Initiatives to Support Low-to-Moderate Income Loans Sold into MAP®

In line with our mission to support housing opportunities for low-to-moderate income borrowers, the Federal Home Loan Bank of New York (FHLBNY) is continually seeking enhancements to the Mortgage Asset Program (MAP®) that will make it more advantageous for our members to underwrite these loans and sell them into MAP.

Current initiatives include:

The FHLBNY is pleased to announce that we have allocated $5 million to continue to provide supplemental funding to credit enhance any qualified LMI mortgages sold into MAP in 2025 with a Loss Coverage Ratio (LC)** greater than 1.50%. The amount needed to “buy down” or credit enhance the mortgage’s LC to 1.50%, up to a maximum of 150 basis points, will be deposited into the Participating Financial Institution’s (PFI’s) Member Performance Account (MPA) on a first-come, first-served basis until the $5 million allocation is exhausted.

For example, if you sold a $250,000 LMI mortgage into MAP with an LC of 2.11%, 61 basis points, or $1,525, would be credited to your MPA. If the same mortgage had an LC of 4.0%, then the maximum credit enhancement of 150 basis points would be credited to your MPA. The supplemental credit for qualified LMI mortgages will be displayed in your monthly Loss Coverage Summary report.

LMI mortgages tend to have a higher LC, and members are required to manage the weighted average LC on their respective Master Commitment to 1.50% or lower. Offering this supplemental funding to help credit enhance LMI mortgages further aligns MAP with our mission, making it more advantageous for PFIs to book and then sell LMI mortgages to the FHLBNY.

The FHLBNY provides a reimbursement grant of up to $10,000 per loan for the lender’s purchase of single-premium LPMI for eligible LMI loans sold to MAP in 2026. The reimbursement only applies to LMI loans with LPMI from MAP-approved mortgage insurance companies.

The FHLBNY recognizes that PFIs may choose to originate loans with loan-to-value (LTV) ratios above 80% without requiring mortgage insurance, to support LMI borrowers and reduce their monthly payments. Loans with LTV ratios over 80% without mortgage insurance don’t qualify for MAP. However, the new LPMI reimbursement option allows PFIs to buy qualified single-premium mortgage insurance for these loans, thereby making them eligible for MAP.

Key LPMI Reimbursement Program Benefits:

- Expands opportunities to serve LMI borrowers by incentivizing PFIs to underwrite and sell qualifying loans into MAP.

- Supports PFIs to offer additional affordable mortgage options for LMI borrowers by covering mortgage insurance costs and reducing monthly payments, while maintaining eligibility for MAP.

- Enhances liquidity by allowing PFIs to sell LMI loans that would otherwise be held in portfolio, freeing up capacity to originate additional loans.

How to Participate:

-

To take advantage of this LPMI Reimbursement Program, PFIs must identify the details of the LPMI cost upon delivering the loan through the MAP Connect System.

- For additional clarity, the Monthly Loss Coverage Summary Report will be enhanced to identify the LMI loans that have qualified for the LPMI reimbursement program.

-

The total LPMI reimbursement will be credited to the PFI’s FHLBNY Demand Deposit Account (DDA) monthly.

The FHLBNY provides supplemental funding to credit enhance any qualified LMI mortgages sold into MAP in 2026 with a Loss Coverage Ratio (LC**) greater than 1.50%. The amount needed to “buy-down” or credit enhance the mortgage’s LC to 1.50%, up to a maximum of 150 basis points, will be deposited into the Participating Financial Institution’s (PFI’s) Member Performance Account (MPA).

For example, if you sold a $250,000 LMI mortgage into MAP with an LC of 2.11%, 61 basis points, or $1,525, would be credited to your MPA. If the same mortgage had an LC of 4.0%, then the maximum credit enhancement of 150 basis points would be credited to your MPA. The supplemental credit for qualified LMI mortgages will be displayed in your monthly Loss Coverage Summary report.

LMI mortgages tend to have a higher LC, and members are required to manage the weighted average LC on their respective Master Commitment to 1.50% or lower. Offering this supplemental funding to help credit enhance LMI mortgages further aligns MAP with our mission, making it more advantageous for PFIs to book and then sell LMI mortgages to the FHLBNY.

Updates to the MAP Program include:

The FHLBNY designed this option to help members better address housing affordability challenges by offering greater flexibility in delivering loans that serve LMI borrowers.

Under the best-efforts commitment, sellers agree to deliver a loan for a specific borrower and property by the commitment expiration date. If the loan is not delivered to the FHLBNY, the seller is not charged a pair-off fee*** for non-delivery—helping reduce financial risk and encouraging the origination of more affordable housing loans.

Key Benefits Include:

- Supports Participating Financial Institutions (PFIs) that do not or cannot hedge their mortgage origination pipeline.

- Helps PFIs serve LMI borrowers and promote sustainable homeownership by minimizing risk exposure.

