Member Services Desk

Weekly Market Update

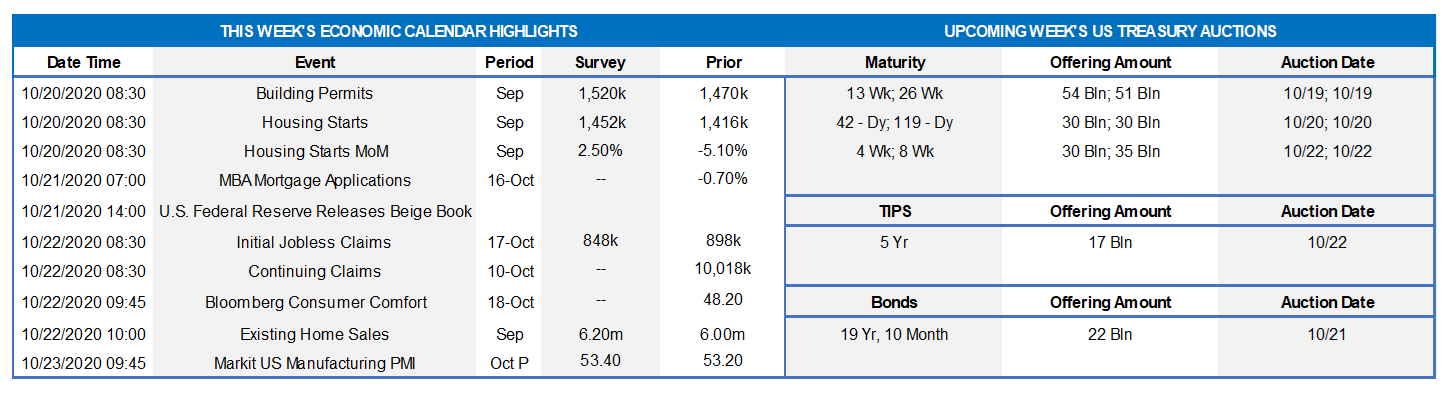

This MSD Weekly Market Update reflects information for the week of October 19, 2020.

Economist Views

Click to expand the below image.

Although progress appears unlikely until after the upcoming elections, the focus of market participants probably will remain on prospects for a fifth fiscal support package. On the data front, reports on housing starts and existing home sales will allow economists to solidify their forecasts for Q3 residential investment. Over a half dozen appearances by Federal Reserve officials will occur in the coming week, covering a variety of topics.

NAHB Housing Market Index: Rosier appraisals of current and future home sales, combined with an anticipated pickup in prospective buyer traffic, likely propelled the National Association of Home Builders’ sentiment gauge to yet another record high in October.

Building Permits & Housing Starts: Buoyed by record-low mortgage interest rates and favorable weather conditions, building permits and housing starts probably rebounded in September, thereby reversing declines reported in August. Residential investment appears poised to add almost two percentage points to Real GDP growth during the third quarter.

Jobless Claims: Online inquiries on how to apply for unemployment insurance benefits suggest that initial claims likely reversed course sharply during the period ended October 17, after a 53K rise to 898K in the past week. Any prospective decline would still leave new filings well above the 233K average that prevailed pre-COVID-19 crisis.

Existing Home Sales: The ongoing surge in home-purchase contract signings points to yet another solid increase in existing home sales in September. Indeed, the consensus estimate of 6.18mn annualized would represent the highest number of closings since December 2006.

Markit Manufacturing PMI: Available Federal Reserve District Bank canvasses suggest a sixth consecutive rise in the Markit factory activity barometer in October.

Federal Reserve Appearances:

Oct. 19: Fed Chair Powell to take part in panel discussion on cross-border payments during the annual IMF meeting.

Oct. 19: Atlanta Fed President Bostic to discuss economic diversity and inclusion.

Oct. 19: Philadelphia Fed President Harkin to discuss post-COVID-19 recovery.

Oct. 20: New York Fed President Williams to make opening remarks at culture event.

Oct. 20: Chicago Fed President Evans to speak at Detroit Economic Club.

Oct. 21: Cleveland Fed President Mester to discuss monetary policy at a virtual event.

Oct. 21: Federal Reserve to release Beige Book Summary of Commentary on Current Economic Conditions

Click to expand the below images.

