Member Advantage

REPORT FROM THE PRESIDENT

Third Quarter 2016

A Critical Role

Last month, S&P Global Ratings issued a report on the Federal Home Loan Bank System. In reaffirming the System’s AA+/Stable rating – the same as the U.S. sovereign rating – S&P highlighted numerous positive aspects about the Federal Home Loan Banks, including our strong capital, funding and risk management positions. Most importantly, however, was S&P’s recognition of the critical role the Federal Home Loan Banks play in the nation’s economy: “We view the FHLBanks’ role as a source of low-cost funding for residential mortgage lending, housing, and community development as very important to meeting the national policy objective of home ownership.”

Last month, S&P Global Ratings issued a report on the Federal Home Loan Bank System. In reaffirming the System’s AA+/Stable rating – the same as the U.S. sovereign rating – S&P highlighted numerous positive aspects about the Federal Home Loan Banks, including our strong capital, funding and risk management positions. Most importantly, however, was S&P’s recognition of the critical role the Federal Home Loan Banks play in the nation’s economy: “We view the FHLBanks’ role as a source of low-cost funding for residential mortgage lending, housing, and community development as very important to meeting the national policy objective of home ownership.”

Of course, it is our members who make the mortgages, who put families in homes they can afford, and who provide the small business loans that drive economic growth and community development. It is the role of the Federal Home Loan Banks to serve as a support system for these activities. It is a role that we perform well; in fact, it is part of our design. As S&P notes, “the System is run as a cooperative for the benefit of its client-owners (private sector financial services companies), with more emphasis on retaining the capacity to quickly increase liquidity provision when needed than on maximizing current profit distribution.”

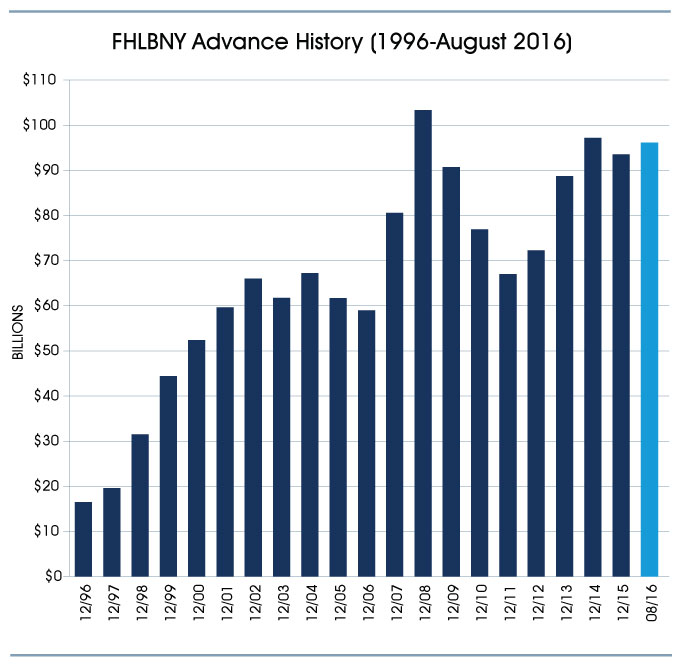

It is the daily availability of this liquidity that makes us a reliable partner for our members. S&P notes that each individual Federal Home Loan Bank’s business position is strong, due in no small part to “the established market position each has within its own district.” We believe that, for our members in New Jersey, New York, Puerto Rico and the U.S. Virgin Islands, there is no more stable partner than the Federal Home Loan Bank of New York. And our business position is indeed strong: at the end of the second quarter, our cooperative had the third-highest net income, advances and assets in the System, as well as the second-highest advances-to-assets ratio. Over the summer, we continued to grow our advances, ending August 2016 with an advances balance of $96.2 billion. This represents an increase in advances of $7 billion as compared to the same period a year ago. As the uncertainty has continued in the economy, our members have increasingly turned to the Federal Home Loan Bank of New York for the liquidity to meet your funding needs, and the products and programs that help you meet the needs of your communities. Our membership is broad and diverse, with institutions of all types and sizes active in driving advances and allowing our funding to reach every part of our District. Our membership spans institutions with different asset sizes, different business models and different areas of focus. But all are bound by a shared commitment to the communities they serve. We share this commitment, and are proud to be a trusted partner to every member of our cooperative.

