Borrower’s Guide

Welcome to the Borrower’s Guide!

We are delighted that you have decided to take advantage of the Federal Home Loan Bank of New York’s (FHLBNY) credit products! As you know, our advances are competitively priced, with flexible features that can help your institution meet its liquidity needs.

This guide will assist you through the process of requesting an advance. You can navigate through each step above. At any time, you may contact your Relationship Manager or a Member Services Desk Representative and they will be happy to assist you.

As always, we value your membership in the FHLBNY and look forward to our ongoing partnership.

Not a Member? To take advantage of the FHLBNY’s credit products, a financial institution must first become a member. If you are not a member, learn how the FHLBNY can be your financial partner.

Step 1: Select the Advance(s) that best suits your institution’s needs

Our wide array of credit products is designed to meet your specific funding needs, with terms ranging from overnight to 30 years. You can also contact your Relationship Manager to discuss the best advance products for your institution.

As a true cooperative, all of our members are treated equally, regardless of asset size; your institution will receive the same terms, whether you are borrowing $1 million or $100 million. Click on an advance for more information or view a printable version of all the descriptions.

Key Contacts

Relationship Managers:

(212) 441-6700

Member Services Desk:

(212) 441-6600

Advance products are categorized by Short-Term (ST), and Medium-Term (MT), Long-Term (LT) and Overnight.

Adjustable-Rate Credit (ARC) Advance (ST, MT & LT)

Amortizing Advance (MT & LT)

Callable ARC Advance (ST, MT & LT)

Callable Fixed-Rate Advance (MT & LT)

Fixed-Rate Advance (ST, MT & LT)

Fixed-Rate Advance with a SOFR Cap* (MT & LT)

Overnight Advance

Principal-Deferred Advance (MT & LT)

Putable Advance* (MT & LT)

Repo Advance (ST, MT & LT)

Please Note: Reduced cost of funding under FHLBNY Community Lending Programs (CLP) is available for all advances with a minimum term of one year, except Putable Advances; CLP Advances are not eligible for the SPA feature or the Advance Rebate Program; our Putables (when available), Callable, Swaps, and Letters of Credit programs require additional agreements; all credit product terms are subject to credit conditions.

Members can obtain rates by:

Other Credit Products, Programs & Features

Advance Rebate Program

Provides members with a cash rebate on a portion of the fees paid relating to the early extinguishment of eligible advances when new eligible advances are obtained within 30 calendar days1. To receive the cash rebate, the prepaid advance(s) must have a remaining term of six months or longer, and new advance(s) must have a term of six months or longer.

Advantages:

- Members receive cash rebate

- Provides additional flexibility with balance sheet management

- Strengthens and adds value to your Co-op

For more information on the Advance Rebate Program, please read this funding strategy article or download the overview.

1Advances booked under Community Lending Programs and advances with remaining maturities of less than six months are not eligible advances.

Letters of Credit

Supports liquidity, asset/liability management, and housing and economic development activities.

Advantages:

- Obtain a guarantee of payment by a highly-rated* financial institution –the FHLBNY –to third parties in the event of a default of performance by a member •Collateralize state and local government deposits at low cost

- Receive credit enhancements for a variety of transactions •Choose from maturities between 2 weeks to 3 years

- Facilitate transactions that promote eligible housing and community development activities at a discounted price.

Click here to learn more about our Letters of Credit.

Interest Rate Derivatives

Reduces income fluctuations caused by interest rate volatility

Advantages:

- Achieve asset/liability management goals

- Hedge interest rate exposure or increase the certainty of future funding costs

- Potentially lower the cost of funding

Note: Available for institutions with total assets less than $10 billion

Putable Advance Modification Program

Offers the ability to potentially lower interest expense, reduce optionality in a member’s balance sheet and to better manage interest-rate and liquidity risks.

|

Modifications: |

Learn more on Financial Intelligence.

Symmetrical Prepayment Advance (SPA) feature

For added flexibility, symmetry can be added for an additional 2 basis points to either Fixed-Rate or Repo Advances with maturities of one year or greater and a minimum advance size of $3 million. If the advance becomes “in the money” during its term, you could extinguish and realize a gain.

Advantages:

- Gain additional flexibility with balance sheet management and/or restructuring (e.g., gains can serve as an offset to unrealized losses in securities portfolios)

- Enhance value during merger and acquisition scenarios (potential gains on the liability side of the balance sheet)

Click here to learn more about our Symmetrical Prepayment Advance (SPA) feature.

Transfers of Advances

Advances may be transferred between member institutions on a case by-case basis. All transaction negotiations (pricing, finding qualified counterparties*, etc.) will be the sole responsibility of the respective member involved in the advance transfer. Upon notification by the respective member that the transaction is complete, the FHLBNY will transfer the advance(s) to the acquiring member and the appropriate collateral and activity based capital stock adjustments will be made.

*To obtain transaction approval, the acquiring member will need to meet FHLBNY credit criteria and collateral requirements.

Please Note: Reduced cost of funding under FHLBNY Community Lending Programs (CLP) is available for all advances with a minimum term of one year, except Putable Advances; CLP Advances are not eligible for the SPA feature or the Advance Rebate Program; our Putables (when available), Callable, Swaps, and Letters of Credit programs require additional agreements; all credit product terms are subject to credit conditions.

Members can obtain rates by:

2

Log onto 1Link® for “live” Overnight and Short-Term Advance Rates (advances under 1 year).

3

Contact the Member Services Desk at (212) 441-6600.

Step 2: Determine Available Collateral

Since the FHLBNY is a secured lender and all of our advances require collateral, it’s important that you know how much collateral you have at the FHLBNY prior to requesting an advance.

