Member Services Desk

Weekly Market Update

This MSD Weekly Market Update reflects information for the week ending May 2, 2025.

Economist Views

Click to expand the below image.

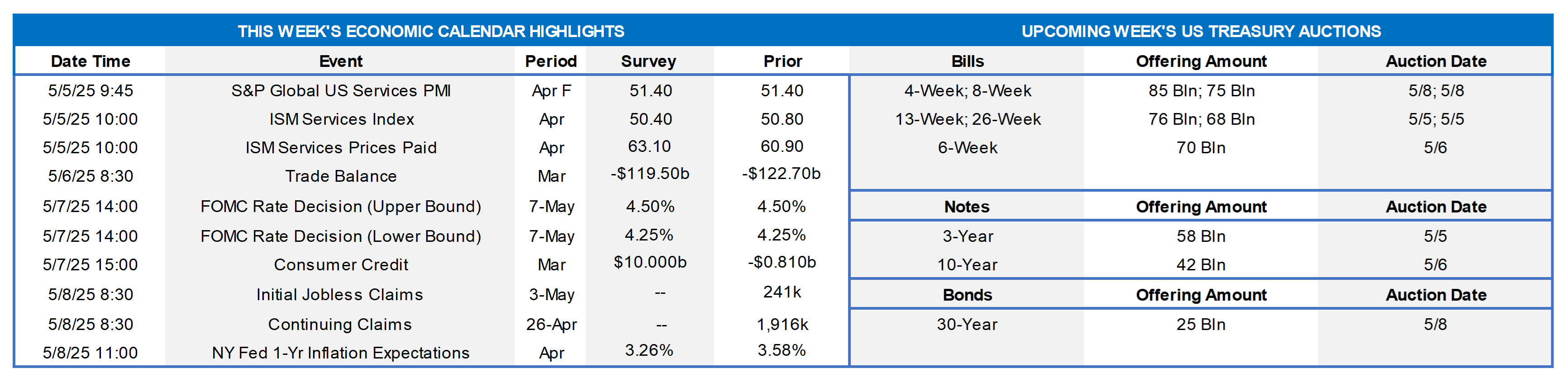

Market focus will clearly be on Wednesday’s FOMC meeting decision, communique, and press conference. Fed-prognosticators universally predict no action on rates, as Fed members and Chair Powell himself have indicated the desire for a further “wait and see” period, particularly with the past month’s tariff policy developments. Given the Fed’s dual mandate to promote maximum employment and maintain stable prices, the tariff policy presents a bit of a conundrum for the Fed in that it can spur inflationary pressures and impede economic growth. Indeed, while backward-looking “hard data” points have generally been non-worrisome, other real-time indicators, such as shipping volumes, have signaled warning signs of weaker activity. Moreover, economic opinion surveys and sentiment readings have been full-blown worrisome, with large declines in confidence and expectations but higher inflation expectations. With current dynamics in flux, the Fed is likely to aim to be sensible and wait for “things to play out” before taking any formal action.

S&P Global Services PMI: The reading this week is expected to be in line with last month’s reading of 51.4.

ISM Services Index: The index is expected to report a slightly lower reading compared to last month – 50.40 vs 50.80.

ISM Services Prices Paid: Expectations are for an increase to over 63, from last month’s 60.9.

Trade Balance: The Trade Balance figure is expected register at slightly under -$120B, a month-over-month increase from the -$122.7 from last month. Front-running activity of tariff impositions has contributed to wider trade deficit numbers in recent weeks.

FOMC Rate Decision: The FOMC decision at this week’s meeting is expected to keep administered rates unchanged in the 4.25%-4.50% range.

Consumer Credit: The US Consumer Credit balance is expected to show a large rebound after the unexpected fall in April.

Initial and Continuing Claims: Initial claims were higher last week and the 4-week moving average has risen to 226k. Continuing claims were also higher last week at 1,916k; they are expected to hover near the same zone and will be watched closely for clues to any concrete evidence of a deterioration in employment conditions.

NY Fed 1-Yr Inflation Expectations: Forecasters call for a slightly lower reading compared to last month — 3.26% vs. 3.58%.

