Credit Products

Give Your Institution the Strategic Flexibility to Maintain a Competitive Edge

The FHLBNY offers credit products designed to help facilitate your balance sheet strategies. Members can customize advances with a wide variety of maturities and structures, allowing you to choose funding that meets your objectives. FHLBNY advances can be customized by size, term, settlement date, amortization schedule, symmetry and more. If this is your first time borrowing with the FHLBNY, we created a Borrower’s Quick Reference Guide to assist members who want to initiate their first borrowing.

As a true cooperative, all of our members are treated equally, regardless of asset size; your institution will receive the same terms, whether you are borrowing $1 million or $100 million. Click on an advance for more information or view a printable version of all the descriptions.

Key Contacts

Relationship Managers

(212) 441-6700

FHLBNY@fhlbny.com

Member Services Desk

(212) 441-6600

MSD@fhlbny.com

Advance products are categorized by Short-Term (ST), and Medium-Term (MT), Long-Term (LT) and Overnight.

Match the interest rate characteristics of your adjustable-rate loan portfolio

Advantages:

- More closely match the attributes of adjustable-rate assets with financing tied to floating rate advance funding

- Tailor to meet specific financing needs with a wide range of maturities, up to 30 years

- Link to the Secured Overnight Financing Rate (SOFR) index with the option to use Simple Averaging or Compounding interest accrual calculations

- Limit exposure to rising and falling interest rates by using embedded options (caps/floors)

As of September 23, 2022, members are now able to embed interest-rate caps/floors into SOFR-Linked Adjustable Rate Credit Advances. Embedding SOFR Caps and Floors can help members to manage their interest expense in a variety of diverse rate environments. Other advantages include:

- Caps give members flexibility to limit the maximum coupon of an ARC if rates rise

- Adding a floor helps members obtain an advantageous level on an ARC by limiting how low the coupon could fall in a declining rate environment

- Members may also create a corridor where they could add a cap and a floor to limit the variability of an ARCs coupon to a specified band

Currently, Structured Advances (including ARCs with a cap/floor) will be limited to $5 billion with no per member limit, available on a first-come, first-served basis. At the FHLBNY’s sole discretion, structured advance parameters may potentially be adjusted based on market conditions. Please consult with the Member Services Desk.

Match the amortization characteristics of your fixed-rate mortgages and mortgage-backed security portfolios

Advantages:

- Enhance match funding of long-term assets

- Borrow fixed-rate funds with the option of customizing the amortization schedule to match a selected prepayment profile

- Maturities and amortization schedule from 1 to 30 years

An advance with a call option that can help members flexibly manage their liquidity needs.

Advantages:

- Manage your balance sheet and capital levels tightly

- Take advantage of the call option based on market conditions

- Avoid a prepayment fee when the call option is exercised on the pre-determined date, adding flexibility to extinguish or rebook the advance

- Link to the SOFR index, enabling members to match the interest rate characteristics of adjustable-rate assets

Click here to learn more about our Callable ARC Advance.

An advance with built-in prepayment options that can help members reduce interest rate risk and prepayment risk at minimal added cost

Advantages:

- No prepayment fees when “called” after the pre-determined lockout period

- Offers protection amidst rising rates with flexibility to lower your cost of funds in static and declining rate environments

- Tool to mitigate both interest rate and prepayment risks

For more information on how the Callable Advance can help meet your institution’s funding needs, please read this funding strategy article or download the overview.

Achieve a wide variety of financial management goals, with maturities ranging from overnight to 30 years*

Advantages:

- Meet liquidity needs

- Fund long-term assets

- Lock in rates for future funding purposes

- Forward start dates are available

- Available with Symmetry for non Community Lending Program Advances with maturities of one year or greater and minimum advance size of $3 million

The FHLBNY also offers the Callable Fixed-Rate Advance, where the borrower has the option of prepaying funding without any penalty. Please contact a Relationship Manager for more information.

*Dependent on financial condition and member type

Combines a fixed-rate borrowing with an embedded interest-rate cap in which the rate remains fixed but may be reduced quarterly if SOFR rises above the pre-selected cap.

