Member Services Desk

Weekly Market Update

This MSD Weekly Market Update reflects information for the week ending June 7, 2024.

Economist Views

Click to expand the below image.

The Fed will likely continue to reduce its holdings of UST and Agency debt and Agency MBS at the pace disclosed at the April meeting. The monthly redemption cap on USTs likely will remain at $25bn, while the monthly redemption cap on Agency debt and Agency MBS continues at $35bn with any amount above that reinvested in USTs. To date, runoffs of maturing securities have pared the System Open Market Account, or SOMA, to $6.846trn from the $8.505trn peak reached in April 2022.

As per convention, the Federal Reserve Board will release an updated Summary of Economic Projections, or SEP. The so-called “dot plot” of policymakers’ expectations for the federal funds rate target through 2026 and over the longer run will receive considerable attention from traders and investors.

NFIB Small Business Optimism Index: The National Federal of Independent Business’ sentiment gauge likely edged higher to a five-month high of 90 in May from 89.7 in the preceding month.

Consumer Prices: The Bureau of Labor Statistics’ report probably will reveal that inflation ebbed further in May. Capped by lower retail energy costs, the Consumer Price Index (CPI) likely edged .1% higher last month – the smallest increase since last October. Core inflation excluding volatile food and energy prices probably also slowed. Lower prices for air travel, apparel, and motor vehicles likely limited the rise in the core CPI to just .2%, also the best performance in seven months. The projections, if realized, would leave the overall and core CPIs 3.3% and 3.4% above their respective year-ago levels, both still well above the Federal Reserve’s 2% target.

Jobless Claims: Initial claims for unemployment insurance benefits likely remained in a range of 215-230K during the filing period ended June 7. Continuing claims – the total number of persons collecting benefits – probably registered below the 1.8mn mark for a ninth straight week during the span ended May 31 – a sign that the newly unemployed are having little trouble finding work.

Producer Prices: Inflation at the wholesale level is expected to also have ebbed in May, with headline and core PPIs rising by .1% and .3%, respectively, following identical .5% gains in April.

Michigan Sentiment Index: Building on the improvement witnessed in the latter half of May, the University of Michigan’s gauge probably climbed to 74.5 in early June, reversing two-thirds of the inflation-induced deterioration posted in the prior month.

Federal Reserve Appearances:

- June 12 Federal Open Market Committee monetary policy statement; Federal Reserve Chair Jerome Powell to hold post-FOMC-meeting press conference.

- June 13 NY Fed President Williams will moderate a discussion with Treasury Secretary Yellen, hosted by the Economic Club of NY.

- June 14 Chicago Fed President Goolsbee to speak at a fireside chat at the Iowa Farm Bureau Economic Summit.

