President’s Report

August 3, 2016

A Financially Strong Partner for Our Members

On May 6, Moody’s Investors Service issued credit opinions on both the FHLBNY and the Federal Home Loan Bank System. The rating agency’s report on our cooperative was very positive, highlighting our strong credit culture, stable profitability, exceptional asset quality and conservative interest rate risk management. Moody’s stated that the rating “reflects the FHLBank System’s financial strength, earnings stability, excellent asset quality and its special role as a provider of liquidity to US banks.”

On May 6, Moody’s Investors Service issued credit opinions on both the FHLBNY and the Federal Home Loan Bank System. The rating agency’s report on our cooperative was very positive, highlighting our strong credit culture, stable profitability, exceptional asset quality and conservative interest rate risk management. Moody’s stated that the rating “reflects the FHLBank System’s financial strength, earnings stability, excellent asset quality and its special role as a provider of liquidity to US banks.”

This role was also highlighted in a speech given by Melvin L. Watt, Director of the Federal Housing Finance Agency, at the 2016 Federal Home Loan Bank Directors’ Conference on May 24. At the end of his remarks, Director Watt thanked the Federal Home Loan Banks “for all the work you have done to support the nation’s housing finance system by creating a stronger and more mission-focused FHLBank System.” As the Moody’s report affirms, the System is indeed stronger. In 2015, the System earned record net income and all 11 Federal Home Loan Banks were profitable. This performance continued in the first quarter of 2016, with the System posting a 23% quarter-over-quarter increase in earnings.

And it is our mission focus that drives the FHLBNY’s performance: at the end of the first quarter, we had the highest ratio of advances-to-assets in the System, reflecting our commitment to being a reliable funding partner for our members. Ours is a diverse membership, with a wide range of institutions that drive advance demand. We ended the first quarter with the third-highest level of advances in the System, and we have continued to experience increased demand for advances through the second quarter. Our balance sheet is stable and our funding profile is balanced, with lower reliance on short-term funding. We believe in our model, and the Moody’s report and Director Watt’s comments confirm the strength of our franchise.

This role was also highlighted in a speech given by Melvin L. Watt, Director of the Federal Housing Finance Agency, at the 2016 Federal Home Loan Bank Directors’ Conference on May 24. At the end of his remarks, Director Watt thanked the Federal Home Loan Banks “for all the work you have done to support the nation’s housing finance system by creating a stronger and more mission-focused FHLBank System.” As the Moody’s report affirms, the System is indeed stronger. In 2015, the System earned record net income and all 11 Federal Home Loan Banks were profitable. This performance continued in the first quarter of 2016, with the System posting a 23% quarter-over-quarter increase in earnings.

And it is our mission focus that drives the FHLBNY’s performance: at the end of the first quarter, we had the highest ratio of advances-to-assets in the System, reflecting our commitment to being a reliable funding partner for our members. Ours is a diverse membership, with a wide range of institutions that drive advance demand. We ended the first quarter with the third-highest level of advances in the System, and we have continued to experience increased demand for advances through the second quarter. Our balance sheet is stable and our funding profile is balanced, with lower reliance on short-term funding. We believe in our model, and the Moody’s report and Director Watt’s comments confirm the strength of our franchise.