As we enter the fourth quarter, we continue to focus on this trusted partnership as we work with our members to ensure that we all close out 2016 on a strong note. Our cooperative continues to perform well, and in the coming months we will announce our third quarter results and dividend declaration. We will also announce our 2016 Affordable Housing Program grants, which reflect a cooperative that meets the housing needs of its communities. And each and every day, our funding will be available to our members, reflecting the critical role that our cooperative, and all the Federal Home Loan Banks, continues to play.

Sincerely,

José R. González

President and Chief Executive Officer

FHLBNY SOLUTIONS

Money Fund Reform and the Impact to FHLBNY Funding Rates

Money Fund Reform (MFR), due to be fully implemented on October 14, 2016, has already had a significant impact on the FHLBNY’s cost of funds, and has improved our short-term rates as they compare to LIBOR. The new MFR regulations are designed to help prevent systemic financial instability by reducing the impacts of potential “runs” on money funds by large institutional investors during crisis scenarios. The new reform provisions are as follows:

Floating Net Asset Value (NAV):

Institutional non-government money funds (prime funds and tax-exempt municipal funds) will be subject to floating NAVs. This is a big concern because investors in money funds often have investment policies that either prefer or require a stable NAV.

Limitation on Withdrawals and Fees:

During stress scenarios, the rules will afford all money-market funds the option to impose “gate provisions,” which would temporarily prevent investors from making withdrawals. Liquidation fees of up to 2% can also be imposed.1

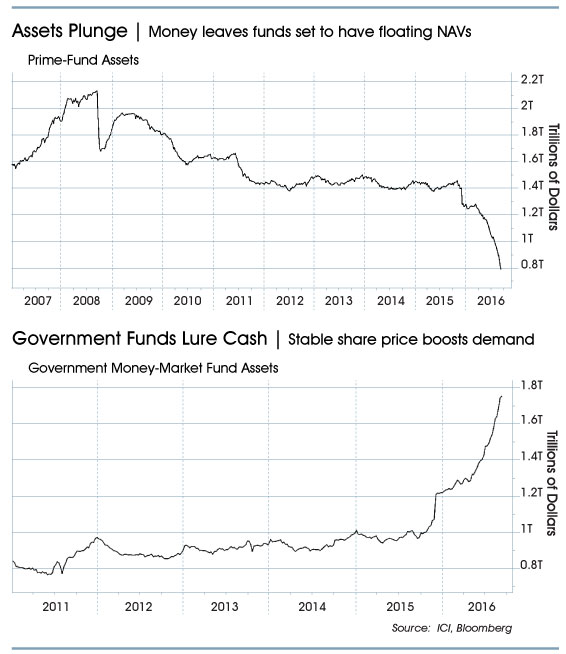

With the impending new reform set to take place within the next few weeks, funds have migratedsignificantly outof prime funds and into government money-market funds (see charts on the right). Since the start of 2015, prime-fund assets have plunged by approximately $700 billion (as of August 31), most of which occurred in 2016 ($500 billion approximately). This massive outflow has negatively impacted demand for bank and other corporate short-term debt instruments and has driven up their cost of funds as a result.

It is unknown as to the magnitude of investors that are waiting until October 14 to make a fund switch — some believe that prime funds could lose an additional $200-$300 billion once MFR is fully implemented next month. While some investors may be waiting to move their money in order to reap the benefits of higher yielding prime funds for as long as possible, prime fund managers are preparing for additional potential outflows by shortening the weighted average maturities of their underlying portfolios.