- Enhances MAP’s competitiveness with Government-Sponsored Enterprise (GSE) programs by providing Best-Efforts Delivery Commitments while maintaining the pricing advantages typically associated with Mandatory execution.

How to Participate:

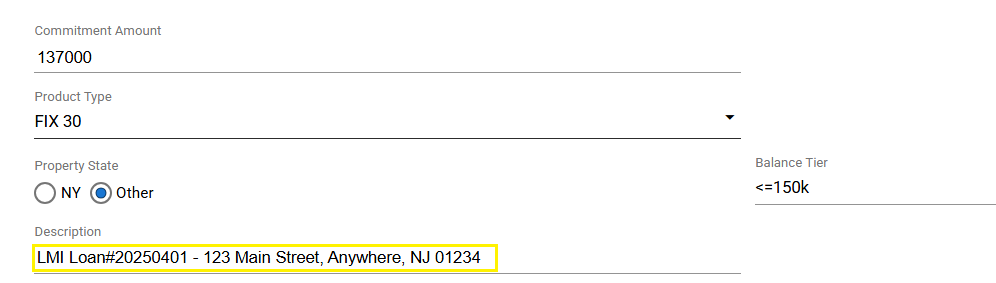

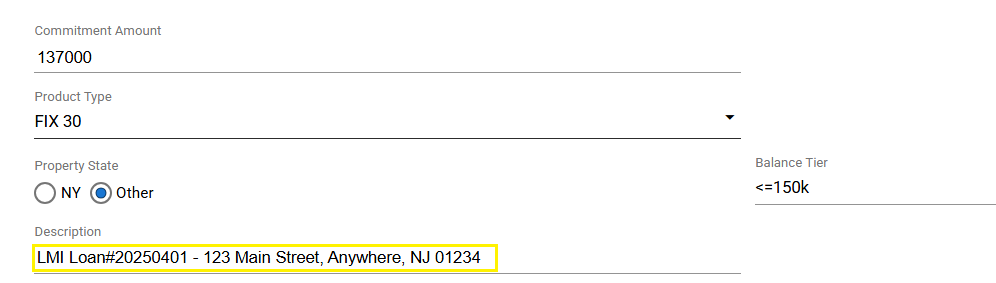

To take advantage of this LMI best-efforts delivery option, members must identify the member loan number beginning with “LMI” and include the subject property address in the description field of the Delivery Commitment template within the LMS Connect system.****

MAP LMI Loan Info

The FHLBNY offers tiered pricing based on loan size for fixed 30-year delivery commitments. Since LMI loans typically have lower loan balances, you can further take advantage of our more competitive MAP pricing for lower-balance loans.

The FHLBNY is pleased to announce the launch of a Best-Efforts Delivery Commitment option for LMI loans. This new option is designed to help our members better address housing affordability challenges by offering greater flexibility in delivering loans that serve LMI borrowers.

Under the best-efforts commitment, sellers agree to deliver a loan for a specific borrower and property by the commitment expiration date. If the loan does not close, the seller is not charged a pair-off fee for non-delivery—helping reduce financial risk and encouraging the origination of more affordable housing loans.

Key Benefits Include:

- Supports Participating Financial Institutions (PFIs) that do not or cannot hedge their mortgage origination pipeline.

- Helps PFIs serve LMI borrowers and promote sustainable homeownership by minimizing risk exposure.

- Enhances MAP’s competitiveness with Government-Sponsored Enterprise (GSE) programs by providing Best-Efforts Delivery Commitments while maintaining the pricing advantages typically associated with Mandatory execution.

How to Participate:

To take advantage of this LMI best-efforts delivery option, members must identify the member loan number beginning with “LMI” and include the subject property address in the description field of the Delivery Commitment template within the LMS Connect system.***

MAP LMI Loan Info

We’re excited to offer these enhancements to support your lending efforts and strengthen access to affordable housing in the communities you serve.

If you have questions regarding these offerings, please call your Relationship Manager at 212-441-6700

Did you know that you can sell loans in which the borrower used the FHLBNY Homebuyer Dream Program® (HDP®) grant into MAP? In addition, these loans may qualify for the new supplemental credit enhancement for LMI mortgages. Contact us for more information.

Note: Loans made through HDP® Plus may be sold into MAP; however, they do not qualify as LMI loans and will not receive supplemental funding. Loans made through HDP Wealth Builder also may qualify for supplemental funding – please refer to program guidelines.

** Loss Coverage Ratio is currently calculated using the S&P Global Ratings’ LEVELS model.

**** If a non-LMI loan is delivered under an LMI DC or a Duplicate DC matching a prior DC (address) is opened, an Adverse Delivery fee may be assessed for delivery and the PFI would be contacted.

Note: The grant funding for LPMI Reimbursement Grant and LMI Credit Enhancement Supplement initiatives will be distributed on a first-come first-serve basis until the allotted funds are exhausted.

Key Contacts

Relationship Managers

(212) 441-6700

FHLBNY@fhlbny.com