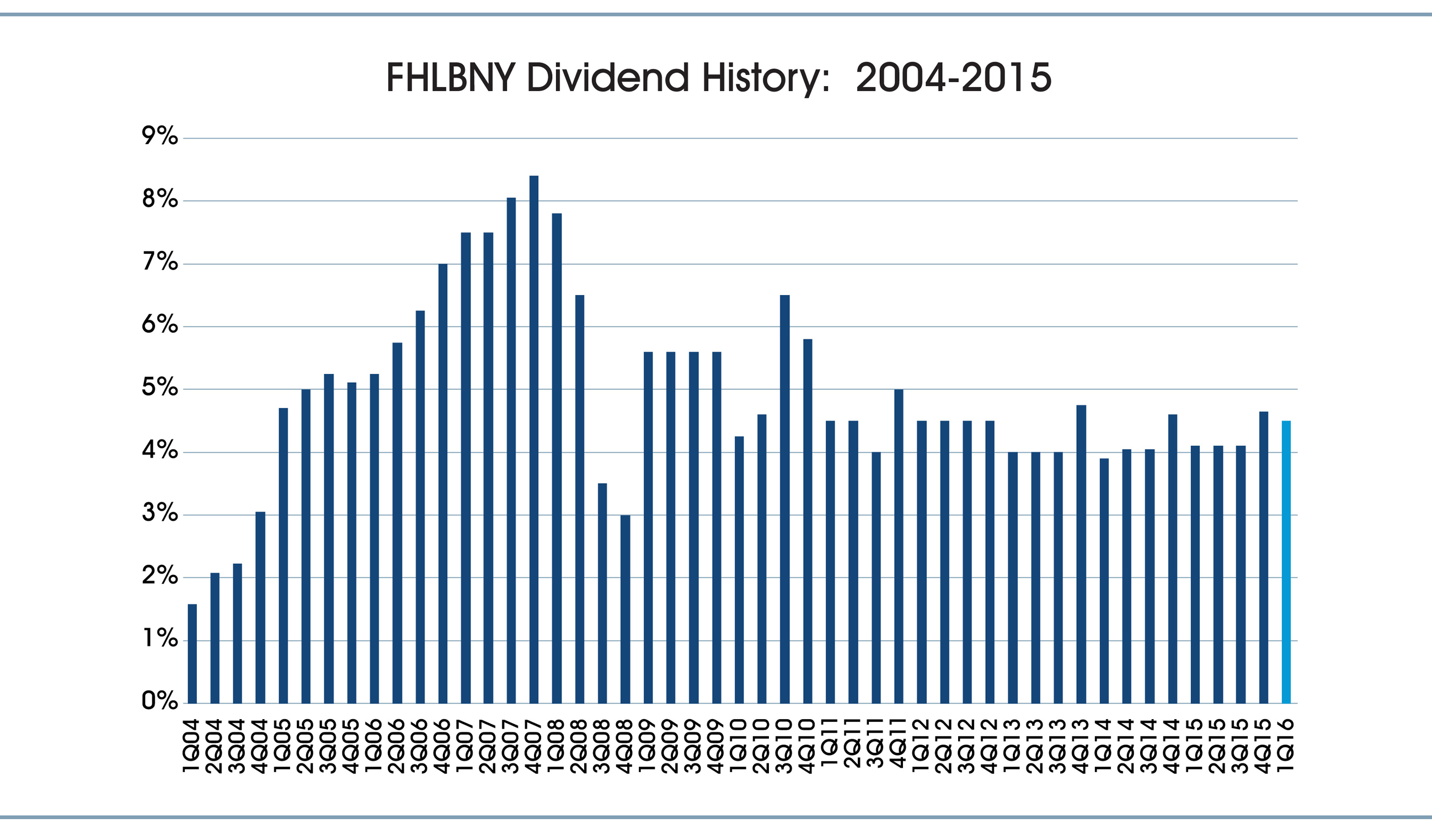

FHLBNY Declares 4.50% Dividend for the First Quarter of 2016

On May 19, your Board of Directors approved a 4.50% dividend for the first quarter of 2016. The cash value was approximately $61.5 million, and funds were distributed to our members on May 20. Our approach to our quarterly dividend has been to focus on providing a consistent and reasonable return to our shareholders, as we believe that a stable dividend is another way in which we provide member value.

As the chart below indicates, our dividend history speaks to our position as a reliable partner for our members.

Published 2015 Annual Report

Our steady dividend, healthy amount of core mission assets, stable balance sheet and reliable funding all contribute to the success of the FHLBNY. Our achievements throughout 2015 were captured in our Annual Report, which was sent to all members in May and is available here. We look forward to continuing to work with our members through the rest of the year to ensure that we have a strong story to tell in 2016.

Director Elections Process Underway

The FHLBNY’s 2016 Director Election process is currently underway. In total, five Directorships will be up for election in 2016: one New Jersey Member Director seat, two New York Member Director seats and two Independent Director seats. The knowledge and experience of our Board helps guide our franchise. Ours is an active and involved Board, much to the benefit of our cooperative.

I encourage all of our members to be involved in the election process. In this regard, I note that our cooperative is strengthened through diversity, be it in our membership, our employees or the communities we all serve. Our Board also benefits from diversity.

Please look out for our Director Election ballot package which is currently scheduled for distribution to eligible members on September 30. Your vote is very important, so we ask that you take the time to review the package upon receipt and promptly return your ballot to the FHLBNY.

Meeting with Our Members

On June 23, we hosted our first stockholders’meeting of the year in Westfield, New Jersey. Our management team was joined by our members to discuss our performance, our products and our partnership. The meeting also featured a presentation from Matt Pieniazek, President of Darling Consulting Group, who provided insights for developing appropriate total balance sheet strategies.

We have additional stockholders’ meetings planned for later in the year, and I hope you are able to join us for one of them. It is our belief that these events can provide our members with a better understanding of our cooperative, and help to ensure you are getting the most value out of your membership with the FHLBNY.

Sincerely,

José R. González

President and Chief Executive Officer

Please read the Newsletter for the Second Quarter 2016

# # #

Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995

This report may contain forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These statements are based upon our current expectations and speak only as of the date hereof. These statements may use forward-looking terms, such as “projected,” “expects,” “may,” or their negatives or other variations of these terms. The Bank cautions that, by their nature, forward-looking statements involve risk or uncertainty and that actual results could differ materially from those expressed or implied in these forward-looking statements or could affect the extent to which a particular objective, projection, estimate, or prediction is realized. These forward-looking statements involve risks and uncertainties including, but not limited to, regulatory and accounting rule adjustments or requirements, changes in interest rates, changes in projected business volumes, changes in prepayment speeds on mortgage assets, the cost of our funding, changes in our membership profile, the withdrawal of one or more large members, competitive pressures, shifts in demand for our products, and general economic conditions. We undertake no obligation to revise or update publicly any forward-looking statements for any reason.

Latest News

06/10/2025

Report from the President: The Silent Stabilizer of the Banking System

04/28/2025

FHLBNY Affordable Housing Advisory Council Open Nomination Period – For 2026 Service

04/24/2025

FHLBNY Announces First Quarter 2025 Operating Highlights

01/20/2023

2023 Update to the Member Products Guide & Correspondent Services Manual

07/20/2021

RSA SecurID® for 1Link-IPR Coming Soon