Member Services Desk

Weekly Market Update

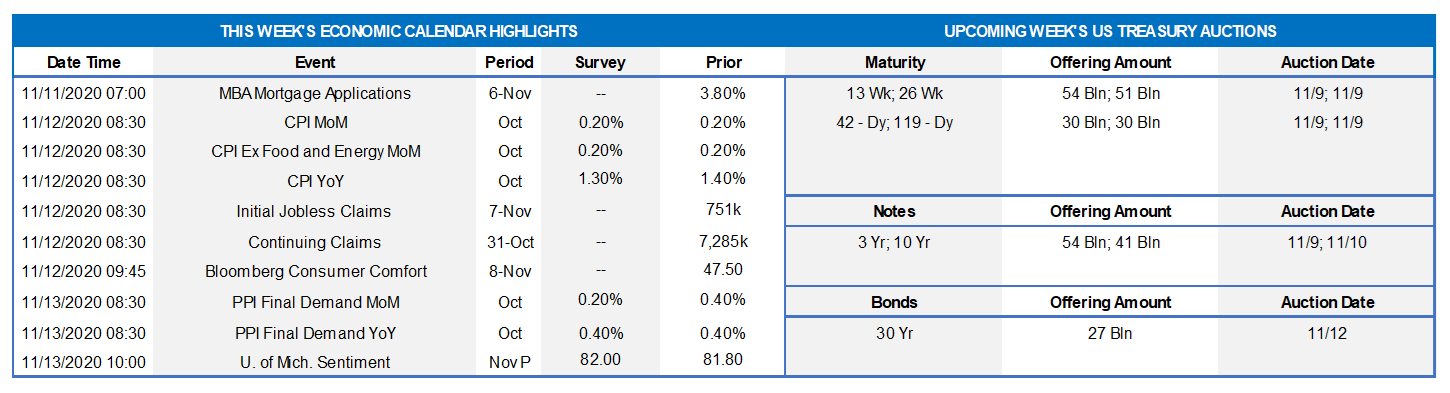

This MSD Weekly Market Update reflects information for the week of November 9, 2020.

Economist Views

Click to expand the below image.

With Election Day and the Federal Open Market Committee behind them, market participants should enjoy a well-deserved rest this coming week. On the statistical menu will be a series of second-tier indicators that will have limited impact on appraisals of the economy. Federal Reserve officials will speak on a variety of topics, but only St. Louis Fed President Bullard is slated to discuss the economy and monetary policy.

NFIB Small Business Optimism Index: Already released labor-market soundings suggest that small-business sentiment likely retreated from the seven-month high posted in September.

JOLTS Job Openings: A rise in online job postings suggests that total job openings likely climbed to 6.65mn in September, reversing a little over three quarters of August’s reported decline. The number of available positions would remain well below the 12.6mn unemployed persons counted during the reference period, however.

Consumer Prices: Lower energy costs probably capped the rise of the Consumer Price Index (CPI) at just 0.1% in October – the weakest performance since the 0.1% dip recorded in May. The core CPI excluding volatile food and energy components likely edged 0.2% higher, after a similar gain in September. The above consensus forecasts would leave the overall and core CPIs 1.3% and 1.7% above their respective year-ago levels.

Jobless Claims: Online inquiries on how to apply for unemployment insurance benefits rose last week, implying that initial claims likely climbed by 25K to 775K during the period ended November 7. The total number of persons on regular state benefit rolls, however, probably moved lower over the final week of October.

Michigan Consumer Sentiment Index: Recent economic soundings and financial market performance suggest that consumer confidence probably improved markedly in early November, propelling the University of Michigan’s sentiment gauge to 85.5 – the highest reading in eight months.

Federal Reserve Appearances:

Nov. 9: Cleveland Fed President Mester to speak at a virtual fintech conference.

Nov. 10: Boston Fed President Rosengren to speak about financial stability.

Nov. 10: Dallas Fed President Kaplan to speak at the Council on Foreign Relations.

Nov. 10: Fed Vice Chair for Supervision Quarles to appear before Senate Banking Committee.

Nov. 10: Fed Governor Brainard to discuss the Community Reinvestment Act.

Nov. 12: Federal Reserve Chair Powell to speak at an ECB forum.

Nov. 12: Chicago Fed President Evans to speak at a Detroit community forum.

Nov. 13: St. Louis Fed President Bullard to discuss economy and monetary policy.

Click to expand the below images.

CHART 1 – UPPER LEFT

Source: : Bureau of Labor Statistics; FHLB-NY. Net hiring in the private sector was considerably better than expected in October. Indeed, the 906K positions added last month was well above the 680K anticipated by the Street. Private service-producing payrolls jumped by 783K during the reference period, thereby pushing the cumulative rise since April to 10.8mn, yet they remained 7.9mn below the pre-pandemic high. Leisure & hospitality (271K), professional & business services (208K), and retailing (104K) once again fueled the reported gain. While all industries still have considerable ground to recover to achieve their February payroll levels, three of the hardest hit service-producing segments – retail trade, leisure & hospitality, and educations & health – have made significant progress toward that end.

