Member Services Desk

Weekly Market Update

Economist Views

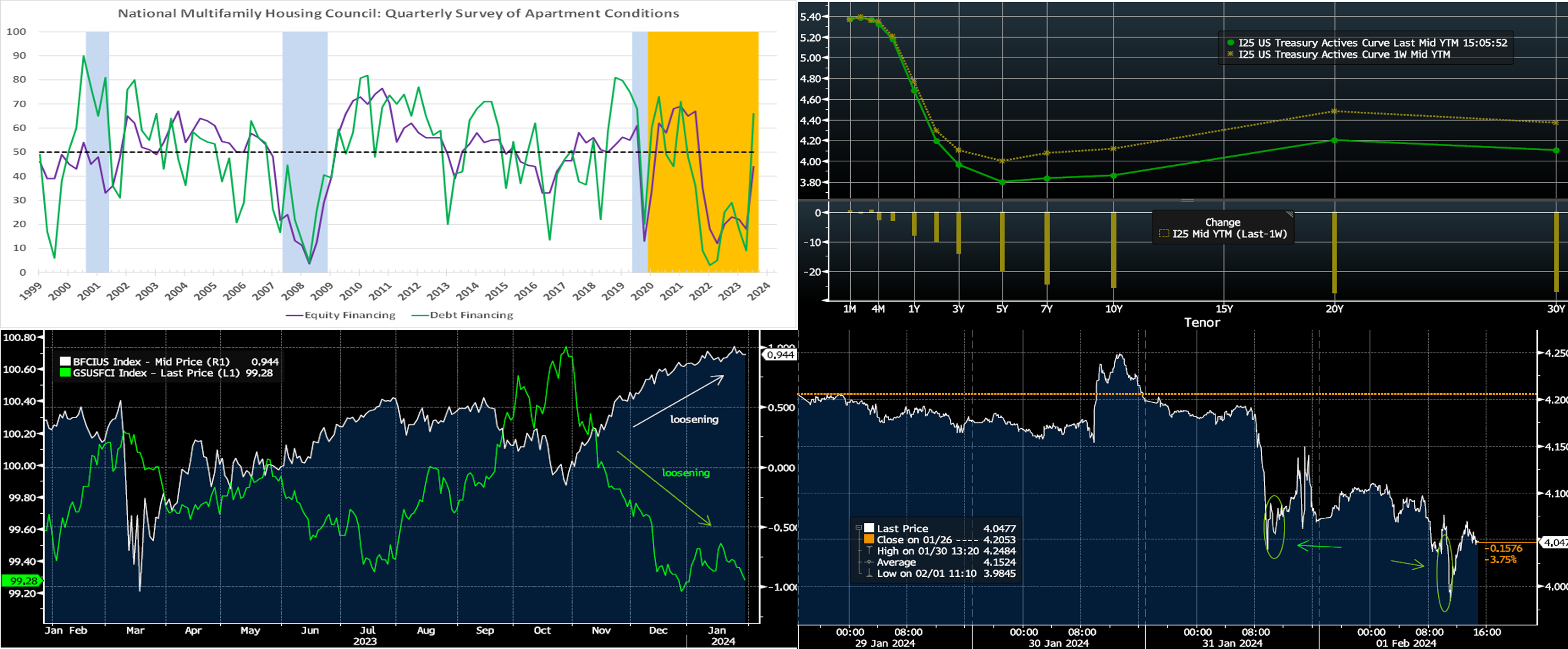

Click to expand the below image.

Please note that the monthly employment situation report to be released on Friday, February 1, at 8:30 a.m. may impact markets and any rate levels referred to herein.

Having weathered yet another Federal Open Market Committee (FOMC) meeting with no change in administered rates, market participants will face an extremely light economic release calendar this upcoming week. Service-sector activity probably reaccelerated at the beginning of the New Year after the slowdown reported in December. Potentially adding a modest boost to the estimated pace of real GDP growth in Q4, the international trade deficit is expected to close marginally lower in December. Consumer installment credit growth likely slowed during the final month of 2023. Jobless claims probably remained at levels consistent with continued tight labor-market conditions. A quintet of Federal Reserve officials – four of whom are FOMC voters in 2024 – will give their current views on the economic outlook.

ISM Service-Producing Index: The expansion in service-producing activity likely entered its second year in January, with this gauge rebounding to 51.5% from the 50.6% reading posted in December.

