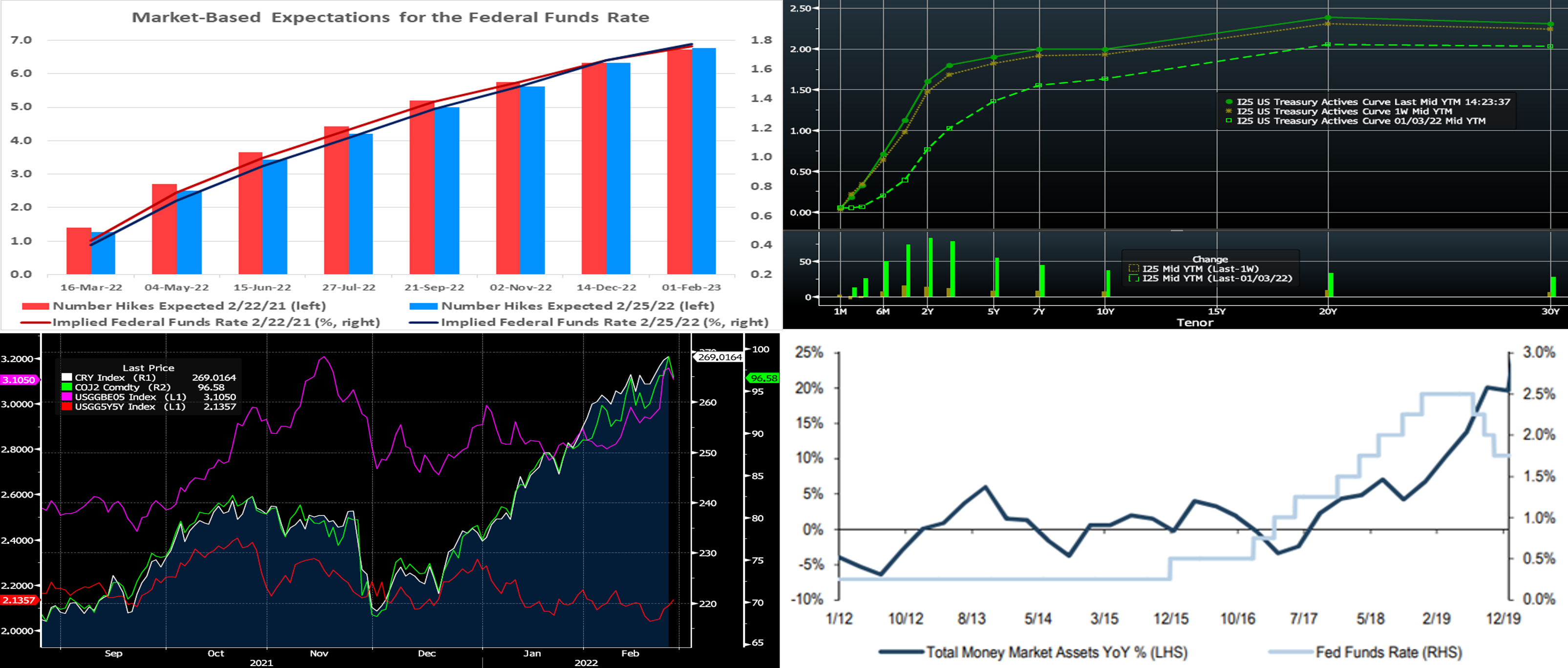

Source: Bloomberg; FHLBNY. The Russian invasion of Ukraine has increased financial market volatility and lowered the estimated market-based probability of a 50 bps hike in the federal funds rate target range at the Federal Open Market Committee’s March 15-16 meeting. At the beginning of the past week (Feb. 22), traders and investors placed the chances of such an increase at 40%. That probability now stands at roughly 28% in the wake of military hostilities and near-term uncertainties. Importantly, market participants do not expect the conflict to delay policymakers from removing accommodation. Moreover, at roughly 6.4, the total number of 25 bps hikes anticipated over the course of this year has remained unaltered from the beginning of last week.

