Member Services Desk

Weekly Market Update

Economist Views

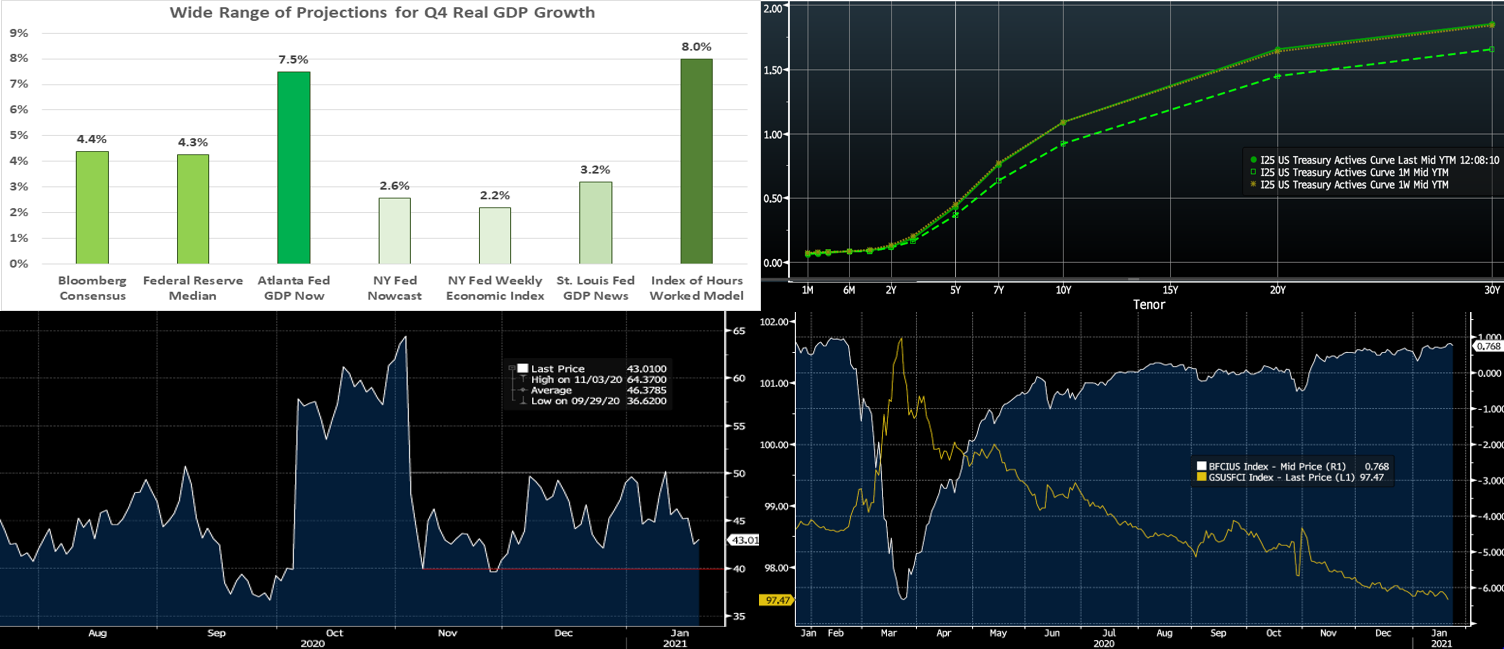

Click to expand the below image.

The first FOMC meeting of 2021 will be the key event this week. The FOMC is universally expected to reiterate that it expects to maintain an accommodative stance of monetary policy, with a federal funds rate target range of 0 to .25%, until it achieves maximum employment and inflation at a rate of 2% over the longer run. Moreover, the communiqué issued after the upcoming gathering likely will repeat that the Federal Reserve will continue to increase its holdings of Treasury securities by at least $80bn per month and of agency mortgage-backed securities by at least $40bn per month until substantial further progress has been made toward the FOMC’s goals. On the economic data front, the advance report on real GDP growth in Q4 likely will be the key release. Soundings from the housing sector are expected to remain strong. Consumer confidence, however, probably began the New Year on a low note.

S&P CoreLogic Home Price Index: Solid demand amid dwindling supply likely propelled home prices higher for a sixth straight month in November. The 0.85% rise anticipated by the Street, if realized, would place the S&P CoreLogic 20-city gauge 8.3% above the level recorded 12 months earlier.

