Member Advantage

REPORT FROM THE PRESIDENT

First Quarter 2018

Disaster Relief Program Grants Introduced in Puerto Rico, U.S. Virgin Islands

In the second half of last year, in response to the devastation wrought by hurricanes Harvey, Irma and Maria, our team – at the request of the Board of Directors – developed a strategic framework for our disaster response efforts to ensure that we are best-positioned to work with our members to support relief and recovery efforts in any future disaster. This framework will allow us to more efficiently respond to disaster events in our District, focusing on the most effective forms of assistance and resources that we are able to provide.

In the second half of last year, in response to the devastation wrought by hurricanes Harvey, Irma and Maria, our team – at the request of the Board of Directors – developed a strategic framework for our disaster response efforts to ensure that we are best-positioned to work with our members to support relief and recovery efforts in any future disaster. This framework will allow us to more efficiently respond to disaster events in our District, focusing on the most effective forms of assistance and resources that we are able to provide.

And while the tools at our disposal include our Disaster Relief Loan Program – $1 billion of which we made available following these hurricanes, and which has provided support following past disasters, including Superstorm Sandy – our Community Lending Programs and even our Affordable Housing Program for more long-term recovery, we also created a pair of grant programs to respond to the specific needs in Puerto Rico and the U.S. Virgin Islands.

On March 19, we unveiled our Homeowner Recovery Grant and Small Business Recovery Grant programs. These programs, funded with $5 million approved by our Board, are administered by our Caribbean member institutions – the local lenders who know the needs of the communities as they continue to recover from last year’s storms.

These members are responsible for identifying grant recipients, and can partner with local non-profits as they do so, and will submit applications to the FHLBNY on behalf of these recipients. The Homeowner Recovery Grant Program provides up to $10,000 per household to owner-occupied single family primary residences in Puerto Rico and the U.S. Virgin Islands with household income at or below 140 percent of the area median income; while the Small Business Recovery Grant Program provides up to $10,000 to small businesses located in Puerto Rico or the U.S. Virgin Islands that sustained damage as a result of the hurricanes. The grants must be used to cover the cost of temporary and/or permanent repairs to homes and small businesses damaged as a result of the September 2017 hurricanes. We believe that having our members administer these programs will allow for the funding to most effectively reach the affected communities, to the benefit of households and small businesses as they continue to recover and rebuild.

A Strong 2017 For the Federal Home Loan Bank System

Last month, we reported on the Federal Home Loan Bank System’s 2017 performance. On March 23, the Office of Finance issued the System’s 2017 Combined Financial Report. In another strong year for the System, our cooperative shined brightly: we were the largest of the eleven Federal Home Loan Banks in terms of both advances and assets balances, had the highest proportion of advances-to- assets, and the second-highest net income.

Overall, Federal Home Loan Bank System advances increased by 3.7 percent in 2017,

closing out the year with more than $730 billion in funding

flowing through communities across the nation.

Fostering Diversity & Inclusion

We take pride not only in our position within the Federal Home Loan Bank System with regards to advances and income, but also in our commitment to fostering diversity and inclusion across our business, where our efforts have long positioned us as a leader among the Federal Home Loan Banks. Last month, we submitted our 2017 Diversity & Inclusion Annual Status Report to the Federal Housing Finance Agency, providing our regulator with a comprehensive account of the FHLBNY’s commitment to Diversity and Inclusion throughout the year. Though FHFA regulations on diversity are relatively new, the ideals of mutual respect, teamwork, and serving the diverse communities in our district have always been at the core of our corporate culture and are the driving force behind our diversity and inclusion efforts. Our collaborative approach to diversity and inclusion – which concentrates not only on employment but also governance, procurement, our capital markets activities and our Affordable Housing and Community Lending programs – also helps facilitate and strengthen the relationships we have with our employees and business partners. We foster diversity and inclusion across our business because it creates value, has a positive impact to our bottom line and our culture, is aligned with our mission and, most importantly, because it is the right thing to do. The responsibility for ensuring that diversity and inclusion is part of the FHLBNY’s business activities is enterprise-wide, from our Board – which reviewed and approved our annual status report at its March 2018 meeting – to our management team to all of our business functions. As we stated in our submission to the FHFA: “It takes a diverse and inclusive effort to have a diverse and inclusive workplace.” In 2017, we succeeded in fostering diversity and inclusion across our business and our FHLBNY, and as we move through 2018, we continue this focus for the benefit of our cooperative.

