Member Services Desk

Weekly Market Update

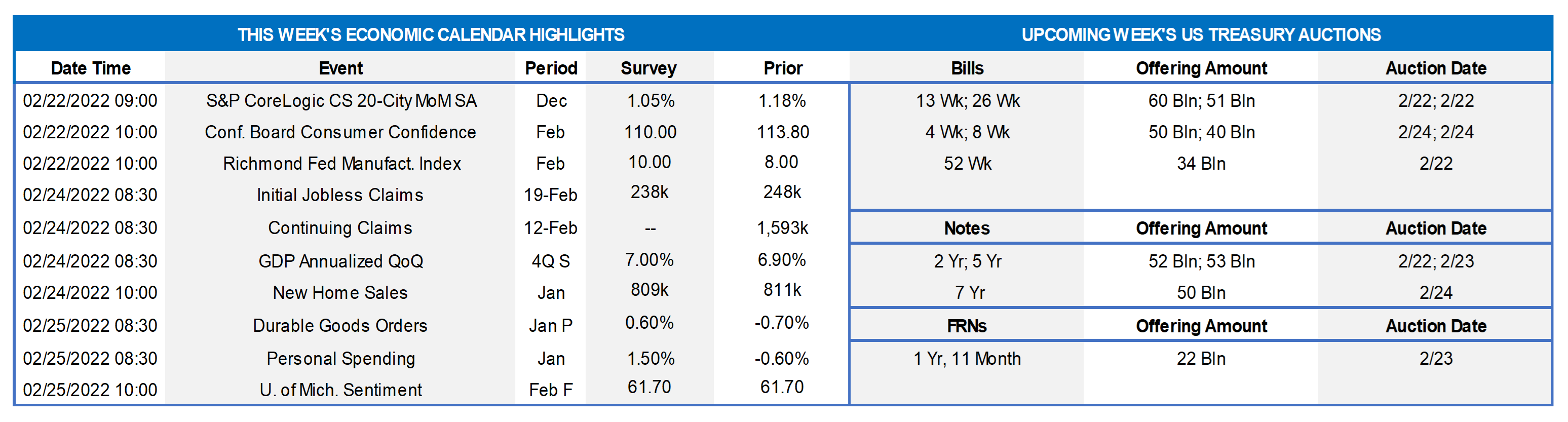

This MSD Weekly Market Update reflects information for the week of February 21, 2022.

Economist Views

Click to expand the below image.

The focus of market participants likely will remain on developments in Ukraine this holiday-shortened week. Russian Foreign Minister Sergei Lavrov agreed to meet with Secretary of State Anthony Blinken in Europe to avert a potential military conflict. Except for an anticipated erosion in consumer confidence this month, the coming slate of economic reports is expected to be positive. A quartet of Federal Reserve officials are scheduled to make public appearances after Presidents’ Day. Traders and investors will pay close attention to policymakers’ comments and views on removing monetary accommodation.

S&P CoreLogic Case-Shiller (SPCLCS) 20-City Home Price Index: Home prices probably continued to climb across the twenty major metropolitan areas canvassed by SPCLCS in December. Indeed, the 1.1% increase anticipated by the Street, after a 1.2% jump in November, would place home selling prices 17.7% above those posted at the end of 2020.

Conference Board Consumer Confidence: Available sentiment soundings suggest that the Conference Board’s consumer confidence gauge likely tumbled to a 12-month low of 107.0 in February from 113.8 in the previous month. Pay particular attention to the so-called labor differential – the percentage of survey respondents feeling that jobs are plentiful less than those believing they are hard to get – for clues to the likely change in the civilian jobless rate this month.

Jobless Claims: Initial and continuing state unemployment insurance claims probably moved lower in their respective reporting periods, as the impact of the Omicron variant gradually wanes.

Real GDP Growth: Data released since the Bureau of Economic Analysis’ advance report suggest that the pace of activity during the fall quarter will be boosted modestly from the previously estimated 6.9% annualized pace.

New Home Sales: A reported jump in single-family building permits suggests that contracts to buy a newly constructed dwelling climbed by 3.6% to a ten-month high seasonally adjusted annual rate of 840K in January.

Durable Goods Orders: Durable goods bookings are expected to have risen by 1% in January, erasing December’s .7% dip. Excluding an anticipated pickup in transportation requisitions, “hard goods” bookings likely edged .3% higher, after a .6% prior-month gain. December’s nondefense capital goods shipments excluding commercial jetliner deliveries will be watched closely to gauge the momentum of business equipment spending at the beginning of the New Year.

