Member Advantage

Balance Sheet Positioning in the Current Rate Environment

July 2015

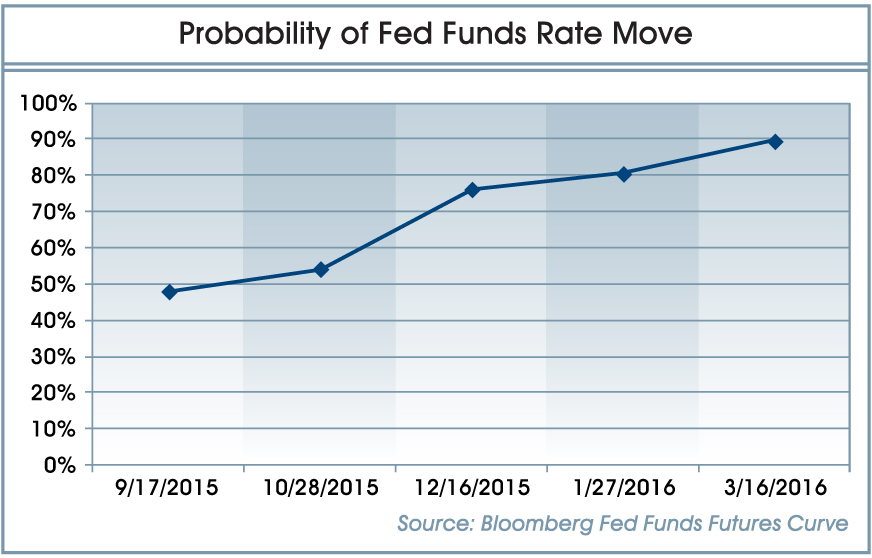

Improving economic metrics, coupled with the Federal Reserve’s consistent guidance that they are poised to raise short-term interest rates indicate we may finally be approaching a rate hike in the near term. According to the Federal Funds Futures Curve, there is a 76% probability of a Fed Funds rate hike by December 2015, with the probability increasing to almost 90% by the March 2016 Federal Open Market Committee meeting (see following chart). Although regulators are concerned about the impact of a rising rate environment, the consensus of members is that higher rates with a steeper yield curve are key to a brighter future. So, if rising rates are generally welcome, what are the other major concerns facing our membership — and how can the FHLBNY help address these issues?

Concerns Regarding a Flattening Yield Curve

Although most members welcome higher long-term rates, they will not necessarily follow at the pace of short-term rate hikes. The long-end of the U.S. Treasury Yield curve has experienced significant downward pressure due to global economic weakness and strong demand for U.S. Treasury Debt. Rising funding costs absent of increased opportunities on the asset side of the balance sheet is a significant issue that will further stress net interest margins. This pressure is compounded by consistently increasing operational costs.

Concerns Regarding a Persistent Low-Rate Environment

Although being prepared for a rising rate environment is critical, preparing for static or declining rates is equally important. What if rates change little over the next several years? Positioning the balance sheet for just one scenario is a huge bet on the direction of interest rates. Your analysis should encompass multiple scenarios so that you can position your balance sheet for earnings and capital growth in all scenarios and not be overly sensitive to unexpected developments. Furthermore, remaining asset-sensitive may make sense for an impending rising rate environment; however, if rates stay persistently low (as they have), earnings and capital growth in the near and long-term horizon will be sacrificed. Although short-term rates are expected to rise by a modest amount this year, this action is not necessarily indicative of a Federal Reserve’s tightening stance, but rather perceived as a reduction to the level of significant accommodation, which has been in place since the financial crisis of 2008. Technically the recession has been over since mid-2009, but a robust recovery has been elusive. Is your institution positioned to maximize earnings and capital should rates remain very low for years to come?

Concerns Regarding Pressure on Core Deposit Levels

The “surge” of liquidity accumulated post-crisis has largely been parked in non-maturity deposit accounts, which are traditionally classified as “core” with long-term retention assumptions. Initially, these deposits were thought to be ephemeral; however, they have stuck around long after the financial crisis. Regulators are concerned that rising rates could cause these deposits to rapidly outflow in search of higher returns, altering interest rate risk positions and stressing liquidity. Further pressure on “core” deposits exists as larger institutions are strongly competing for these funds as they move toward compliance with the new Interagency Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR) measures.1 Both measures look toward the stability of on-balance sheet funding and give significant value to retail deposits.

Asset Liability Management (ALM) Planning and the FHLBNY

The FHLBNY can help members optimize their balance sheet in preparation for the scenarios discussed. Match funding with term advances can assist members with retaining longer-term assets, boosting earnings, preserving spread, and fortifying capital while reducing interest rate sensitivity and helping to achieve ALM goals. You may wish to consider the following strategies to help maximize the balance sheet and enhance bottom-line earnings in multiple interest rate scenarios.