We are also focused on providing our members with the tools and information needed to navigate through our operating environment. In this issue of the Member Advantage, we offer insight into the funding environment as we see it, as well as potential strategies for finding opportunities in the current market.

Sincerely,

José R. González

President and Chief Executive Officer

SPECIAL FEATURE: FUNDING ENVIRONMENT RECAP

Operating Environment Insights

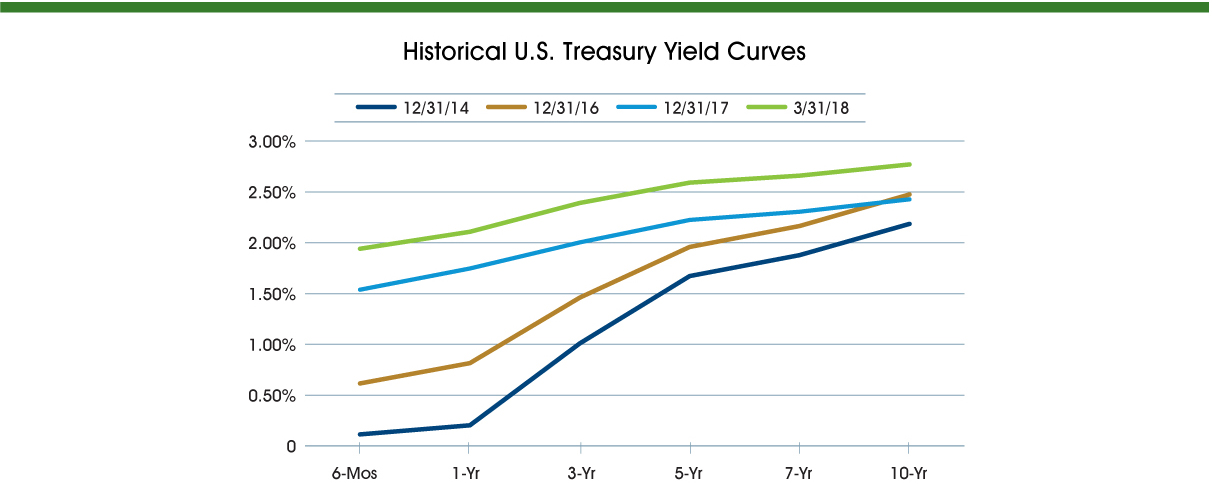

Now that six post-crisis rate hikes are behind us, the Fed continues to move forward with a tightening economic stance with the anticipation of more short-term rate hikes to follow. Although the overnight Fed Funds rate has increased by 150 bps, the long end of the yield curve has largely been range-bound. Since year-end 2015, the Fed Funds rate has climbed by 125 bps, while the 10-year Treasury has averaged 2.14%, and is currently only at 2.85%. Looking at the chart above, the current yield curve has experienced an upward shift since year-end 2017; however, it is still very flat, causing significant headwinds to our members’ net interest margins this year, absent a significant steepening.

Additional economic challenges include softer mortgage origination volumes resulting from rising rates and intense competition for retail funding. Welcome tax reform changes are adding to members’ bottom line earnings and capital, which leads to heightened appetites for funding to leverage that capital accompanied by a more aggressive posture when seeking loan growth. The rising rate environment is putting added pressure on deposits because there is a stronger risk of money outflowing as consumers seek higher returns. Adding to our dynamic banking environment is the potential for regulators to lift the total asset threshold defining Systemically Important Financial Institutions (SIFI) to $250 billion. Should the threshold be increased, the doors could be opened for heightened M&A as larger acquirers will no longer be dissuaded from executing smaller deals due to their diminished desire and need to obtain significant scale when seeking merger partners.