Impacts to the FHLBNY Cooperative

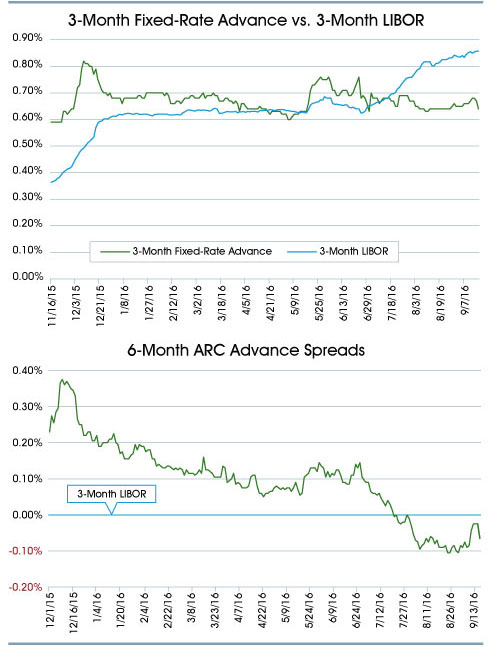

Growth of government money-market funds has heightened demand for GSE debt, including Federal Home Loan Bank (FHLBank) discount notes, which serve as a core investment for many government money-market funds. Increased demand for FHLBank debt has served to improve the cooperative’s cost of funds and member borrowing rates. The massive flight of cash from prime funds has also dampened demand for bank commercial paper and certificate of deposit offerings. Consequently, unsecured lending rates have risen. The current 3-Month LIBOR rate of 0.86% (as of 9/21/16) has reached a level not seen since 2009. Our regular 3-Month Fixed-Rate Advance rate compares very favorably to 3-Month LIBOR, and is currently 22 basis points under that benchmark rate (as seen in the chart above). In fact, since December 1, 2015, our 3-Month advance rate improved by 44 basis points as compared to 3-Month LIBOR. These attractive short-term rate levels have created increased demand for FHLBNY advances. Should 3-Month LIBOR remain elevated post-MFR implementation, we believe that heightened advance demand will persist at the FHLBNY and throughout the FHLBank System.

Rates on short-term Adjustable Rate Credit (ARC) Advances have also shown improvement. Looking at the rates of our 3-Month LIBOR ARC Advance with a 6-month term (as seen in the chart on the right), it would have cost a member 3-Month LIBOR plus 20 basis points to book at year-end 2015. If a member booked the same 6-month ARC on September 16, it would have cost a member 3-Month LIBOR less 6 basis points.

Short-Term Advances and Final Considerations

Since the financial crisis, many of our members have been keeping their advances “short” to fend off margin compression and boost bottom line earnings. With MFR shortly taking effect, our members are still benefitting from low and even more stable funding costs that compare very favorably to LIBOR. Once MFR is fully implemented we should have a better understanding in regard to its lingering impacts.

As always, the FHLBNY strives to offer solutions to help meet the liquidity and funding needs of our members. If you have any questions on MFR or any strategy discussed in this article, please contact your Relationship Manager at (212) 441-6700.

1Both institutional and retail prime funds will have a “gate provision” where redemptions can be temporarily suspended for up to 10 days and a liquidation fee of up to 2% could also be imposed if the fund’s liquid assets falls below 30%. Government money-market Funds could “opt in” and structure their funds with “gates” and fees as well.

Take Advantage of the FHLBNY’s Education Program

Could your institution benefit from a financial planning workshop or educational training? We often customize education programs for members to help maximize profitability and assist with their strategic planning. The following programs are offered upon request.

MEMBER-DIRECTOR EDUCATION PROGRAM

Specifically created for directors and managers of member institutions. This program is customized to address members’ specific needs and concerns and will cover a wide range of issues commonly faced by most community lenders. We can visit the member‘s institution, or host their team at our corporate headquarters in New York City.

MUNICIPALITY EDUCATION

Customized workshop for members and their municipal customers to discuss the FHLBank System, the potential advantages of the MULOC and Refundable MULOC, the importance of the product’s triple-A rating, and the mechanics of the issuance process.

STRATEGIC FINANCIAL PLANNING WORKSHOP

Offered in partnership with Parliment Consulting Services, Inc., this hands-on workshop focuses on strategic financial planning to help members gain and maintain sustainable earnings growth.

