Member Services Desk

Weekly Market Update

Economist Views

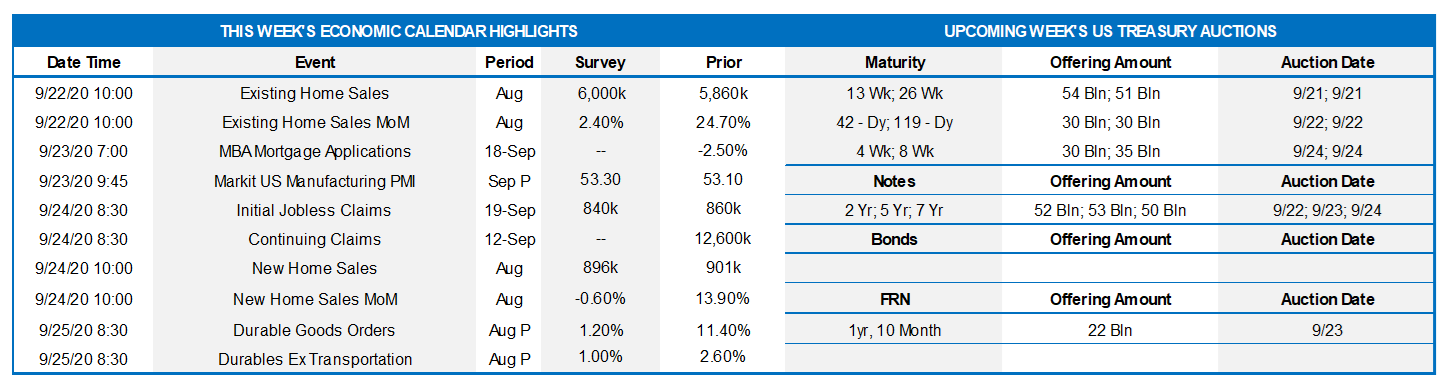

Click to expand the below image.

Federal Reserve officials will make over a dozen public appearances this week. A pair of testimonies by Fed Chair Powell with Secretary Mnuchin before the House Finance and Senate Banking Committees likely will receive the most attention from market participants and the press. Moreover, a series of discussions by district bank presidents on the economic outlook and monetary policy may shed additional light on the recent changes to the FOMC’s Statement on Longer-Run Goals and Monetary Policy Strategy. On the data front, both existing and new home sales probably posted solid increases in August. Initial claims for jobless benefits are expected to rise in the latest reporting period. Durable goods orders likely rose but at a significantly slower pace than in July.

Existing Home Sales: The surge in purchase-contract signings over the June-July span suggests that existing home sales jumped by 10.9% to a 6.5mn SAAR in August – the highest number of closings since May 2006. With the number of dwellings on the market expected to contract by 4.7% to a seven-month low of 1.43mn, the stock of available homes probably fell to a record low 2.6 months’ supply.

Weekly Jobless Claims: An increase in online requests for information on filing for jobless benefits suggest that initial claims moved back above the 900K mark last week.

New Home Sales: Reported pickups in single-family building permits and housing starts suggest that new home purchases climbed to a SAAR of 950K in August – the strongest contract signings since December 2006.

Durable Goods Orders: Durable goods bookings are expected to have edged 1.3% higher in August, boosting the cumulative rise since April to roughly 40%. Pay heed to non-defense capital goods shipments excluding jetliner deliveries for clues to the pace of business equipment spending during the summer quarter.

Federal Reserve Appearances:

Sept. 21: Fed Board to hold open meeting on Community Reinvestment Act.

Sept. 22: Chicago Fed President Evans to discuss the economy and monetary policy.

Sept. 22: Fed’s Powell and Treasury’s Mnuchin to testify before House committee.

Sept. 23: Cleveland Fed President Mester to discuss payments and the pandemic.

Sept. 23: Fed’s Powell to appear before House panel on COVID-19.

Sept. 23: Chicago Fed President Evans to discuss the economy and monetary policy.

