Member Advantage

REPORT FROM THE PRESIDENT

First Quarter 2017

A Reliable Partner for the Communities We All Serve

Our housing mission is vital to our cooperative: it shapes our culture, supplements our commitment to the community and strengthens our partnerships with our members. Our Affordable Housing Program, First Home Clubsm and Community Lending Programs provide our members and our cooperative with the ability to make immediate and lasting investments in neighborhoods, towns and cities across our region. Through these programs, we promote stability in communities and create opportunities for families and individuals to grow.

Our housing mission is vital to our cooperative: it shapes our culture, supplements our commitment to the community and strengthens our partnerships with our members. Our Affordable Housing Program, First Home Clubsm and Community Lending Programs provide our members and our cooperative with the ability to make immediate and lasting investments in neighborhoods, towns and cities across our region. Through these programs, we promote stability in communities and create opportunities for families and individuals to grow.

Last year, we focused on expanding the reach of our housing mission. We created an internal Affordable Housing and Community Investment Committee, drawing on expertise from across the FHLBNY to help ensure that our housing programs have the full strength of our franchise behind them. Throughout 2016, we substantially increased our member education and outreach initiatives to raise awareness of all of our affordable housing and community lending programs.

This outreach resulted in the highest number of project applications ever submitted for a single AHP funding round. This is a record we hope does not stand for long: we will begin taking applications for our 2017 AHP funding round the week of April 24th, and we hope to set a new mark for member participation this year. On March 21st, we filed our 2016 Form 10-K, and, in that filing, we reported that we have set aside $44.8 million from our 2016 earnings to fund the Affordable Housing Program and First Home Clubsm(FHC) this year; of which, $33.2 million is allotted toward AHP. And this year, the reliability of our grant funding is even more important as the possibility of tax reform and other market challenges have the potential to reduce funding from other sources.

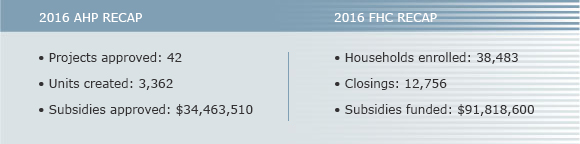

Last year, we awarded $34.5 million in AHP subsidies to help fund 42 affordable housing initiatives, creating or rehabilitating 3,362 affordable housing units, including more than 2,200 units dedicated to very low-income housing and more than 3,200 units of vital affordable rental housing. We also helped create 1,693 new homeowners through First Home Clubsm funding, which totaled $13.5 million in 2016. But we know that these numbers cannot truly capture the importance of our housing mission. Rather, that is reflected in the people these programs help.

The affordable housing initiatives we support through our housing programs have a real impact on real lives, and every year we are honored to partner with our members and housing partners on our AHP grants to help make these lives better by providing quality affordable housing. The continued success of the AHP reflects the commitment we share with our members to the communities we all serve. This success is seen is homes and neighborhoods across our region. I thank our members for participating in the program, and I look forward to your continued participation when the application process begins later this month.

FDIC Publishes Federal Home Loan Bank Product Guide

The Affordable Housing Program is but one of the many programs and products available to our members that comprise the value of membership in the Federal Home Loan Bank. Throughout the year, we are in constant contact with our members through visits, training sessions and publications such as this to ensure that each of our members is maximizing this value. For example, within the pages of this newsletter we have provided articles on funding solutions to enhance member earnings and the all-in value of membership. I would also like to report that, on April 6th, the FDIC published the Affordable Mortgage Lending Guide, Part III: Federal Home Loan Banks. This guide is aimed at helping local lenders learn more about products and programs offered by the Federal Home Loan Banks, including advances, the Affordable Housing Program, Community Investment Program and the MPF® Program. These materials can be found at the Affordable Mortgage Lending Center, an online resource center featuring data, fact sheets, and mortgage lending studies produced by the FDIC and other federal agencies. Of course, if you have any questions on your membership or the products and programs we offer, please do not hesitate to contact us. We want to make sure you are getting the most out of being a member of our cooperative.