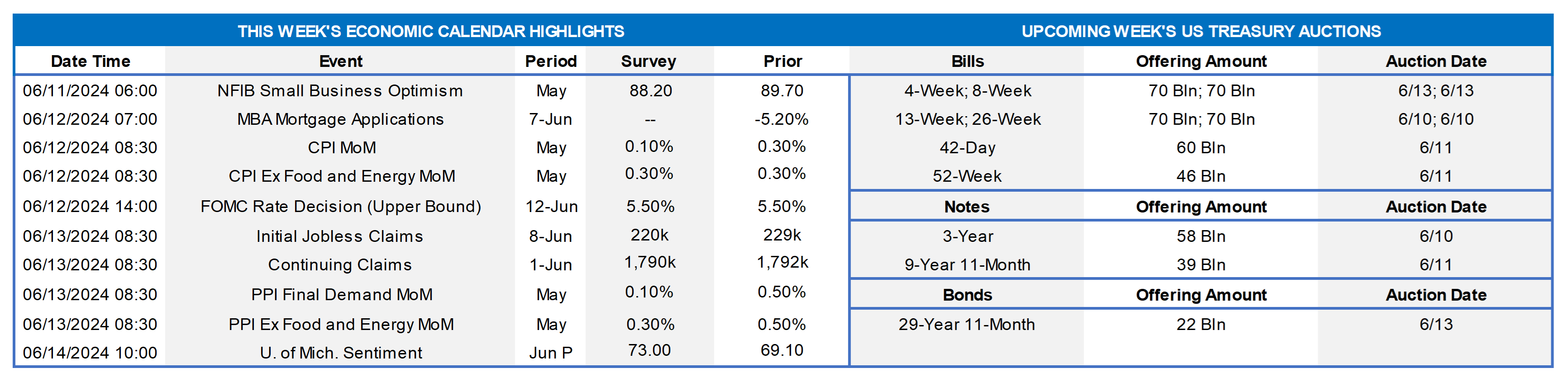

CHART 1 UPPER LEFT and CHART 2 UPPER RIGHT

Source: Bloomberg; Board of Governors Federal Reserve; FHLB-NY. Following the upcoming FOMC meeting, the Federal Reserve Board will release an updated Summary of Economic Projections, or SEP. The so-called “dot plot” of policymakers’ expectations for the federal funds rate target through 2026 will receive considerable attention from market participants. At the time of the March 20th meeting, policymakers thought that the equivalent of three 25 bps cuts in administered rates might be appropriate over the course of 2024, thereby leaving the target range at 4½% to 4¾% by year-end (see left-side chart). The median call for end-2025 at that time entertained the possibility of a further 75 bps of rate cuts to 3¾% to 4%, with an equivalent reduction to 3% to 3¼% by the end of 2026. However, market participants’ rate-cut expectations for this year have changed dramatically in response to economic soundings since the March FOMC meeting and are now far less aggressive than those expressed in the SEP issued at that time, as can clearly be seen in the right-side chart. Fed policymakers’ recent statements that rates likely will remain higher for longer, moreover, imply that the forecast dots will be moved higher in the upcoming SEP.

