Member Services Desk

Weekly Market Update

This MSD Weekly Market Update reflects information for the week ending December 9, 2022.

Economist Views

Click to expand the below image.

The Federal Open Market Committee (FOMC) meeting will be the marquee event of the upcoming week. Policymakers are expected to raise the target range for the federal funds rate once again, with markets pricing with near certainty a smaller 50 bps hike to 4¼% to 4½%. The post-meeting communiqué likely will note that recent indicators point to modest growth in spending and output and reiterate that job gains have been robust in recent months and the unemployment rate has remained low. Despite the recent moderation, the statement can be expected to repeat that inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher energy prices, and broader price pressures. Remarks will likely indicate that further rate increases will be necessary to return inflation to the desired 2% target yet acknowledge again that, given the lags of monetary policy effects, the cumulative tightening to date will be taken into consideration in determining the pace of future hikes. The FOMC will continue the reduction of its holdings of USTs, agency debt, and agency MBS, as described in the Plans for Reducing the Size of the Federal Reserve’s Balance Sheet that was issued in May. As per convention, the Fed will release a new Summary of Economic Projections. With market participants currently expecting the monetary policy tightening cycle to end in May 2023, the so-called “dot plot” will be analyzed closely for changes to policymakers’ rate forecasts over the year-end 2022-2025 horizon.

NFIB Small Business Optimism Index: Small business confidence is expected to have eroded slightly in November, leaving the NFIB’s optimism gauge at 90.8.

Consumer Prices: Anticipated declines in airfares, along with lower gas and used vehicle costs, probably capped the rise of the Consumer Price Index (CPI) at .2% in November, after a pair of .4% rises in September and October. Excluding volatile food and energy items, the so-called core CPI is expected to edge just .2% higher – the smallest one-month increase since August 2021. Those projections, if realized, would place the overall and core CPIs 7.2% and 6% above their respective year-ago levels – both well above the Federal Reserve’s desired 2% target.

Empire State Manufacturing Survey: Manufacturing activity in NYS is expected to ebb slightly in December, with the general business conditions diffusion index declining to -.5% from 4.5%.

Retail & Food Services Sales: Capped by an anticipated pullback in auto-dealer revenues, retail and food services sales probably were unchanged in November, after a broad-based 1.3% gain in October. Market participants will pay particular attention to so-called “control” sales excluding auto, building materials and gasoline purchases. Barring any prior-month revisions, the .1% dip anticipated by the Street would place core purchases over the October-November span 4.9% annualized above their July-September average, after a 7.6% annualized summer-quarter gain.

Jobless Claims: New claims for unemployment insurance benefits probably remained in the recent 225-245K range during the week ended December 10. Pay attention to continuing claims which jumped by 62K to a 42-week high of 1.67mn during the period ended November 25 for further evidence that recently furloughed employees are having a more difficult time finding work.

Industrial Production & Capacity Utilization: Stepped-up utilities output likely propelled the Federal Reserve Board’s industrial production gauge .2% higher last month, more than offsetting the .1% dip witnessed in October. With additions to productive capacity expected to match the output gain during the reference period, the overall operating rate probably held steady at 79.9%.

Federal Reserve Appearances:

- Dec. 14 FOMC monetary policy decision.

- Dec. 14 Federal Reserve Chair Jerome Powell to hold post-FOMC-meeting press conference.