CHART 2 – UPPER RIGHT

Source: Bloomberg. The UST curve “bull flattened” the past week but remains a bit higher and steeper than a month ago. Evident here, however, is that the curve mid-week had “bull flattened” to be virtually on top of its shape a month ago; subsequently it traded back from these more extreme levels. To reiterate, the Fed’s guidance and programs have served to pin the shorter maturities, and so again maturities past 4-year led movements. The mid-week moves were essentially spurred by a two-pronged dynamic. Firstly, the Treasury’s Refunding announcement revealed a decrease in the pace of 10-year+ maturity auction size increases while keeping 2 to 7-year maturity increases at the same ongoing pace. Secondly, the election results led to unwinds of short UST and/or curve steepener positions, as the outcome, at least for now, is perceived by the market to lead to a decreased chance of robust and very large fiscal packages/spending and associated UST supply. The main prompt for UST yields rebounding higher on Friday was the better-than-expected jobs data. Lastly, lest forgotten, the FOMC meeting “came and went” with no meaningful changes and little new information.

CHART 3 – LOWER LEFT

Source: Bloomberg. Record low mortgage rates have supported an ongoing boom in the mortgage banking and housing sectors. Portrayed here is the Agency mortgage “current coupon” (basically the yield on par-priced Agency MBS) spread to the average of the UST 5-year/10-year yields. This spread now resides at the low of the past year. The Fed’s programs and asset purchases have succeeded in driving spreads and yields tighter/lower, as investors search for incremental yield. Banks have been notable buyers of Agency MBS in recent months, given slower loan demand.

CHART 4 – LOWER RIGHT

Source: Goldman Sachs. The tighter spreads and lower yields cited above have led to a “real world” impact via lower mortgage rates and increased affordability for homeowners, as seen here in 2020 and in a longer-term historical context.

FHLBNY Advance Rates Observations

Front-End Rates

Short-end advance rates were 1-2 bps lower out to 3-mo but unchanged thereafter, week-over-week. Heavy T-bill issuance was a feature, as usual, but net supply has slowed and thereby allowed for easier market absorption. Continuing a recent trend, money market funds experienced ~$13.15bn of outflow on the week. Overall market supply of short paper has moderated in recent months, however, thereby blunting the impact of these investor outflows.

Heavy T-Bill issuance will remain a theme; UST issuance overall is now net positive supply in that more is being issued than what the Fed is buying in its programs, and so this scenario could prove a small challenge. However, with short UST rates at rock-bottom levels, and the Fed likely on hold for a long period, rates may trade in a sideways pattern. Net T-bill issuance has been lower since mid-summer and even negative in recent weeks, and Treasury has announced plans to shift issuance out the curve, but a new fiscal relief package may complicate/alter this forecast. But market sentiment towards the election outcome, albeit not final and still ongoing, is that the probability of very large fiscal legislation has been reduced, thereby leading to less T-bill supply.

Term Rates

Medium and longer-term advance rates were a few bps higher in the shorter maturities and then 3 to 5 bps lower, in progressive fashion, 5-year and longer. Rates 5-year and shorter generally remain pinned in a narrow range, and so again it was the portion of the curve 5-year and out that led the week’s change. Please refer to the previous section for further color on the market moves.

Rates still trade at historically low levels across the yield curve, and the curve is priced for the Fed to be on hold for several years. If suitable or sensible from an ALM perspective, it may be worthwhile to consider extending liabilities and locking in term rates. Note that election outcomes still have the potential to spur further moves in the curve and rates. Please call the Member Services Desk to discuss rate levels and potential ideas.

This week brings 3/5/10-year UST auctions. Anticipation of this supply likely led to Friday’s rebound from the previous days’ “bull flattening”. Corporate issuance should add yet again to its historic record annual pace. Attention will remain on the elections, prospects of further relief legislation, and certainly also on COVID-19 developments which have been notably worsening.

The Symmetrical Prepayment Advance Feature

With rates at or near multi-year lows, it is a compelling juncture to use the SPA feature on term advances. This feature allows member to capture, at prepayment, changes in the Fair Value of the advance which are favorable to the member. Contact us to discuss.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the

MSD Team.

Special Member Alert

The FHLBNY recently announced a newly expanded and flexible Disaster Relief Funding (DRF) advance program which offers discounted rate advances with maturities 1-mo and greater. Additionally, we have announced that PPP loans will be accepted as eligible collateral. Please contact us with any questions.