Member Services Desk

Weekly Market Update

This MSD Weekly Market Update reflects information for the week of March 28, 2022.

Economist Views

Click to expand the below image.

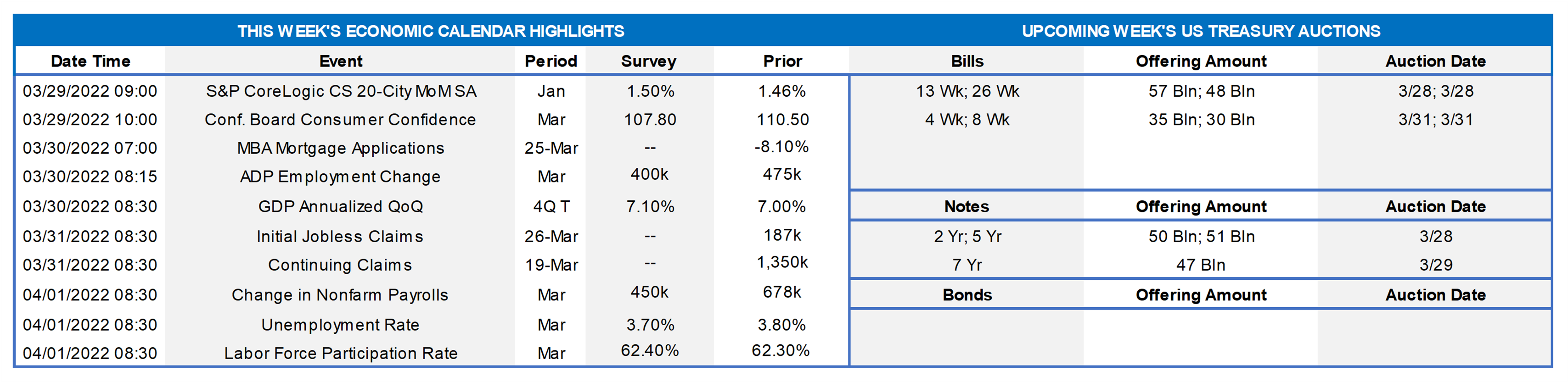

A crowded economic data calendar should distract the market from overseas developments this week. Buoyed by the dearth of dwellings on the market, home selling prices probably remained on a tear at the beginning of the year. While inflation concerns are expected to have weighed on consumers’ spirits, manufacturers likely experienced their strongest activity since last November. Labor market soundings probably tightened considerably during the winter quarter. A quartet of Federal Reserve presidents will appear in public to discuss a variety of timely topics.

S&P CoreLogic Case-Shiller (SPCLCS) 20-City Home Price Index: Home prices probably moved higher across the twenty major metro areas canvassed by SPCLCS in January. Indeed, the 1.5% jump projected by the Street, after an identical hike in December, would place home selling prices 18.7% above those posted at the beginning of 2021.

Conference Board Consumer Confidence: Concerns about the impact of the Russia/Ukraine conflict on domestic economic activity probably left the Conference Board’s consumer sentiment gauge at a 13-month low of 107 in March. As always, focus on the so-called labor differential – the percentage of survey respondents feeling that jobs are plentiful less than those believing they are hard to get – for clues to the likely change in the civilian jobless rate this month.

JOLTS Job Openings: To be released 3/29, a sharp snapback in online help-wanted postings suggests that total job openings likely rebounded to a record 11.7mn in February. Given the reported decline in civilian unemployment last month, that result would leave the gap between available positions and the jobless at an all-time wide of 5.4mn. Put another way, there would be roughly 1.9 jobs per available unemployed person in February.

ADP National Employment Report: Expected to show an estimated 400K private-sector jobs added in March, after a 475K increase in the previous month. Given the sizable undershoot from the 654K net positions added in the Bureau of Labor Statistics’ February establishment survey, a sizable upward prior-month revision appears highly likely in this week’s report.

Real GDP Growth: Data released since the BEA’s preliminary report suggest that Q4 2021 activity will be boosted modestly from the previously estimated 7.0% annualized pace.

Employment Situation Report: Net hiring likely slowed in March, with nonfarm employers adding a projected 450K workers, following a larger-than-expected 678K leap in February. The sharp decline in the insured unemployment rate between establishment survey periods hints that the civilian jobless gauge may have moved three ticks lower to 3.5%, reaching Fed officials’ median year-end expectation. Average hourly earnings growth is expected to have resumed in March, after stalling in the preceding month.

