Member Advantage

MESSAGE FROM THE PRESIDENT

Second Quarter 2019

Through the first quarter of 2019, our members have experienced stable loan demand, though at levels below the same period last year. This loan demand has been accompanied by tighter liquidity and a more competitive deposit environment.

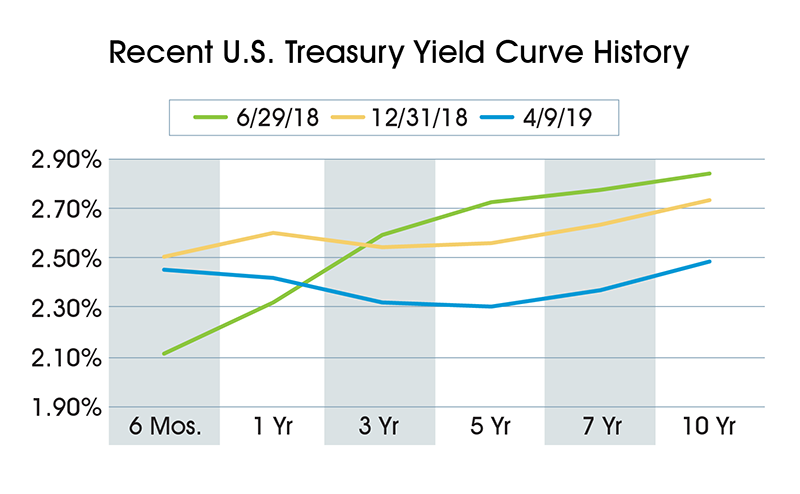

In the broader market, a very flat yield curve has persisted and is now inverted as compared to year-end 2018, with a parallel downward shift in rates. Given the Federal Reserve’s signaling of an extended pause with regards to increasing short-term interest rates, some focus has shifted from risks associated with rising rates to the potential of an economic slowdown alongside a decreasing rate environment and weaker asset quality.

In this edition, we feature several advance structures that can help our members position their institutions for the current economic and operating environment and prepare for the shifting landscape.

Sincerely,

José R. González

President and Chief Executive Officer

Welcome New Members

Three new members were welcomed into our cooperative since the last edition:

- Korean American Catholics Federal Credit Union

- M.Y. Safra Bank, FSB

- NCPD Federal Credit Union

- SECNY Federal Credit Union

- The Disability Fund, Inc.

GAIN VALUABLE FLEXIBILITY IN A SHIFTING INTEREST RATE & OPERATING LANDSCAPE

The FHLBNY has a product mix that can assist members with efficiently navigating the current operating environment, affording the ability to both manage risk and offer flexibility to optimize earnings. In this edition, we highlight three of our funding options to consider for a shifting interest rate environment.

Symmetrical Prepayment Advance (SPA) Feature

A “symmetry” feature can be added to certain fixed-rate advances for an additional two basis points. The SPA feature offers the potential to harvest a gain from an advance that becomes “in the money” or incurs an unrealized gain due to a shift in interest rates. Symmetry is requested at the time of booking and may be added to qualified fixed-rate advances with maturities of one year or greater, allowing our members to receive compensation for favorable changes in the Fair Value of the advance when prepaying. This compensation is net of prepayment fees.

SPA STRUCTURES & TERMS

TERMS AVAILABLE: 1-30 years (Term dictated by individual product parameters.)

MINIMUM TRANSACTION SIZE: $3 million

MINIMUM PARTIAL PREPAYMENT SIZE: $3 million

ADVANCE TYPES WITH SPA: Fixed-Rate Advances

Note: Prepayment above $1 billion per member per month will require review and approval from the FHLBNY. Discounted fixed-rate Community Lending Program Advances are excluded. Terms and restrictions apply.

Offset to Unrealized Lossed of Fixed-Rate Securities

From a market value perspective, advances and fixed-rate security portfolios have an inverse relationship in a changing interest rate environment. The market value of advances with symmetry will increase in a rising rate environment, while fixed-rate securities may incur unrealized losses. Having liabilities with unrealized gains that can be monetized serves as a real offset to unrealized losses in security portfolios.

Potential to Monetize Gains

Should a member have an advance with a positive fair market value, they may extinguish and harvest a potential gain (net of prepayment fees) to bolster earnings. Members rebooking advances with terms of six months or greater may also benefit from our Advance Rebate Program to receive back part of the prepayment fee associated with extinguishing an advance prior to its maturity date.

Merger & Acquisition (M&A) Situations

If there is a possibility of an imminent or future merger or acquisition, the SPA feature can add significant value to the deal—from both the position of the acquirer and the institution being acquired. Often, during the process of an acquisition, an acquirer may choose to de-lever and shrink the balance sheet of the newly consolidated entity to bolster capital and to sell “underwater” or risky assets while taking the opportunity to book losses to “merger-related” expenses. By funding security portfolios with advances with the SPA feature, losses associated with divesting “underwater” securities could potentially be mitigated while de-levering (should advance gains be harvested during this process).

Callable Advance

Callable Advances are fixed-rate term funding that prepayment fee, in whole or in part, after a pre- determined lockout period. The advance is a flexible funding tool that can assist in addressing interest rate risk now, while also affording the option to make adjustments in the future based on the prevailing interest rate environment and a member’s need for long-term funding. Upon inception of the advance, you choose the term and lockout period and select either a “European” or one-time option to extinguish, or the “Bermudan” option where you have an opportunity to extinguish at the end of the lockout period and on a quarterly basis thereafter.