International Trade Balance: A reported narrowing of the merchandise trade deficit in December suggests that the combined shortfall in international trade in goods and services likely closed to $62.3bn from $63.2bn in November.

Consumer Credit: Consumer installment credit is expected to have expanded by $16.5bn in December, following the surprisingly large $23.8bn takedown witnessed in the prior month.

Jobless Claims: Initial claims for unemployment insurance benefits likely remained in a historically low 205-220K range during the filing period ended February 3. Keep an eye on continuing claims for the week ended January 26 for any signs that recently furloughed employees are having a more challenging time finding work.

Annual Revisions to Consumer Price Index Series: Each year, with the release of the January Consumer Price Index report, seasonal adjustment factors are recalculated to reflect price movements from the just-completed calendar year. This routine annual recalculation may result in revisions to seasonally adjusted indices for the previous 5 years. Revised seasonally adjusted indices, as well as recalculated seasonal adjustment factors for the past five years, will be made available on Friday, February 9, 2024.

Federal Reserve Appearances:

- Feb. 5 Atlanta Fed President Bostic to provide opening remarks at an event on the economic returns of education and training.

- Feb. 5 Federal Reserve to release quarterly Senior Loan Officer Opinion Survey on Bank Lending Practices.

- Feb. 6 Cleveland Fed President Mester to give a speech on economic outlook in Columbus, OH.

- Feb. 6 Philadelphia Fed President Harker to speak on the Fed’s role in the economy at the Rowan Institute in Glassboro, NJ.

- Feb. 7 Federal Reserve Governor Adriana Kugler to speak on the economic outlook and monetary policy at a Brookings event.

- Feb. 7 Richmond Fed President Barkin to speak at the Economic Club of Washington DC on the national and regional outlooks.

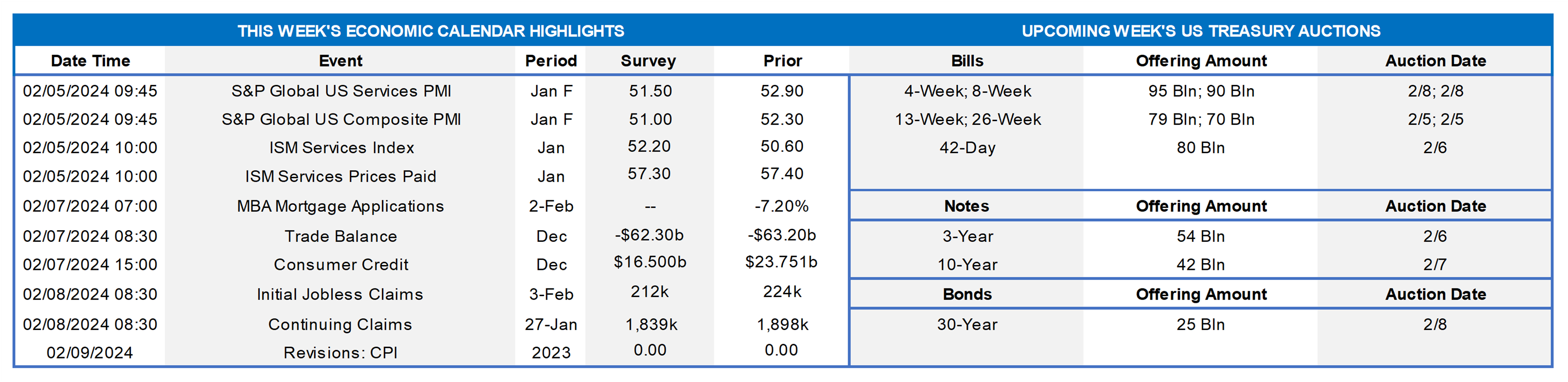

CHART 1 UPPER LEFT

Source: National Multifamily Housing Council (NMHC); National Bureau of Economic Research; FHLB-NY. Notes: The diffusion indices are calculated by taking one-half the difference between positive and negative responses and adding 50; blue-shaded areas denote recessions, and orange-shaded areas highlight current expansion. Apartment market conditions continued to weaken in the NMHC’s Quarterly Survey of Apartment Market Conditions for January 2024. Except for the Debt Financing gauge, which returned to positive territory this quarter, the Market Tightness, Sales Volume, and Equity Financing indices all printed below the 50-point breakeven mark. According to the NMHC, recent interest-rate reductions and hopes of easier monetary policy in the future have caused the perceived availability of debt financing to increase for the first time in nine quarters. Nonetheless, the apartment markets continued to witness decreasing rent growth and rising vacancy rates as the highest level of new supply in more than thirty years gets absorbed.