ISM Manufacturing Report: The nationwide manufacturing expansion probably marked its 22nd month in March, with the pace of activity likely quickening from February’s reported clip. District Federal Reserve Bank canvasses suggest that the Purchasing Managers Index climbed to a four-month high of 60.5% from 58.6% in the preceding month.

Motor Vehicle Sales: To be released 4/1, analysts expect sales to be a SAAR of 13.1m in March, down 7.2% from the 14.1mn sold in February and 26.5% below the 17.8mn purchased a year ago.

Federal Reserve Appearances:

- Mar. 29 Philadelphia Fed President Harker to discuss the economic outlook at The Center for Financial Stability in New York.

- Mar. 29 Atlanta Fed President Bostic to take part in a discussion about economic leadership.

- Mar. 31 New York Fed President Williams to make opening remarks at a conference on the future of New York City.

Click to expand the below image.

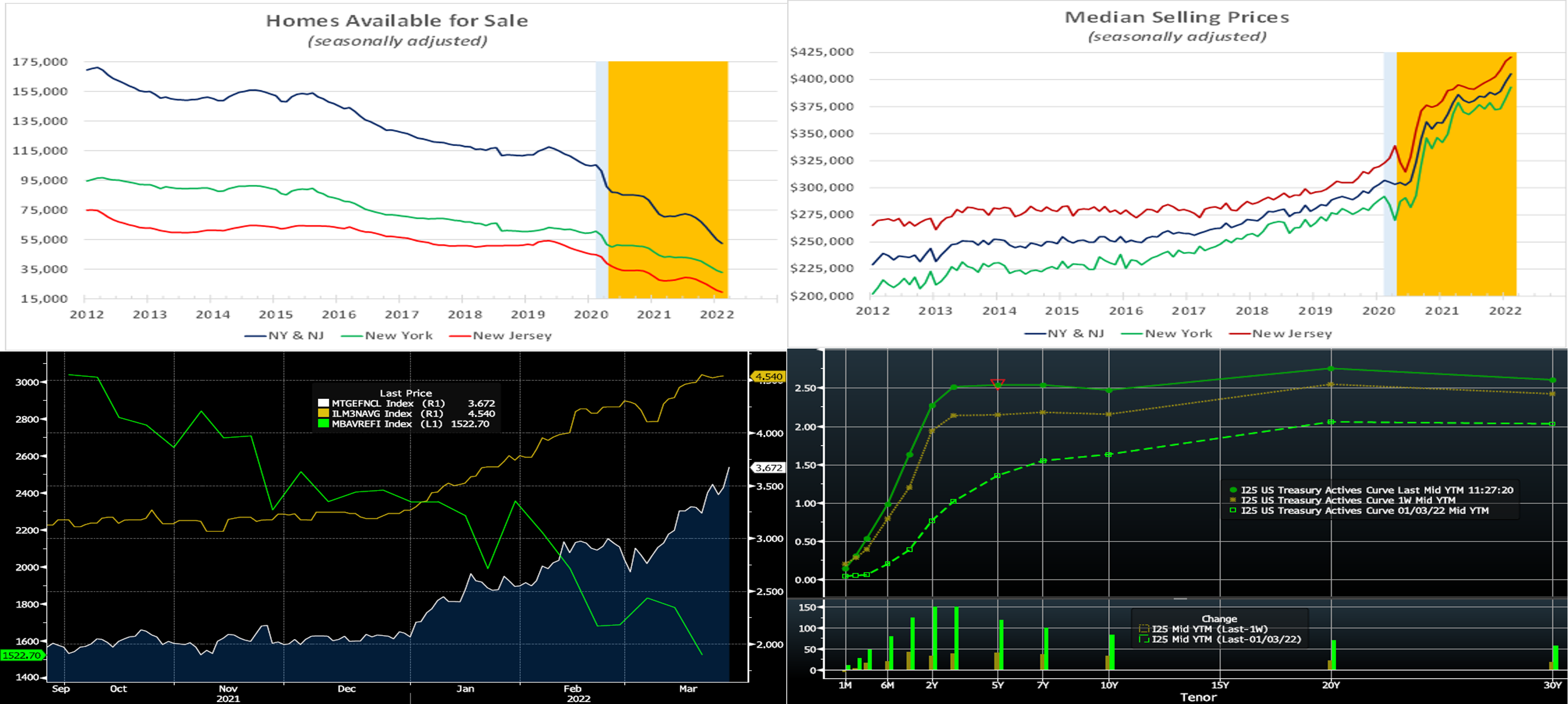

CHART 1 UPPER LEFT

Source: NY State Association of Realtors; NJ Realtors; FHLB-NY. The dearth of available dwellings on the market in New York and New Jersey continues to buoy home selling prices in the FHLB-NY district. Indeed, the stock of unsold homes across the two states has contracted by a hefty 27.4% over the 12 months ended February to a record low of just 55K after seasonal adjustment.

