Financial Intelligence

What Goes Up Must Come Down—Managing Interest-Rate Risk with the Fixed-Rate with Cap

Notice: The Fixed Rate with LIBOR Cap is temporarily suspended as a result of LIBOR cessation. The FHLBNY is no longer offering any structured products that are created using LIBOR-based hedges that mature beyond 2021. However, hedges using alternative indices are now being evaluated to create these products for our members. If you have interest in structured products, please contact your Relationship Manager at 212-441-6700.

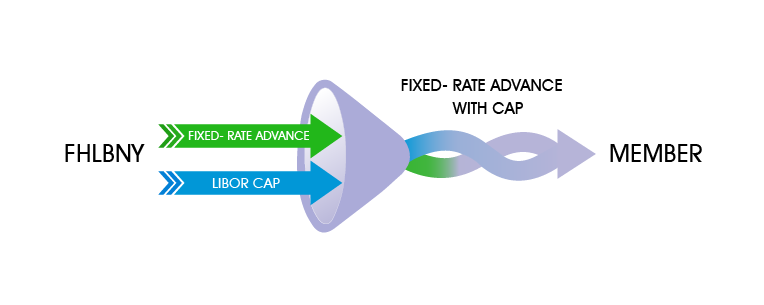

The FHLBNY Fixed-Rate Advance with a LIBOR Cap (Fixed-Rate with Cap) product is a hybrid funding option that combines a fixed-rate borrowing with an embedded interest-rate cap that is tied to the 3-Month LIBOR rate, with maturities from 1 to 10 years.

The advance rate would remain fixed, but may be reduced quarterly if 3-Month LIBOR rises above an agreed upon strike threshold (cap). Rates will adjust depending on the number of basis points 3-Month LIBOR is above the cap, either on a one-to-one basis (1×) or by a basis point for every two basis points (0.5×) the index is over the cap with a “floor” of zero percent. As rates rise and assets extend, the rate on the Fixed-Rate with Cap will decline, lowering the member’s cost of funds. If 3-Month LIBOR falls back below the strike threshold on a reset date, the advance would return to its original fixed rate.

Potential Benefits of the Fixed-Rate with Cap:

Helps provide protection against rising interest rates – lowers a member’s cost of funds as rates rise.

Will assist with ALM metrics – the Cap can potentially have significant value when conducting regulatory shock scenarios.

Flexible medium- to long-term funding option – best used to extend liabilities, potentially enhance spreads, and preserve margins

Helps achieve operational ease – has the benefits of an interest rate cap and may potentially be accounted for without the issues associated with stand-alone derivatives. Members are advised to consult with their accountant in order to confirm the appropriate accounting treatment.

Interest-Rate Risk Management – A Historical Perspective

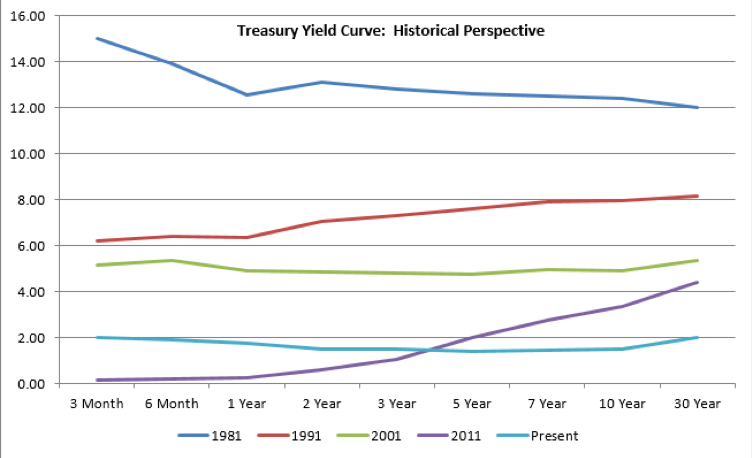

The U.S. economy of late 1970s and early 1980s was impacted by significant inflation and unemployment, volatile interest rates, inverted yield curves, and the phase-out of Regulation Q1 — all contributing to a high level of “underwater” assets held at financial institutions.

Looking at the yield curve from 1981, short-term rates skyrocketed causing an inverted yield curve. Institutions that were funding their long-term assets with short-term funding found themselves paying substantially higher rates to their depositors than they were receiving on their long-term assets. As a result, several institutions were driven toward insolvency, incurring large losses and depleting capital levels.

Over the past 30 years there has been an evolution in regulation, with an amplified focus on interest-rate risk management. Asset liability management processes have evolved significantly, requiring a more detailed and complex examination of the balance sheet and its attributes.

Responding to the times, institutions would come to rely on medium- and long-term wholesale funding as instruments to manage duration gap and to preserve spread. Additionally, reliance on derivative instruments (interest rate swaps, caps, and floors) increased significantly to more closely “match-fund” asset classes without inflating the balance sheet. However, the introduction of FASB 133 in the late 1990s made the use of derivatives more complex, requiring institutions to adhere to very specific accounting standards throughout the life of the instrument, or risk being required to mark-to-market their derivative, which could lead to earnings volatility.

