Member Services Desk

Weekly Market Update

This MSD Weekly Market Update reflects information for the week ending July 21, 2023.

Economist Views

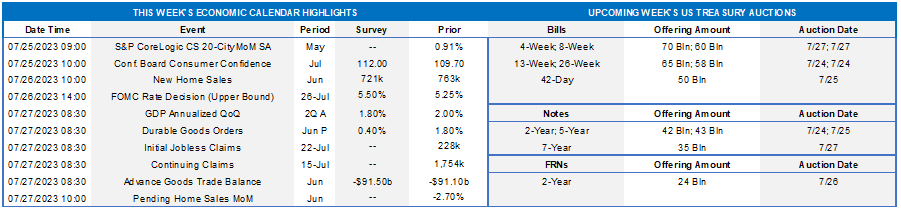

Click to expand the below image.

The Federal Open Market Committee (FOMC) meeting will be the marquee event of the week. Policymakers are almost universally expected to raise the target range for the federal funds rate to 5¼% to 5½%. The post-meeting communiqué likely will reiterate that economic activity continues to expand at a modest pace and repeat that job gains have been robust, and the unemployment rate has remained low. Echoing the statement issued after the June gathering, the FOMC probably will highlight that the banking system is sound and resilient, though tighter credit conditions for households and businesses likely will weigh on economic activity, hiring, and inflation. Despite the potential resumption of rate hikes, the communiqué probably will omit any forward guidance indicating that the policymakers anticipate that some additional policy firming may be necessary to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2% over time.

The statement is expected to repeat that in determining the extent of future increases in the federal funds rate target range policymakers will consider the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments. A wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments will continue to be monitored in assessing the appropriate stance of monetary policy. The FOMC will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities. To date, runoffs of maturing securities have pared the System Open Market Account, or SOMA, by $850 million to $7.645 trillion from July 2022 peak.

Durable Goods Orders:

Durable goods bookings are expected to have edged 0.4% higher in June after the surprising 1.7% jump recorded in May. Pay particular attention to core nondefense capital goods shipments, excluding jetliner deliveries for clues to the strength of business equipment spending at the end of the spring quarter.

Real GDP Growth:

With economic reports exceeding market expectations in recent weeks, projections for the Bureau of Economic Analysis’ first pass at spring-quarter real GDP growth have been climbing higher. The median Street forecast calls for a 1.8% annualized advance in Q2, almost matching the fall quarter’s 2% clip. As is often the case with the advance report, the range of estimates is quite wide, extending from a 0.7% contraction to a 2.8% gain.

Pending Home Sales:

Capped by the limited number of dwellings on the market, contracts to purchase a home probably moved lower once again in June, adding to the 8.1% decline witnessed over the March-May span.

Federal Reserve Appearances:

- July 26 Federal Open Market Committee policy decision.

- July 26 Federal Reserve Chair Jerome Powell to hold press conference following FOMC meeting.

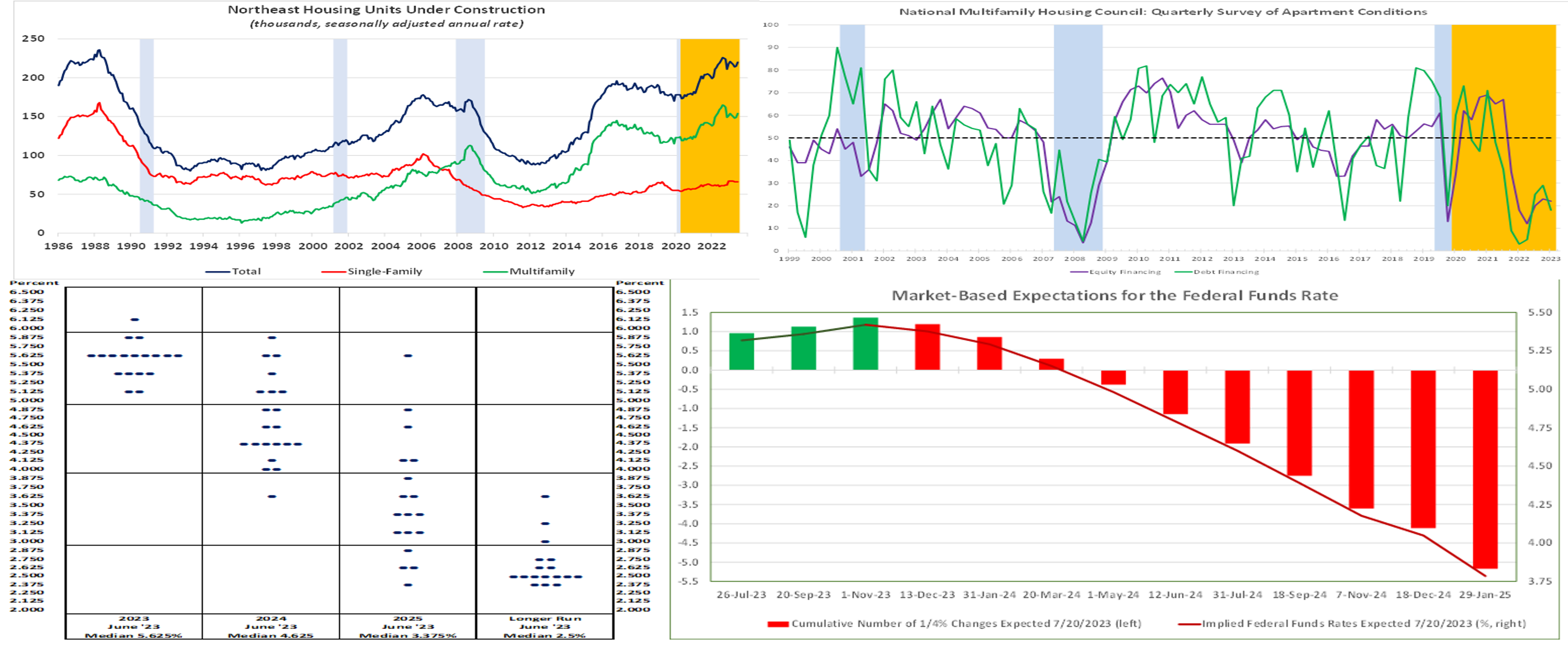

Notes: Blue shaded areas denote recession. Orange shaded area highlight current economic expansion.