Laddering Strategy – Pool funding with a laddering strategy can enable members to grow assets while preserving spread in different rate environments and enhance profitability now. Consider using a series of regular Fixed-Rate or Amortizing Advances structured to match the cash flows of long-term assets. From a marginal cost perspective, adding FHLBNY advance funding is often less expensive than a campaign to attract CD business and onboard customers.

Callable Advance – his advance affords members the option of extinguishing funding, in whole or in part, after a pre-determined lock-out period, either one time (European option) or on a quarterly basis thereafter (Bermudan option). The Callable Advance enables members to match-fund or pool-fund assets, lock in a spread, and enhance bottom-line profitability, while providing the flexibility to alter course in response to different interest rate and balance sheet scenarios, such as the following:

Faster Prepayment Speeds: If a Callable Advance is used to match-fund mortgage production or a pool of mortgagebacked securities, and prepayment speeds are faster than anticipated, the advance can be extinguished at no charge, either entirely or partially, depending on funding needs. It is not necessary to retain long-term funding if its need has been reduced or eliminated.

Balance Sheet Changes: Over the course of a multi-year matchfunding scenario, balance sheets often undergo significant change. In the event the deposit base changes and term funding is no longer needed, the advance can simply be extinguished. A member’s interest-rate risk position may warrant adding significant duration to their liabilities now, and the advance can be used with the full intention of extinguishing once the asset or liability mix changes in the future. If the member believes a rising rate environment could cause significant outflow of core deposits, they may want to add term Callable Advances to their liability mix now (if core deposit outflow is experienced, the member can retain this advance; if core deposit outflow is not realized, the advance can be extinguished).

Static or Declining Interest Rate Environment: There is no reason to retain “out of the money” funding when using the Callable Advance. In the event rates decline, a member can extinguish and rebook a new “at market” advance; if rates are static or increase moderately, the member may extinguish and rebook an advance with the same remaining life of the existing advance at a lower coupon rate.

Commercial Lending: With intense competition for commercial deals, lenders have been competing by extending the term of their offerings and adding interest rate risk in the process. The Callable Advance allows a lender to match-fund that production and lock in spread. In the event that a loan is prepaid, the Callable Advance can simply be extinguished at no cost.

Adjustable Rate Credit (ARC) Advance with a Cap – This product offers an adjustable rate tied to either 1-month or 3-month LIBOR, with an embedded cap. The ARC Advance with a Cap enables members to add term floating-rate funding to the balance sheet, with the benefit of a low initial coupon rate and the protection of a cap (which allows the member to lock in a maximum rate should short-term rates increase). This advance is a good option for members that need earnings and capital growth now and are willing to pay a higher coupon rate in the future, or feel that shortterm rates will not experience a significant increase over the term of the advance (but need the protection of the cap for ALM purposes). The embedded cap is particularly helpful in mitigating Economic Value of Equity at Risk, as this advance becomes “in the money” when running upward regulatory shock scenarios.

Fixed-Rate Advance with a LIBOR Cap – This product provides fixed-rate, term funding with an embedded 3-month LIBOR Cap. If 3-month LIBOR rises and breaks through the predetermined strike threshold, the advance will decline either a basis point for every basis point 3-month LIBOR is above the strike (1× multiplier) or a basis point for every 2 basis points 3-month LIBOR is above the strike (0.5× multiplier) flooring at zero. This advance allows a liabilitysensitive member to reduce funding mismatches with the added benefit of the cap — as rates rise the expense associated with this advance declines while expenses associated with other liability categories increase. The embedded cap is particularly valuable when conducting upward regulatory shock scenarios, as this advance quickly becomes “in the money” and assists with Economic Value of Equity at Risk. The May 2015 edition further discusses the benefits of this advance.

Understanding how to leverage your FHLBNY membership can be a critical component to navigate through today’s challenges. The FHLBNY is here to assist with all of your funding and hedging needs. Our product suite can help with mitigating risk, maximizing earnings, and positioning your balance sheet for success at different points in the interest rate cycle. The FHLBNY welcomes any feedback from our members on how our product suite could help you manage your balance sheet more effectively. All strategies discussed in this article should be carefully considered, and, if you have any questions, consult your Relationship Manager at (212) 441-6700.

1 The U.S. Interagency LCR measures an institution’s liquidity available to cover short-term liquidity needs over a 30-day stress scenario, while their NSFR calibrates the required and available “stable” funding looking out over a 1-year time horizon. The LCR is being phased in over a multi-year time horizon that started in January 2015. The NSFR is in the proposal stages and its planned “rollout” is not expected to be until 2018.

Latest News

06/10/2025

Report from the President: The Silent Stabilizer of the Banking System

04/28/2025

FHLBNY Affordable Housing Advisory Council Open Nomination Period – For 2026 Service

04/24/2025

FHLBNY Announces First Quarter 2025 Operating Highlights

01/20/2023

2023 Update to the Member Products Guide & Correspondent Services Manual

07/20/2021

RSA SecurID® for 1Link-IPR Coming Soon