Advantages:

- Provides protection against rising interest rates (lowers your institution’s cost of funds as rates rise)

- Flexible medium-long-term funding option best used to extend liabilities, potentially enhance spreads, and preserve margins

- Available with Symmetry for non Community Lending Program Advances with maturities of one year or greater and minimum advance size of $5 million

*Currently, Structured Advances (including Fixed-Rate Advance with SOFR Cap) will be limited to $5 billion with no per member limit, available on a first-come, first-served basis. At the FHLBNY’s sole discretion, structured advance parameters may potentially be adjusted based on market conditions. Please consult with the Member Services Desk.

A quick source of liquidity to help manage daily cash flows and provide funding for various short-term uses

Advantages:

- Same-day access to funds for immediate cash needs

- Ability to borrow up to maximum borrowing capacity

- No additional borrowing limit restrictions above standard FHLBNY credit and collateral limits

- No set-up or renewal fees

- Can be initiated conveniently through 1Link®, our secure internet banking system

A hybrid advance product that combines elements of the Fixed-Rate and Amortizing Advance. It begins as a Fixed-Rate Advance, allowing members to choose a specific amount of time they would like to defer the principal payment of the advance up to 5 years. When the lockout, or principal-deferred period ends, the advance becomes an Amortizing Advance where the member makes principal and interest payments on the loan up to another 30 years.

Advantages:

- Valuable asset/liability management tool

- Fully amortizing (back-end) with a choice of varying balloon terms

- Mirrors characteristics of a typical construction deal with a permanent take-out

- No embedded options in the advance

For more information on how the Principal-Deferred Advance (PDA) can help meet your institution’s funding needs please visit our PDA page. You can also read this funding strategy article or download the overview.

A wide array of maturities and lockouts for medium- to long-term funding where the FHLBNY retains the option to terminate the advance at specified times

Advantages:

- Competitive pricing

- Customized maturities from 2 to 10 years with lockout periods ≥ 1 year

- One-time or quarterly option exercise

- Customized strikes are available

View our Putable Advance Information.

*Currently, Putable Advances are subject to an overall program limit of $10 billion, with no per member limit, available on a first-come, first-served basis. At the FHLBNY’s sole discretion, Putable advance parameters may potentially be adjusted based on market conditions. Please consult with the Member Services Desk.

Obtain preferential pricing when using Treasury or Agency issued Mortgage-Backed or CMO securities collateral

Advantages:

- Effectively utilize your securities portfolio as collateral and obtain improved advance pricing

- No penalties for pledging smaller blocks of securities

- Receive the same low rates for AAA-rated Agency and Non-Agency securities

- Maturities from 2 days to 10 years

- Available with Symmetry for Fixed-rate, non-Community Lending Program Advances with maturities of one year or greater and minimum advance size of $3 million

Please Note: Reduced cost of funding under FHLBNY Community Lending Programs (CLP) is available for all advances with a minimum term of one year, except Putable Advances; CLP Advances are not eligible for the SPA feature or the Advance Rebate Program; our Putables (when available), Callable, Swaps, and Letters of Credit programs require additional agreements; all credit product terms are subject to credit conditions.

To maintain access to FHLBNY’s products, programs, and services, members are required to complete and submit their Member Attestation Form by the requested deadline annually. In addition, throughout the year, members must promptly disclose to the FHLBNY any material adverse change events that may impact their financial condition by both emailing msd@fhlbny.com and contacting their designated Relationship Manager at (212) 441-6700.

Rate Information

Other Credit Products, Programs & Features

Provides members with a cash rebate on a portion of the fees paid relating to the early extinguishment of eligible advances when new eligible advances are obtained within 30 calendar days¹. To receive the cash rebate, the prepaid advance(s) must have a remaining term of six months or longer, and new advance(s) must have a term of six months or longer.

Advantages:

- Members receive cash rebate

- Provides additional flexibility with balance sheet management

- Strengthens and adds value to your Co-op

For more information on the Advance Rebate Program, please read this funding strategy article or download the overview.

1Advances booked under Community Lending Programs and advances with remaining maturities of less than six months are not eligible advances.

Supports liquidity, asset/liability management, and housing and economic development activities.