Conference Board Consumer Confidence: Concerns about the current economic environment and growing civil unrest probably weighed on consumer sentiment at the beginning of 2021, leaving the Conference Board’s gauge at a seven-year low of 80.5.

Durable Goods Orders: Durable goods bookings likely climbed for an eighth straight month in December. The 1% gain projected by the Street would boost the cumulative rise from April’s pandemic low to a hefty 47.4%. Last month’s non-defense capital goods shipments excluding jetliners will provide a final reading on business equipment spending ahead of the Bureau of Economic Analysis’ advance report on Q4 real GDP.

Initial Jobless Claims: Initial and continuing claims for regular state unemployment insurance benefits probably moved lower in their respective reporting periods but remained well above levels prevailing before the pandemic shuttered the economy in mid-March.

Real GDP: The recovery from the pandemic-induced shuttering of the economy continued during the fall but at a considerably slower pace than the breakneck 33.4% annualized clip witnessed in Q3.

The median 4.4% annualized increase in Q4 real GDP anticipated by the Bloomberg consensus would leave activity 2.4% below its 2019 year-end level, implying that the lost output from the pandemic crisis will not be recouped fully until the middle of 2021.

New Home Sales: Reported hikes in single-family building permits and housing starts hint that contracts to purchase a newly constructed dwelling jumped by 12.4% to a seasonally adjusted annual rate of 945K in December, completely reversing the falloff posted in November.

Pending Home Sales: Home-purchase contract signings are expected to have dipped by 1.0% in the final month of 2020, boosting the cumulative decline from August’s all-time high to 6.4%.

Upcoming Federal Reserve Appearance:

Jan. 27: FOMC to release post-meeting statement.

Jan. 27: Fed Chair Powell to hold post-FOMC-meeting press conference.

Jan. 29: Dallas Fed President Kaplan to speak at local energy forum.

Click to expand the below images.

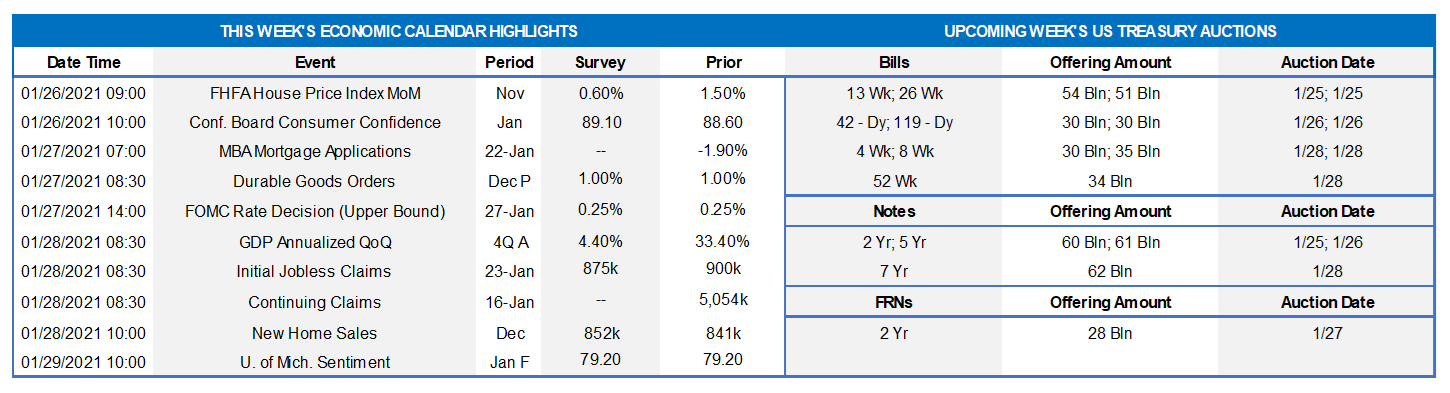

CHART 1 – UPPER LEFT

Source: Bloomberg, BLS, Fed, FHLBNY. The recovery continues from the pandemic-induced economic collapse. The pace of business activity during the final quarter of 2020 probably slowed sharply from the summer’s breakneck 33.4% annualized pace, but the range of available projections remains wide. The median 4.4% annualized increase in real Q-4 GDP anticipated by the Bloomberg consensus would leave activity 2.4% below its 2019 year-end level, implying that the lost output from the COVID-19 crisis will not be recouped fully until the middle of this year. The alarming recent increase in coronavirus infections experienced nationwide suggests that risks lie to the downside on near-term growth, but any shortfall probably will be recovered quickly once vaccines become widely distributed. Private firms and public institutions expect real GDP to grow by ~3.9% over the course of calendar 2021, followed by a 3.1% gain in 2022.

