Financial Intelligence

LIBOR’s Transition to SOFR

UPDATE:

On March 16, 2020, the FHFA extended to June 30, 2020 the FHLBanks’ ability to enter into LIBOR-based instruments that mature after December 31, 2021, except for investments and option embedded products.

September 2019

The LIBOR Transition is the biggest transformation in financial services today, affecting some $200 trillion of U.S. Dollar transactions. LIBOR is slated for cessation at the end of 2021. Increasingly, financial regulators in the US and UK are speaking out about LIBOR reform, and their message is uniform – transition needs to begin today.

This leaves FHLBNY members and their clients with a need to identify an alternate benchmark index for new floating-rate transactions and a strategy for managing legacy LIBOR transactions extending beyond 2021. In this article, we’ll talk about the alternative benchmark, the role of the Federal Home Loan Bank System in developing a new market, and the role of the Federal Home Loan Bank of New York in providing alternative floating-rate funding.

Introducing SOFR: A New Benchmark Rate, New Products and New Markets

The Alternative Reference Rate Committee (ARRC), a group of private-market participants convened by the Federal Reserve Board and the Federal Reserve Bank of New York (New York Fed), endorsed the Secured Overnight Financing Rate (SOFR) to be LIBOR’s replacement benchmark index in 2017. The New York Fed began publishing SOFR in April 2018, and SOFR-indexed products began trading in the capital markets in the second half of 2018.

As of July 2019, more than $240 billion in SOFR bonds have been issued into the market, and nearly $200 billion in SOFR swaps have been transacted. While this represents encouraging growth for products referencing a new index, there is much work to do given the short time horizon. The International Swaps and Derivatives Association (ISDA) reports that in the second quarter 2019, derivatives traded notional referencing SOFR was $84.7 billion, or 0.25% of the $32.4 trillion derivatives traded notional referencing LIBOR during the period. The securities side has made better progress: in the second quarter of 2019, 65% of floating rate notes issued were LIBOR-indexed,17% referenced SOFR, and 15% referenced Treasury Bill rates.

SOFR and the Federal Home Loan Bank System

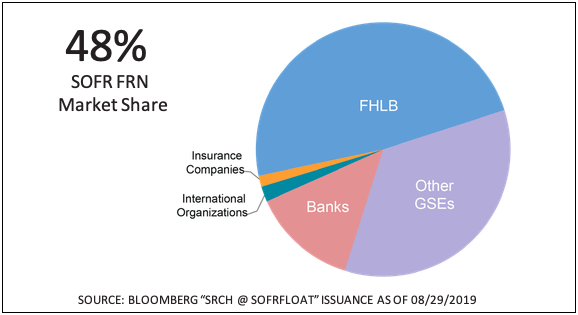

As the second-largest issuer of floating-rate notes (FRNs) after the U.S. Treasury, with $316 billion outstanding, the Federal Home Loan Bank (FHLB) System was, and remains, a key stakeholder in benchmark reform. The FHLB System was an early advisor to the ARRC in 2016 and, since 2018, has been represented at meetings of the ARRC through the Federal Home Loan Bank of New York.

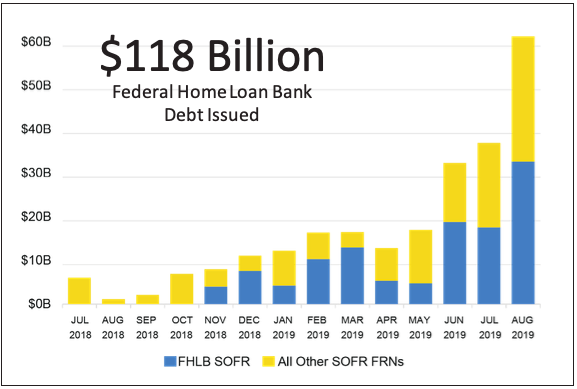

The FHLB System began issuing SOFR bonds in November 2018, and today the FHLB System is the #1 issuer of SOFR Bonds, with more than $118 billion issued as of August 2019.

The FHLB System alone makes up 48% of all SOFR FRNs outstanding. Even more impressively, in just nine months, the FHLB System has shifted its floating-rate debt composition from 99% LIBOR to 33% SOFR/66% LIBOR, meaning that the FHLB System has already converted a third of its floating rate debt to SOFR. In June, July and August of 2019, the FHLB System issued more SOFR debt than LIBOR debt.