Advantages:

- Obtain a guarantee of payment by a highly-rated* financial institution (the FHLBNY) to third parties in the event of a default of performance by a member

- Collateralize state and local government deposits at low cost

- Receive credit enhancements for a variety of transactions

- Choose from maturities between 2 weeks to 3 years

- Facilitate transactions that promote eligible housing and community development activities at a discounted price.

Click here to learn more about our Letters of Credit.

*The FHLBNY is currently rated “Aa1” and “AA+” by Moody’s and Standard & Poor’s, respectively. These ratings are equivalent to those assigned to the U.S. Government.

Reduces income fluctuations caused by interest rate volatility

Advantages:

- Achieve asset/liability management goals

- Hedge interest rate exposure or increase the certainty of future funding costs

- Potentially lower the cost of funding

Note: Available for institutions with total assets less than $10 billion

In an effort to provide our members with additional solutions for today’s challenging economic environment, the FHLBNY is pleased to offer members the ability to modify Putable Advances into new Fixed-Rate Advance structures. Members can modify Putable Advance structures which have been previously modified if at least 365 days have passed since the prior modification. Advances that have already been modified into regular fixed structures cannot be re-modified.

For added flexibility, symmetry can be added for an additional 2 basis points to either Fixed-Rate or Repo Advances with maturities of one year or greater and a minimum advance size of $3 million. If the advance becomes “in the money” during its term, you could extinguish and realize a gain.

Advantages:

- Gain additional flexibility with balance sheet management and/or restructuring (e.g., gains can serve as an offset to unrealized losses in securities portfolios)

- Enhance value during merger and acquisition scenarios (potential gains on the liability side of the balance sheet)

Click here to learn more about our Symmetrical Prepayment Advance (SPA) feature.

Advances may be transferred between member institutions on a case by-case basis. All transaction negotiations (pricing, finding qualified counterparties*, etc.) will be the sole responsibility of the respective member involved in the advance transfer. Upon notification by the respective member that the transaction is complete, the FHLBNY will transfer the advance(s) to the acquiring member and the appropriate collateral and activity based capital stock adjustments will be made.

*To obtain transaction approval, the acquiring member will need to meet FHLBNY credit criteria and collateral requirements.

Please Note: Reduced cost of funding under FHLBNY Community Lending Programs (CLP) is available for all advances with a minimum term of one year, except Putable Advances; CLP Advances are not eligible for the SPA feature or the Advance Rebate Program; our Putables (when available), Callable, Swaps, and Letters of Credit programs require additional agreements; all credit product terms are subject to credit conditions.

To maintain access to FHLBNY’s products, programs, and services, members are required to complete and submit their Member Attestation Form by the requested deadline annually. In addition, throughout the year, members must promptly disclose to the FHLBNY any material adverse change events that may impact their financial condition by both emailing msd@fhlbny.com and contacting their designated Relationship Manager at (212) 441-6700.

Rate Information

The 0% Development Advance (ZDA) Program

Thank you for your interest in this program.

At this time, all available funds for the 0% Development Advance (ZDA) Program have been fully allocated.

For updates on future ZDA offerings, please check back regularly or contact Member Services Desk at 212-441-6600 with any questions.

