Member Services Desk

Weekly Market Update

This MSD Weekly Market Update reflects information for the week of February 8, 2021

Economist Views

Click to expand the below image.

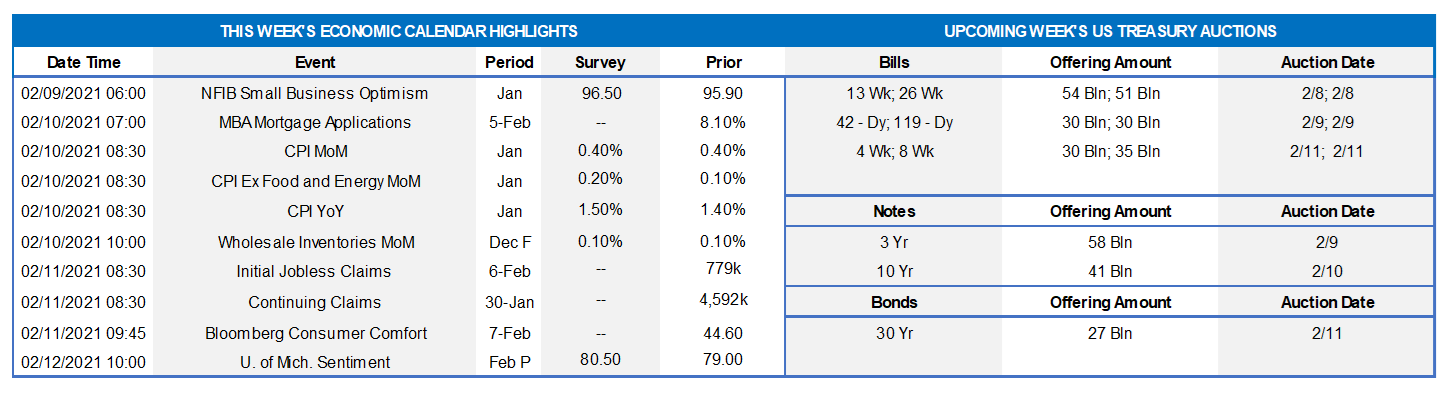

With only a pair of Federal Reserve speaking engagements and less than a half-dozen generally second-tier economic indicators on this week’s calendar, the attentions of market participants likely will be drawn to the Biden Administration’s ongoing efforts to get the American Rescue Plan through Congress and the impeachment trial of former President Trump.

NFIB Small Business Optimism Index: Small business sentiment likely rebounded at the beginning of the New Year, after the surprising expectations-led drop suffered in December.

JOLTS Job Openings: A reported pullback in online help-wanted postings suggests that available job openings probably fell to a six-month low of 6.3mn in December from 6.53mn in November. If that projection is on the mark, the number of unemployed persons exceeded available positions by a whopping 4.4mn at the end of 2020.

Consumer Price Index: Higher retail energy costs likely propelled the Consumer Price Index (CPI) 0.4% higher in January, matching the increase posted in December. The core CPI excluding volatile food and energy components probably quickened slightly during the reference period, rising by 0.2% following a 0.1% prior-month uptick. Those projections, if realized, would place both the overall and core CPIs 1.5% above their respective January 2020 levels, well shy of the Fed’s desired 2% target.

Jobless Claims: Initial claims for regular state unemployment insurance benefits probably receded for a fourth straight week, during the period ended February 6, to their lowest level since the 716K filings recorded at the end of last November. The total number of persons on regular state benefit rolls likely fell to the lowest level since the pandemic forced the shuttering of the economy last March. However, the total number of persons receiving unemployment assistance under all programs probably remained elevated and ~15mn above the level experienced before the crisis.

Michigan Sentiment Index: Consumer confidence probably recovered in early February, reversing the modest deterioration witnessed in January.

Federal Reserve Appearances:

Feb 8: Cleveland Fed President Mester to discuss the economy at a virtual event hosted by Rotary Club of Toledo.

Feb 10: Federal Reserve Chair Powell to speak to the Economic Club of New York.

