President’s Report

June 1, 2015

At the Bank

Consistency and Reliability

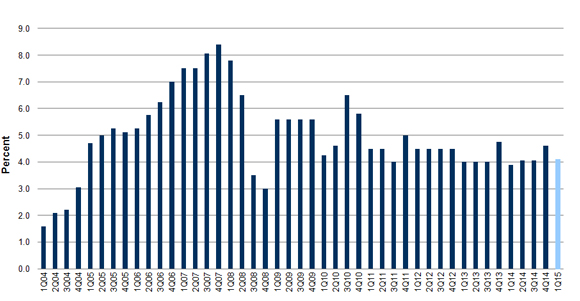

On May 21, your Board of Directors approved a dividend for the first quarter of 2015 of 4.10 percent (annualized). The dollar amount of this dividend was approximately $56.0 million, and it was distributed to our members the following day. As the chart below indicates, our continued ability to provide a consistent and reasonable quarterly dividend speaks to our position as a reliable partner for our members.

FHLBNY Dividend History: 2004-2015

On-Balance Sheet Support

Reliability is at the center of everything we do. Our advances provide our members with access to funding every day. We closed April 2015 with $88.5 billion in advances, a level that was supported by our $2.5 billion Advance Special Offering, a program we ran the week of April 13 which offered reduced rates for long-term regular Fixed-Rated Advances and Adjustable Rate Credit Advances with terms of four years or greater. We experienced significant interest in the Special, which was reflective of our focus on creating products that help our members meet the ever-changing needs of the communities we all serve.

Off-Balance Sheet Support

This focus also drove our decision to join with MAX Exchange to develop a program to enable our members to sell conforming and jumbo residential whole loan mortgages on an open exchange platform. We expect to launch a pilot program with MAX later in the year. We believe that the exchange may provide our members with easy secondary mortgage market access and better execution, thereby improving your capacity to serve your markets.

Community Support

We take pride in developing new ways to serve our members, but dependability is at the heart of one of our oldest programs, as well. This year marks the 25th anniversary of our first Affordable Housing Program grants, and over that time, the AHP has become one of the most successful and reliable sources of financing for housing initiatives in our region.

In May, we announced four grants as additions to our 2014 Affordable Housing Program grant round. These four grants – which we made with M&T Bank and Evans Bank – total $3,952,000 and will help create or preserve 258 affordable homes. Two of these grants – totaling $1.66 million – were awarded to projects in Buffalo, and were announced at on-site events featuring Congressman Brian Higgins (NY-27) and Buffalo Mayor Byron Brown. At an event that also featured David Nasca, president and CEO of Evans Bank and a member of our Board, Congressman Higgins stated that the AHP grant was “one piece of a collaborative puzzle that will support a fantastic effort to breathe new life into this site.”

Indeed, the AHP program works because it supports the strong partnerships that exist between community-focused local lenders, non-profit housing organizations, dedicated developers and our elected officials at the city, state and federal levels, all working together to build affordable housing for all who need it. Events like those held in Buffalo celebrate the community partnerships that the AHP proudly supports. And we look forward to continuing this support: the deadline for project applications for the 2015 AHP round of funding is June 15.

Lehman Brothers Files Suit

Late in the day on May 13, Lehman Brothers Holdings Inc. filed a complaint against the Bank in the U.S. Bankruptcy Court in the Southern District of New York seeking damages in excess of $150 million plus interest. The suit is related to the termination of interest-rate swaps following Lehman’s bankruptcy in 2008. The suit does not come as a surprise. We had engaged in mediation with Lehman without reaching a settlement, and we have discussed this matter at length with our Board over the past seven years. We believe that Lehman’s position is without merit, and we intend to aggressively defend against Lehman’s complaint and pursue our claim against Lehman.

An 11-Member System

June 1 marks a new day for the Federal Home Loan Bank System. On May 31, the merger between the Federal Home Loan Banks of Des Moines and Seattle concluded, and today, our System is comprised of 11 Federal Home Loan Banks. When the two institutions announced the approval of their merger application in December 2014, they expressed their belief that the merger would “result in a cooperative that is stronger than either the Seattle or Des Moines Bank on an individual basis.” And on May 12, at the annual Federal Home Loan Bank Directors’ Conference, Federal Housing Finance Agency Director Mel Watt stated that “this will be an historic event that both Des Moines and Seattle, as well as FHFA, believe will result in a stronger FHLBank System.”

A stronger cooperative makes for a stronger System, and today the Federal Home Loan Bank System remains as reliable and focused on our members as ever. At the Federal Home Loan Bank of New York, that reliability drives us every day.Sincerely,

José R. González

President and Chief Executive Officer

# # #

Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995

This report may contain forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These statements are based upon our current expectations and speak only as of the date hereof. These statements may use forward-looking terms, such as “projected,” “expects,” “may,” or their negatives or other variations of these terms. The Bank cautions that, by their nature, forward-looking statements involve risk or uncertainty and that actual results could differ materially from those expressed or implied in these forward-looking statements or could affect the extent to which a particular objective, projection, estimate, or prediction is realized. These forward-looking statements involve risks and uncertainties including, but not limited to, regulatory and accounting rule adjustments or requirements, changes in interest rates, changes in projected business volumes, changes in prepayment speeds on mortgage assets, the cost of our funding, changes in our membership profile, the withdrawal of one or more large members, competitive pressures, shifts in demand for our products, and general economic conditions. We undertake no obligation to revise or update publicly any forward-looking statements for any reason.

Latest News

07/23/2025

FHLBNY Announces Second Quarter 2025 Operating Highlights

07/11/2025

$2.8 Million in Additional Funding Added to the 0% Development Advance (ZDA) Program

07/10/2025

Report from the President: Driving Communities Forward

02/22/2023

Notice of FHLB Members Selected For Community Review (Effective February 23, 2023)

07/28/2021

An Enhancement to our Callable Adjustable Rate Credit Advance (Callable ARC)