Deposit Trends

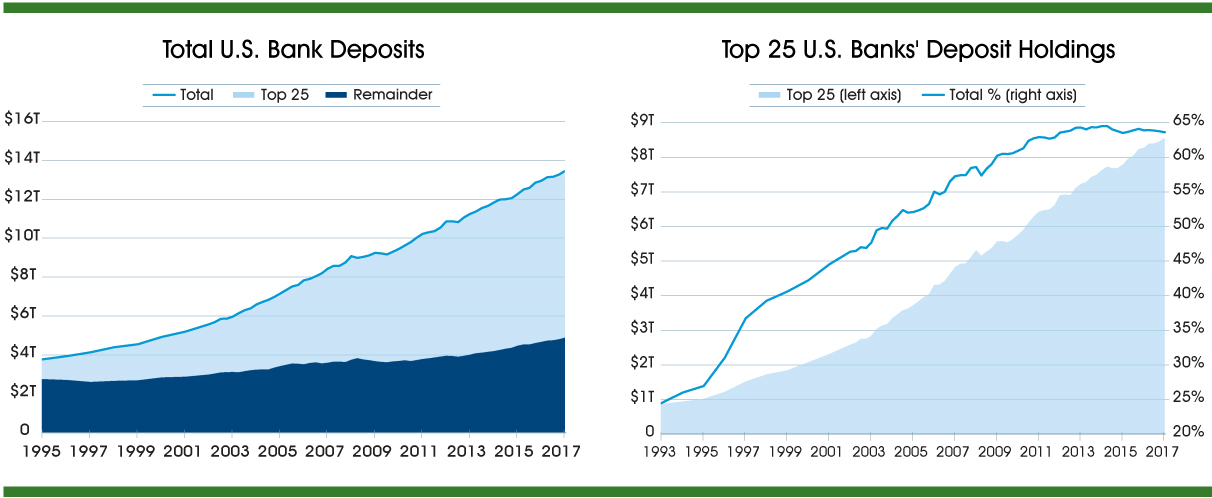

As mentioned in previous editions of the Member Advantage, competition for deposits has significantly intensified due to BASEL III’s post-crisis liquidity measures, and deposits are flowing in greater proportions to the largest of institutions who benefit most from having retail deposits as opposed to other funding sources. The rate of deposit growth amongst the largest of institutions has greatly surpassed the rest of the industry over the course of time, as illustrated in the following charts. The percentage of total deposits amongst the top 25 banks has approached 65%, up from the 25% range 25 years ago — an enormous transformation, which if sustained, may lead to more and more banking organizations to seek merger partners due to liquidity constraints.

Data source: USBanklocations.com.

FHLBNY SOLUTIONS

Leverage Membership to Achieve Your ALM Goals — the Time For Action Is Now

In today’s operating environment, community banking organizations are feeling the squeeze on liquidity as they seek to achieve balance sheet growth. Rising rates are putting deposits at risk of flight, rate competition is intensifying, and larger firms are investing heavily in technology to try to attract and retain retail deposits. Consider the following strategies to assist with overcoming the significant “headwinds” of the current operating environment.

Get Ahead of Potential Deposit Flight

Consumer indifference to deposit rates appears to have changed, and we are hearing that depositors have started to move their money as they are requiring be er returns. Heavy outflow of core deposits, which are long-term in nature, could materially alter your interest rate risk profile and make you susceptible to declining earnings and regulatory risk. We realize that the need to raise rates varies greatly based on region, and that is reflected among our membership. However, failing to act could limit balance sheet growth opportunities.