Sept. 23: Boston Fed President Rosengren to discuss the U.S. economy.

Sept. 23: Fed Governor Quarles to give speech on the economic outlook.

Sept. 23: San Fran Fed President Daly to discuss labor force implications of COVID.

Sept. 24: Fed’s Powell and Treasury’s Mnuchin to testify before Senate committee.

Sept. 24: St. Louis Fed President Bullard to discuss economy and monetary policy.

Sept. 24: Chicago Fed President Evans to discuss economy and monetary policy.

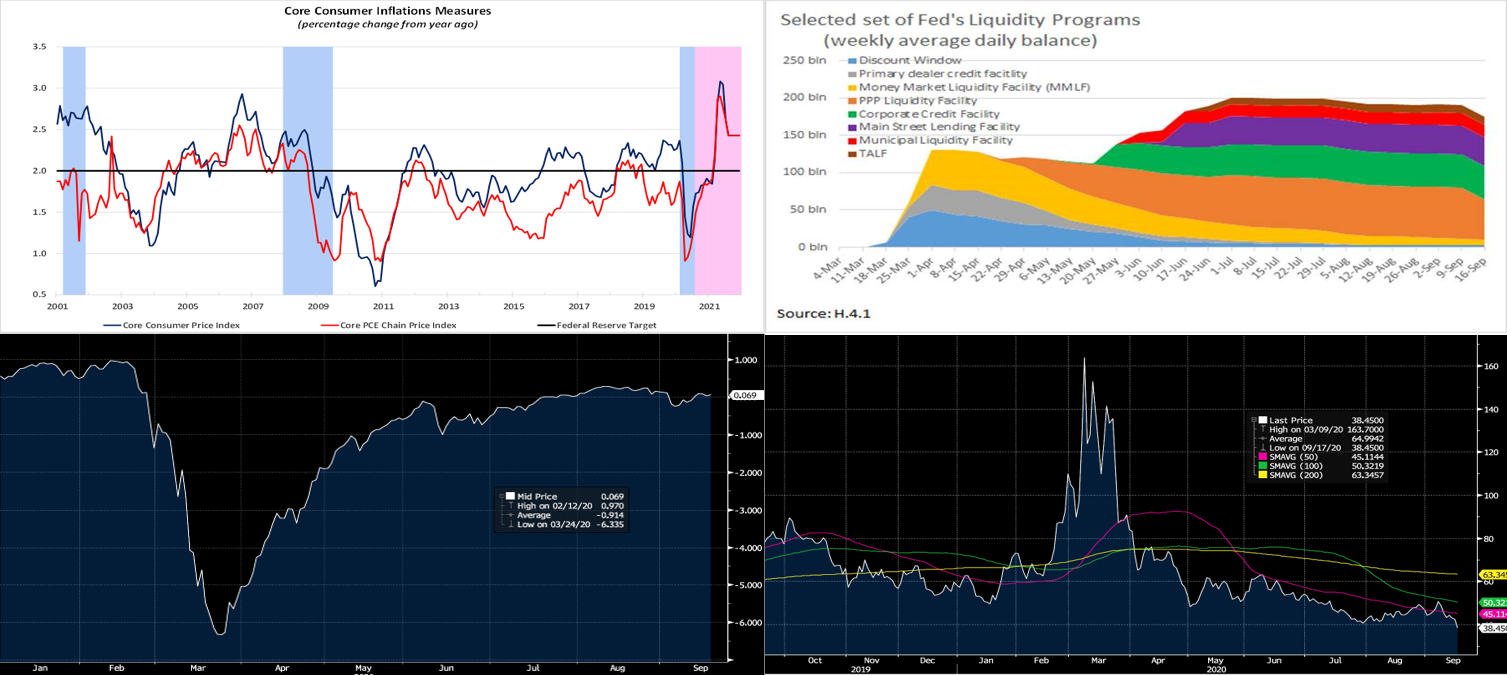

Click to expand the below images.