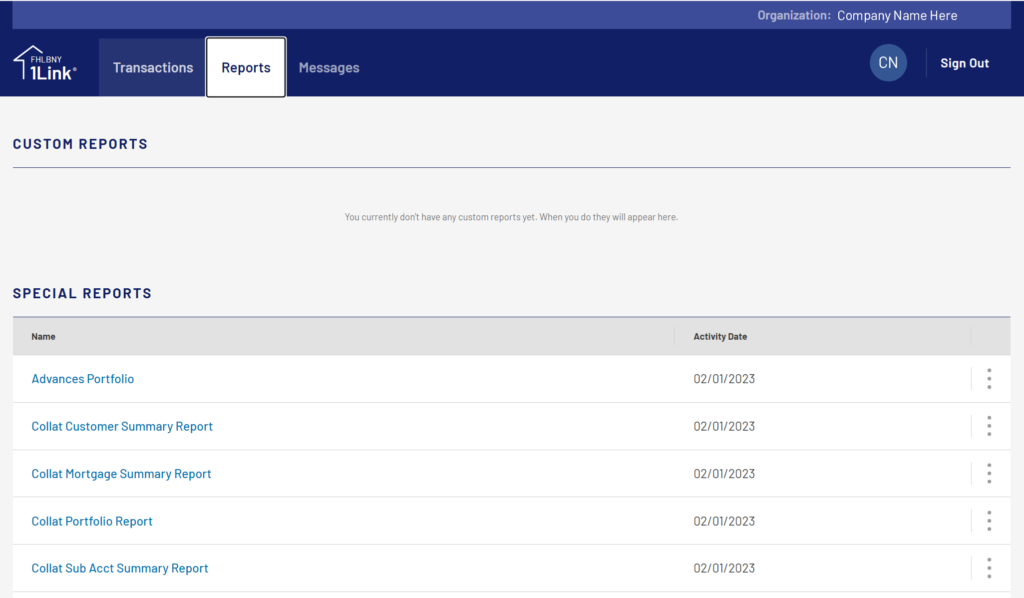

Members can view their Collateral Position Report on 1Link, which enumerates a member’s borrowing potential. Once you log into 1Link, click on the “Reports” tab, then scroll to the “Special Reports” section and select the “Collateral Customer Summary Report”.

Note: When you transact an advance through 1Link®, you will be able to view your available borrowing amount and your current collateral position on the same transaction screen.

Key Contacts

Relationship Managers:

(212) 441-6700

Member Services Desk:

(212) 441-6600

How do I pledge collateral?

For an overview of the collateral process, please visit our Collateral Guide.

Step 3: Initiate Your Advance

Now you are ready to initiate your first advance.* All you need is:

- Your Overnight Investment account number

- The advance product you are interested in

- The amount** and term of the advance

- The type of collateral you are pledging

- Be prepared to purchase a requisite amount of FHLBNY Capital Stock

Once you have all this information, contact a Member Services Desk Representative or your Relationship Manager to complete the advance request. You can also use 1Link® to initiate short-term advances (under one year).

Benefits of initiating short-term advances through 1Link®

- Initiate transactions conveniently from your PC with “live” advance rate updates

- Create short-term, forward-start advances

- Rollover or payoff maturing advances in a single transaction

- Request real-time rate indications on advance products, where applicable

- Access and view your current day advance transaction status any time

- Check to see which advances are maturing each day

- Verify your FHLBNY portfolio of outstanding advances, FHLBNY stockholdings and collateral availability

*In order to initiate an advance, you must be an authorized user on the Global Authorization Form.

** The FHLBNY’s current Capital Plan requires a stock purchase of 4.5% of the borrowed amount.

Key Contacts

Relationship Managers:

(212) 441-6700

Member Services Desk:

(212) 441-6600

Step 4: Receive Funds

Once the advance transaction is completed and approved by the FHLBNY, the funds will be deposited into your FHLBNY Overnight Investment Account (OIA). Using our wire transfer service, you can transfer the funds into another demand account or wire them out of your account. The fastest and most efficient way to move funds out of your demand account is by using 1Link® to initiate your wires.

When you initiate your wires through 1Link®, you can:

- Save $4 for each domestic repetitive wire out

- Save $12 each domestic non-repetitive wire out

- Save $5 for book transfers (free with 1Link®)

- Conveniently initiate current and future-dated domestic wires and book transfers right from your

PC - Receive quick confirmation for 1Link®-initiated payments

- Receive detailed wire advice for incoming and outgoing wires

- View your current day outgoing wires and book transfer transaction status anytime

- Use templates to make repetitive wire transfers easy

- Receive detailed wire information on Daily Wire Statement report

- View wires and sign all with a single signing process

Key Contacts

Relationship Managers:

(212) 441-6700

Member Services Desk:

(212) 441-6600

Key Contacts

Relationship Managers:

(212) 441-6700

Member Services Desk:

(212) 441-6600 or

(800) 546-5101, option 1

1Link® Helpdesk:

(800) 546-5101, option 1

Step 5: Review Transaction

After the transaction is completed, we will provide you with reports to help you manage your cash position with the FHLBNY. The primary report is the Daily Advice of Account Activity.

This report describes the financial activity of the prior day, including information about advances and other credit transactions, stock purchases and redemptions and securities safekeeping transactions. The Daily Advice of Account Activity is available through the FHLBNY’s 1Link® service.

In addition, the FHLBNY provides you with a Monthly Statement of Account Activity that provides general information on all debits and credits that have been posted to your OIA account. The Monthly Statement is available on 1Link® as well. Quarterly TB-13a reports are also provided to members as requested. To request a TB-13a report or a walk-through of any of the above information, please contact your Relationship Manager at [email protected].