President’s Report

September 6, 2016

At the Bank

A Wide Range of Products for Our Members

On August 25th, the Bank was honored to participate in the groundbreaking of a new branch office for Community Resource Federal Credit Union in North Greenbrush, New York. Community Resource utilized our Urban Development Advance (“UDA”) to help fund the new branch, which will create four full-time jobs and increase access to financial services in the community.

The UDA provides financing for economic development projects in urban areas that benefit individuals or families with incomes at 100 percent or less of the area median income. Our UDA advances are priced below regular advance rates, and provide a non-competitive source of low-priced, long-, medium- and short-term funding to our members. In 2015, we funded more than $735 million in UDA advances – funding that helps support businesses and drive job growth in communities across our District, just like it will in North Greenbrush.

The UDA is part of our suite of Community Lending Programs – which also includes our Community Investment Program and Rural Development Advance – and represents one of the many ways members like Community Resource utilize their Home Loan Bank membership to benefit the communities they serve. We are focused on enhancing member value, and we believe that offering a wide range of products to meet our members’ needs is a key way to deliver this value.

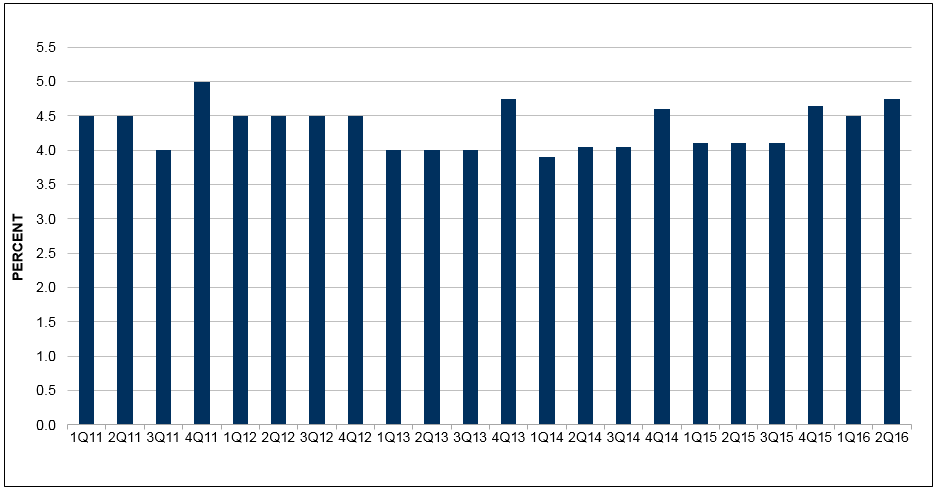

FHLBNY Declares 4.75% Dividend for the Second Quarter of 2016

On August 18th, your Board of Directors approved a 4.75 percent dividend for the second quarter of 2016, with a cash value of approximately $65.4 million – funds which were distributed to our members on August 19th. Providing a fair and consistent dividend – as evidenced in the chart below – is another way in which we deliver value to our members, and serves as a reflection of both the strength of our cooperative and our role as a reliable and stable partner for our members.

FHLBNY Dividend Rate History

Jay Ford Re-Elected to FHLBNY Board; Director Election Process Still Ongoing

I would like to congratulate Jay M. Ford, president and CEO of Crest Savings Bank, on being re-elected to serve on our Board for a four-year term as a Member Director representing New Jersey. Director Ford, who currently serves as chairman of the Board’s Audit Committee, is a valuable member of our Board and a strong advocate for our New Jersey members. His expertise and insight have strengthened our cooperative over his past eight years of Board service, and I look forward to his contributions in his upcoming term, which begins on January 1, 2017.

We announced the results of the election for the open New Jersey Member Director seat on August 30th because Director Ford was the lone candidate in the running. However, the Bank will hold elections for two open New York Member Director seats, as well as for two open Districtwide Independent Director seats, later this year. Our members will receive ballots in connection with these elections in early October. Our Board delivers tremendous value to our cooperative, and there will be a number of highly qualified candidates in this year’s election. I encourage all of our members to participate in the election process.

In Washington

Obama Administration Announces PROMESA Oversight Board Appointments

On June 30th, President Barack Obama signed into law the Puerto Rico Oversight, Management, and Economic Stability Act (“PROMESA”), which creates a structure for exercising federal oversight over the fiscal affairs of the Commonwealth of Puerto Rico. It was also announced that PROMESA would establish an Oversight Board with broad powers of budgetary and financial control over Puerto Rico to help stabilize its financial situation. On August 31st, the Administration announced that I, along with six others, had been appointed to the Oversight Board. I am honored by the opportunity to serve on the Oversight Board, as I believe it will provide a significant public service, one that will benefit the Commonwealth of Puerto Rico and its many stakeholders. More information on the Oversight Board can be found on the White House website.

I hope you had a relaxing holiday weekend, and have returned to the office well-rested and ready to finish the year strong.

Sincerely,

José R. González

President and Chief Executive Officer

# # #

Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995

This report may contain forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These statements are based upon our current expectations and speak only as of the date hereof. These statements may use forward-looking terms, such as “projected,” “expects,” “may,” or their negatives or other variations of these terms. The Bank cautions that, by their nature, forward-looking statements involve risk or uncertainty and that actual results could differ materially from those expressed or implied in these forward-looking statements or could affect the extent to which a particular objective, projection, estimate, or prediction is realized. These forward-looking statements involve risks and uncertainties including, but not limited to, regulatory and accounting rule adjustments or requirements, changes in interest rates, changes in projected business volumes, changes in prepayment speeds on mortgage assets, the cost of our funding, changes in our membership profile, the withdrawal of one or more large members, competitive pressures, shifts in demand for our products, and general economic conditions. We undertake no obligation to revise or update publicly any forward-looking statements for any reason.

Latest News

07/11/2025

$2.8 Million in Additional Funding Added to the 0% Development Advance (ZDA) Program

07/10/2025

Report from the President: Driving Communities Forward

04/24/2025

FHLBNY Announces First Quarter 2025 Operating Highlights

02/22/2023

Notice of FHLB Members Selected For Community Review (Effective February 23, 2023)

07/28/2021

An Enhancement to our Callable Adjustable Rate Credit Advance (Callable ARC)