The FHLBNY is a trusted source for on-demand access to liquidity

Insurance companies play a key role within the U.S. housing market. The Federal Home Loan Bank of New York (FHLBNY) promotes housing and economic development by providing low-cost, flexible liquidity to member financial institutions. This closely aligns with our insurance company members’ significant investments and participation in the mortgage market along with their economic development initiatives. Our insurance company members count on us to be a reliable and stable source of liquidity in any market condition.

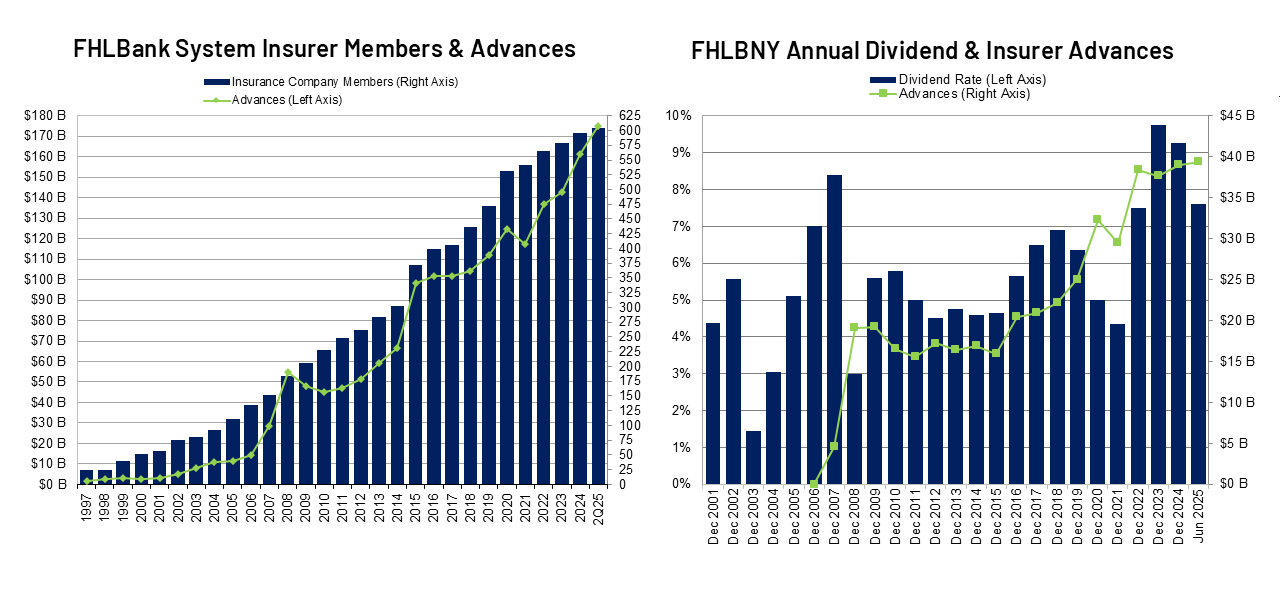

Membership and advances by insurance companies have increased exponentially as more and more realize the integral role the FHLBNY plays to insurers looking to converge liquidity and working capital needs (as shown in the chart below). Overall, the Federal Home Loan Bank System (FHLBanks) has over 596 insurance company members, while the percentage of all FHLBanks borrowings by insurance companies has increased from $28.67 billion to $161.14 billion between 2007 and 2024.

Insurance companies typically capitalize on their membership to satisfy contingent and strategic funding needs, in addition to financing capital, acquisition costs, and new facilities. This enables them to manage their liquidity positions and obtain affordable financing to support lending, investing, daily operations and grow their business in order to support the housing markets and the communities they serve.

Since the FHLBNY is structured as a cooperative, our members are shareholders. Paid from 2024 income, we returned $576.9 million in dividends to our members for a full-year dividend rate of 9.38%. This high performance is a testament to our dedication to provide value to our members.

FHLBNY Insurance Company Members

- AIG Insurance Company - Puerto Rico

- Allied World Insurance Company

- American Home Assurance Company

- Ameritas Life Insurance Corp. of NY

- Anthem HealthChoice Assurance, Inc.

- Assured Guaranty Inc.