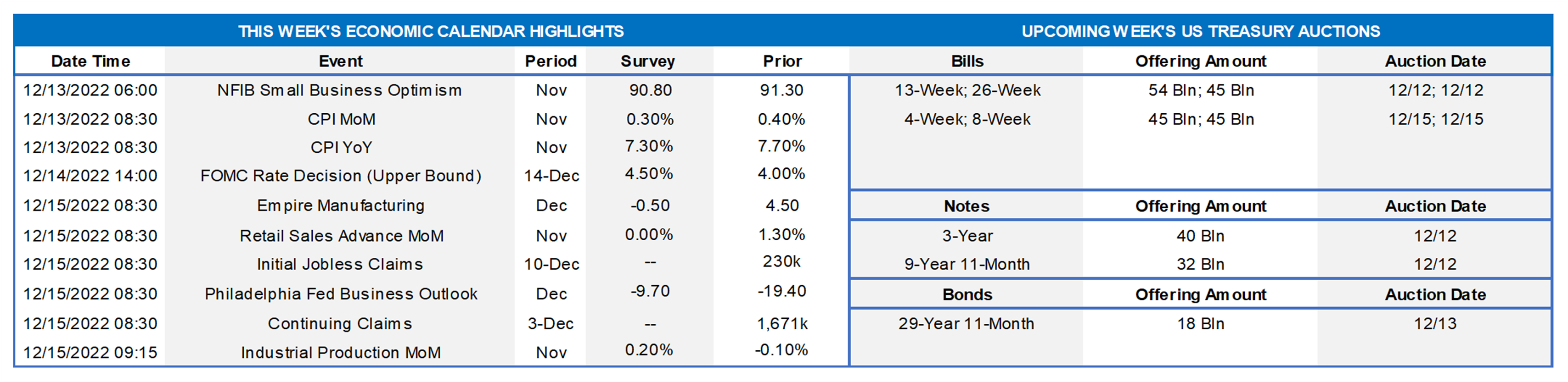

CHART 1 UPPER LEFT

Source: Bloomberg; FHLB-NY. Markets will intently focus on the policy action taken at the upcoming week’s FOMC meeting. The prospective path of the federal funds rate based on futures prices has moved lower since the November 2 FOMC. Like then, market participants expect a 50 bps increase in the target range to 4.25-4.5% on December 14th with certainty but now place the chances of a 75 bps hike at about 5%, down from just over 25% back at that time. Looking ahead, the Federal Reserve tightening cycle is currently expected to end at the beginning of next May, with a terminal rate of roughly 4.95%. The current expectation for year-end 2023 of almost 4.5% is slightly below the 4.625% anticipated by policymakers in the “dot plot” issued after the September FOMC meeting, and so the Fed’s impending fresh dot plot will be assessed closely by the market.

CHART 2 UPPER RIGHT

Source: JP Morgan. For historical perspective on the Fed’s rate-hike cycle, shown here is the change (LHS, %) in the Fed funds rate over the 12-month period following the first hike in the 1994, 2004, 2015, and 2022 hike-cycles (start dates used are 2/4/94, 6/30/04, 12/16/15, and 3/16/22). The current and ongoing tightening pace has been the swiftest in decades, partly attributable to the rock-bottom rate levels at the cycle’s start. The impacts this year have been notable, with rates and the curve trading in their widest ranges in decades and many points on the curve more than doubling over the span. Given this historically swift pace and the Fed’s noting that a lag exists between hikes and their economic effects, the Fed is widely expected to slow the pace to a 50 bps hike this week.