Achieve Balance Sheet Growth Amid Net Interest Margin (NIM) Presuure

Although NIM pressure has persisted post-financial crisis, the current operating environment is seemingly very different from the past nine years, with an extremely flat yield curve posing the potential risk of an inversion if the long-end of the yield curve does not steepen. Absent of a steepening yield curve, you may be able to stabilize Net Interest Income (NII) through additional asset growth, as many members have done post-crisis. As mentioned previously, this year’s tax reform will likely positively impact most members’ capital – so consider getting ahead of that capital increase by adding additional leverage now by either retaining mortgage production or by adding securities. Some members are adding securities now and structuring their cash flows to coincide with new loan growth.

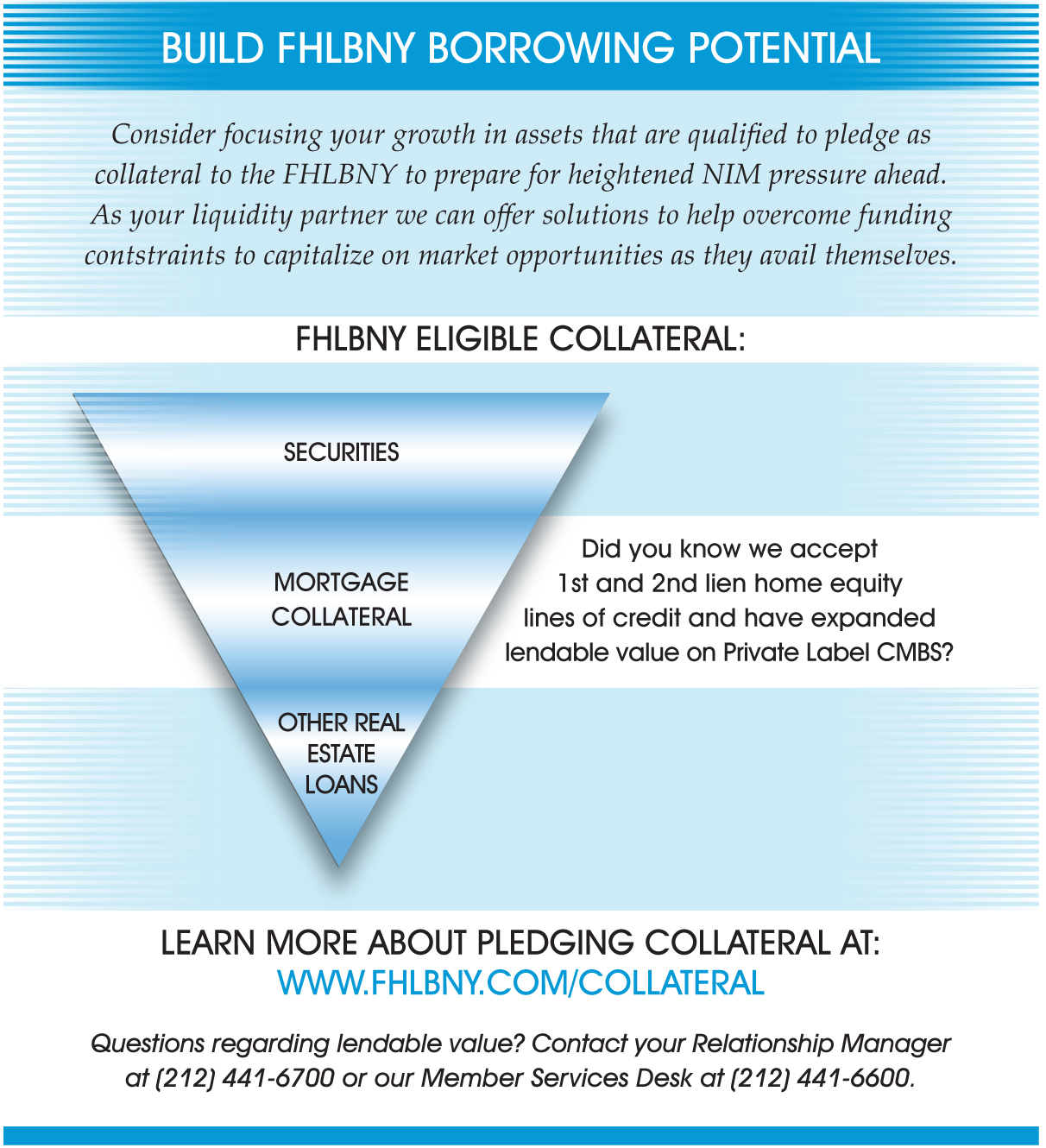

If you believe your balance sheet interest rate position could withstand longer-term assets, going further out on the curve to gain additional yield could be a prudent strategy. Important to consider is the ability to pledge these assets as collateral to the FHLBNY, so your liquidity position is not materially altered. Hedging long-term assets by layering in longer-term FHLBNY funding structures may also present a solution. The following FHLBNY advance products may assist with achieving your asset growth goals.

Regular Term “Bullet” Advances

The FHLBNY is pleased to assist its members with arriving at a funding structure that helps maximize NII while mitigating interest-rate risk. A “laddering” approach to funding term assets uses a mix of short-term and long-term regular advances. Depending on your ALM position, there may be periods of interest rate risk exposure on the horizon where long-term liabilities will be necessary to stay within your risk tolerance limits. Regular advances are straightforward and easy to model – their simplicity makes them the most popular advance category among our cooperative.

Consider adding symmetry to your regular advance for an additional two bps by requesting the Symmetrical Prepayment Advance (SPA) Feature. The SPA feature allows an advance to incur a gain which could be realized if the mark-to-market valuation becomes “in the money” during the life of the advance (When monetizing a gain in an advance with the SPA feature added, the advance would still be subject to a prepayment penalty, which would be deducted