Press Releases

October 12, 2016

Contact:

Eric Amig – (212) 441-6807

Brian Finnegan – (212) 441-6877

FHLBNY Presents M&T Bank With Community Pillar Award

-Award recognizes M&T Bank’s Continuing Commitment to Affordable Housing and Community Development-

Buffalo, NY — José R. González, president and CEO of the Federal Home Loan Bank of New York (“FHLBNY”), announced that the Bank has recognized its member, M&T Bank, with The Community Pillar Award, which recognizes the institution’s ongoing dedication to creating affordable housing opportunities in the communities it serves.

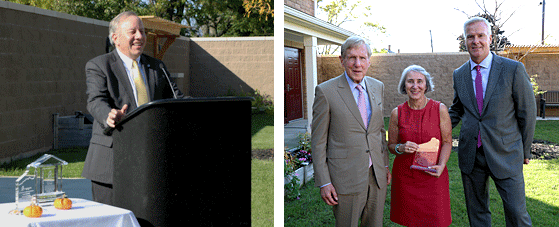

From left to right: José R. González, President and CEO.

Robert G. Wilmers, Chief Executive Officer and Chairman, M&T Bank. Kate Bukowski, Vice President, M&T Bank.

Paul Héroux, SVP, Chief Bank Operations Officer & Community Investment Officer.

“Since making its first Affordable Housing Program grant 25 years ago, M&T has become our most active partner in our Community Investment programs,” said Mr. González. “The community support M&T provides assists households and families in Buffalo and Western New York, across the state, throughout our region and beyond. They are active supporters of the communities they serve – a true community bank. We are proud to honor M&T with our Community Pillar award, and even more proud to be their partner.”

“M&T Bank calls Buffalo its home and, under the leadership of Bob Wilmers, has demonstrated a true commitment to their hometown by investing in local neighborhoods, helping local residents achieve home-ownership, and playing a role in Buffalo’s renaissance,” said Congressman Brian Higgins (NY-26).

“Every day, my colleagues at M&T Bank work hard to help families and neighborhoods grow stronger, and the Federal Home Loan Bank of New York is an important partner and resource. Together, we have facilitated more than $111 million in additional investments within the communities we serve, to develop new affordable housing units and provide mortgages to first-time home buyers. We’re honored to be recognized, and we’re deeply grateful for your continued support of M&T’s community-focused initiatives,” said M&T Bank Chairman and CEO Robert G. Wilmers.

The Community Pillar Award was presented to M&T Bank at Hope Gardens, a supportive, permanent living facility for homeless women in Buffalo which received a $280,000 Affordable Housing Program (“AHP) grant from M&T Bank and the FHLBNY in 2011. The AHP was created by Congress in 1989, and provides member-lenders with direct subsidies which are passed on to income-qualified households through sponsoring local nonprofit organizations. AHP financing is combined with other funding sources to create housing for moderate-, low- and very low-income families. Program awardees receive this funding through a competitive application process. Each competing project must be sponsored by a financial organization that is a member of the Bank in partnership with a community-based sponsoring organization. Since making its first grant in 1991, M&T Bank has partnered with the FHLBNY to support 257 projects with $94.2 million in grants to help build or preserve 12,316 units of affordable housing. These projects have also generated an estimated $1.6 billion in total development costs, driving economic growth at the local level.

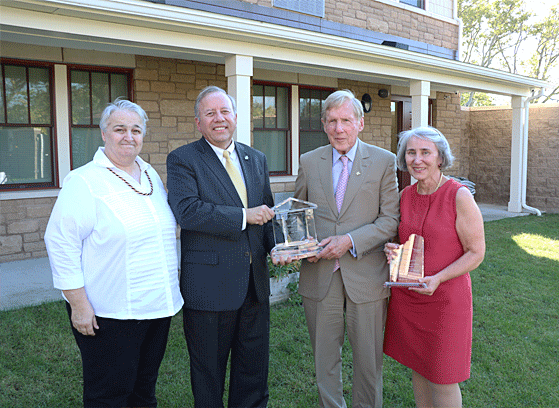

Left to Right: Marlies A. Wesolowski, Executive Director for the Lt. Col. Matt Urban Human Services Center of W.N.Y.

José R. González, President and CEO. Robert G. Wilmers, Chief Executive Officer and Chairman, M&T Bank.

Kate Bukowski, Vice President, M&T Bank.

M&T Bank has also been very active in the FHLBNY’s First Home Clubsm, a program that was launched by the FHLBNY in 1995 to offer an incentive for households with incomes at or below 80 percent of area median income to save towards the purchase of a new home. The program is a non-competitive set-aside of the AHP and is administered through approved members of the FHLBNY. The First Home Clubsm provides down payment and closing cost assistance by granting $4 in matching funds for each $1 saved in a dedicated account (up to $7,500 in matching funds) to an eligible first-time homebuyer purchasing a home through one of the FHLBNY’s approved members. In total, M&T Bank has accessed $17 million in grant funding to help 2,201 households become homeowners. M&T Bank currently supports more than 1,100 households enrolled in the First Home Clubsm program.

M&T Bank

M&T is a financial holding company headquartered in Buffalo, New York. M&T’s principal banking subsidiary, M&T Bank, operates banking offices in New York, Maryland, New Jersey, Pennsylvania, Delaware, Connecticut, Virginia, West Virginia and the District of Columbia. Trust-related services are provided by M&T’s Wilmington Trust-affiliated companies and by M&T Bank

About the Federal Home Loan Bank of New York

The Federal Home Loan Bank of New York is a Congressionally chartered, wholesale Bank. It is part of the Federal Home Loan Bank System, a national wholesale banking network of 11 regional, stockholder-owned banks. As of June 30, 2019, the FHLBNY serves 324 financial institutions in New Jersey, New York, Puerto Rico, and the U.S. Virgin Islands. The Federal Home Loan Banks support the efforts of local members to help provide financing for America’s homebuyers.

# # #

Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995

This report may contain forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These statements are based upon our current expectations and speak only as of the date hereof. These statements may use forward-looking terms, such as “projected,” “expects,” “may,” or their negatives or other variations on these terms. The Bank cautions that, by their nature, forward-looking statements involve risk or uncertainty and that actual results could differ materially from those expressed or implied in these forward-looking statements or could affect the extent to which a particular objective, projection, estimate, or prediction is realized. These forward-looking statements involve risks and uncertainties including, but not limited to, regulatory and accounting rule adjustments or requirements, changes in interest rates, changes in projected business volumes, changes in prepayment speeds on mortgage assets, the cost of our funding, changes in our membership profile, the withdrawal of one or more large members, competitive pressures, shifts in demand for our products, and general economic conditions. We undertake no obligation to revise or update publicly any forward-looking statements for any reason.

Latest News

07/23/2025

FHLBNY Announces Second Quarter 2025 Operating Highlights

07/11/2025

$2.8 Million in Additional Funding Added to the 0% Development Advance (ZDA) Program

07/10/2025

Report from the President: Driving Communities Forward

02/22/2023

Notice of FHLB Members Selected For Community Review (Effective February 23, 2023)

07/28/2021

An Enhancement to our Callable Adjustable Rate Credit Advance (Callable ARC)