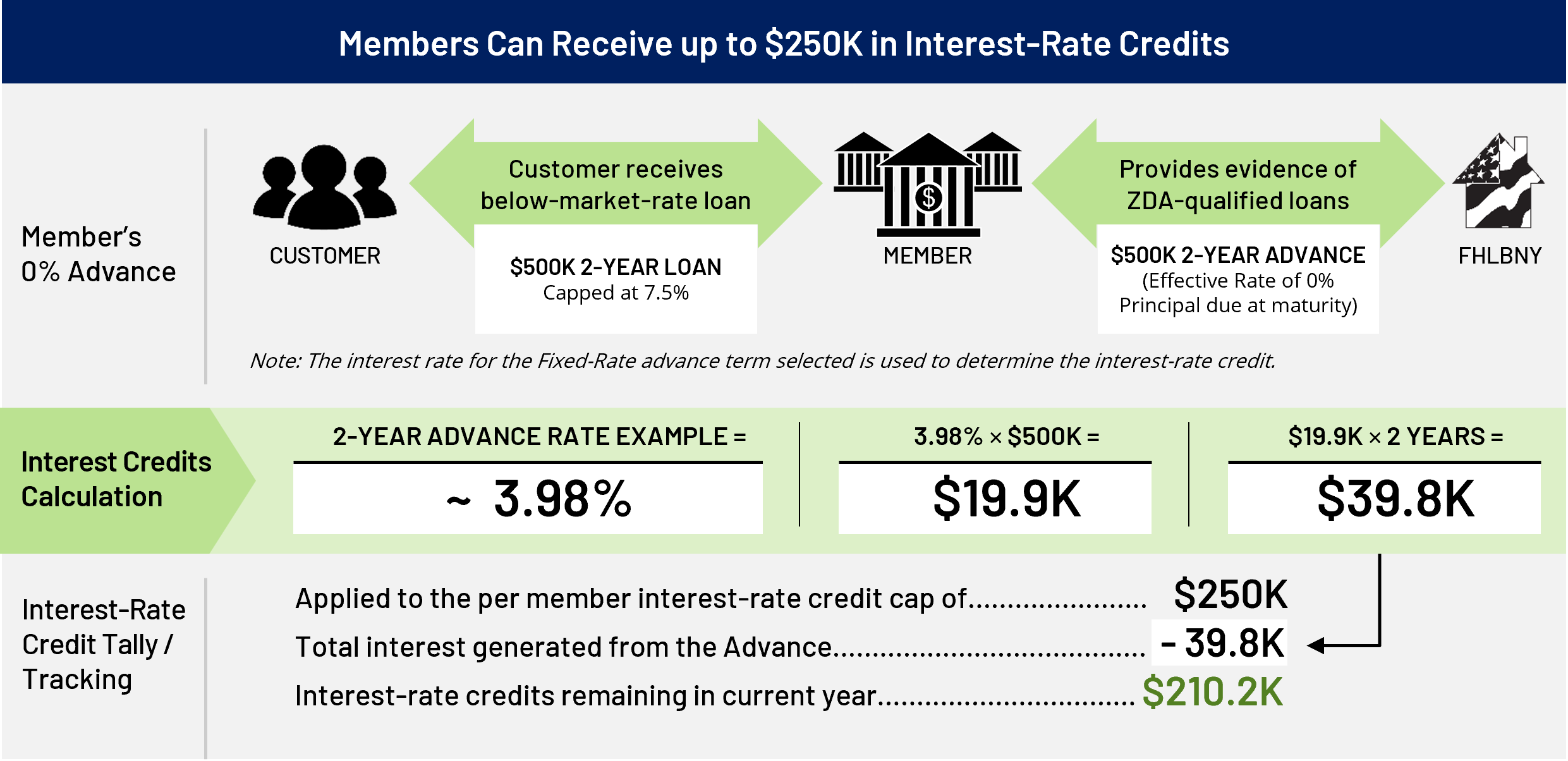

The Federal Home Loan Bank of New York (FHLBNY) 0% Development Advance (ZDA) Program provides members with subsidized funding in the form of interest-rate credits to assist in originating fixed-rate loans or purchasing loans/investments that meet one of the eligibility criteria under the Business Development Advance, Climate Development Advance, Infrastructure Development Advance, Tribal Development Advance, or the new Housing Development Advance. This program is intended to support economic development by incentivizing members to provide below-market-rate loans or invest in qualified initiatives.

Members can apply for interest rate credits up to $250,000 for any combination of the five advance types under the ZDA Program by submitting the ZDA Application Form. The overall program total available to the membership is $10 million in interest-rate credits ― provided on a first-come, first-served basis, as advances are issued.*

ZDA Program Benefits

The ZDA Program can afford members with greater flexibility to tailor their fixed-rate lending products to better serve their communities. Members can take advantage of the discounted liquidity through this program to:

- Support communities by providing competitive interest rates to fund initiatives that create affordable homes, help sustain your local economy and foster job opportunities

- Enhance relations with underserved communities and expand your reach

- Develop new and/or strengthen existing customer relationships

- Gain a competitive advantage when bidding and/or buying eligible loans

*Funding is provided on a first-come, first-served basis until the total allocation is reached.

| ZDA Program Attributes and Structure | |

|

Terms1 |

1 to 3 Years |

|

Advance Type |

Fixed-Rate Advances |

|

Member Cap2 |

$250K in Interest-Rate Credits |

|

Maximum Rate Charged for Qualifying Fixed-Rate Loans |

7.5% (Prime rate at the time of program launch) |

|

Loan Dates |

Qualified fixed-rate loans and qualified investment securities purchases must be issued/purchased on or after January 1, 2025, and closed or settled by December 1, 2025. |

1Subject to terms at time of product offering. The maturity date of the zero percent advance(s) shall not exceed the remaining term of the qualified loans/investments.