- Atlantic Specialty Insurance Company

- Build America Mutual Assurance Company

- Chubb Insurance Company of PR

- Commerce and Industry Insurance Company

- Cooperativa de Seguros Multiples de PR

- Cumberland Mutual Fire Insurance Company

- Equitable Financial Life Insurance Co.

- Everest Reinsurance Company

- Excellus Health Plan, Inc.

- Genworth Life Insurance Co. of New York

- Gerber Life Insurance Company

- Gotham Insurance Company

- Guardian Insurance Company, Inc.

- Guardian Life Insurance Co. of America

- Horizon Healthcare of New Jersey, Inc.

- Horizon Healthcare Services, Inc.

- Kingstone Insurance Company

- Lincoln Life & Annuity Co. of New York

- MAPFRE PRAICO Insurance Company

- Merchants Mutual Insurance Company

- Metropolitan Life Insurance Company

- Metropolitan Tower Life Insurance Co.

- MONY Life Insurance Company

- New Jersey Manufacturers Insurance Co.

- New York Life Insurance Company

- New York Marine & General Insurance Co.

- Prudential Insurance Company of America

- SBLI USA Life Insurance Company, Inc.

- SCOR Reinsurance Company

- Security Mutual Insurance Company

- Security Mutual Life Insurance Co. of NY

- Selective Insurance Company of America

- Selective Insurance Company of New York

- SiriusPoint America Insurance Company

- Spinnaker Insurance Company

- Sterling Insurance Company

- Stratford Insurance Company

- Teachers Ins. & Annuity Assoc of America

- The US Life Ins. Co. in the City of NY

- Transamerica Financial Life Insurance Co

- Transatlantic Reinsurance Company

- Trans-Oceanic Life Insurance Company

- Triple-S Advantage, Inc.

- Triple-S Salud, Inc.

- Triple-S Vida, Inc.

- Tudor Insurance Company

- United Surety and Indemnity Company

- Universal Insurance Company

- Utica Mutual Insurance Company

- Western World Insurance Company

- Wilton Reassurance Life Company of NY

Benefits of Partnering with the FHLBNY

Flexible Funding Source

Membership at the FHLBNY affords insurance companies access to a wide range of liquidity tools through the use of our various credit products called “advances.”

Members can gain access to low-cost, wholesale funding for financial flexibility and backup liquidity to help meet unexpected cash flow needs and manage risk and profitability. Explore FHLBNY funding solutions to:

- Meet liquidity and working capital needs

- Augment income streams

- Benefit from letters of credit and other products to enhance operating leverage

- Increase earnings through strategic liquidity management and quarterly dividends

- Finance capital, acquisition costs, or new facilities without liquidating earning assets

- Manage cash flow needs

- Grow investment income by reducing short-term liquidity balances and increasing invested asset balances

- Fill liability maturity gaps and support match funding programs

- Enhance operating leverage and liquidity with letters of credit as an alternative form of collateral

- Secure grant money for low-income housing or community development projects

- Access discounted community investment funds

- Demonstrate an enhanced liquidity position to regulators and rating agencies

Membership Eligibility Requirement

In order to be eligible for membership, your company should be:

- Duly organized by law

- Subject to inspection and regulation

- Of sound financial condition

- Committed to ensuring sound and economical financial policies

- Able to purchase membership stock upon approval as outlined in the membership application

Worksheets are available here to help you determine membership eligibility and calculate the initial FHLBNY membership stock amount. These tools are also provided above under Related Links.

Key Contacts

Relationship Managers

(212) 441-6700

FHLBNY@fhlbny.com

You have a vision for your financial future

Our partnership can play a key role to help get you there.

How are Insurance Companies Taking Advantage of Membership?

They typically use membership to fulfill the following needs:

- Contingent and strategic liquidity

- Match funding or pool funding

- Asset and liability management

We also offer exclusive resources to our members for beneficial insight and education

Visit our Resource Center

Related Links

Insurance Companies Overview Factsheet

Forms & Agreements for New Members

About the Federal Home Loan Banks

HLB 009 HIC – Health Insurance Companies Eligibility Worksheets

HLB 009 LC – Life Insurance Companies Eligibility Worksheets

HLB 009 PC – Property & Casualty Insurance Companies Eligibility Worksheets

Whitepapers

Business Wire

Best’s Special Report:

Insurers’ Funding Agreements With Federal Home Loan Banks Likely to Increase