Personal Income and Spending: Personal income probably dipped by .3% last month, erasing December’s .3% increase. Buoyed by already reported surges in goods purchases during the reference period, consumer spending likely jumped by 1.4%, erasing a .6% prior-month decline.

Federal Reserve Appearances:

- Feb. 22 Atlanta Fed President Bostic to take part in a moderated discussion on the Fed’s role in the community.

- Feb. 24 Richmond Fed President Barkin to discuss the economy with the Maryland Chamber of Commerce.

- Feb. 24 Atlanta Fed President Bostic to participate in a moderated virtual discussion of banking in a digital era.

- Feb. 24 Cleveland Fed President Mester to give virtual speech on the economic and monetary policy outlook.

- Feb. 24 Fed Governor Waller to discuss the economic outlook at an event hosted by the University of CA, Santa Barbara.

Click to expand the below image.

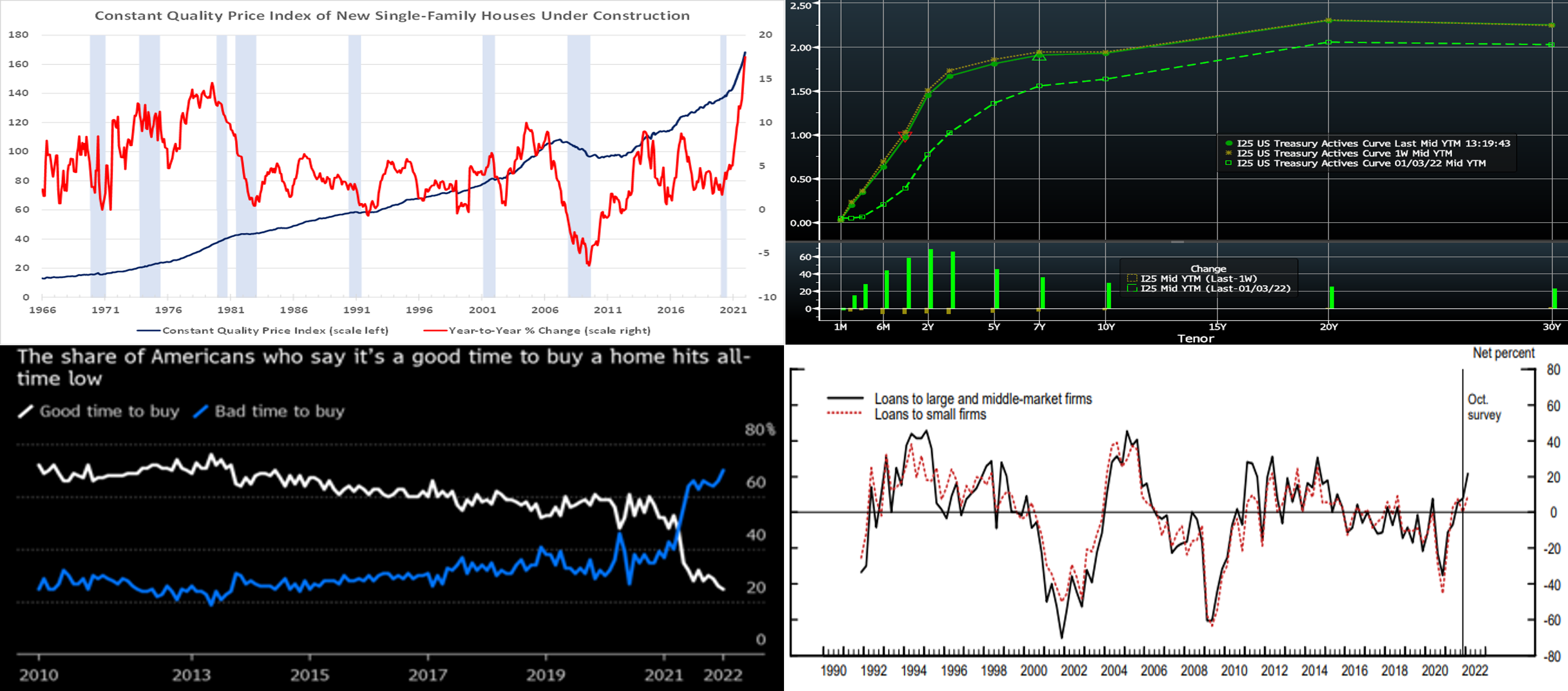

CHART 1 UPPER LEFT

Source: Census Bureau; National Bureau of Economic Research; FHLBNY. Note: Shaded areas denote recessions. Supply and labor shortages propelled home construction costs sharply higher last year. Indeed, the cost to build a new single-family dwelling nationwide soared by a record 17.5% over the course of calendar 2021, following a comparatively modest 5.1% increase in 2020. It took 6.8 months to build a single-family home in 2020. With the number of one-family homes currently under construction at the highest level since December 2006, it is probable that the time from start to completion lengthened considerably last year. That estimate will be released by the Census Bureau on March 17.