Contact your Relationship Manager to schedule a program and discuss your specific needs at

(212) 441-6700.

Keep Securities Unencumbered & Enhance Margins with the Municipal Letter of Credit (MULOC)

Through the FHLBNY’s MULOC program, members can utilize their whole-loan mortgage collateral to secure municipal deposits, in lieu of directly pledging security collateral. As a result, members can enhance their liquidity positions by keeping security collateral unencumbered. Additionally, operational expenses may also be reduced as the value of our MULOC will not change with market conditions during the term of the Letter of Credit, whereas the value of security collateral fluctuates, requiring continuous monitoring and the potential of margin calls throughout the life of the municipal deposit. Lastly, the MULOC enables members to deploy their liquidity in higher-yielding assets such as loans instead of investing in lower-yielding security collateral.

Please visit our MULOC page to learn more about the program or consult your Relationship Manager at (212) 441-6700.

Have You Considered the Economic Impact of Your Dividend?

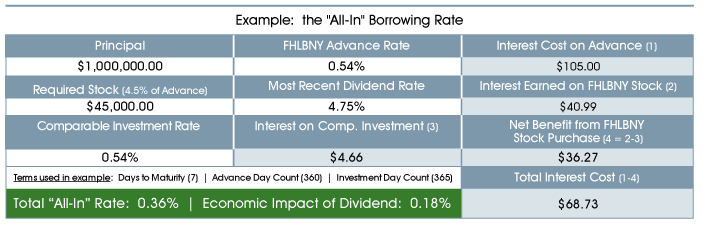

Members may wish to keep in mind the potential economic benefit of the FHLBNY’s dividend, which, depending on the advance term, can substantially lower the “all-in“ borrowing cost of an advance. The FHLBNY has an activity-based capital stock requirement equal to 4.5% of its outstanding advances. The performance of our capital stock has been historically strong, and has benefitted members by offsetting or lowering the “all-in” cost of the advance.

For example, if your institution borrows a one-week advance for $1 million at 54 basis points, with a capital stock requirement of $45,000 (with a dividend yield assumption of 4.75%), the net income from the activity based stock purchase would effectively reduce the interest expense of this trade by $36.27, or effectively lowering the “all-in” rate to 36 basis points — 18 basis points less than the coupon rate.

As illustrated in the example below, the economic impact of our activity-based capital stock can be determined by comparing an alternative investment yield to that of our dividend. Assuming you can receive an alternative short-term investment yield equivalent to the cost of the advance (54 basis points in this case), the positive spread created by the yield of our stock dividend effectively lowers the overall cost of the transaction, and quite substantially in the shorter tenors. For longer-term advances the dividend would impact the borrowing cost to a lesser degree; however, a benefit would remain and the “all-in” borrowing rate would be lower than the regular posted rate.

Please note: Although FHLBNY capital stock has been high-performing and has had a very competitive dividend rate for an extended period of time, the dividend rate is not guaranteed, and as such, it may fluctuate throughout the life of the advance. The economic impact of the stock dividend will vary based on the actual dividend rate.

HIGHLIGHTS / NEWS & UPDATES

Welcome New Members

Since our last edition, the FHLBNY has welcomed three members into our cooperative:

Brunswick Bank and Trust Company

Edge Federal Credit Union

St. Joseph’s Parish Buffalo Federal Credit Union

Industry Events & Holidays

For the upcoming industry events please visit the “Industry Events” section. Please also note the FHLBNY will be closed in observance of the following national holidays.

November 11: Veterans’ Day

November 24: Thanksgiving Day

December 26: Christmas Day (observed)

Latest News

07/23/2025

FHLBNY Announces Second Quarter 2025 Operating Highlights

07/11/2025

$2.8 Million in Additional Funding Added to the 0% Development Advance (ZDA) Program

07/10/2025

Report from the President: Driving Communities Forward

02/22/2023

Notice of FHLB Members Selected For Community Review (Effective February 23, 2023)

07/28/2021

An Enhancement to our Callable Adjustable Rate Credit Advance (Callable ARC)