CHART 2 UPPER RIGHT

Source: Bloomberg. Top pane is yield (LHS, %), bottom pane is change (LHS, bps). From last Thursday afternoon to this one, the UST curve posted a notable bull flattening, with shorter tenors 7 to 13 bps lower, while 5-year-and-longer tenors were 20 to 26 bps lower. The generally as-expected UST Refunding announcement provided some impetus, as the announced supply for next week in 3/10/30-year tenors was not a large increase. Month-end and flight-to-quality buying also spurred UST demand. The FOMC was the main event this past week. While not dovish in tone, the market nonetheless expects a series of rate cuts this year. In terms of market-implied pricing of the Fed, the chance of a 25 bps cut in March is ~39%, down slightly from ~49% last week. The year-end 2024 forward is ~3.845%, roughly 9 bps lower than last week. The market prices for a cumulative total of ~148 bps of cuts by the end of 2024.

CHART 3 LOWER LEFT

Source: Bloomberg. This week’s FOMC official statement omitted its prior reference to tighter financial and credit conditions. Perhaps this chart illuminates a reason why, given that both Bloomberg’s (RHS, White) and Goldman Sachs’ (LHS, green) US Financial Conditions indices as of yesterday reflected loosening conditions over the past few months; indeed, the indices were at/near the “loosest” of the past year. These conditions may have influenced Chair Powell’s press briefing comments that the Fed would like to gain greater confidence that inflation is sustainably moving towards its 2% target before engaging in rate cuts. He also cast doubt on a March cut for the same reason. In turn, the market dialed back its pricing of the chances of a March cut from ~66% to ~35% probability, although the market slightly boosted the overall extent of cuts for 2024 to ~150 bps.

CHART 4 LOWER RIGHT

Source: Bloomberg. Shown here is the past 4-day trend of the 2-year SOFR swap rate (RHS, %) and its notable moves. And we offer our periodic reminder to members on two fronts. Firstly, notable moves in rates often occur overnight or in the early morning after the release of data or news. Secondly, our Advance levels are generally ready by or near 9 a.m., so it is not necessary to wait for our Daily Rate Sheet (DRS). Indeed, our DRS will be stale if/when there have been market moves. Please contact the Member Services Desk to obtain rate and/or market updates and thereby potentially take advantage of opportunities presented by market moves.

FHLBNY Advance Rates Observations

Front-End Rates

- Short-end rates were up a bp on shorter tenors but 2 bps lower in the 5 and 6-month week-over-week. Net T-bill supply remains positive, given announcements from the Treasury regarding upsized auctions and issuance needs. But the supply continues to be absorbed well as Money Market Funds (MMFs) switch from the Fed’s RRP to T-bills with competitive yields. Moreover, MMFs currently stand at or near all-time high AUM levels.

- Absent top-tier data, the markets will likely focus on Fedspeak in the upcoming week.

Term Rates

- The longer-term curve, generally mirroring moves in USTs and swaps, bull flattened week-on-week. While the 2-year was ~8 bps lower, the 5-year was ~20 bps lower. The decline in rates stirred some renewed interest in term advances. Please refer to the previous section for color.

- On the UST term supply front, the upcoming week serves a hefty slate of 3/10/30-year auctions. Note that UST auctions usually occur at 1pm and can occasionally cause volatility around that time. Please contact the Member Services Desk for further information on market dynamics, rate levels, or products.

Grant funding under the FHLBNY 2023 Small Business Recovery Grant (SBRG) Program has begun and some funds are still available. The SBRG Program provides grant funds to benefit FHLB-NY members’ small business and non-profit customers. Please visit the SBRG webpage.

Price Incentives for Advances Executed Before Noon: In effect as of Tuesday, September 5, 2023, the FHLBNY is pleased to now offer price incentives for advances executed before Noon each business day. These pricing incentives offer an opportunity to provide economic value to our members, while improving cash and liquidity management for the FHLBNY. For further details, kindly refer to the Bulletin.

The Symmetrical Prepayment Advance Feature

For those anticipating term funding needs, and with rates on an uptrend, it can be an appropriate juncture to consider our SPA feature. This feature allows the member to capture, at prepayment, changes in the fair value of the advance which are favorable to the member. Contact Member Services Desk to discuss.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the MSD Team.