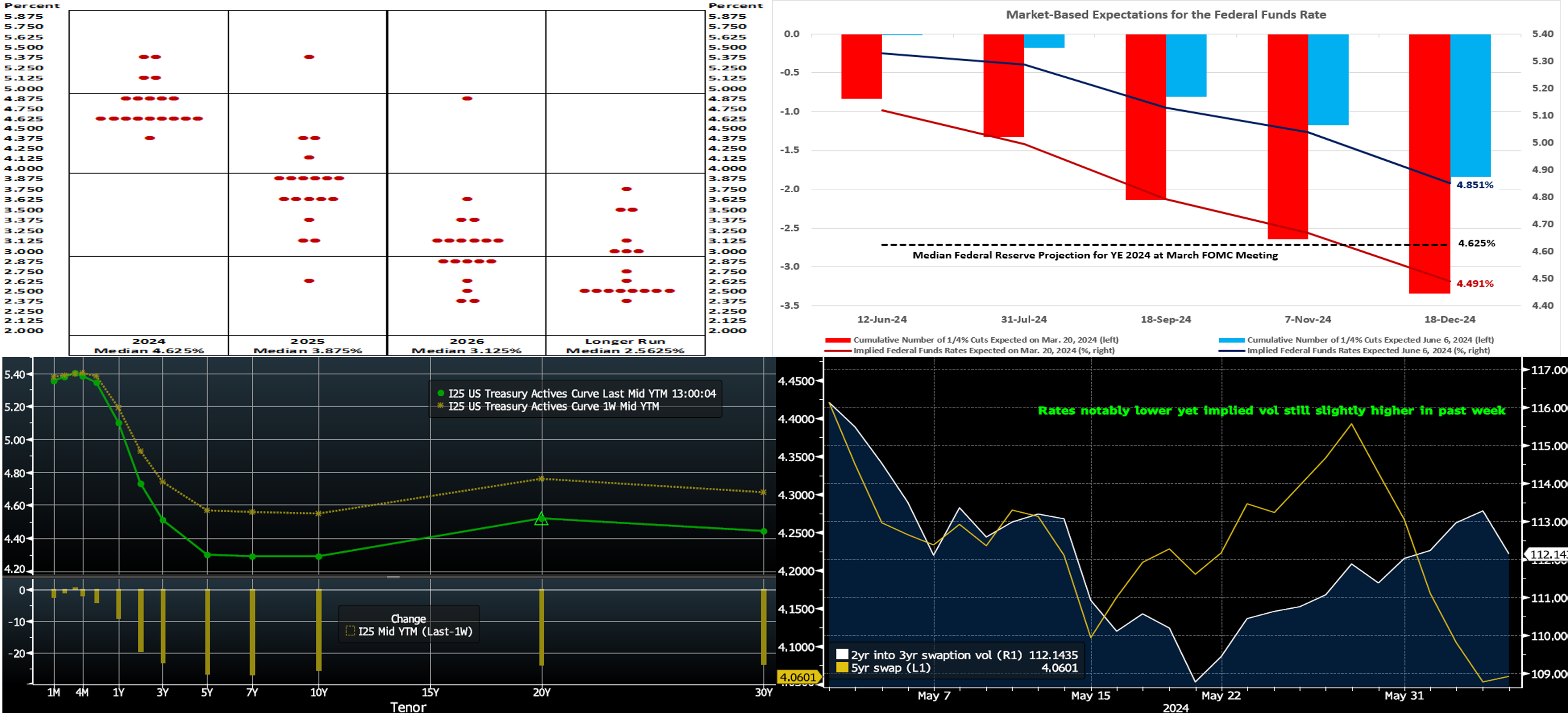

CHART 3 LOWER LEFT

Source: Bloomberg. Top pane is yield (LHS, %), bottom pane is change (LHS, bps). As of midday Thursday, the UST curve notably declined week-on-week, led by the 5- to 10-year zone. While the 2-year fell by ~20 bps, the 5-year declined by ~26 bps. Some slightly softer-than-expected economic data, along with initial rate cuts by the Bank of Canada and European Central Bank, helped drive the move. Job market-related data reflected a potential tempering, but the first-tier employment situation report to be released tomorrow morning will shed better light. In terms of market-implied pricing of the Fed, there is now ~75% chance of a 25 bps rate cut priced for the September 19th FOMC. The year-end 2024 forward is 4.86%, or ~13 bps lower than a week ago, implying a cumulative total of 46.5 bps of cuts by the end of this year. The FOMC meeting will surely be the highlight of the upcoming week.

CHART 4 LOWER RIGHT

Source: Bloomberg. Note: Pricing and commentary as of midday Thursday. The post-Memorial Day period has thus far produced a notable decline in yields, as shown here in the 5-year swap (LHS, %, Gold) which has fallen ~34 bps to 4.06%. For those deliberating on the potential need for fixed-rate term funding, this move may present an opportunity. Meanwhile, option implied volatility has slightly increased over this period, as can be seen here in 2-year-into-3-year swaption implied volatility, or “vol” (RHS, annual bps, White). It remains to be seen how long this dynamic will last, as rates and vol have typically held a same-direction relationship over the past year. For those considering putable advances, this past week’s trend is optimal; the decline in rates is clearly welcome, and the higher vol increases the value of the option sold within a putable, thereby lowering the advance coupon. Kindly call the Member Services Desk to discuss market dynamics and advance pricing.

FHLBNY Advance Rates Observations

Front-End Rates

- Short-end rates, relative to a week ago, were little changed. The 5 and 6-month tenors were each lower by two bps, as the market priced in a bit more rate cut potential into the latter part of this year. Money Market Fund AUM has rebounded from its mid-April tax date-related dip, while net T-bill issuance has tapered off in the past six weeks, and so the supply/demand dynamic in the short-end remains solid and FHLB paper continues to trade tight to T-bills. Looking ahead, short-end markets will be influenced by the looming FOMC outcome.

- The market’s focus will clearly steer towards the looming FOMC meeting.

Term Rates

- The longer-term curve, generally mirroring moves in USTs and swaps, declined markedly from a week ago. While the 2-year moved ~21 bps lower, the 5-year was ~27 bps lower. Please refer to the previous section for color on the changes.

- On the UST term supply front, the upcoming week serves 3/10/30-year auctions sandwiched around Wednesday’s FOMC announcement. Note that UST auctions usually occur at 1pm and can occasionally spur volatility around that time. Please contact the Member Services Desk for further information on market dynamics, rate levels, or products.

The FHLBNY is pleased to announce the 2024 0% Development Advance (ZDA) Program, now available with a new streamlined submission process. This program provides members with subsidized funding in the form of interest rate credits to assist in originating loans or purchasing loans/investments that meet the eligibility criteria under the Business Development Advance (BDA), Climate Development Advance (CDA), Infrastructure Development Advance (IDA), or Tribal Development Advance (TDA). Please contact the Member Service Desk for information and/or visit our ZDA information page.

Price Incentives for Advances Executed Before Noon: In effect as of Tuesday, September 5, 2023, the FHLBNY is pleased to now offer price incentives for advances executed before Noon each business day. These pricing incentives offer an opportunity to provide economic value to our members, while improving cash and liquidity management for the FHLBNY. For further details, kindly refer to the Bulletin.

The Symmetrical Prepayment Advance Feature

For those anticipating term funding needs, and with rates on an uptrend, it can be an appropriate juncture to consider our SPA feature. This feature allows the member to capture, at prepayment, changes in the fair value of the advance which are favorable to the member. Contact Member Services Desk to discuss.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the MSD Team.