The FHLB System’s strength in the SOFR market allows the FHLBNY to offer SOFR funding to our members at competitive levels. The FHLBNY began offering the SOFR-linked Adjustable Rate Credit (ARC) Advance in November 2018.

What are the advantages of SOFR-indexed funding?

|

What are some considerations to keep in mind in connection with the transition to SOFR as a funding index?

|

“Since 2014, the official sector has publicly warned that LIBOR could become unstable. My key message to you today is that you should take the warnings seriously the regulator of LIBOR has said that it is a matter of how LIBOR will end rather than if it will end, and it is hard to see how one could be clearer than that.”

Randall Quarles

Vice-Chair for Supervision, Board of Governors of the Federal Reserve System

June 3, 2019

“The FHLBanks provide access to reliable liquidity to approximately 6,800 members in support of housing finance and community investment. Our regular and frequent issuance of SOFR-linked securities strengthens the FHLBanks’ ability to meet the current and future needs of our members as we participate in the development of the SOFR index in support of our mission.”

Randy Snook

Chief Executive Officer, Federal Home Loan Banks’ Office of Finance

August 21, 2019

“As the leading issuer of LIBOR- linked securities, the Federal Home Loan Banks have a unique role and responsibility in both the development of the SOFR market and the transition away from LIBOR.”

José R. González

President and Chief Executive Officer, Federal Home Loan Bank of New York

December 3, 2018

Web References*

You’ll find many valuable sources of information on the subject of SOFR and LIBOR reform. Here are a few to start:

ARRC Alternative Reference Rates Committee

Your first SOFR stop. Offers News, Presentations Consultations, Meeting Minutes since 2014 https://www.newyorkfed.org/arrc

Federal Reserve Bank of New York

Your source for daily SOFR, TGCR, BGCR rates and volumes, historical indicative data from 4/2/2018, proxy survey data from 1998

https://apps.newyorkfed.org/markets/autorates/sofr

ISDA International Swap and Derivatives Association

Evolving derivatives fallbacks, supplements, consultations, protocols, market statistics https://www.isda.org

CME Group: SOFR futures and cleared SOFR swaps exchange

A SOFR page featuring trade data, news, and a running summary of SOFR issuance

https://www.cmegroup.com/trading/interest-rates/secured-overnight-financing-rate-futures.html

ICE Intercontinental Exchange: LIBOR’s administrator

https://www.theice.com/iba/libor

FASB Financial Accounting Standards Board

LIBOR and SOFR Hedge Accounting in Transition new

https://www.fasb.org

*Note: These websites are not operated or maintained by the FHLBNY

Disclaimer: Notwithstanding any language to the contrary, nothing contained in these disclosures is intended to constitute an offer, inducement, promise, or contract of any kind. Any product descriptions and pricing may be subject to change without notice.

The content provided in these disclosures is presented as a courtesy to be used only for informational purposes and is not represented to be error free. The FHLBNY makes no representations or warranties of any kind with respect to the content contained herein, such representations and warranties being expressly disclaimed. The FHLBNY is not a financial or investment advisor.

Moreover, the FHLBNY does not represent or warrant that the content of these disclosures is accurate, complete or current for any specific or particular purpose or application. It is not intended to provide nor should anyone consider that it provides legal, accounting, tax or other advice. Such advice should only be rendered in reference to the particular facts and circumstances appropriate to each situation. The FHLBNY encourages you to contact appropriate professional(s) and consultant(s) to assess your specific needs and circumstances and to render such advice accordingly. In addition, the FHLBNY is not endorsing or recommending the use of the means or methods contained in or through these disclosures for any special or particular purpose.

It is solely your responsibility to evaluate the risks or merits of any funding or investment strategy. In no event will FHLBNY or any of its officers, directors or employees be liable for any damages — whether direct, indirect, special, general, consequential, for alleged lost profits, or otherwise – that might result from any use of or reliance on these materials.

Key Contacts

Relationship Managers:

(212) 441-6700

Member Services Desk:

(212) 441-6600 or

(800) 546-5101, option 1

[email protected]

What’s Next?

We believe that the tools, methods, markets and expertise are all out there to make today the best day to start planning your LIBOR transition. We plan to periodically post topics pertaining to LIBOR transition.

Subjects would include:

- What Will LIBOR Fallback Look Like?

- SOFR vs LIBOR: Index Construction and Instrument Conventions

- Creating a Transition Checklist

- LIBOR Reform: How Did We Get Here?

Please send suggestions, comments and requests to [email protected]