Member Services Desk

Weekly Market Update

Economist Views

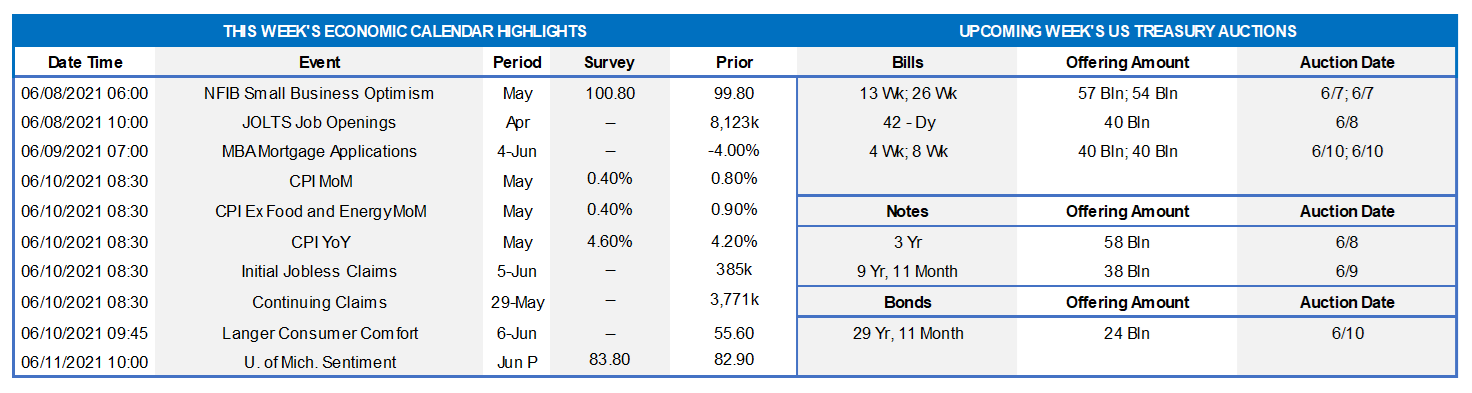

Click to expand the below image.

Market participants will enjoy a well-deserved rest this week. Except for the Bureau of Labor Statistics’ update on consumer prices in May, the light statistical calendar contains primarily second-tier releases. Small business confidence and consumer sentiment gauges probably improved in their latest respective reporting periods. Job openings likely dipped slightly in April from the record level posted in March. Jobless claims are expected to remain on downtrends but elevated compared to pre-pandemic levels. Federal Reserve officials will observe their traditional blackout period ahead of the June 15-16 FOMC meeting.

NFIB Small Business Optimism Index: Already reported increases in hiring plans, job availability, and worker compensation suggest that the National Federation of Independent Business’ sentiment gauge climbed from 99.8 in April to 101.5 in May – the highest reading since October.

JOLTS Job Openings: A modest dip in online help-wanted postings hints that job openings nationwide likely dipped from the record-high 8.1mn posted in March.

Consumer Price Index: Consumer prices are expected to have moved higher for a 12th straight month in May. The median Street call for the headline CPI calls for a 0.4% rise, following April’s outsized .8% jump. The core inflation barometer excluding volatile food and energy costs is also projected to slow to .4% from .9% in the preceding month. Available data suggest that supply-related hikes in motor vehicle costs and stepped-up airline fares probably will boost the overall and core CPIs in May. The median Street forecasts, if realized, would place the overall and core CPIs 4.7% and 3.4% above their respective year-ago levels. While both well above the Federal Reserve’s 2% target, May’s readings largely reflect base effects as prior-year declines drop out of the calculations.

Jobless Claims: Initial and continuing claims under regular state unemployment insurance programs probably moved lower during their latest respective reporting periods. Those figures continue to understate the severe impact of the pandemic and the slow healing of the domestic labor market, however. Indeed, as of May 15, just over 15.4mn persons were still receiving some sort of unemployment assistance, down from the pandemic peak of 32.4mn hit last June but still well above the level prevailing before the pandemic began over a year ago.

Michigan Sentiment Index: Weekly sentiment soundings suggest that the University of Michigan’s consumer confidence barometer improved to 84.5 in early June from 82.9 in the preceding month. Given the recent acceleration in consumer prices, survey respondents’ inflation expectations likely will receive considerable attention in the upcoming report.