**No Federal Reserve Appearances as the Committee is in blackout mode pending the Wednesday’s rate decision.**

CHART 1 UPPER LEFT and CHART 2 UPPER RIGHT

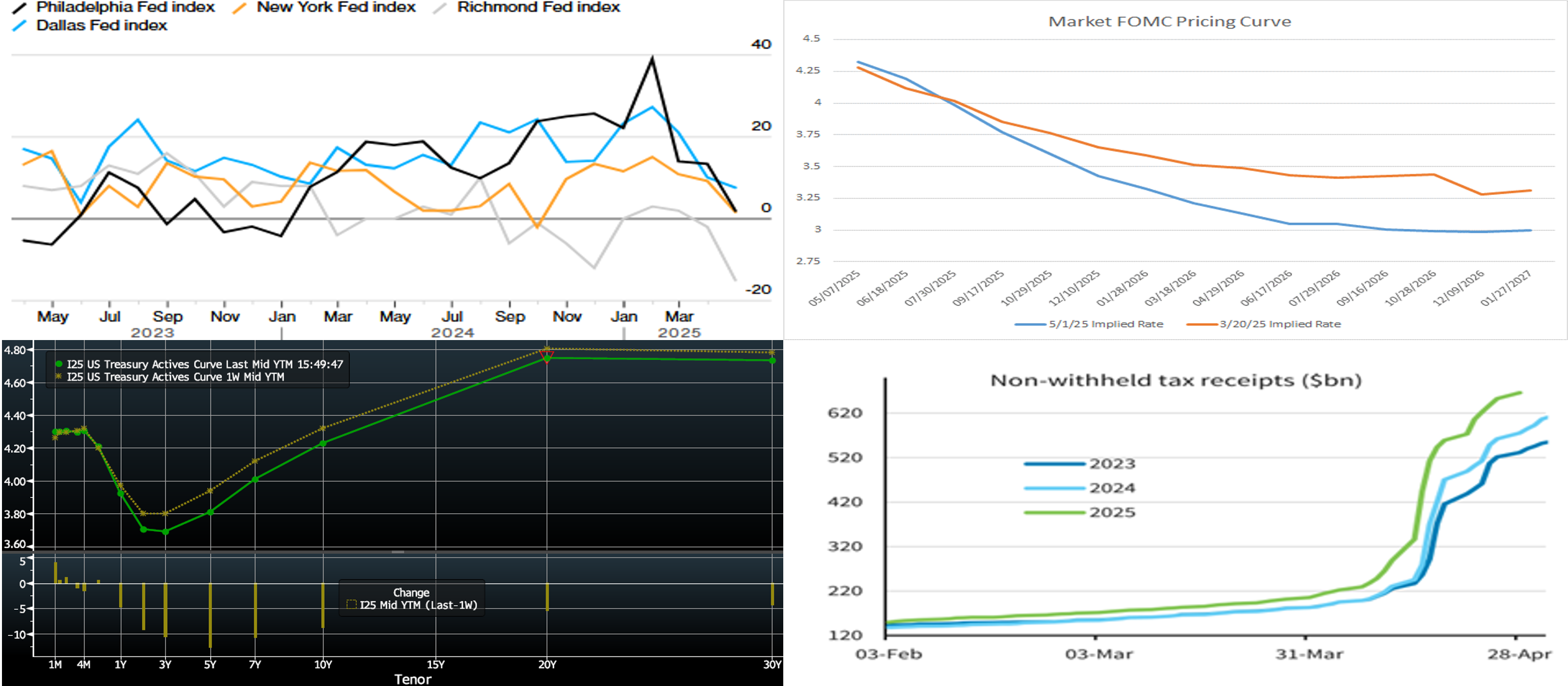

Source: Bloomberg; Federal Reserve Banks of Philadelphia, New York, Richmond, and Dallas. Notes: Diffusion indexes in which readings above zero indicate growth; data as of 4/29. The current economic backdrop is, in many ways, one in which much “lies in wait” for the impact of tariff policy. “Hard data,” or data based on actual results, has been generally decent but is also lagging so it essentially informs us that conditions were okay heading into the month of April. Meanwhile, “soft data,” or data based on sentiment and opinion surveys, can shed light on the future and has been decidedly poor this past month in both consumer and business sectors. Shown here (Left-side chart) are results of recent Fed-district reports on manufacturing business’ capital spending plans for “Capex spending expectations six months ahead.” Clearly, the trend has been down and sharply so in the past two months. While these reports may embody soft data, they importantly indicate a worrisome trend that may result in lower economic growth. Indeed, a Bloomberg survey of economists this past week reflected a median recession-risk probability in the next twelve months of 46%. Owing to this month’s altered and more uncertain economic landscape, markets since the last FOMC meeting have priced for more aggressive Fed rate cuts in the next year, per the Right-side chart of 1-month OIS forwards. Essentially, over the past month, the market has added roughly one 25-bps cut to 2025. For the upcoming week’s FOMC, however, the chance of a cut is virtually nil, as the Fed has indicated that it prefers to “wait and see” on the impacts of tariff policy.

CHART 3 LOWER LEFT

Source: Bloomberg. Top pane is yield (LHS, %); bottom pane is change (LHS, bps). At Thursday’s close, the UST term curve was lower from the week prior, with the 2, 5, and 10-year lower by 8, 13, and 9 bps, respectively. The early-April tariff-induced liquidation in stocks, bonds, and credit cooled further, although financial condition metrics remain a bit tighter than prior to the April 4th “tariff day.” Nonetheless, uncertainty looms, and markets remain on guard waiting for the looming FOMC meeting. As of late Thursday, the market prices end-2025 fed funds at 3.42%, or 5 bps lower than a week ago which equates to ~3.7 25-bps Fed cuts. The market’s end-2026 forward is ~2.99%, or 10 bps lower than a week ago.

CHART 4 LOWER RIGHT