CHART 2 – UPPER RIGHT

Source: Bloomberg. In a shortened week, the UST curve finished virtually unchanged. The Fed’s guidance and programs continue to pin shorter-end yields, and longer yields bounced up and down in a narrow range, owing to conflicting factors. Economic data was mixed, with still concerningly high jobless claims offset by strong housing-related data. While Covid-19 conditions have hit distressingly high infection and death tolls, there are bolstered vaccination and relief measures and optimism for the months ahead. Another round ($1.9trn) of relief legislation has been proposed by the new Administration, although details and its size have already entered the “early haggling stage”. The FOMC meets this upcoming week, but it is likely to “come and go” without much impact.

CHART 3 – LOWER LEFT

Source: Bloomberg. Depicted here is the ICE BoA MOVE index, a yield curve weighted index of the normalized implied volatility on 1-month US Treasury options. While it popped higher into year-end and the beginning of 2021 on the theme of reflation/fresh stimulus/potential increased UST bond issuance, it has now receded to below its mid-range since Election Day. With the Fed on likely “status-quo hold” and the counteracting forces mentioned above, rate movements and volatility have been tempered until more clarity evolves on outcomes.

CHART 4 – LOWER RIGHT

Source: Bloomberg. Portrayed here is the Bloomberg Financial Conditions Index (RHS) juxtaposed with the Goldman Sachs Financial Conditions Index (LHS). These indices aim to track and measure the overall level of stress in financial and credit markets, and they utilize variables such as interest rates/credit spreads/equity prices to decipher potential impacts on the economy. For the Bloomberg index, a positive value indicates accommodative conditions (and the opposite for a negative value). Meanwhile, for the Goldman index, a declining value indicates easing conditions; indeed, this index now sits at its lowest level ever since its 1990-inception. The Fed has prevailed in forging these conditions and will likely “stay the course” for the foreseeable future.

FHLBNY Advance Rates Observations

Front-End Rates

Short-end advance rates finished mostly unchanged week-over-week. T-bill issuance was its usual market feature, but net supply has slowed and thereby allowed for easier market absorption. Money market funds’ AUM decreased by ~$8.6bn this past week, thereby essentially reversing the prior week’s increase. From a bigger-picture vantage point for 2021, an overall moderation in market supply of short paper is expected to help keep short-end rates relatively steady.

Heavy T-Bill issuance will remain a theme; UST issuance overall is now net positive supply in that more is being issued than what the Fed is buying in its programs. However, with short UST rates at rock-bottom levels, and the Fed likely on hold for a long period, rates may trade in a near-term sideways pattern. Importantly, net T-bill issuance has been lower since last summer and even negative in recent months, and Treasury has announced plans to shift issuance out the curve. Even with a new relief package and related borrowing, these supply/demand and Treasury issuance dynamics should keep short rates in check on the upside.

Term Rates

Medium and longer-term Advance rates were also generally unchanged on the week. Please refer to the previous section for further color on market dynamics.

On the UST supply front, next week brings 2/5/7-year auctions. Corporate issuance should accelerate further post its usual strong start-of-the-year pattern. As predicted last issue, a slate of bank issuance occurred this past week post-Q4 2020 earnings releases. Focus this week will turn to the FOMC meeting yet also remain on Covid-19 and fiscal legislation developments.

New Product Alert: In order to satisfy member needs and provide greater product flexibility to match bond and derivative market conventions, FHLB-NY now offers SOFR-linked advances based on SOFR-index compounding. Note that this product is in addition to SOFR-linked advances based on SOFR-index averaging which have been offered since November 2018.

The Symmetrical Prepayment Advance Feature

With rates at or near multi-year lows, it is a compelling juncture to use the SPA feature on term advances. This feature allows member to capture, at prepayment, changes in the Fair Value of the advance which are favorable to the member. Contact us to discuss.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the

MSD Team.

Special Member Alert

The FHLBNY recently announced a newly expanded and flexible Disaster Relief Funding (DRF) advance program which offers discounted rate advances with maturities 1-mo and greater. Additionally, we have announced that PPP loans will be accepted as eligible collateral. Please contact us with any questions.