Member Advantage

Why Regulators are Still Focused on Interest Rate and Liquidity Risk

By Guest Author Robert Colvin, Chief Executive Officer of Bank Strategies Group

February 2015

Not since the abolishment of Regulation Q in 1980 has the industry experienced game changing regulation that will materially alter the interest rate risk (IRR) positions and liquidity profile of all financial institutions. New BASEL III liquidity regulations now applicable to large banking institutions will compel them to hold core deposits like never before, resulting in both IRR and liquidity issues for the rest of the industry. Outside of the large banks to which the new regulations apply, few in the industry are aware of the implications and no one seems to care…except the regulators.

In addition, there are other changes in the industry that have occurred since the “great recession” that have intensified IRR and created liquidity concerns for regulators, such as:

the increase and extension of investment balances caused by the extended period of historic low interest rates;

the increase of deposits in the industry and the concern of what happens if/when these deposits leave; and

the change in the mix of deposits — 84% of all industry deposits reside in non-maturity deposits.

These issues, coupled with the potential for rising rates, have created a very difficult environment for IRR and liquidity risk management like we’ve never seen before. Let me explain.

Balance Sheet Changes as a Result of the “Great Recession”

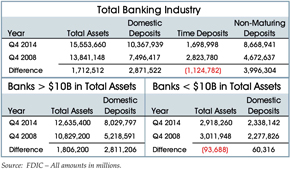

Since the “great recession” began (year-end 2008), money poured into the banking industry — $2.87 trillion in domestic deposits, as of the fourth quarter of 2014 reporting period. Regulators refer to this increase in deposits as “surge deposits.” Furthermore, given the nearly zero percent rate paid on deposits since the recession began, depositor preferences shifted from time deposits (CDs) to non-maturity deposits (checking, savings, and money market accounts). Both banks and credit unions have experienced this shift in depositor preference. Today, on average, 84 cents of every deposit dollar can immediately move off balance sheets or into a higher paying time deposit. The following tables highlight the deposit changes that have occurred since year-end 2008.

As you can see, virtually all of the growth in domestic deposits ($2.81 trillion) occurred in banks with total assets greater than $10 billion (108 banks). For the 6,481 banks nation-wide, the growth in domestic deposits was just $60.3 billion. Although we are now experiencing an uptick in loan growth, it is still securities that have grown most significantly. Given the extended period of historic low rates and a flat yield curve, many sought to preserve margins by investing in securities with longer maturities. Unfortunately, even with the extension in term, margins still declined.

As surge deposits exit depository institutions and large banks take steps to maintain (or even increase) their current deposit levels to comply with new liquidity requirements, the rest of the industry will have to compensate. Thus, the IRR and liquidity problem!

Liquidity Coverage Ratio (LCR)/Net Stable Funding Ratio (NSFR)

Both the LCR and NSFR regulations are mandated under BASEL III’s liquidity requirements, which resulted from the great recession. The objective of the LCR regulation is to implement a quantitative minimum liquidity standard that will ensure that large organizations maintain unencumbered, high quality liquid assets (HQLA) in an amount equal to or greater than their total net cash outflows over a 30-day stress period. HQLAs are primarily securities with 0% and 20% risk weightings. Sources of funding that are considered less likely to be affected at a time of liquidity stress are assigned significantly lower outflow rates. Conversely, types of funding that are historically vulnerable to liquidity stress events are assigned higher outflow rates. The final LCR regulation was issued in October 2014 and began to take effect in January 2015 for institutions with assets greater than or equal to $250 billion. Modified requirements apply to institutions with assets between $50 billion and $250 billion, and will begin to take effect in January 2016.

The NSFR regulation is focused on a longer-term time horizon. The objective of the NSFR is to limit overreliance on short-term wholesale funding and increase the amount of “stable funding” over a one-year time horizon based on specific liquidity risk factors assigned to assets, off-balance sheet liquidity exposures, and other contingent funding obligations. The objective of the standard is to ensure that stable funding exists on an ongoing basis over one year to cover an extended stress scenario (stress scenario defined by regulation). The NSFR ratio is defined as: stable funding/weighted long-term assets. The definition of “stable funding” and “weighted long-term assets” are defined by the new regulations. The ratio must be at least 100% for banks to be compliant.