CHART 2 UPPER RIGHT

Source: Bloomberg. Note: Top pane is yield (%), bottom pane is change (bps). As of midday Friday, the UST yield curve finished higher and somewhat flatter from the week prior, with yields up by ~14 bps in 2-year, ~9 bps in 5-year, and ~7 bps in 10-year. Yields had been notably lower on Thursday morning post the news of the Russian invasion of Ukraine; the development sparked a sharp flight-to-quality move, with stocks plunging and credit markets widening. However, the moves were reversed later Thursday and even more so on Friday. The Ukraine situation remains fluid, but, as cited above, the Fed is still expected to commence Fed hikes in March. And, while at the end of the prior week (Feb. 18) the market priced for a cumulative 5.9 hikes of 25bps in 2022, it now prices for 6.4. Yields, meanwhile, remain notably higher than at the start of the year. Market volatility, both day-to-day and intraday, remains high. Members should monitor conditions for potentially more optimal transaction timing. Market focus this upcoming week will remain on Ukraine developments and Fed-speak.

CHART 3 LOWER LEFT

Source: Bloomberg. The Russia-Ukraine crisis has amplified an economic and market-related dynamic, namely that of rising energy and commodities prices in a global economy grappling with but also aiming to “leave behind” a pandemic. The upward price pressures, evidenced here in the CRB Commodities Index (White, RHS ) and Brent Crude Oil (Green, RHS,$), have spurred inflationary forces and expectations, as seen here in the rising 5-year TIPS Breakeven Inflation rate (Purple, LHS,%). As mentioned above, and despite the uncertainty and fluid situation, the market prices for the Fed to remain on course for at least a 25 bps hike at its March meeting. Note in the chart that the 5-year 5-year forward TIPS Breakeven (Red, LHS, %) is well below the 5-year and has generally traded in a sideways range in recent months. In this light, the market indeed expects the Fed to commence with hikes and for the inflation forces to be eventually arrested/resolved.

CHART 4 LOWER RIGHT

Source: Federal Reserve, JP Morgan. Depicted here is the behavior, during the last rate-hike cycle, of Money Market Fund (MMF) AUM growth (year-over-year change) versus the Fed Funds upper–bound target rate. Note that it took multiple (3) hikes of 25 bps before MMF AUM growth began an ascent. Much like current conditions, Fed Funds and short rates were so low prior to the rate-hike cycle that MMFs had waived their investment management fees; subsequently, as Fed hikes ensued, fees were gradually reinstated, thereby causing a lag effect in the relative attractiveness of MMFs for investors. This dynamic may be pertinent to the forecasting and pricing of deposits in the current cycle, i.e. it may take a few hikes before “hotter money”-type deposits experience larger outflows.

FHLBNY Advance Rates Observations

Front-End Rates

- In a short and interesting week, short-end Advance rates closed mixed and steeper from the week prior. While rates out to 3-month were 5 to 6 bps lower, those for 5 and 6-month were 4 to 5 bps higher. Helping spur this move was the market’s repricing lower the odds/extent of a near-term 50 bps Fed hike, as well as some flight-to-quality buying in reaction to the Ukraine crisis. Some of that buying was reflected in MMF AUM being up ~7bn on the week. Meanwhile, the longer maturities have crossed further into the Fed’s anticipated hike cycle and so moved higher. Short-term rates are now highly subject to the Fed and the market’s pricing thereof, with also the Ukraine crisis potentially of impact.

- At this stage, most maturities cross into upcoming FOMC meetings, thereby making them highly responsive to the market’s moves and pricing of the Fed.

Term Rates

- The advance rates curve generally mimicked the UST curve week-over-week and finished higher and flatter from the week prior. The 2-year was ~12 bps higher, while 5-year was ~6 bps higher. Kindly refer to the previous section for relevant market color.

- On the UST supply front, this week serves a reprieve. Markets and rates are highly prone to move on Ukraine news and Fed-speak. Given market volatility, members should monitor conditions for potentially more optimal timing on transactions. Please call the desk for information on market dynamics, rate levels, or products.

Product Alert: FHLBNY is pleased to announce enhancements to our Advance Rebate Program, which provides members an opportunity to receive a cash rebate when prepaying an eligible advance and rebooking a new advance within a 30-day period. Rebate-eligible advances now must have a minimum of 6-months (reduced from 1-year) remaining. Moreover, the potential cash rebate has been increased. This program can be suitable for those wishing to extend their liability duration and/or potentially improve net interest margin. Please call the Member Service Desk at (212) 441-6600 for more information.

The Symmetrical Prepayment Advance Feature

With rates at or near multi-year lows, it is a compelling juncture to use the SPA feature on term advances. This feature allows member to capture, at prepayment, changes in the Fair Value of the advance which are favorable to the member. Contact us to discuss.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the MSD Team.