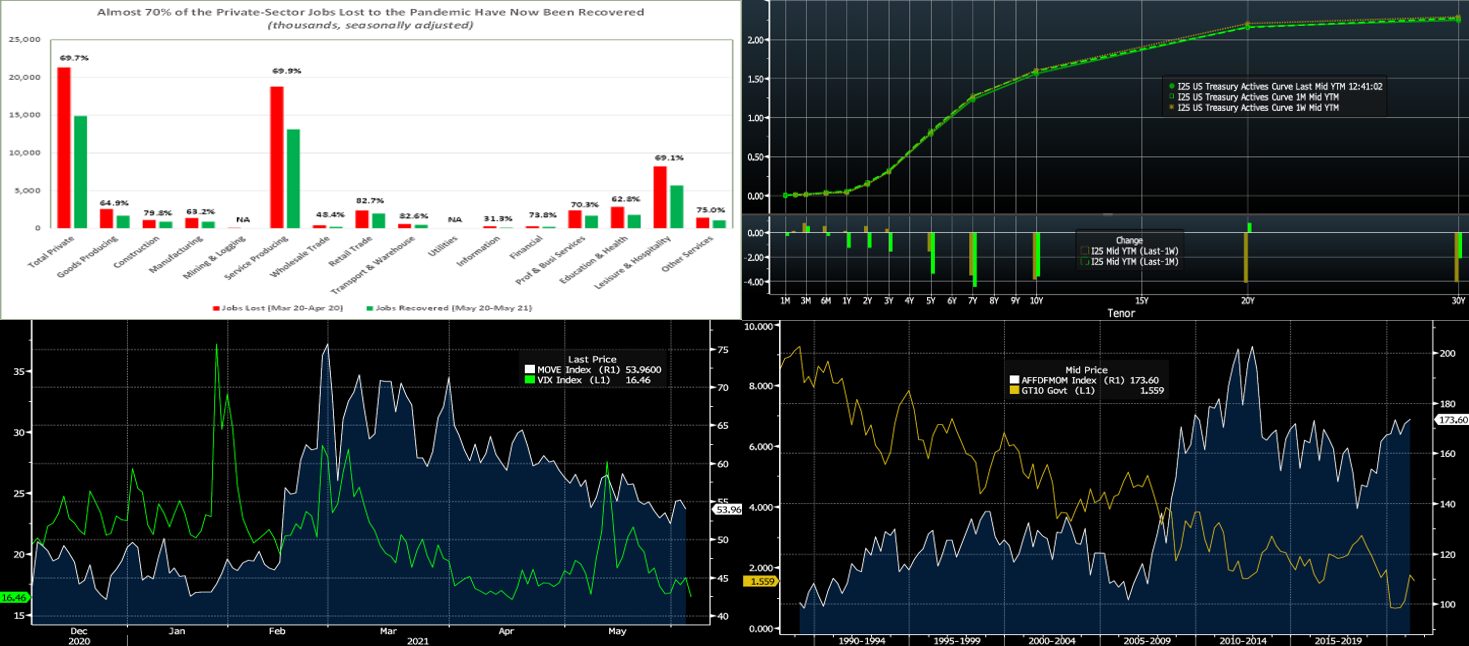

Click to expand the below images.

CHART 1 – UPPER LEFT

Source: BLS; FHLBNY. The Bureau of Labor Statistics reported that nonfarm payrolls expanded by a hefty 559K in May, following upwardly revised increases of 278K in April and 785K in March. Stepped-up hiring by service-producing segments hit hard by the pandemic fueled May’s gain. To date 14.9mn, or 69.7%, of the 21.4mn private jobs lost over the March-April 2020 span have been recovered. The hardest hit sectors can be expected to make significant further strides over the balance of the year, as vaccinations spread across the country and social-contact restrictions are lifted.

CHART 2 – UPPER RIGHT

Source: Bloomberg. Note: top pane is yield (%), bottom pane is change (bps). In a holiday-truncated week, UST yields closed a few bps lower, led by the 5-year and longer sector. After trading relatively “sideways” for most of the week, yields moved lower on Friday post the employment report. Following Thursday’s strong ADP jobs release, Friday’s employment report was decent but below some heightened market expectations. Consequently, a few market-watchers termed it a “Goldilocks number”; in other words, while the report portrays progress, it was not enough to warrant more heightened concerns over inflation and/or Fed asset tapering. Consequently, short-covering ensued, even with UST supply looming this coming week. The Fed, as well as foreign and real money (such as banks and pension funds) investor buying, continues to provide a steady demand backdrop for bonds. In the past month, a few Fed members have begun to express that “the time to talk about tapering” of its asset purchase program is drawing nearer. All in all, this mix of dynamics continues to keep yields relatively range-bound, as evidenced in the chart.