2Assessed annually and is subject to change. A member’s interest-rate credit cap is calculated using the interest rate of the Advance at the time of booking. Interest rate credits (subsidies) are credited back to members’ accounts monthly, over the life of the Advance.

|

Terms1 |

1 to 3 Years |

|

Advance Type |

Fixed-Rate Advances |

|

Member Cap2 |

$250K in Interest-Rate Credits |

|

Maximum Rate Charged for Qualifying Fixed-Rate Loans |

7.5% (Prime rate at the time of program launch) |

|

Loan Dates |

Qualified fixed-rate loans and qualified investment securities purchases must be issued/purchased on or after January 1, 2025, and closed or settled by December 1, 2025. |

1Subject to terms at time of product offering. The maturity date of the zero percent advance(s) shall not exceed the remaining term of the qualified loans/investments.

2Assessed annually and is subject to change. A member’s interest-rate credit cap is calculated using the interest rate of the Advance at the time of booking. Interest rate credits (subsidies) are credited back to members’ accounts monthly, over the life of the Advance.

| Loan Qualifications | |

| Business Development Advance (BDA) | |

| The BDA assists members in originating or purchasing fixed-rate loans to support the funding needs of small businesses, including farms and non-profit customers. |

|

| Climate Development Advance (CDA) | |

| The CDA assists members in originating or purchasing climate or energy efficient-oriented fixed-rate loans/investments in support of environmental initiatives (e.g., loans for solar panels, farm and agricultural loans, or the purchase of green bonds or related ESG securities). |

|

| Infrastructure Development Advance (IDA) | |

| The IDA assists members in originating or purchasing fixed-rate loans and investment securities to support local infrastructure development (e.g., construction or C&I loans, Bond Anticipation Notes or Securities that give rural communities access to clean water supply, reliable energy and vital internet access). |

|

| Tribal Development Advance (TDA) | |

| The TDA assists members in originating fixed-rate loans or purchasing assets that support housing and community and economic development on tribal lands. |

|

| NEW: Housing Development Advance (HDA) | |

| The HDA assists members in originating or purchasing fixed-rate loans that support the pre-development or acquisition phases of affordable housing projects. |

|

Advance Request & Certification

- Submit loan information using the ZDA Program Application Form (ZDA-002).

- Members must certify the loans align with the program Purpose and have met the Guidelines. Project submissions outside of the program guidelines will be evaluated on a case-by-case basis and require written justification.

- After application approval, members can contact the Member Services Desk to request funding under the ZDA for the approved amount(s), drawing upon your institution’s available interest-rate credits.

- The Advance amount must be equal to or less than the loan(s) and/or investment securities submitted.

- Funding is provided on a first-come, first-served basis until the total $10 million allocation is reached. Application approvals are not a guarantee of funding; the advance(s) must be drawn.

Please note: To maintain access to FHLBNY’s products, programs, and services, members are required to complete and submit their Member Attestation Form by the requested deadline annually. In addition, throughout the year, members must promptly disclose to the FHLBNY any material adverse change events that may impact their financial condition by both emailing msd@fhlbny.com and contacting their designated Relationship Manager at (212) 441-6700.

Advances are transacted in the same manner as traditional Advances, in adherence with all credit, collateral, and capital stock requirements, and are subject to lending parameters under the Credit Risk Management Framework.

Loans or investments members make to their local farming community may qualify for our 0% Development Advance Program.

Examples include loans for agricultural/farming equipment (plows, tillers, seed drills and cultivators), loans for crop provisions (fertilizer, seeding, and other planting needs), or for investments in sustainable farming tactics

Application Deadline

Submit your application to

zdasubmissions@fhlbny.com

by December 1, 2025 for this ZDA Program Round.