Click to expand the below images.

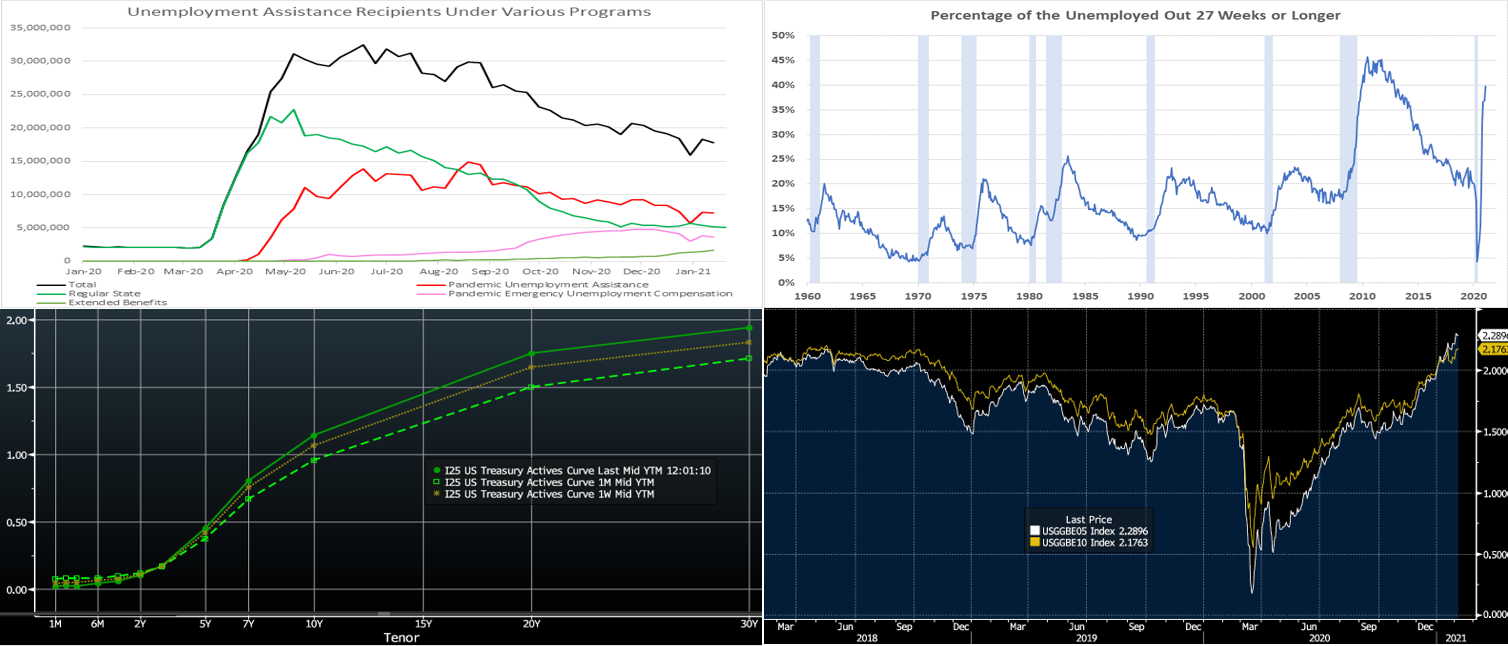

CHART 1 – UPPER LEFT

Source: Dept. of Labor; FHLBNY. While the number of persons receiving regular state unemployment insurance benefits has receded sharply since the shuttering of the economy last March, those receiving assistance under other pandemic-related programs remains elevated. As of the week ended January 16, a staggering 17.8mn Americans, or 11.1% of the civilian labor force, were receiving assistance under a variety of programs.

CHART 2 – UPPER RIGHT

Source: Dept. of Labor; FHLBNY. Remaining on the topic of employment and the data release this past Friday, an insightful barometer of job market health is the share of workers unemployed for longer durations. While this measure is below the extreme levels prevalent after the Great Recession, it is undeniably now at a historically high level. Fed Chairman Powell, in his press conferences, has repeatedly invoked this condition as a source of Fed concern/focus. Until this measure portrays a sustainable turnaround, the Fed will likely “stay the course” on rates and asset purchases.