from the payout upon extinguishment). Advances with the SPA feature added could also potentially assist members who are looking for merger partners. Upon a merger we often see members conduct balance sheet restructurings that may include advance pay-offs. When considering a merger, whether you are an acquirer or are being acquired, there is an advantage of having gains in your liabilities that can be monetized, because there is a high potential these advances will be paid off upon commencement of the deal.

Callable Advances

The Callable Advance affords a member the option of prepaying an advance, in whole or in part, after a specified period of time, either on a one-time (European Option) or quarterly basis (Bermudan Option) without a prepayment fee. There is an upcharge for the “call” feature, which varies in cost depending on the pre-determined strike period and the ultimate term of the advance. However, the Callable Advance can potentially be an extremely valuable ALM tool and can assist in different rate and operating environments.

Static or Declining Rates

Should you elect to deploy a Callable Advance and rates remain static or decline, you will have the ability extinguish the advance at the strike date and rebook at a lower rate. You do not have to be “stuck” with an out of the money coupon rate on your advance.

Rising Rates

If rates rise, the Callable Advance will be fixed for its ultimate term. If you choose a “Bermudan” option, you will be ready to take action to strategically extinguish when entering a different point in the rate cycle.

Change in Balance Sheet Mix

What if your balance sheet mix changes and you no longer require term funding? Simply extinguish the Callable Advance and obtain the funding at the duration your balance sheet requires. If you are match funding a pool of assets such as mortgages, and prepayments are higher than expected, you can partially extinguish the funding, retaining the term funding you require.

Fixed-Rate Advance with a LIBOR Cap

This advance can be impactful in a rising rate environment. The structure is long-term and has a fixed coupon, but with the added feature of an embedded cap tied to 3-Month LIBOR (Cap). The Cap allows the advance coupon to reset downward (on a quarterly basis) after 3-Month LIBOR rises above a pre-determined threshold. When rates rise and your other liabilities reprice upward, the interest expense on this advance would decline and offer potential relief.