CHART 1 – UPPER LEFT

Source: U.S. Dept. of Commerce; FHLB-NY. Consumer spending ended the summer on a high note. Retail and food services sales jumped by 1.9% in September – more than double the 0.8% gain anticipated by market forecasts. With the exceptions of a modest dip in electronics purchases and no change in food and beverage sales, all major business segments enjoyed higher revenues during the reference period. Excluding motor vehicle, building materials, and gasoline purchases, retail “control” – the portion of this past Friday’s report that is used by the Bureau of Economic Analysis to estimate nominal consumer goods purchases in GDP – rose by 1.4% in September, after a 0.3% dip in August. Control purchases advanced at a stunning annualized clip of 37.9% during the summer quarter, more than offsetting the 9.8% decline posted in Q2 during the shuttering of the U.S. economy. Economists likely will boost their projections for Q3 real GDP growth in response to this report.

CHART 2 – UPPER RIGHT

Source: Bloomberg. In a holiday-shortened week, the UST curve essentially reversed some of last week’s move and thereby remains range-bound. The Fed’s guidance and programs have served to pin the shorter maturities, and so it has been the longer end of the curve leading any moves. This past week experienced a mild “bull flattening”, with 5-year and longer yields decreasing 3 to 7 bps in progressive fashion out the curve. Assisting the move was an absence of term UST issuance as well as the “in limbo” status of an additional fiscal relief package.

CHART 3 – LOWER LEFT

Source: Bloomberg. The Bloomberg Barclays Global Aggregate Negative Yielding Debt USD Market Value Index has jumped in recent weeks and now sits at $16.6tn which is within “whiskers” of its all-time high of $17.04tn from August 2019. Economic weakness from pandemic impacts have spurred central banks to expand their balance sheets to buy bonds and thereby drive yields lower. The overarching global theme of low inflation and low rates persists for now and continues to support international demand for US securities.

CHART 4 – LOWER RIGHT

Source: Bloomberg. Having cited the above, US rates are at record low levels, and it could prove difficult for them to move much lower, especially since the curve is already pricing for the Fed to be on hold the next few years plus the potential for fiscal package(s) in the year ahead. Depicted here is the spot-starting (.394%) and the 1-year forward starting (.509%) 5-year swap rate. Given this backdrop and if suitable from an ALM perspective, hedging and/or term funding might be worth a review; note that swaps and advances can be executed on a forward start basis. Please call the Member Services Desk to discuss potential strategies.

FHLBNY Advance Rates Observations

Front-End Rates

Short-end advance rates generally finished 1bps higher week-over-week. Heavy T-bill issuance was a feature, as usual, but net supply has been slowing and thereby allowing for easier market absorption. Continuing a recent trend, money market funds experienced ~$18.3bn of outflow on the week. Overall market supply of short paper has moderated in recent months, however, thereby somewhat blunting the impact of these investor outflows.

Heavy T-Bill issuance will remain a theme; UST issuance overall is now net positive supply in that more is being issued than what the Fed is buying in its programs, and so this scenario could prove a small challenge. However, with short UST rates at rock-bottom levels, and the Fed likely on hold for a long period, rates may trade in a sideways pattern. Net T-bill issuance has been lower since mid-summer, and Treasury has announced plans to shift issuance out the curve, but a new fiscal relief package may complicate/alter this forecast.

Term Rates

Medium and longer-term advance rates were 1 to 6 bps lower on the week, in a “bull flattening” shift that served to partially reverse the prior week’s move. Rates 5-year and shorter generally remain pinned in a narrow range, and so again it was the portion of the curve past 5-year that led the week’s change. Please refer to the previous section for further color on the market moves.

Rates trade at historically low levels across the yield curve, and the curve is priced for the Fed to be on hold for several years. If suitable or sensible from an ALM perspective, it may be worthwhile to consider extending liabilities and locking in term rates. Note that the impending election has the potential to spur further moves in the curve and rates. Please refer to the previous section for pertinent information and kindly call the Member Services Desk to discuss rate levels and potential ideas.

Next week features only the regular 20-year and then a TIPS 5-year, in terms of impending UST auctions. Corporate issuance should add yet again to its historic record pace. Attention will remain on the prospects of further relief legislation and certainly also on COVID-19 developments.

The Symmetrical Prepayment Advance Feature

With rates at or near multi-year lows, it is a compelling juncture to use the SPA feature on term advances. This feature allows member to capture, at prepayment, changes in the Fair Value of the advance which are favorable to the member. Contact us to discuss.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the

MSD Team.

Special Member Alert

The FHLBNY recently announced a newly expanded and flexible Disaster Relief Funding (DRF) advance program which offers discounted rate advances with maturities 1-mo and greater. Additionally, we have announced that PPP loans will be accepted as eligible collateral. Please contact us with any questions.