1Regulation Q, which imposed interest rate ceilings on deposits, was phased out over a period of six years, from 1981 to 1986.

Today’s Rate Environment

As the current interest rate cycle progresses, the yield curve has inverted with long-term treasury rates testing historic lows. With a seemingly softening economy, combined with global economic weakness, long-term Treasuries have rallied and continue to drift downward, while the mortgage markets have followed. Mortgage rates are now very low, with some offering traditional 15-year and 30-year fixed-rate mortgages hovering in the range of 2.75% and 3.25%, respectively.

Some members have looked to reduce interest-rate risk by selling their long-term fixed-rate mortgage production to the FHLBNY’s Mortgage Partnership Finance® (MPF®) Program. Pressure on net interest margins and lower yields on alternative investment options incent others to portfolio a portion of their fixed-rate mortgage production, while addressing and managing interest-rate risk using the FHLBNY’s medium- and long-term advances. Now members are able to hedge their loan production in yet another way…

The Fixed-Rate with Cap can be an effective tool to mitigate interest-rate risk in a rising rate environment. By locking in a minimum spread and reducing a member’s cost of funds as 3-Month LIBOR rises above the embedded cap, the Fixed-Rate with Cap can assist liability-sensitive members with addressing funding mismatches associated with holding long-term assets.

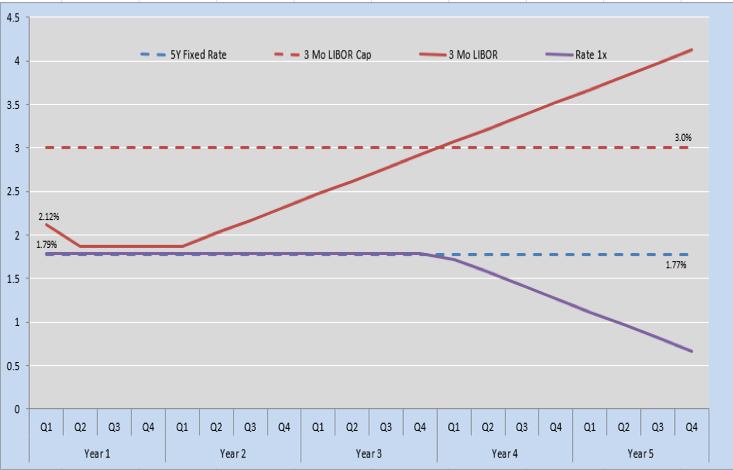

Let’s take a look at example of a hypothetical 5-year Fixed-Rate with Cap, with a cap of 3.0% and 1× multiplier, and an initial rate of 1.79% (2 basis points above the 5-year Fixed-Rate Advance, as of 8/16/19).

A static then rising rate environment was incorporated in this example where 3-Month LIBOR steadily rises after year one and breaches the cap in the first quarter of year four. The Fixed-Rate with Cap would remain at 1.79% throughout the first three years of this scenario, beginning to re-price downward in the first quarter of year four as 3-Month LIBOR rises above the 3.0% cap. In this example, 3-Month LIBOR reaches 4.12% by the end of year five causing the advance coupon to retreat to 0.67%. If 3-Month LIBOR never breaks through the cap the advance rate would remain at 1.79%. If 3-Month LIBOR declined back below the cap on a reset date, the advance rate would return to its initial rate.

In this example, the Fixed-Rate with Cap would lower the member’s cost of funds on this advance, offsetting increases in interest expense experienced across their interest-bearing deposit base or other wholesale borrowing categories.

If you would like to learn more about this new product offering and its possible effectiveness for your institution, contact a Relationship Manager at (212) 441-6700 or the Member Services Desk at 212-441-6600. The FHLBNY is always looking for new ways to meet the needs of its members and we look forward to hearing from you.

Disclaimer: Notwithstanding any language to the contrary, nothing contained in these disclosures is intended to constitute an offer, inducement, promise, or contract of any kind. Any product descriptions and pricing may be subject to change without notice.

The content provided in these disclosures is presented as a courtesy to be used only for informational purposes and is not represented to be error free. The FHLBNY makes no representations or warranties of any kind with respect to the content contained herein, such representations and warranties being expressly disclaimed. The FHLBNY is not a financial or investment advisor.

Moreover, the FHLBNY does not represent or warrant that the content of these disclosures is accurate, complete or current for any specific or particular purpose or application. It is not intended to provide nor should anyone consider that it provides legal, accounting, tax or other advice. Such advice should only be rendered in reference to the particular facts and circumstances appropriate to each situation. The FHLBNY encourages you to contact appropriate professional(s) and consultant(s) to assess your specific needs and circumstances and to render such advice accordingly. In addition, the FHLBNY is not endorsing or recommending the use of the means or methods contained in or through these disclosures for any special or particular purpose.

It is solely your responsibility to evaluate the risks or merits of any funding or investment strategy. In no event will FHLBNY or any of its officers, directors or employees be liable for any damages — whether direct, indirect, special, general, consequential, for alleged lost profits, or otherwise – that might result from any use of or reliance on these materials.

Key Contacts

Relationship Managers:

(212) 441-6700

Member Services Desk:

(212) 441-6600 or

(800) 546-5101, option 1