José R. González

President and Chief Executive Officer

FHLBNY SOLUTIONS

Ways to Enhance Earnings & Expand Your Value

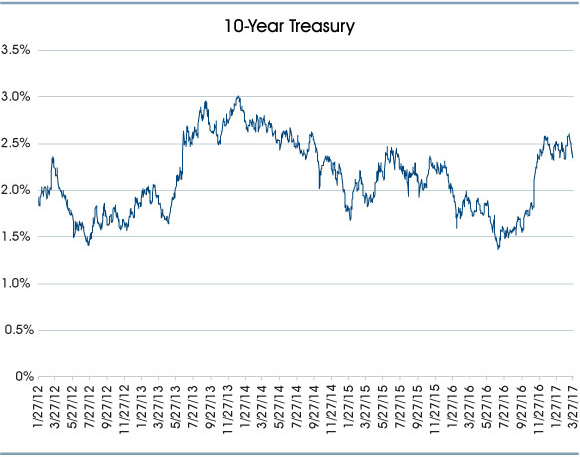

As we end the first quarter and begin the second quarter of 2017, we still face a relatively flat yield curve with a Fed Funds rate of 1% and a 10-year Treasury yield hovering just below 2.50%. Although the longer end of the yield curve has experienced significant upward movement since the 2016 elections, the past two Fed Rate moves have flattened the slope of the yield curve, further pressuring Net interest Margins (NIMs).

The 10-year Treasury is averaging 2.45% year-to-date for 2017 — up only 28 bps from the average of the prior three years (2.17%), although up over 100 bps since its recent low of 1.37% (recorded on July 6, 2016). Despite economic metrics pointing to an improving economy, which is expected to fuel stronger loan demand for our members, wider margins have yet to be fully realized. We’ve all heard much talk about rising interest rates, especially with current political and fiscal policy stances appearing to move us toward an era of decreased regulation and the potential of massive economic stimulus, which combined could be significant fuel to propel GDP beyond the current 2% range. However, if global geopolitical and market influences continue to put pressure on the long end of the yield curve, members will still be faced with the issue of a flat yield curve and narrow NIMs, albeit with a higher volume of loan originations due to increased lending activity.

Financial institutions are certainly traversing through “murky waters.” The following are some thoughts and strategies to consider as you navigate through the current landscape, presented to potentially help position your institution for a variety of different scenarios in the years ahead.

Enhancing Earnings Now

As mentioned in previous editions of the Member Advantage, we often see members positioning their balance sheets for a rise in rates, neglecting the forgone income in their assessments of risk should rates not rise. With the significant NIM pressure we’ve been experiencing over the past several years, sitting on excess capital is foregone income, forgone capital growth and missed opportunity. The FHLBNY can provide you with strategic funding solutions that could help you boost bottom-line income, achieve balance sheet growth and capitalize on opportunities while mitigating risk.

Leverage Capital with Regular Advances

Many members leverage their capital through FHLBNY financing when their asset growth surpasses that of their deposit growth. Our members’ product of choice is generally Fixed-Rate Advances, either short-term or long-term to match-fund longer term assets. During the post-financial crisis era, a large part of our advance book was relatively short-term, so that members could enhance earnings during a period where there was no clear indication of rate increases on the horizon. Due to the uncertainty in the long end of the Treasury curve, many members are still “rolling short” and waiting for pressure on the long end of the curve to subside. Conversely, some members view that the current rate environment still offers relatively cheap funding and are locking in term advances now to be prepared for rising rates. It all depends on your institution’s asset liability management (ALM) position and market sentiment.

