President’s Report

April 13, 2017

The Reach of Our Housing Mission

A Reliable Partner for the Communities We All Serve

Our housing mission is vital to our cooperative: it shapes our culture, supplements our commitment to the community and strengthens our partnerships with our members. Our Affordable Housing Program, First Home Clubsm and Community Lending Programs provide our members and our cooperative with the ability to make immediate and lasting investments in neighborhoods, towns and cities across our region. Through these programs, we promote stability in communities and create opportunities for families and individuals to grow.

Last year, we focused on expanding the reach of our housing mission. We created an internal Affordable Housing and Community Investment Committee, drawing on expertise from across the FHLBNY to help ensure that our housing programs have the full strength of our franchise behind them. Throughout 2016, we substantially increased our member education and outreach initiatives to raise awareness of all of our affordable housing and community lending programs.

This outreach resulted in the highest number of project applications ever submitted for a single AHP funding round. This is a record we hope does not stand for long: we will begin taking applications for our 2017 AHP funding round the week of April 24th, and we hope to set a new mark for member participation this year. On March 21st, we filed our 2016 Form 10-K, and, in that filing, we reported that we have set aside $44.8 million from our 2016 earnings to fund the Affordable Housing Program and First Home Clubsm (FHC) this year; of which, $33.2 million is allotted toward AHP. And this year, the reliability of our grant funding is even more important as the possibility of tax reform and other market challenges have the potential to reduce funding from other sources.

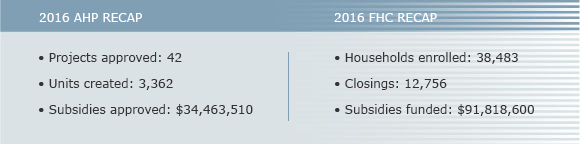

Last year, we awarded $34.5 million in AHP subsidies to help fund 42 affordable housing initiatives, creating or rehabilitating 3,362 affordable housing units, including more than 2,200 units dedicated to very low-income housing and more than 3,200 units of vital affordable rental housing. We also helped create 1,693 new homeowners through First Home Clubsm funding, which totaled $13.5 million in 2016. But we know that these numbers cannot truly capture the importance of our housing mission. Rather, that is reflected in the people these programs help.

The affordable housing initiatives we support through our housing programs have a real impact on real lives, and every year we are honored to partner with our members and housing partners on our AHP grants to help make these lives better by providing quality affordable housing. The continued success of the AHP reflects the commitment we share with our members to the communities we all serve. This success is seen is homes and neighborhoods across our region. I thank our members for participating in the program, and I look forward to your continued participation when the application process begins later this month.

FDIC Publishes Federal Home Loan Bank Product Guide

The Affordable Housing Program is but one of the many programs and products available to our members that comprise the value of membership in the Federal Home Loan Bank. Throughout the year, we are in constant contact with our members through visits, training sessions and publications such as this to ensure that each of our members is maximizing this value. For example, within the pages of this newsletter we have provided articles on funding solutions to enhance member earnings and the all-in value of membership. I would also like to report that, on April 6th, the FDIC published the Affordable Mortgage Lending Guide, Part III: Federal Home Loan Banks. This guide is aimed at helping local lenders learn more about products and programs offered by the Federal Home Loan Banks, including advances, the Affordable Housing Program, Community Investment Program and the MPF® Program. These materials can be found at the Affordable Mortgage Lending Center, an online resource center featuring data, fact sheets, and mortgage lending studies produced by the FDIC and other federal agencies. Of course, if you have any questions on your membership or the products and programs we offer, please do not hesitate to contact us. We want to make sure you are getting the most out of being a member of our cooperative.

Sincerely,

José R. González

President and Chief Executive Officer

# # #

Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995

This report may contain forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These statements are based upon our current expectations and speak only as of the date hereof. These statements may use forward-looking terms, such as “projected,” “expects,” “may,” or their negatives or other variations of these terms. The Bank cautions that, by their nature, forward-looking statements involve risk or uncertainty and that actual results could differ materially from those expressed or implied in these forward-looking statements or could affect the extent to which a particular objective, projection, estimate, or prediction is realized. These forward-looking statements involve risks and uncertainties including, but not limited to, regulatory and accounting rule adjustments or requirements, changes in interest rates, changes in projected business volumes, changes in prepayment speeds on mortgage assets, the cost of our funding, changes in our membership profile, the withdrawal of one or more large members, competitive pressures, shifts in demand for our products, and general economic conditions. We undertake no obligation to revise or update publicly any forward-looking statements for any reason.

Latest News

06/10/2025

Report from the President: The Silent Stabilizer of the Banking System

04/28/2025

FHLBNY Affordable Housing Advisory Council Open Nomination Period – For 2026 Service

04/24/2025

FHLBNY Announces First Quarter 2025 Operating Highlights

01/20/2023

2023 Update to the Member Products Guide & Correspondent Services Manual

07/20/2021

RSA SecurID® for 1Link-IPR Coming Soon