Source: Barclays Research; US Treasury. April proved to be a notable month in both markets and our business, as members took advantage of opportunities in rate movements while also managing liquidity in the latter half of the “tax-date month.” As seen here, tax receipts at the US Treasury through April 28th trended above 2024 levels. At this juncture, most of the receipts are likely in hand, although perhaps the Treasury is still processing some mailed checks. Overall, receipts ran about 8% higher than in 2024. The tax payments spurred bank deposit and Money Market Fund withdrawals, thereby removing cash from the financial system and adding another element of upward pressure on very short-end financing rates (SOFR, for e.g.) at month-end. Advance balances, in turn, experienced an uptick in the past few weeks. The influx of tax receipts has increased the US Treasury’s cash balance from a low of around $280bn in late March to now ~$600bn. These funds will gradually work their way back out of the Treasury and into the financial system.

FHLBNY Advance Rates Observations

Front-End Rates

- As of Thursday afternoon, short-end rates were mixed vs. a week ago. The Overnight rose 7 bps, as the typical balance sheet and UST auction settlement dynamics pressured short-end money market rates and SOFR higher. This trend should fade next week if it follows the usual pattern. The 1- to 6-month sector was lower by 1 to 7 bps, in flattening fashion, owing to the market’s repricing lower of Fed rate cut expectations in 2025. Robust Money Market Fund AUM levels have helped underpin demand for short-end paper, and cash should gradually return to the sector post the usual April tax-date withdrawals. Also helpful is that net T-bill supply is expected to be modestly negative in the month ahead, owing to debt ceiling dynamics.

- The market will focus squarely on the FOMC meeting and any further trade policy news in the upcoming week.

Term Rates

- The longer-term curve, generally mirroring moves in USTs and swaps, was lower vs. the week prior, with the 2, 5, and 10-year lower by 7, 12, and 11 bps, respectively. Kindly refer to the previous section for color on market dynamics and changes. We encourage members to engage with the Member Services Desk for current rate levels and market color.

- On the UST term supply front, the upcoming week serves a hefty slate of 3/10/30-year auctions. Given the past month’s themes, the markets will monitor the auctions’ foreign participation levels. Note that UST auctions usually occur at 1pm and can occasionally spur volatility around that time. Please contact the Member Services Desk for further information on market dynamics, rate levels, or products.

Price Incentives for Advances Executed Before Noon: In effect as of Tuesday, September 5, 2023, the FHLBNY is pleased to now offer price incentives for advances executed before Noon each business day. These pricing incentives offer an opportunity to provide economic value to our members, while improving cash and liquidity management for the FHLBNY. For further details, kindly refer to the Bulletin.

Looking for more information on the above topics? We’d love to speak with you!

Archives

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the MSD Team.