Adjustable Rate Credit (ARC) Advance with an Embedded Cap

The ARC Advance with an embedded cap offers a floating rate tied to a common market index (such as 1-Month or 3-Month LIBOR), and allows you to reduce current interest expense due to a lower initial coupon rate on the advance relative to locking in a term fixed-rate advance. However, this advance structure has the added feature of an embedded cap (of your choosing) that locks in the maximum rate you could pay during the term of the advance.

If you believe that we are heading toward a yield curve inversion with a potentially more accommodative Fed stance in the future, this advance could be leveraged to “ride down the curve” with a downwardly repricing coupon rate as short-term rates decline. If rates remain static, you will be paying less over the course of time, and the embedded Cap can potentially be helpful when conducting regulatory interest rate shock scenarios in the modeling of your balance sheet.

Use FHLBNY Letters of Credit to Secure Your Municipal Deposit Base

Our Municipal Letter of Credit (MULOC) affords members the ability to accept municipal or public unit deposits and use their whole-loan mortgages to collateralize those deposits. There are a number of benefits to using the MULOC versus using securities as collateral:

Enhances “on-balance sheet” liquidity

The MULOC encumbers your whole-loan mortgages, while keeping highly liquid securities unencumbered.

Operationally efficient

Securities collateral requires constant monitoring with continuous reporting to the municipality. The notional value of the MULOC does not change during its term.

Secure

MULOCs carry the reliability of FHLBNY’s triple-A credit rating. In the unlikely event that a default occurs with securities collateral, the municipality may be subject to market valuation risk when they take legal action to take possession of such collateral. In contrast, by accepting an FHLBNY MULOC, the municipality can submit the draw certificate to the FHLBNY for immediate payment.

Low Cost

Our MULOC is competitively priced to allow our members to use their liquidity for higher yielding assets such as loans, instead of lower yielding securities collateral. Refundable MULOCs are also available to collateralize transaction accounts more efficiently and economically. Contact us for a quote today.

Funds can be lent back into the communities

MULOCs allow a member to use the municipal deposit funding to lend back into the community, instead of locking that liquidity up in securities collateral – a meaningful point to your municipality.

We believe that the operating and interest rate environment in 2018 will be very dynamic with both headwinds and tailwinds on many fronts. If members are not on a growth trajectory, NIMs and capital positions could deteriorate. Staying relevant, growing earnings, and investing in people and technological infrastructure will be key to sustaining your organization for the long-term. The FHLBNY stands ready to assist you with your liquidity needs through a variety of funding structures.

We believe that the operating and interest rate environment in 2018 will be very dynamic with both headwinds and tailwinds on many fronts. If members are not on a growth trajectory, NIMs and capital positions could deteriorate. Staying relevant, growing earnings, and investing in people and technological infrastructure will be key to sustaining your organization for the long-term. The FHLBNY stands ready to assist you with your liquidity needs through a variety of funding structures.

If you have any questions about our advances and credit products, or the strategies mentioned, contact your Relationship Manager at (212) 441-6700 or our Member Services Desk at (212) 441-6600. We welcome the opportunity to present to your Board, management, and/or ALCO teams regarding these strategies or other topics of your choosing as you navigate through 2018.

NEWS / HIGHLIGHTS

Welcome New Members

Since our last edition, four members joined the FHLBNY cooperative:

Guardian Life Insurance Company of America

Nova UA Federal Credit Union

Ticonderoga Insurance Company

Western Division Federal Credit Union

Upcoming Events

The FHLBNY looks forward to connecting with our members and business associates in person at the following upcoming events. Please visit the Upcoming Events section on our website.

Latest News

07/23/2025

FHLBNY Announces Second Quarter 2025 Operating Highlights

07/11/2025

$2.8 Million in Additional Funding Added to the 0% Development Advance (ZDA) Program

07/10/2025

Report from the President: Driving Communities Forward

02/22/2023

Notice of FHLB Members Selected For Community Review (Effective February 23, 2023)

07/28/2021

An Enhancement to our Callable Adjustable Rate Credit Advance (Callable ARC)