CHART 2 UPPER RIGHT

Source: NY State Association of Realtors; NJ Realtors; FHLB-NY. Since February 2021, the median home price across the Empire and Garden States has jumped by 10.2%, or approximately $3.4K, to a record high $405.35K. Last month’s realtor reports showed that homes were changing hands in just 49 days, with seller’s receiving 1.2% above their asking price.

CHART 3 LOWER LEFT

Source: Bloomberg. It remains to be seen if recent market moves will forcefully hamper the housing market. As seen here, the Agency MBS Current Coupon (imputed yield of a par-priced MBS, White, RHS, %) and the consumer 30-year mortgage rate (RHS, Gold, %) have risen markedly in the past few months. In turn, housing affordability metrics have taken a turn for the worse. A key metric for housing will likely be employment, and so this upcoming week’s jobs report will help reveal if the strong jobs market is intact. These higher MBS yields, meanwhile, provide better yields for financial institutions to put funds (either “on hand” or via a new advance) to work in assets. Also shown here is the mortgage refinance index (LHS, Green) which has essentially cratered owing to the dramatic rise in rates.

CHART 4 LOWER RIGHT

Source: Bloomberg. Note: Top pane is yield (%), bottom pane is change (bps). The UST yield curve surged higher in the past week, as the market priced for more aggressive Fed tightening. A main precipitant to the move was Fed Chairman Powell, who this week indicated that the Fed was prepared to hike 50 bps if necessary to combat inflationary forces. Other Fed Governors voiced similar sentiments throughout the week. As of Friday midday, the 1-year was ~40 bps higher, while the 2 to 5-year sector was ~34 to 39 bps higher on the week. The Russian invasion of Ukraine is still in the news but not leading to any doubt that the Fed will march onwards with rate hikes. The S&P 500 remained relatively stable and was ~1% higher on the week as of midday Friday. As seen in the chart, yields are notably higher than at the beginning of the year, most notably in the 1 to 5-year sector where more aggressive Fed hikes have been priced into the curve. Market focus this upcoming week will remain on Ukraine developments while also turning to the heavy slate of economic data. And any Fed-speak will be closely monitored for clues to future Fed moves.

FHLBNY Advance Rates Observations

Front-End Rates

- Short-end Advance rates finished higher and steeper from the week prior. The 1-month-and-in sector rose a bp, as the market experienced “safety flows” into very short instruments which kept a lid on rates in this zone; the Fed’s RRP, for instance, reached $1.8trn mid-week and very short T-bills saw demand. And MMFs have maintained extremely short durations in the current climate. Rates 2-month and longer rose 8 to 17 bps on the week, as the market priced even more aggressive Fed hikes for 2022 compared to last week; this pricing and the fact that maturities are crossing further into the timeline of the expected Fed hiking cycle, were causal factors in the rate moves.

- At this stage, all maturities cross into upcoming FOMC meetings, thereby making them highly responsive to the market’s moves and pricing of the Fed.

Term Rates

- The advance rates curve generally mimicked the UST curve week-over-week and surged higher from the week prior. Kindly refer to the previous section for relevant market color.

- On the UST supply front, this week brings 2/5/7-year auctions. Markets and rates remain highly prone to move on Ukraine news and Fed-speak. This upcoming week also offers a slew of economic data. Given market volatility, members should monitor conditions for potentially more optimal timing on transactions. Please call the desk for information on market dynamics, rate levels, or products.

Product Alert: FHLBNY is pleased to announce enhancements to our Advance Rebate Program, which provides members an opportunity to receive a cash rebate when prepaying an eligible advance and rebooking a new advance within a 30-day period. Rebate-eligible advances now must have a minimum of 6-months (reduced from 1-year) remaining. Moreover, the potential cash rebate has been increased. This program can be suitable for those wishing to extend their liability duration and/or potentially improve net interest margin. Please call the Member Service Desk at (212) 441-6600 for more information.

Forward Start Advance (FSA): For members with upcoming borrowing or refunding plans, consider the FSA as a method to opportunistically “lock in” rates before advance settlement date. Please call the Member Service Desk at (212) 441-6600 for more information.

The Symmetrical Prepayment Advance Feature

With rates at or near multi-year lows, it is a compelling juncture to use the SPA feature on term advances. This feature allows member to capture, at prepayment, changes in the Fair Value of the advance which are favorable to the member. Contact us to discuss.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the MSD Team.