The balance sheet component that is given the most favorable treatment for both regulations are “stable retail funds,” generally thought of as core deposits. For the LCR calculation, the larger the higher balance of these deposits, the lower the amount of HQLAs required to maintain. In the NSFR calculation, the larger the balance of these deposits, the more long-term assets the institution can support.

The LCR and NSFR requirements are game changers because they create new competition for core deposits. As the economy improves, and if surge deposits leave the industry, all depository institutions will feel the impact, and the magnitude could be significant. As mentioned earlier, $2.87 trillion in surge deposits flowed to depository institutions post crisis. Even if the industry experiences a 40% outflow of these funds, you are talking $1 trillion in deposits that could potentially need replacement. Further complicating the matter is the fact that approximately 84% of these deposits can be moved immediately. All of this gives good reason for regulator concern.

No institution, regardless of size, can escape the reality of what’s on the horizon. Depositors have suffered through anemic returns for years, and when the needle moves on rates, they may rapidly move their funds to seek higher returns elsewhere. No one will be able to escape the price competition for deposits that will likely develop. Already there are signs of this trend beginning in select markets, and all of this magnifies IRR and liquidity risks. For those institutions that have assumed their deposit base is secure, it is my guess they have not fully considered the unintended consequences of the LCR and NSFR regulation. Even though these regulations are only applicable to the largest institutions, they are a game changer for our industry, and their ramifications should be carefully considered and monitored.

Steps to Consider Regarding IRR and Liquidity Risk

The purpose of IRR models is to allow institutions to be proactive and understand the potential risks that may lie ahead under different scenarios. However, the primary concern regulators have today is that institutions do not fully grasp the potential IRR risks on the horizon, and as a result, have not reflected these risks in the assumptions that drive their modeling results. As a consequence, reports being created for senior managers and board of directors suggest the institution has little if any IRR, when in reality the risks may be substantial.

The FDIC, along with the other federal regulators, has long emphasized the importance of an annual independent review of IRR management systems. An independent review by a qualified third party is critical given the challenges facing all institutions today. As stated in December 2014 issue of the FDIC’s publication Supervisory Insights, “An effective independent review provides the board with assurance that the IRR measurement system produces results that are reliable and relevant for strategic business decisions.” Your IRR model is only as good as its assumptions — without proper validation of your modeling inputs, without back testing your results, and without properly thought-out scenario analysis, you will be flying blind into a potentially perfect storm.

The most important thing you can do today is implement an independent review of your IRR process by a well-qualified third party — one that can challenge internal assumptions and validate that the IRR process is sound. It is critical that the risks reported to senior managers and directors are credible so risk limits can be fully understood and adhered to for more effective decision making. In addition, contingency funding plans must be evaluated and ready for action. Making sure the IRR modeling and liquidity planning process is sound will provide all institutions with the confidence to take charge as events unfold.

As surge deposits leave the industry, every depository institution will be impacted in one form or another. The funding options the FHLBNY provides offer a wide variety of terms and structures that can help address both contingent and strategic liquidity needs. Make sure that you have FHLBNY borrowing potential suitable for your institution’s needs — you want liquidity to be available when you need it most, and you do not want to be caught off guard should deposit flight scenarios be realized.

To discuss funding opportunities with the FHLBNY, contact a Relationship Manager at (212) 441-6700. For questions regarding this article, contact Robert Colvin, Chief Executive Officer of Bank Strategies Group, at (316) 775-7524 or visit www.bankstrategiesgroup.com.

Latest News

07/23/2025

FHLBNY Announces Second Quarter 2025 Operating Highlights

07/11/2025

$2.8 Million in Additional Funding Added to the 0% Development Advance (ZDA) Program

07/10/2025

Report from the President: Driving Communities Forward

02/22/2023

Notice of FHLB Members Selected For Community Review (Effective February 23, 2023)

07/28/2021

An Enhancement to our Callable Adjustable Rate Credit Advance (Callable ARC)