CHART 3 – LOWER LEFT

Source: Bloomberg. The range-bound markets have squelched volatility levels. Depicted here is the ICE MOVE index (RHS, white), a yield curve weighted index of the normalized implied volatility on 1-month Treasury options. It is the weighted average of volatilities on the UST 2/5/10/30-year. Also depicted is the VIX index, an implied volatility measure of the S&P 500. Markets have priced volatility demonstrably lower since the past winter. While a continued range-bound market during the summer may lead to further declines, these lower levels of implied volatility afford a more opportune time to buy any option-based hedge protection such as caps.

CHART 4 – LOWER RIGHT

Source: JP Morgan. Depicted here is the National Association of Realtors (“NAR”) Index of Homebuyer Affordability (RHS, white); it tracks the affordability of housing, based on a mix of median home prices, income levels, and mortgage rates. A higher level indicates a more affordable housing market in the aggregate. Also shown here is the UST 10-year yield (LHS, gold). Unsurprisingly, lower rates tend to lead to and support higher affordability. In a historical context, the NAR index resides in a zone that should be supportive of the housing markets, especially with mortgage rates still at relatively low levels.

FHLBNY Advance Rates Observations

Front-End Rates

Short-end advance rates finished flat to a bp higher week-over-week. Money Market Funds’ AUM increased by ~$2.4bn on the week, thereby providing continued demand for short paper. Meanwhile, the GSEs continue to invest larger sums into money markets, and the US TGA continues its decline. In a more recent development, state and local governments are receiving federal disbursements from the most recent relief bill and are parking funds in short-term investment “placeholders”. For any members experiencing such municipal deposit inflows, consider our Refundable Municipal Letter of Credit product; please call the desk to discuss. From a bigger-picture vantage point, the overall moderation in the supply of short paper, relative to high cash levels in the market, is expected to keep short-end rates relatively steady and under downward pressure in the year’s first half.

UST issuance overall is now net positive supply in that more is being issued than what the Fed is buying in its programs. However, with short UST rates at rock-bottom levels and the Fed on hold for a long period, rates are likely to persist in a near-term sideways to softer pattern. Importantly, weekly net T-bill issuance has been lower since 2020 and negative in recent months, and Treasury has announced plans to shift issuance out the curve. Further legislative packages and related borrowing may lead to an eventual increase of T-bill auction sizes and positive net supply, but for now overall market supply/demand dynamics should keep short rates in check on the upside.

Term Rates

On the week, medium and longer-term Advance rates were lower by 1 to 5 bps, led by the 5-year and longer sector, in a “bull flattener” move. Kindly refer to the previous section for further color on relevant market dynamics.

On the UST supply front, this week holds hefty 3/10/30-year auctions. The market will maintain its attention on any Covid-19 and legislative developments this week. The Fed is in “blackout mode”, and the economic calendar is relatively light; the CPI release will likely be watched closely by the market.

Advance Special Offering: Symmetrical Prepayment Advance feature —Please contact your Relationship Manager at

212-441-6700 or the Member Services Desk at 212-441-6600 for information.

New Product Alert: In order to satisfy member needs and provide greater product flexibility to match bond and derivative market conventions, FHLB-NY now offers SOFR-linked advances based on SOFR-index compounding. Note that this product is in addition to SOFR-linked advances based on SOFR-index averaging which have been offered since November 2018.

The Symmetrical Prepayment Advance Feature

With rates at or near multi-year lows, it is a compelling juncture to use the SPA feature on term advances. This feature allows member to capture, at prepayment, changes in the Fair Value of the advance which are favorable to the member. Contact us to discuss.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the

MSD Team.

Special Member Alert

The FHLBNY recently announced a newly expanded and flexible Disaster Relief Funding (DRF) advance program which offers discounted rate advances with maturities 1-mo and greater. Additionally, we have announced that PPP loans will be accepted as eligible collateral. Please contact us with any questions.