Sources: Census Bureau, National Bureau of Economic Research and FHLB-NY

Builders have been responding to the nationwide dearth of housing units available, but shortages of labor, materials and appliances have lengthened completion times. The number of housing units under construction in the Northeast climbed by 2.3% to a five-month high seasonally adjusted annual rate of 220,000 in June, just shy of the current expansion’s peak of 226,000 recorded last August. In contrast to other areas of the country, where the split between single-family and multifamily units under construction is 44% to 56%, activity in our region is heaving skewed towards the latter category. Indeed, over the first half of this year, multifamily structures have accounted for almost 70% of the total housing units awaiting completion.

CHART 2 UPPER RIGHT

Notes: The diffusion indexes below are calculated by taking one-half the difference between positive and negative responses and adding 50. Blue shaded areas denote recessions. Orange shaded area highlights current expansion.

Sources: National Multifamily Housing Council, National Bureau of Economic Research and FHLB-NY

Apartment market conditions continued to weaken in the National Multifamily Housing Council’s (NMHC’s) Quarterly Survey of Apartment Market Conditions for July 2023, with the Market Tightness, Sales Volume, Equity Financing and Debt Financing indexes all clocking in well below the 50-point breakeven mark. According to the NMHC, both debt and equity capital continue to pull back from the apartment market amid rising interest rates and slowing rent growth. As a result, transaction volume fell for the fifth straight quarter, with current apartment owners unwilling to offer the lower prices buyers deem necessary to compensate for an uncertain economic outlook. Of note, a small but growing share of respondents are finally starting to report a pickup in apartment deal flow as the Federal Reserve nears the end of its tightening cycle.

CHART 3 LOWER LEFT & CHART 4 LOWER RIGHT

Source: Bloomberg, Federal Reserve and FHLB-NY

Market participants and policymakers have different views on the prospective federal funds rate path beyond this week’s FOMC meeting. While the median Federal Reserve official’s forecast calls for one more 25-bps hike in the target range to 5½% to 5¾% before yearend, traders and investors are far less certain. Moreover, likely reflecting skepticism that the FOMC will be successful in engineering an ever-elusive soft landing, market participants currently expect policymakers to be far more aggressive in cutting rates in 2024 than the latest “dot plot” envisioned. Indeed, traders and investors expect the federal funds rate to end next year at roughly 4%, well below the 4.625% envisioned by attendees at the June FOMC meeting.

FHLBNY Advance Rates Observations

Front-End Rates

- Short-end rates were relatively flat week overr week, higher from a week ago, with the 2-week to 2-month tenors up 3 to 6 bps. Net T-bill supply remains robust, as Treasury rebuilds its account post-debt ceiling agreement; however, it has been absorbed well thus far, as Money Market Funds (MMFs) switch from the Fed’s RRP to T-bills with competitive yields. Moreover, FHLB supply continues to subside from peak levels of spring, further assisting T-bill interest from investors. These dynamics are conspiring to limit upward pressure on rates from the T-bill supply resurgence.

- With the Fed in blackout mode and no speakers except for Chairman Powell following this week’s FOMC, the market will be tuning in for the committee statement and his comments during the subsequent press conference for hints of future FOMC decisions.

Term Rates

- The longer-term curve was higher from last week, the largest moves up were seen in the 2-3 year part of the curve – +24 and +23 bps respectively. Kindly refer to the previous section for relevant market color. The advance curve remains inverted out to 5-year, thereby offering opportunities to extend in advance duration at lower coupon cost.

- On the UST term supply front, the upcoming week serves an auction for 2/5/7-year notes as well as a 2-year FRN. Please contact the Member Services Desk for further information on market dynamics, rate levels, or products.

ZDA reminder: FHLB-NY recently launched the new 0% Development Advance (ZDA) Program providing members with subsidized funding in the form of interest rate credits to assist in originating loans or purchasing loans/investments that meet one of the eligibility criteria under the Business Development Advance, Climate Development Advance, Infrastructure Development Advance, or Tribal Development Advance. This program is intended to support economic development by incentivizing members to provide below-market-rate loans or invest in qualified initiatives. Reservation requests for the program have exceeded the currently available program amount; new requests will be added to the waitlist and filled if previously reserved funds become available. Please contact the Member Services Desk to learn more and/or visit ZDA Overview page.

Forward Start Advance (FSA): For members with upcoming borrowing or refunding plans, consider the FSA as a method to opportunistically “lock in” rates before advance settlement date. Please contact the Member Services Desk at (212) 441-6600 for more information.

The Symmetrical Prepayment Advance Feature

For those anticipating term funding needs, and with rates on an uptrend, it can be an appropriate juncture to consider our SPA feature. This feature allows the member to capture, at prepayment, changes in the fair value of the advance which are favorable to the member. Contact Member Services Desk to discuss.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the MSD Team.