President’s Report

October 11, 2016

A Critical Role

Last month, S&P Global Ratings issued a report on the Federal Home Loan Bank System. In reaffirming the System’s AA+/Stable rating – the same as the U.S. sovereign rating – S&P highlighted numerous positive aspects about the Federal Home Loan Banks, including our strong capital, funding and risk management positions. Most importantly, however, was S&P’s recognition of the critical role the Federal Home Loan Banks play in the nation’s economy: “We view the FHLBanks’ role as a source of low-cost funding for residential mortgage lending, housing, and community development as very important to meeting the national policy objective of home ownership.”

Of course, it is our members who make the mortgages, who put families in homes they can afford, and who provide the small business loans that drive economic growth and community development. It is the role of the Federal Home Loan Banks to serve as a support system for these activities. It is a role that we perform well; in fact, it is part of our design. As S&P notes, “the System is run as a cooperative for the benefit of its client-owners (private sector financial services companies), with more emphasis on retaining the capacity to quickly increase liquidity provision when needed than on maximizing current profit distribution.”

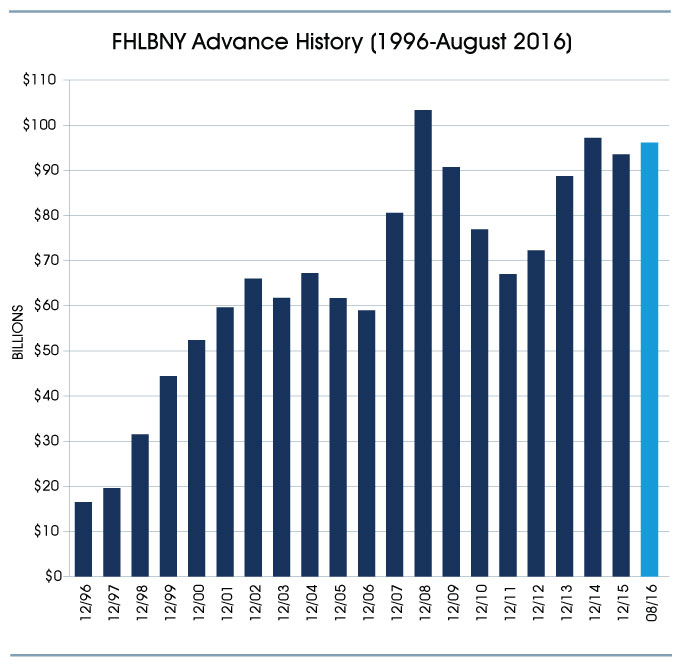

It is the daily availability of this liquidity that makes us a reliable partner for our members. S&P notes that each individual Federal Home Loan Bank’s business position is strong, due in no small part to “the established market position each has within its own district.” We believe that, for our members in New Jersey, New York, Puerto Rico and the U.S. Virgin Islands, there is no more stable partner than the Federal Home Loan Bank of New York. And our business position is indeed strong: at the end of the second quarter, our cooperative had the third-highest net income, advances and assets in the System, as well as the second-highest advances-to-assets ratio. Over the summer, we continued to grow our advances, ending August 2016 with an advances balance of $96.2 billion. This represents an increase in advances of $7 billion as compared to the same period a year ago. As the uncertainty has continued in the economy, our members have increasingly turned to the Federal Home Loan Bank of New York for the liquidity to meet your funding needs, and the products and programs that help you meet the needs of your communities. Our membership is broad and diverse, with institutions of all types and sizes active in driving advances and allowing our funding to reach every part of our District. Our membership spans institutions with different asset sizes, different business models and different areas of focus. But all are bound by a shared commitment to the communities they serve. We share this commitment, and are proud to be a trusted partner to every member of our cooperative.

As we enter the fourth quarter, we continue to focus on this trusted partnership as we work with our members to ensure that we all close out 2016 on a strong note. Our cooperative continues to perform well, and in the coming months we will announce our third quarter results and dividend declaration. We will also announce our 2016 Affordable Housing Program grants, which reflect a cooperative that meets the housing needs of its communities. And each and every day, our funding will be available to our members, reflecting the critical role that our cooperative, and all the Federal Home Loan Banks, continues to play.

Sincerely,

José R. González

President and Chief Executive Officer

Please read the Newsletter for the Third Quarter 2016

# # #

Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995

This report may contain forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These statements are based upon our current expectations and speak only as of the date hereof. These statements may use forward-looking terms, such as “projected,” “expects,” “may,” or their negatives or other variations of these terms. The Bank cautions that, by their nature, forward-looking statements involve risk or uncertainty and that actual results could differ materially from those expressed or implied in these forward-looking statements or could affect the extent to which a particular objective, projection, estimate, or prediction is realized. These forward-looking statements involve risks and uncertainties including, but not limited to, regulatory and accounting rule adjustments or requirements, changes in interest rates, changes in projected business volumes, changes in prepayment speeds on mortgage assets, the cost of our funding, changes in our membership profile, the withdrawal of one or more large members, competitive pressures, shifts in demand for our products, and general economic conditions. We undertake no obligation to revise or update publicly any forward-looking statements for any reason.

Latest News

07/11/2025

$2.8 Million in Additional Funding Added to the 0% Development Advance (ZDA) Program

07/10/2025

Report from the President: Driving Communities Forward

04/24/2025

FHLBNY Announces First Quarter 2025 Operating Highlights

02/22/2023

Notice of FHLB Members Selected For Community Review (Effective February 23, 2023)

07/28/2021

An Enhancement to our Callable Adjustable Rate Credit Advance (Callable ARC)