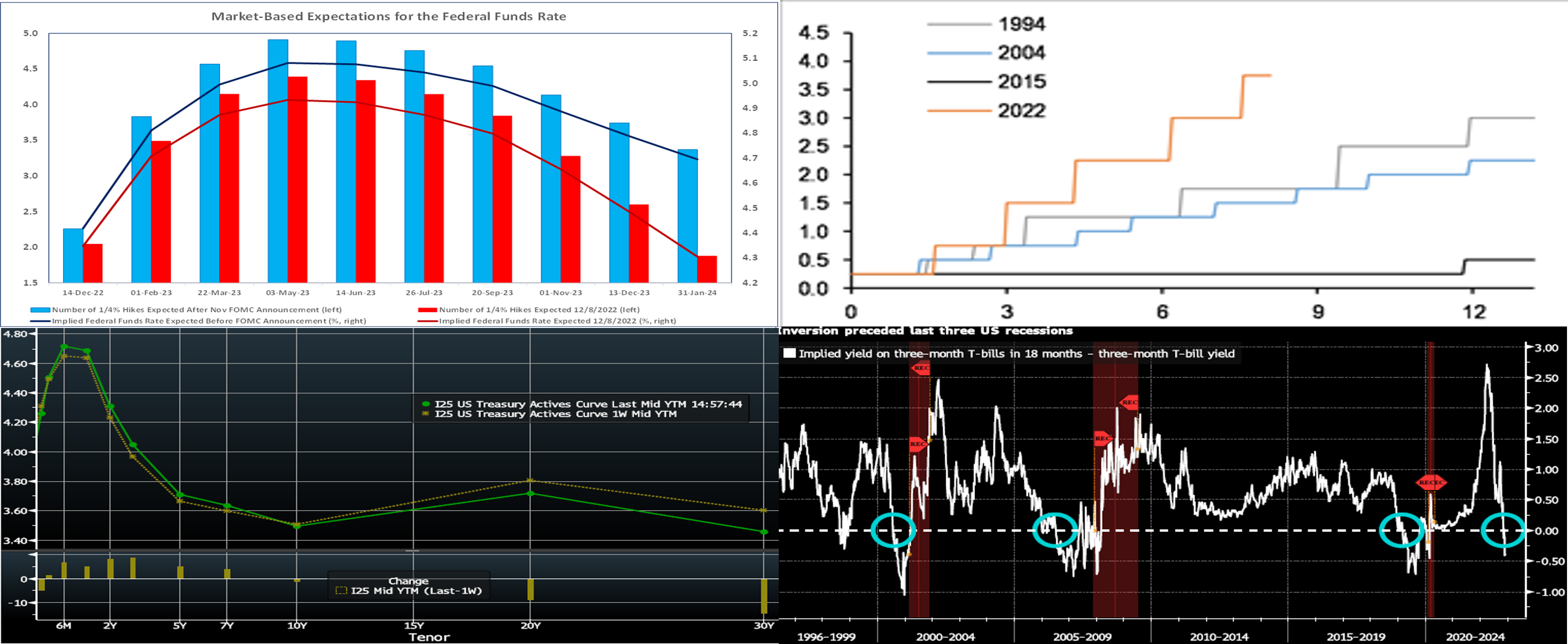

CHART 3 LOWER LEFT

Source: Bloomberg. Note: Top pane is yield (LHS,%), bottom pane is change (bps). UST yields, as of late Thursday, finished mixed from the week prior, as the shorter-end rose but very long-end yields declined. For instance, while 2-year was ~8 bps higher, the 10-year was roughly unchanged, and 30-year was ~15 bps lower. The decline in the long-end was likely related to pension fund re-balancing flows and reported inflows to bond ETFs over the past week. The 2 to 10-year sector yields had been lower mid-week but subsequently reversed on Thursday. Rates-market activity was reported as lower than normal, as surely many participants are marking time before the impending FOMC meeting. The market now prices for a 100% chance of a 50 bps hike for this coming week’s FOMC and with ~5%, unchanged from a week ago, probability of a 75 bps hike. The peak funds rate in spring 2023 last stands at ~4.95%, up from 4.88% a week ago.

CHART 4 LOWER RIGHT

Source: Bloomberg. As surely all readers are aware, many points on the yield curve have inverted this year, with shorter rates higher than longer ones. Portrayed here is the differential (RHS, %) between the current 3-month T-bill yield and the implied 3-month yield in 18-months forward. As evidenced in the chart, an inversion in these curve points has preceded the last three recessions. Interestingly, a 2018 Fed research paper first highlighted the importance of this forward curve as a more reliable recession indicator than traditional yield curves, and it is a curve sector that Fed Chair Powell is known to watch closely to monitor recession risks. Essentially and in simple terms, the curve is pricing for recessionary risks ahead and a response of future rate cuts from the Fed. An open question is whether the market has gone too far in its pricing of rate cuts as early as late-2023; if the Fed indicates that a long period of “Fed on hold” could ensue, then forward rates may adjust higher and, in turn, push 2-year and other shorter-end yields higher. Perhaps Powell will receive questions on this front, and thereby spark market reaction, in the post-meeting Q&A.

FHLBNY Advance Rates Observations

Front-End Rates

- Short-end rates are mostly higher from a week ago, with changes led by the 2 to 3-week zone which have now crossed deeper into the Fed hike expected at this upcoming week’s FOMC; please see the prior slide for more Fed-pricing color. Very short tenors declined on the week, while the 1 to 3-month sector was up ~3-5 bps, The FOMC outcome should provide further direction to rates this week.

- Given the Fed’s tightening and data-dependent posture, rates will remain highly responsive to the FOMC meeting this upcoming week.

Term Rates

- The longer-term curve finished mixed from a week ago, roughly mirroring moves in the UST and swaps markets. The 2 to 4-year sector, as of Thursday afternoon, was a few bps higher from the week prior, while the 5 to 10-year zone was roughly unchanged to a few bps lower. Kindly refer to the previous section for relevant market color. The advance curve remains inverted out to 5-year, thereby offering opportunities to extend in advance duration for minimal or lower coupon cost. The flat curve and high implied volatility environment also can serve to make putable advances more compelling.

- On the UST term supply front, this upcoming week serves 3/10/30-year auctions on Monday/Tuesday. Being in the two days prior to the FOMC outcome, this supply has the potential to pressure the yield curve higher, as dealers and investors may demand extra yield to compensate for FOMC-related market risk. Kindly call the desk for information on market dynamics, rate levels, or products.

Product Alert: FHLBNY is pleased to announce the reintroduction, after a temporary suspension owing to Libor-cessation, of the Putable Advance, Fixed-Rate with SOFR Cap Advance, and ARC with SOFR Cap/Floor Advance. The Callable Advance continues to be offered. This expansion of the product menu will provide members with more options and flexibility for the management of funding and/or hedging needs.

Forward Start Advance (FSA): For members with upcoming borrowing or refunding plans, consider the FSA as a method to opportunistically “lock in” rates before advance settlement date. Please contact the Member Services Desk at (212) 441-6600 for more information.

The Symmetrical Prepayment Advance Feature

For those anticipating term funding needs, and with rates on an uptrend, it can be an appropriate juncture to consider our SPA feature. This feature allows the member to capture, at prepayment, changes in the fair value of the advance which are favorable to the member. Contact Member Service Desk to discuss.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the MSD Team.