Manage Liquidity “At the Margin”

We often hear of our members running deposit raising campaigns and offering preferential rates to attract term deposits as a way of managing their interest rate risk. Attracting new customers and “mining” your existing customer base is understandably critical when building franchise value. However, we’ve also heard of deposit raising campaigns being costly and how offering preferential rates have cannibalized the deposit base as existing customers shift their funds into higher-yielding deposit products. Managing interest rate risk with customer CDs can also be risky, largely due to the inefficient “breakage fees” that are often present in CD agreements (i.e., in the event alternative investments become very compelling, customers could move their funds out of your institution, regardless of breakage fees).

Partnering with the FHLBNY to help manage both your liquidity and interest rate risk position may make better sense due to the operational ease and overall cost of booking an advance. FHLBNY funding is available immediately, giving you the ability to obtain the structures you require when you need them, with the reliability that these funds will remain on your books for the entire term of the advance.

Pre-Invest Future Cash Flows

During the course of your balance sheet modeling, you may have upcoming principal and interest payments that you wish to deploy immediately. Short-term FHLBNY advances can potentially enable you to book securities or loans investments now in anticipation of the future cash flows, and immediately start realizing net interest income.

Match-Fund with Callable Advances

The FHLBNY’s Callable Advance gives members the option to extinguish the borrowing with no prepayment fee, in whole or in part, after a pre-determined lockout period. Members can either purchase a one-time option to extinguish (European) or can purchase an option to prepay on a quarterly basis (Bermudan) after the lockout period. There is a small premium on this advance depending on the term and the length of the lockout; however, the flexibility this funding affords could prove to be very valuable. So why use the Callable Advance?

1. Should rates remain static, decline, or move up slightly, you can extinguish after the lockout period and rebook an advance at a lower rate with a similar remaining average life, which could greatly reduce the average cost of the strategy.

2. If your deposit base or asset mix changes where you no longer require long-term funding, you may simply extinguish at no charge. If you require term funding to bring your institution in alignment with your ALM tolerance levels, you may book a term Callable Advance with the intention of restructuring your balance sheet and extinguishing after the lockout.

3. If prepayment speeds on mortgages are faster than anticipated, you may partially extinguish a Callable Advance and maintain the exact amount of term funding you require. If mortgages prepay entirely, you won’t be straddled with unneeded term funding – you can simply extinguish.

Prefund New Branches

Members have used our short-term advance options to prefund activity of new branches. Based on budgeted future inflows of deposits, members can maximize profitability immediately at the new branch by using FHLBNY liquidity to start growing its asset base. When deposit gathering efforts start to gain traction, members can simply pay off their short-term borrowings.

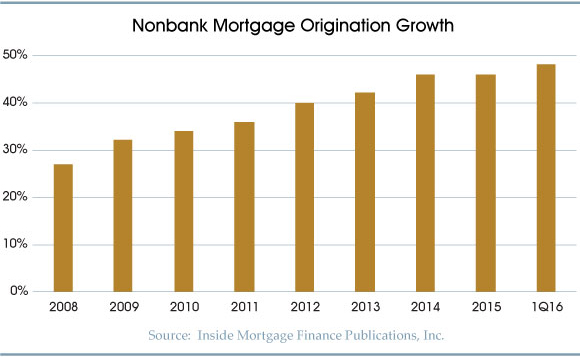

Using Advances to Upgrade Mortgage Lending Delivery Systems

We have a wide diversity of lenders within our cooperative that provide valuable personalized service, which often gives them a competitive advantage when dealing with the unique circumstances of their customer base. However, there has been an undeniable transformation occurring in the mortgage lending landscape due the rapid evolution of financial technology platforms over the past several years. “Frictionless lending” is the term that has been coined for the technology that allows customers to obtain mortgages and other loans via their smart phones and the Internet, and is fast becoming the norm. This technological evolution is evident by the trend in residential mortgage underwriting, as there has been explosive growth amongst nonbank mortgage originations over the past several years. Inside Mortgage Finance Publications, Inc. reported that in 2008 nonbank mortgage originations accounted for 27% of all mortgage originations, and in almost eight years climbed to approximately 48% as of Q1 2016. It is estimated that nonbank originations have recently surpassed that of banks and accounted for over half of all mortgage originations in the U.S. as of Q3 2016.