CHART 3 – LOWER LEFT

Source: Bloomberg. The UST curve notably steepened on the week, with shorter maturities 1-2 bps lower but maturities 5-year and out higher in progressive fashion by 1 to 8 bps. Having last week briefly touched 1%, the 10-year UST closed this week ~1.15%. The 2-year/10-year slope is at its highest since April 2017. The Fed’s guidance and programs continue to pin shorter-end yields, but longer-maturity yields are moving on various dynamics. The distressing Covid-19 situation of the past few months appears to be moderating to some degree, and bolstered vaccination programs are underway. A further round of relief legislation gathered steam this week, and Friday’s lackluster-to-mixed jobs data may serve to push closer the timing and increase the size of an eventual package along with the attendant UST supply to finance it. These dynamics pushed stocks higher and helped to support the “reflation theme” in the markets, namely that conditions could be primed for major improvement later in the year and thereafter. Also adding to the steepening move was the Treasury’s announcement of a record auction of 3/10/30-year UST’s this coming week.

CHART 4 – LOWER RIGHT

Source: Bloomberg. Further on the “reflation theme” and curve steepening, depicted here are the 5 and 10-year “Breakeven Inflation Rates” (calculated as the difference between the yield of a nominal/regular UST and that of an inflation-protected TIPS security) which have surged further since last autumn. Essentially the market expects and has priced for higher inflation “down the line”. Indeed, the Fed’s current guidance and programs hope to achieve this outcome.

FHLBNY Advance Rates Observations

Front-End Rates

Short-end advance rates finished 3 bps lower week-over-week. T-bill issuance was its usual market feature, but net supply has slowed and thereby allowed for easier market absorption. Money market funds’ AUM decreased by ~$13.3bn this past week but failed to stem the decline in the short-end rates space. From a bigger-picture vantage point for 2021, an overall moderation in market supply of short paper, in tandem with high cash levels in the market, is expected to help keep short-end rates relatively steady and under downward pressure in the year’s first half.

Heavy T-Bill issuance will remain a theme; UST issuance overall is now net positive supply in that more is being issued than what the Fed is buying in its programs. However, with short UST rates at rock-bottom levels and the Fed on hold for a long period, rates are likely to persist in a near-term sideways to softer pattern. Importantly, weekly net T-bill issuance has been lower since last summer and even negative in recent months, and Treasury has announced plans to shift issuance out the curve. Even with a new relief package and related borrowing, these supply/demand and Treasury issuance dynamics should keep short rates in check on the upside.

Term Rates

On the week, medium and longer-term Advance rates were 1-2 bps lower 4-year and shorter but 1-8 bps higher in progressive fashion out the curve thereafter. Please refer to the previous section for further color on relevant market dynamics.

On the UST supply front, next week brings a record $126bn of 3/10/30-year UST auctions. Corporate issuance should accelerate further post its usual strong start-of-the-year pattern and earnings releases. Focus this week will revolve around Covid-19 and fiscal legislation developments.

New Product Alert: In order to satisfy member needs and provide greater product flexibility to match bond and derivative market conventions, FHLB-NY now offers SOFR-linked advances based on SOFR-index compounding. Note that this product is in addition to SOFR-linked advances based on SOFR-index averaging which have been offered since November 2018.

The Symmetrical Prepayment Advance Feature

With rates at or near multi-year lows, it is a compelling juncture to use the SPA feature on term advances. This feature allows member to capture, at prepayment, changes in the Fair Value of the advance which are favorable to the member. Contact us to discuss.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the

MSD Team.

Special Member Alert

The FHLBNY recently announced a newly expanded and flexible Disaster Relief Funding (DRF) advance program which offers discounted rate advances with maturities 1-mo and greater. Additionally, we have announced that PPP loans will be accepted as eligible collateral. Please contact us with any questions.