CHART 1 – UPPER LEFT

Source: BLS; FHLBNY. While core inflation rates likely will move back above 2% at the end of next winter, the Fed’s updated Statement on Longer-Run Goals and Monetary Policy Strategy implies that the current accommodative policy stance will remain in place for an extended period of time. Specifically, the past week’s FOMC meeting noted that maximum employment is a broad-based and inclusive goal that should be assessed via shortfalls rather than deviations from that level and that, in the future, it will seek to achieve inflation that averages 2% over time. When inflation runs persistently below the 2% target for a period of time, moderate overshoots above that level will subsequently be tolerated for “some time”. Furthermore, the updated “dot plot” from the meeting envisioned no change in the Federal Funds rate target range through 2023.

CHART 2 – UPPER RIGHT

Source: Federal Reserve Bank; FHLBNY. Portrayed here is a select set of the Fed’s arsenal of programs deployed to combat the pandemic crisis and associated liquidity constraints. The growth in these programs has moderated and even down-ticked in recent weeks. The reliance on facilities to improve funding conditions for key market intermediaries has diminished significantly since the spring.

CHART 3 – LOWER LEFT

Source: Bloomberg. The Bloomberg Financial Conditions Index recovered from its depths of early spring and has since hovered near slightly positive territory. This index tracks the overall level of financial stress in the U.S. money, bond, and equity markets to help assess the availability and cost of credit. A positive value indicates accommodative financial conditions, while a negative value indicates tighter financial conditions relative to pre-crisis (late 2000’s financial crisis) norms. The Fed’s massive asset purchase and liquidity/funding programs clearly propelled and have maintained these conditions. In many ways, the Fed has done all it can do at this stage which helps explain its advocacy for further fiscal relief via federal legislation.

CHART 4 – LOWER RIGHT

Source: Bloomberg. The Fed’s programs and rates guidance have served to quell market moves and volatility. Depicted here is the ICE BofA MOVE index, a yield curve weighted index of the normalized implied volatility on 1-month Treasury options, which currently sits at an all-time record low. It should be noted, however, that the implied volatility on 3-month expiry options currently trades at much higher levels than 1-month, owing to the upcoming election and perceived potential for greater risk and/or market movements in that timeframe.

FHLBNY Advance Rates Observations

Front-End Rates

Short-end advance rates finished 1 to 3bps lower week-over-week. Heavy T-bill issuance was a feature, as usual, but net supply has been slowing and thereby allowing for easier market absorption. Government-only (G.O.) funds experienced ~$43bn and Prime funds ~$7bn of outflows on the week, but overall supply of short Treasury and Agency paper has moderated, thereby blunting the impact of these outflows.

Heavy T-Bill issuance will remain a theme; UST issuance overall is now net positive supply in that more is being issued than what the Fed is buying in its programs, and so this scenario could prove a small challenge. However, with short UST rates at rock-bottom levels, and the Fed likely on hold for a long period, rates may trade in a sideways pattern. Net T-bill issuance has been lower since mid-summer, and Treasury has announced plans to shift issuance out the curve, but a new fiscal relief package may complicate/alter this forecast.

Term Rates

Medium and longer-term Advance rates were essentially unchanged on the week, in concert with low volatility and the color on the previous section.

Next week features UST 2/5/7-year auctions. Given the current market climate and Fed guidance, these should be absorbed without any impact. Corporate issuance should add to its record pace and typical strong September pattern. Attention will remain on the prospects of further relief legislation and certainly also on COVID-19 and the question of whether or not it is being managed effectively enough to avoid any pauses in reopening.

The Symmetrical Prepayment Advance Feature

With rates at or near multi-year lows, it is a compelling juncture to use the SPA feature on term advances. This feature allows member to capture, at prepayment, changes in the Fair Value of the advance which are favorable to the member. Contact us to discuss.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the

MSD Team.

Special Member Alert

The FHLBNY recently announced a newly expanded and flexible Disaster Relief Funding (DRF) advance program which offers discounted rate advances with maturities 1-mo and greater. Additionally, we have announced that PPP loans will be accepted as eligible collateral. Please contact us with any questions.