FEATURES & BENEFITS

MAXIMUM ADVANCE SIZE: $100 million

MINIMUM ADVANCE SIZE: $5 million

FINAL MATURITIES AVAILABLE: 3, 5, 7 or 10 years

LOCKOUT PERIODS: 1, 2, 3 or 5 years

CALL OPTIONS: Bermudan (quarterly) or European (one-time)

REQUIRED OPTION EXERCISE NOTIFICATION TO THE FHLBNY: Nine business days

Note: Prepayment above $1 billion per member per month will require review and approval from the FHLBNY. Terms and restrictions apply.

Adjust for Balance Sheet Changes

Should members require longer-duration liabilities today to meet current Asset/Liability Management (ALM) objectives, they can utilize Callable Advances and strategically terminate in the future should their balance sheet composition change. Our members’ balance sheets are dynamic, with change being a constant, as our members are often embarking on new strategies to achieve deposit growth or to alter the composition of assets to optimize profitability, reduce risk or to best utilize capital. Needs for term funding often are dynamic as well and will vary over time. Callable Advances can potentially assist in achieving member goals today while offering flexibility in the future to extinguish (entirely or partially at no additional cost) to avoid being “straddled” with unnecessary term-funding.

Hedge Prepayment Risk

Callable Advances are excellent tools to fund pools of whole-loan mortgages or mortgage-backed securities. Not only does the Callable Advance lock in spreads for a period of time, but it can also be extinguished, either entirely or partially, should the prepayment speeds of mortgage assets be greater than expected. Again, added flexibility can be extremely valuable and offer a member the precision to maintain the exact degree of term funding they require.

“Win” in Multiple Scenarios – Rising, Declining or Static Rate Environments

Callable Advances allow a member to lock-in spread and mitigate risks associated with a rising rate environment. Moreover, this advance offers flexibility to lower the cost of funds in a static and declining rate environment. Should rates decline, members can “ride down the curve” by strategically extinguishing the callable and “rolling short” or rebooking advances of the same remaining life but with a lower coupon rate. Should rates remain static, members can also extinguish and rebook advances with the same remaining life, but with a lower coupon than the prevailing rate on the existing Callable Advance.

Flexibility in M&A Scenarios

M&A activity can often be driven by liquidity and interest rate risk as financial institutions seek to partner with entities that have liability structures that complement each other. At the FHLBNY, we have seen M&A activity increase in recent years. Often times, mergers are accompanied by term advances being prepaid early, with significant prepayment fees incurred. During a merger, the option to extinguish advances at no additional cost can prove very beneficial to the overall economics of the deal.

Fund Longer-Duration Assets to Anchor The Balance Sheet

With the current flat and now inverted yield curve at certain points, members may opt to add longer-duration assets as “insurance” to anchor their balance sheets and fend off spread compression associated with assets repricing down the curve. The Callable Advance allows members to lock in spreads—and should rates decline you can take action and strategically extinguish and rebook advance funding with a lower coupon. If members add longer-duration securities, a declining rate environment would translate into those securities incurring unrealized gains. Should the need arise to harvest those gains in order to bolster earnings or offset losses associated with deteriorating asset quality (which may be present during an economic downturn), members can safely take the gains and extinguish the long-term funding associated with those assets.

Adjustable Rate Credit (ARC) Advance With an Embedded Cap

The ARC Advance with an embedded cap is a floating- rate advance tied to either 1-month or 3-month LIBOR; it contains an embedded cap that limits the cost of the floating rate to a maximum coupon rate should LIBOR rise to the cap threshold. The cap provides an upper limit to the coupon rate, and is often beneficial when conducting regulatory shock scenarios.

FEATURES & BENEFITS

FINAL MATURITIES AVAILABLE: 1-30 years

LIBOR INDICES: 1- or 3-month LIBOR

INTEREST PAYMENT: Quarterly (based on Actual/360 day count)

Note: Prepayment above $1 billion per member per month will require review and approval from the FHLBNY. Terms and restrictions apply.

Reduce Funding Costs And Build Protection From Rising Rates

With the Fed seemingly on hold, members may want the ability to reduce funding costs in a declining rate environment with the security of an upper-limit on the advance coupon. Liability-sensitive members find the ARC Advance with an embedded cap advantageous because it will not only provide protection from rising rates but also will allow the advance coupon to ride down the curve when we enter a different point of the interest rate cycle. In addition to the cap providing an upper limit to the coupon of this advance, it also assists with regulatory shock scenarios when calculating Net Interest Income at Risk and Economic Value of Equity at risk. Considering we have an inverted yield curve and stable monetary policy, being able to reduce funding costs in a declining rate environment is valuable, especially considering the additional advantages associated with this advance structure.

The FHLBNY will be glad to answer questions and discuss opportunities

to utilize our products to achieve your balance sheet management goals

Have a suggestion for a new funding structure or advance product? Contact us.

Member Services Desk: (212) 441-6600

Relationship Managers: (212) 441-6700

DID YOU KNOW ABOUT?

The New SOFR-ARC Advance

Learn more about our new Secured Overnight Financing Rate (SOFR)-Linked

Adjustable Rate Credit (ARC) Advance.

The Homebuyer Dream ProgramTM

Our First Home Clubsm will be replaced by our new, modernized Homebuyer Dream Program™ (HDP) for first-time homeowners.

Upcoming Events

Visit us online for current event postings. We look forward to connecting with our members

and associates.

Have suggestions for a future topic? E-mail your thoughts to [email protected].

Latest News

07/23/2025

FHLBNY Announces Second Quarter 2025 Operating Highlights

07/11/2025

$2.8 Million in Additional Funding Added to the 0% Development Advance (ZDA) Program

07/10/2025

Report from the President: Driving Communities Forward

02/22/2023

Notice of FHLB Members Selected For Community Review (Effective February 23, 2023)

07/28/2021

An Enhancement to our Callable Adjustable Rate Credit Advance (Callable ARC)