CHART 2 UPPER RIGHT

Source: Bloomberg. Note: Top pane is yield (%), bottom pane is change (bps). As of midday Friday, the UST yield curve finished modestly lower and steeper from the week prior. Yields were ~5 to 6 bps lower in the 2 and 3-year and then a few bps lower thereafter. The Ukraine crisis has spurred a moderate flight-to-quality dynamic in the past week, especially given the looming long weekend, as stocks wobbled ~2% lower (S&P 500) and credit markets experienced spread widening. Fed-speak was mixed, still on the hawkish side yet a few members also downplayed the chances of a near-term 50 bp hike. The market now prices under a 25% chance of a 50 bp hike in March, compared to last week’s pricing of over 90%. And, while last week the market priced for a cumulative 6.6 hikes of 25bps in 2022, now the curve is priced for only ~5.9. Yields remain notably higher than the start of the year. Market volatility, both day-to-day and intraday, remains high. Members should monitor conditions for potentially more optimal transaction timing. Market focus this upcoming week will be on Ukraine developments and Fed-speak.

CHART 3 LOWER LEFT

Source: FNMA; Bloomberg. Further on the housing topic, while current data reflects a still-robust sector (evidenced by a strong Existing Home Sales data release this past Friday), there may be headwinds in the offing. As seen here, a recent Fannie Mae survey reflects an increasingly higher number of “bad time to buy” respondents. Granted, the chart reflects this sentiment increasing since last year, yet the housing sector has remained sturdy. However, current higher home prices, in tandem with mortgage rates (now near or over 4% on conforming 30-year) over 1% higher than last year, are notably and negatively impacting affordability metrics and may begin to crimp sales and price growth in the year ahead.

CHART 4 LOWER RIGHT

Source: Federal Reserve. The latest (January 2022) Fed’s Senior Loan Officer Opinion Survey on Bank Lending Practices, roughly corresponding to Q4 2021, revealed a promising trend. The “Net Percent of Domestic Respondents Reporting Stronger Demand for Commercial and Industrial Loans” increased further into positive territory from the last report in October. In a hopeful and positive aspect of the report, all market types (large, middle, small) of borrowers were in positive territory.

FHLBNY Advance Rates Observations

Front-End Rates

- In a clear reversal of prior weeks, short-end Advance rates closed lower from the prior week by 5 to 7 bps. Driving this move was the market’s repricing lower the odds/extent of near-term Fed hikes and the Ukraine crisis-spurred flight-to-quality dynamic. High cash levels persist in the short-end, as demand for the Fed’s RRP, which stands last at ~$1.65trn, remains strong. Money market fund AUM remains high, although falling again by ~$44n in the past week. Short-term rates are now highly subject to the Fed and the market’s pricing thereof.

- At this stage, most maturities cross into upcoming FOMC meetings, thereby making them highly responsive to market movements.

Term Rates

- The advance rates curve generally mimicked the UST curve week-over-week and finished modestly lower by a few bps. Kindly refer to the previous section for further color on relevant market dynamics.

- On the UST supply front, this holiday-shortened week brings UST auctions of 2/5/7-year. Markets and rates are highly prone to move on Ukraine news and Fed-speak. Given market volatility, members should monitor conditions for potentially more optimal timing on transactions. Please call the desk for information on market dynamics, rate levels, or products.

Product Alert: FHLBNY is pleased to announce enhancements to our Advance Rebate Program, which provides members an opportunity to receive a cash rebate when prepaying an eligible advance and rebooking a new advance within a 30-day period. Rebate-eligible advances now must have a minimum of 6-months (reduced from 1-year) remaining. Moreover, the potential cash rebate has been increased. This program can be suitable for those wishing to extend their liability duration and/or potentially improve net interest margin. Please call the Member Service Desk at (212) 441-6600 for more information.

The Symmetrical Prepayment Advance Feature

With rates at or near multi-year lows, it is a compelling juncture to use the SPA feature on term advances. This feature allows member to capture, at prepayment, changes in the Fair Value of the advance which are favorable to the member. Contact us to discuss.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the MSD Team.