As the members of the millennial generation, the largest cohort of the population in the U.S. (estimated to be over 90 million) become more active participants in the economy and housing market, the availability of reliable mobile delivery systems will become even more important. In short, our view is that technological development cannot be ignored — it must be embraced. The time is now for members to consider enhancing their technology-based platforms in order to remain competitive and relevant in mortgage underwriting and in other lending sectors.

How can the FHLBNY help you facilitate technological advancement with respect to your mortgage lending platforms? FHLBNY liquidity can be used to finance your technological infrastructure investment, with the appropriate product structure and term options to suit your needs. Members have built up an abundance of available collateral in the last few years as the FHLBNY expanded collateral opportunities and worked with members to maximize borrowing capacity. We believe that earmarking some of your “dry powder” to invest in your future is a good pursuit in the present. The FHLBNY is committed to supporting your long-term sustainability. To discuss funding options and any strategy discussed in this article, contact our Member Services Desk at (212) 441-6600 or your Relationship Manager at (212) 441-6700.

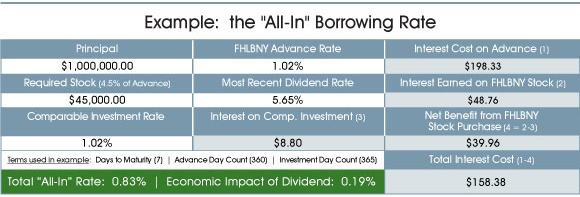

Consider the Economic Impact of Your Dividend

Members may wish to keep in mind the potential economic benefit of the FHLBNY’s dividend, which, depending on the advance term, can substantially lower the “all-in“ borrowing cost of an advance. The FHLBNY has an activity-based capital stock requirement equal to 4.5% of its outstanding advances. The performance of our capital stock has been historically strong, and has benefitted members by offsetting or lowering the “all-in” cost of the advance.

For example, if your institution borrows a one-week advance for $1 million at 102 bps, with a capital stock requirement of $45,000 (with a dividend yield assumption of 5.65%), the net income from the activity-based stock purchase would effectively reduce the interest expense of this trade by $39.96, or effectively lowering the “all-in” rate to 83 bps — 19 bps less than the coupon rate.

As illustrated in the example below, the economic impact of our activity-based capital stock can be determined by comparing an alternative investment yield to that of our dividend. Assuming you can receive an alternative short-term investment yield equivalent to the cost of the advance (102 bps in this case), the positive spread created by the yield of our stock dividend effectively lowers the overall cost of the transaction, and quite substantially in the shorter tenors. For longer-term advances the dividend would impact the borrowing cost to a lesser degree; however, a significant benefit would remain making the “all-in” borrowing cost lower than the regular posted rate.

Please note: Although FHLBNY capital stock has been high-performing and has had a very competitive dividend rate for an extended period of time, the dividend rate is not guaranteed, and as such, it may fluctuate throughout the life of the advance. The economic impact of the stock dividend will vary based on the actual dividend rate.

NEWS / HIGHLIGHTS

Welcome New Members

Since our last edition, five members joined the FHLBNY cooperative:

Ameritas Life Insurance Corp. of New York

Transatlantic Reinsurance Company

Industry Events

For upcoming industry events, please visit the Industry Events section.

Latest News

07/23/2025

FHLBNY Announces Second Quarter 2025 Operating Highlights

07/11/2025

$2.8 Million in Additional Funding Added to the 0% Development Advance (ZDA) Program

07/10/2025

Report from the President: Driving Communities Forward

02/22/2023

Notice of FHLB Members Selected For Community Review (Effective February 23, 2023)

07/28/2021

An Enhancement to our Callable Adjustable Rate Credit Advance (Callable ARC)